View/Download this article in PDF format.

For decades, agribusinesses have secured special treatment in Washington. Through various price supports, direct payments, subsidized loans, grants, crop insurance, and other federal interventions, layers of highly subsidized farm programs now create an interconnected web of duplicative, inefficient, and costly subsidies that are largely unaccountable to taxpayers. Even though most agribusinesses would survive without support from Uncle Sam, agribusiness lobbyists have convinced Congress that taxpayers should subsidize nearly every aspect of agriculture often regardless of the state of the farm economy or whether federal support is in the public interest. The bulk of these subsidies continue to flow primarily to wealthy landowners and the most profitable agricultural operations. If private sector risk management options were allowed to compete on a level playing field and agribusinesses covered more of the costs of running their own businesses, taxpayers would bear less unnecessary risks and save billions of dollars.

Risks Inherent in Agriculture

Agribusinesses face a wide range of risks and incur several expenses in managing profitable enterprises. Major risks include the following (with examples of typical expenses):

- Financial (interest payments on agricultural loans)

- Human (life insurance to cover impacts of death, injury, sickness, divorce, or dissolution of partnerships)

- Institutional (changes in government regulations and federal, state, and local taxes)

- Price or market (variations in crop prices and costs of inputs like fertilizer, fuel, seed, storage, transportation, labor, etc.)

- Production (crop insurance for yield losses, pesticide purchases to control weeds and insects, and availability of water)

Helping producers manage these risks has been a stated goal of federal policymakers for decades, and taxpayers spend billions of dollars every year on various federal programs to this end. In many ways, agriculture is one of the most heavily subsidized industries. With the nation holding nearly $17 trillion in debt and in gridlock over how to reduce deficits, Washington must grapple with what role the government should play in managing and influencing American agriculture by helping agricultural producers manage risk. Policymakers in Washington have demonstrated how they do not fully trust the free market to manage all of the risks associated with agriculture. It is critical, however, that any government intervention in the market occurs only where there is a demonstrated need, and it does not simply crowd out private solutions while picking winners and losers between or even within industries.

An often repeated line is that agriculture is uniquely at risk from forces beyond its control, namely pests, disease, and the weather. But these risks, which are not actually unique to agriculture, can also be confronted with several unique risk management tools not available in other industries (for more details see our piece entitled Federal-Free Risk Management in Agriculture). The key is to ensure that the government’s role in managing everyday risks faced by agricultural businesses is relegated only to risks that individual agribusinesses and the market are incapable of successfully managing.

Types of Federal Subsidies Designed to Mitigate Agribusiness Risks

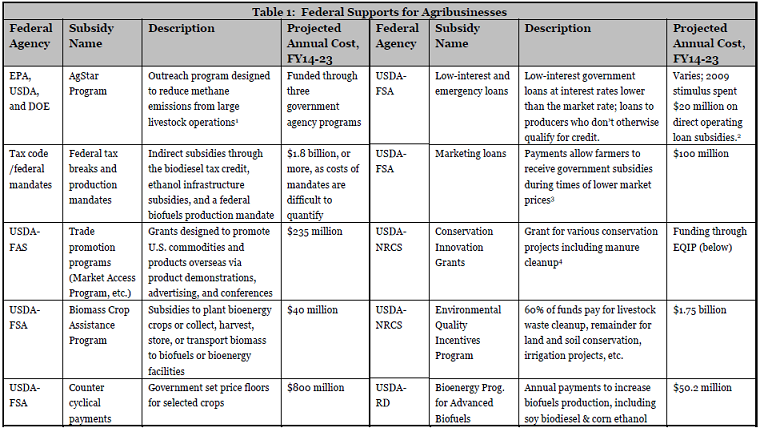

Agribusinesses are eligible for an array of federal subsidies that address nearly every imaginable risk or cost of doing business. Table 1 includes a list of the most prominent and costly supports for agriculture.

.png)

Types of Agribusiness Risks Subsidized by Taxpayers

The following chart lists most risks faced by agribusinesses and describes whether taxpayers subsidize these business risks through various federal subsidies, loans, and other programs. Most expenditures incurred to avert these risks are also deductible on agribusinesses’ annual tax returns. As you can see, in one way, shape, or form, the federal government subsidizes nearly every expense on agribusinesses’ balance sheets. Some of the few expenses that are not covered by government programs include routine equipment repairs, life and health insurance, and property taxes. Appendix 1 includes examples of which federal programs subsidize these business costs/risks.

.png)

Unintended Consequences When Agribusinesses Face Less Risks

When Uncle Sam steps in to cover most costs of doing business for agribusinesses, numerous unintended consequences result since producers take on more risk and bear less expenses. Some of these unintended consequences include the following:

- Subsidies pick winners and losers, resulting in greater production of certain subsidized crops like corn, soybeans, and wheat while other crops lose production acreage.

- Most subsidies benefit already profitable agribusinesses that would survive without federal supports while young and beginning farmers face entry barriers, sometimes caused by subsidies being built into land prices.

- Private sector risk management options are crowded out and costs are shifted onto taxpayers and the public when agribusinesses face less business risks.

- Sensitive land such as highly erodible acres or wetlands is converted into annual production of subsidized crops, with resulting impacts on downstream water quality.

Conclusion

With record farm profits projected this year, agribusinesses don’t require the current level of taxpayer support they receive from Washington. Congress should reject the farm lobby’s push for a continuation of status quo policies, some of which originated during the Great Depression, and the creation of new expensive entitlement programs to increase taxpayer costs in guaranteeing agribusiness incomes. A more cost-effective, transparent, accountable, and responsive agricultural safety net should instead be crafted that allows the private sector to take on risks currently covered by taxpayers.

* To view the full fact sheet, including the Appendix, see Federal Subsidization of Agribusiness Costs.

For more information, contact Joshua Sewell at 202-546-8500 or josh[at]taxpayer.net.