Tomorrow, Ryan Alexander, president of Taxpayers for Common Sense, will testify before the House Ways and Means Committee on “Post Tax Reform Evaluation of Recently Expired Tax Provisions.”

We’ve long monitored and cataloged the nearly annual legislative event of extending packages of expiring tax provisions.

At Taxpayers, we believe the practice of tax extenders undercuts the most broadly agreed upon goals of tax policy: to provide certainty to individuals and businesses; to provide a predictable flow of revenue to the government; and to encourage future behavior. The procedural history and practice of tax extenders is equally flawed.

The hodge-podge package of unrelated provisions has no rational basis as a whole, and in almost every case extender bills are passed without debate on any of the individual provisions. Like earmarks in appropriations, tax extenders also have one unsung beneficiary: lobbyists. Because extenders allow for narrow changes to tax law that often benefits a single industry, and have to be renewed year after year, they are perfect playing field for lobbyists.

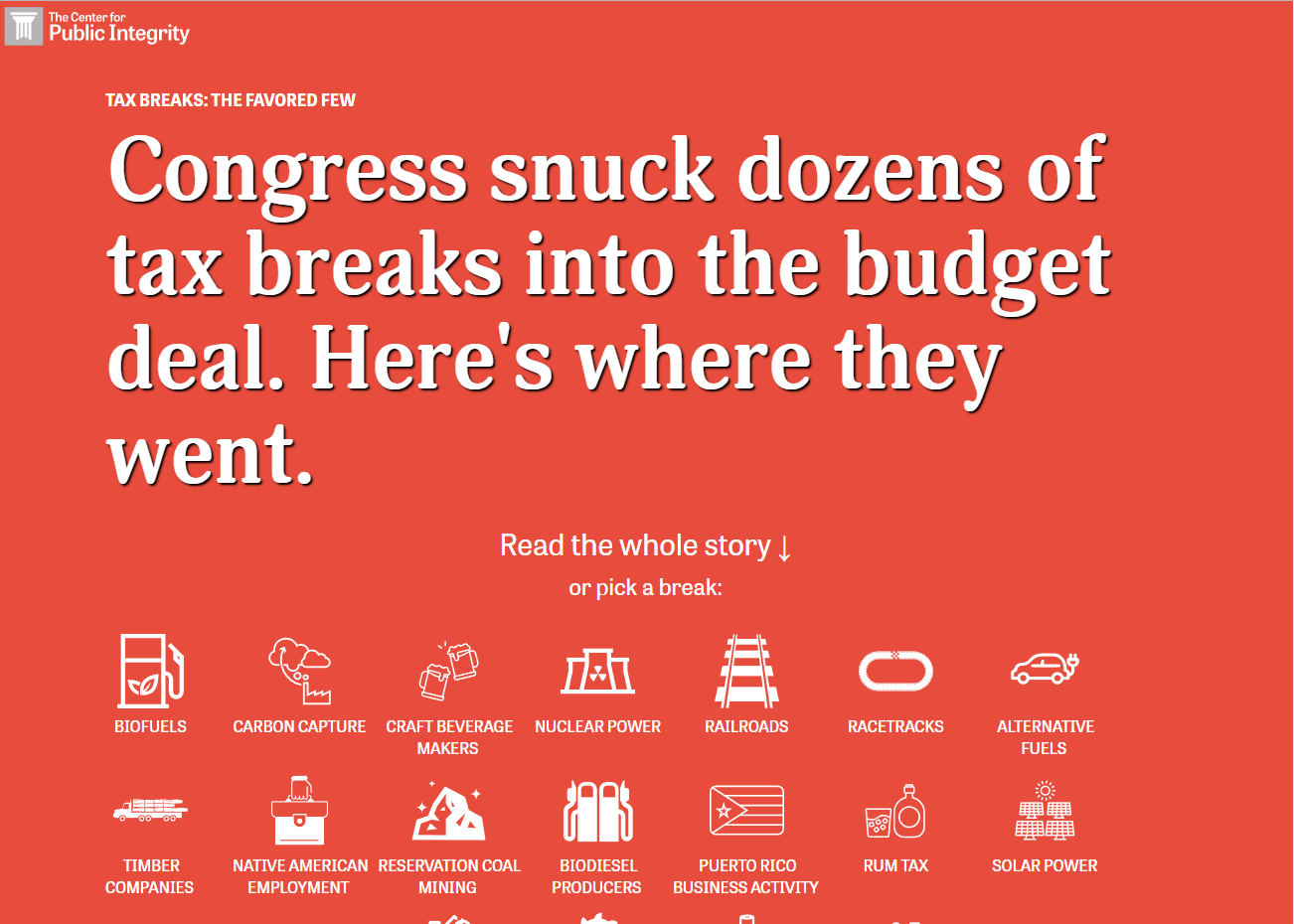

The Center for Public Integrity just released an excellent, long form, investigative piece on the subject of tax extenders and recently expired provisions in the tax code, in which Ms. Alexander, and TCS vice president, Steve Ellis are quoted. Mr. Ellis famously calls extenders the roaches of the DC tax policy world. Because, “They seem to always survive.”