For 15 years, the Greenhouse Gas Reporting Program (GHGRP) has served as America's industrial carbon ledger. Created in 2009 under the Clean Air Act, it requires annual emissions reports from thousands of facilities across nearly every sector of the economy—steel mills, refineries, chemical plants, landfills, power stations, and oil and gas producers. Over 8,000 facilities report under GHGRP, producing one of the most comprehensive public datasets on greenhouse-gas emissions in the world.

On September 16, the Environmental Protection Agency (EPA) proposed to shut most of it down.

The proposed rollback is sweeping. The rule would remove reporting requirements for all industries, including natural-gas distribution, except for segments of the oil and gas industry that are subject to a methane "waste emissions charge" introduced by Congress in 2022. And this reporting is suspended until 2034 because Congress recently delayed the implementation of the waste emissions charge until 2034. Until then, America would fly blind.

The EPA GHGRP serves as the bedrock of many federal, state, and local programs and initiatives. States draw on it to compile greenhouse-gas inventories. Local governments and communities rely on it to track nearby polluters. The Treasury and Internal Revenue Service (IRS) rely on it to issue regulations implementing federal energy tax credits. Ending the GHGRP is only part of the broader movement that seeks to minimize federal oversight with little transparency and accountability, leaving the public and stakeholders with no means to verify taxpayer dollars are being spent without waste, fraud, and abuse.

That is where the risk to taxpayers comes in—Treasury and the IRS rely on EPA GHGRP to implement the 45Q carbon capture credit and the 45V hydrogen production credit, which are particularly vulnerable to waste and abuse without a robust reporting system. IRS rules for 45Q explicitly reference GHGRP subpart RR, which verifies whether captured carbon is truly stored underground. IRS guidance for 45V uses emissions data from GHGRP subpart W to calculate the GHG intensity of the hydrogen produced and the corresponding credit amount.

Weak oversight invites abuse and 45Q has already been plagued by problems—the Treasury Inspector General for Tax Administration already found close to $900 million dollars' worth of 45Q claims did not meet EPA reporting requirements. Although the EPA GHGRP is far from perfect, killing it could lead to billions of dollars in tax credits given away for carbon that is never actually captured and securely stored underground. Without GHGRP, the IRS would have little if not zero means to verify reported data, essentially rubber stamping any number that carbon capture and storage (CCS) facilities file in their tax forms.

For taxpayers, the effect is plain. Scrapping the GHGRP leaves Washington spending vast sums on subsidies without the basic information needed to confirm that carbon is being captured or that hydrogen is actually clean. It undercuts transparency at the very moment when costs of carbon capture and hydrogen tax credits, worth tens of billions, are expected to ramp up.

Unfortunately for taxpayers, the IRS has indicated no plans to issue new rules to address potential integrity and implementation challenges of 45Q and 45V, based on the recently released agency rulemaking calendar. Any 45Q and 45V credit rewarded in absence of GHGRP is a blatant giveaway of taxpayer dollars.

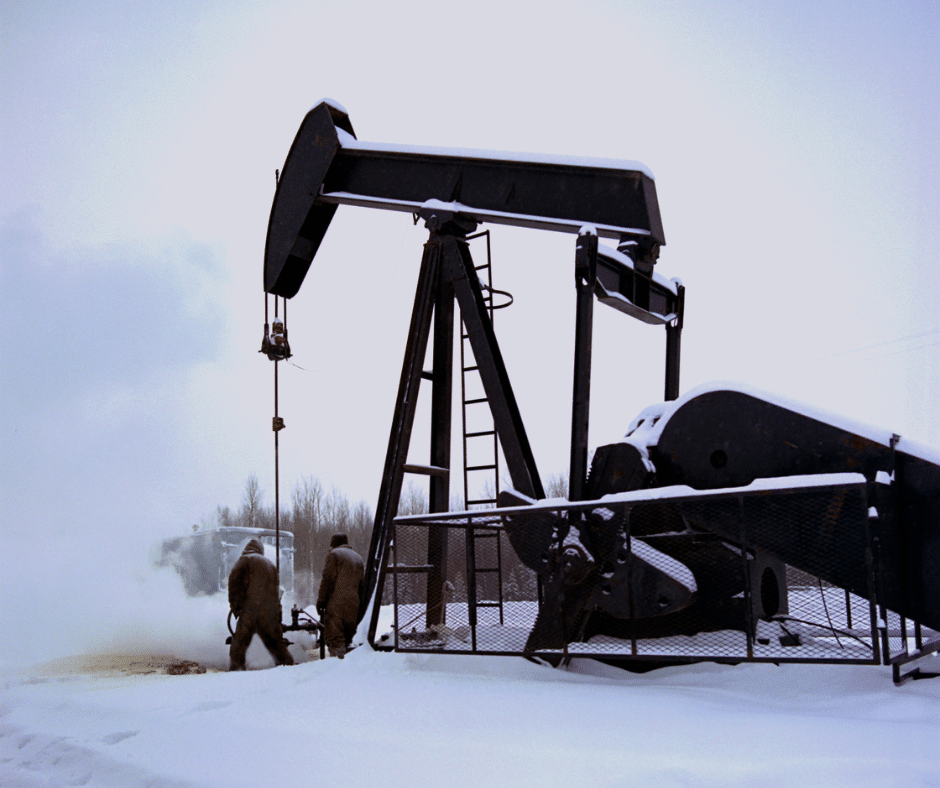

- Photo by Anthony Maw on Unsplash