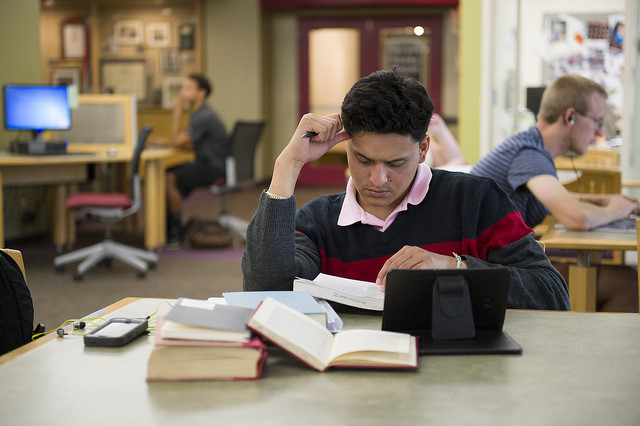

Like a student with a term paper to do, Congress tries to make up for doing nothing most of the year, with a furious finish in December. Heck they even gave themselves an extension on finishing the fiscal year 2016 spending bills and still two months into the new fiscal year they haven’t finished them. While they passed a $305 billion transportation bill late last night, they’ve still got an omnibus spending bill and possible tax extenders all coming down the pike.

Like a student with a term paper to do, Congress tries to make up for doing nothing most of the year, with a furious finish in December. Heck they even gave themselves an extension on finishing the fiscal year 2016 spending bills and still two months into the new fiscal year they haven’t finished them. While they passed a $305 billion transportation bill late last night, they’ve still got an omnibus spending bill and possible tax extenders all coming down the pike.

The omnibus legislation with all twelve spending bills crammed together will likely run well over 1,000 pages and lawmakers will get only a few days (if that) to read it before they vote. After the budget deal last month, everyone knows what the top line number is, and it sounds like the funding levels for the various agencies have been agreed to now. The final hold up are the riders.

What is a rider? Spending bills are not supposed to set policy, just dole out the dough. But while there are appropriations every year, policy bills are less predictable. So policy is masqueraded as spending provisions – don’t spend any money enforcing this policy, or no funds can be used to do this action – and added to the legislation. This dynamic is most pronounced when the Congress is under control of one party and the White House is in the hands of the other, like now or the end of the Bush presidency or most of the Clinton years. Because spending bills are viewed as must pass, riders are a way to force the President to accept some policy restrictions they would otherwise oppose. But that doesn’t mean there isn’t negotiation, and that’s what the fight is now – which riders can President Obama swallow while holding his nose and which will he refuse under any circumstances. Currently congressional Democrats are crying foul, but it’s fairly likely that some deal will be struck in the coming days.

Another deal that has been made is the five-year transportation bill or FAST Act (Fixing America’s Surface Transportation Act). Despite misgivings over the ridiculous and wasteful offsets they tapped to cover Highway Trust Fund shortfalls, the House and Senate both overwhelming passed the bill yesterday. This bill also picked up a few free-loaders. The corporate welfare Export-Import Bank was reauthorized for another four years and one good provision from the Bipartisan Budget Agreement of 2015 – an extraction of savings from the companies administering the heavily subsidized crop insurance program – was jettisoned. Didn’t even last a month.

One other piece of legislation is bubbling under the surface. The tax extenders package is a hodge-podge of various targeted tax expenditures (breaks) that are only authorized for a year or two. The current batch actually expired at the end of 2014 and there is an effort to extend them retroactively through the end of 2016. Actually that’s the fall back plan. There is also an effort to make some of them permanent. Predictability is important in tax law. It enables companies and individuals to plan and make investment decisions. The fickle nature of the extenders are a problem. And a tax provision extended five times for ten years costs the same as a provision that lasts ten years and beyond. But the thing is many of these should be jettisoned. We shouldn’t be giving tax breaks to the owners of NASCAR tracks and racehorses. Bonus depreciation was created in 2008 to give the economy a boost in the midst of the Great Recession; it can go away now. Making many of the provisions permanent is costly – approaching $1 trillion. And while five extensions for 10 years equals 10 years outright, the biennial review allows some of these to be jettisoned or refined. There should be an evaluation of what is working, what isn’t and what bang for the forgone revenue buck we are getting. Extenders are bad policy, but permanence isn’t necessarily right either.

We don’t know how the last month of the year will turn out. There could still be a shut down, for instance. But we do know that Congress should not cram 12 months of policy work into just one.

Photo credit: Ohio University Libraries via flickr