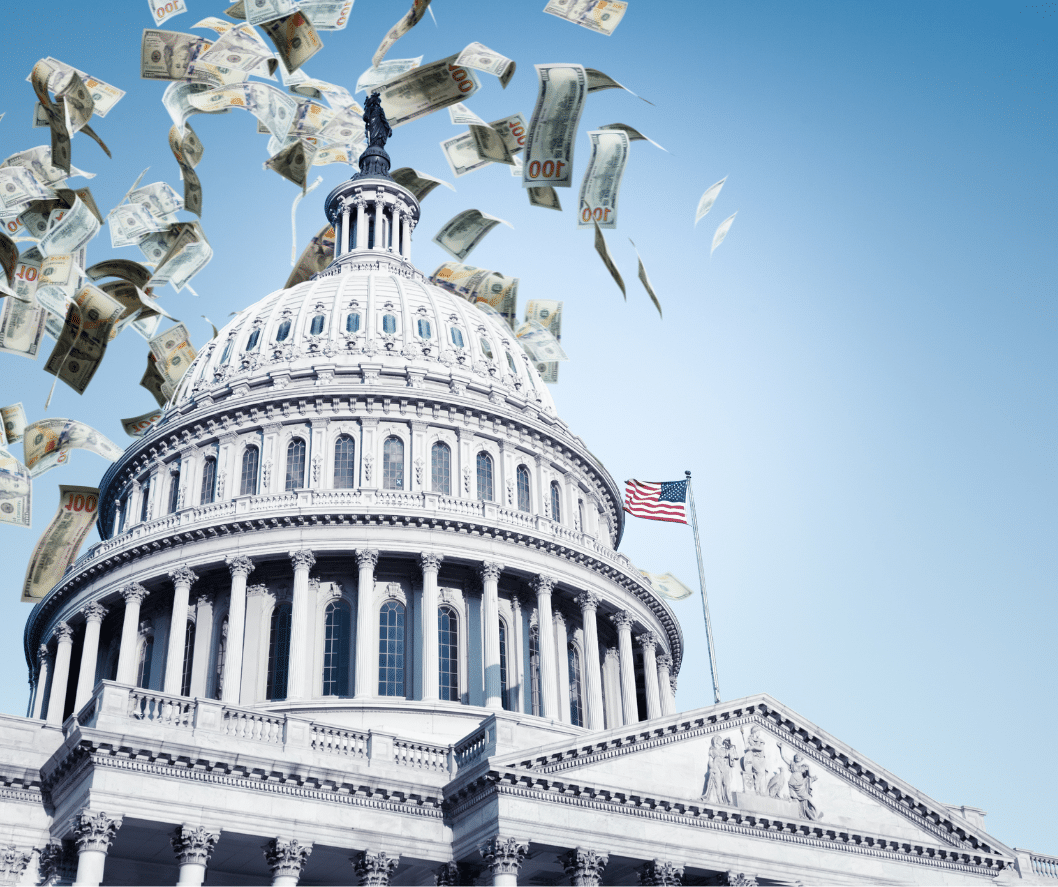

Mega-rich American businesses that move their corporate headquarters to tropical island tax havens, or are in the process of doing so, received more than $1 billion in business from the federal government last year, according to a report released by Congressmen Richard Neal (D-MA) and Jim Maloney (D-CT).

The report evaluated contracting data from the Federal Procurement database for more than 20 companies that have relocated their offices offshore. Most of the relocations have happened in the last few years.

While these corporate bad apples benefit from our nation’s infrastructure, technology, education, protection from terrorists and other services, they don’t pay a dime of federal taxes. To add insult to taxpayer injury, these scofflaws were rewarded with more than $1 billion in federal contracts last year, a majority of which were defense and homeland security related.

The corporations hitting the federal contract jackpot include:

— Accenture, one of the nation’s leading business consulting firms, moved to Bermuda to avoid paying taxes in July 2001. Since then, the company has received more than a billion dollars in federal contracts, which includes a hundred million dollar management consulting contract with the Department of Defense.

— TYCO International, one of the leaders of this parade of shame overseas, has received hundreds of millions of taxpayer dollars, including a multi-year, billion dollar contract to build specific radio systems for the Army and for the Space and Naval Warfare Systems Center.

— Foster Wheeler, a construction company which now calls Bermuda home, has received more than $600 million in federal contracts, including hundreds of millions from the Navy and the Marine Corps for environmental cleanup.

These companies do not deserve to have the goldmines that they acquired as a result of their overseas moves augmented by federal contracts. Tyco International, a manufacturing company, has saved $400 million and Ingersoll-Rand has saved $40 million last year by moving to the sunny islands. Enron also had 800 faux-businesses set up in offshore havens to avoid millions in taxes.

A growing chorus of lawmakers, businesses and other government officials are raising more and more concern about this alarming trend. The State of California announced yesterday that it would divest from any American company that hides assets in offshore tax havens. The state has created a blacklist of 23 companies that claim headquarters in Bermuda and elsewhere. It is also expected tonight that a large group of lawmakers are going to offer an amendment to the Homeland Security bill that will prohibit government contracts from being awarded to companies that desert the U.S. during a time of war. Specifically, Democrats are expected to offer a motion tonight that would prohibit the new Department of Homeland Security from issuing contracts to companies that reincorporate in offshore havens like Bermuda simply to avoid U.S. taxes.

Reps. Neal and Maloney are currently gathering signatures from other lawmakers to try a force a vote on their bill that denies tax benefits to corporations that set up shop overseas. The Neal-Maloney Corporate Patriot Enforcement Act (H.R. 3884), the first bi-partisan bill introduced in the House, currently has over 140 co-sponsors, and would save U.S. taxpayers $4 billion over ten years.

This corporate hypocrisy is outrageous and the American people rightly see this as an issue of fairness. Corporations have no right to benefit from America's defense and homeland security if they're not willing to pay for it.

Now that Congress has passed corporate reform, it is time to direct our attention to preventing corporations from cheating the nation's taxpayers out of billions of dollars.