On December 9, the federal government leased 30,528 acres of public land in Colorado for oil and gas development at the recently reduced federal royalty rate of 12.5%. The result is an estimated $57 million in lost royalty revenue on oil and gas production over the lifespan of these leases.

This adds to mounting losses—TCS calculates that taxpayers have already lost $454 million in projected royalty revenue from leases sold since July 4, when the One Big Beautiful Bill Act (OBBBA) reduced the onshore royalty rate to 12.5%—below what states and private interests charge. Yesterday’s auction also saw little competition; one third of leased acres were sold at the $10 minimum bid. This lowers initial sale revenue and is further evidence that industry interest is driven by factors like production potential and global oil prices, not leasing terms — and taxpayers should not be asked to pay for needless industry giveaways (like below-market royalty rates).

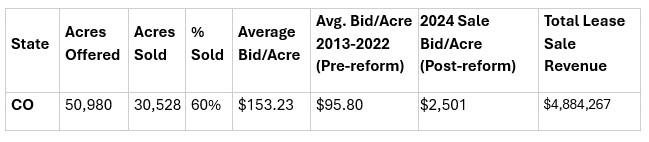

Yesterday’s lease sale offered 60 parcels of land, covering nearly 51,000 acres of federal land across 6 Colorado counties, for oil and gas development. The sale leased just 60% of available acreage, making it subject to the OBBBA provision requiring a replacement sale—which is triggered when a quarterly lease sale in certain states receives bids on fewer than 75% of the acres offered. As we detailed before, these replacements sales could be even more costly for taxpayers as the Bureau of Land Management will be forced to offer (or reoffer) more land in areas that were not competitive to begin with.

Of the 31,000 acres leased Tuesday, around 37%—11,258 acres—were leased at the legal minimum bid of $10 per acre. Revenue from the lease sale was driven by just two competitive parcels, totaling less than 1,000 acres but accounting for more than a quarter of total auction revenue. For comparison, the relatively high saturation of minimum bids reduced yesterday’s average bonus bid per acre to just 6% of a sale held in 2024 under the higher 16.67% royalty rate.

This low industry interest is further evidence that “favorable” leasing terms alone do not lead to competitive auctions and high returns for taxpayers. Leasing decisions are driven by a number of factors—both parcel-specific, like production potential and proximity to existing infrastructure, and by the global energy market, like oil and gas prices. In fact, more than a decade of leasing data suggests that leasing terms have little to no impact on when and where a company leases.

Last year, before the reforms were rolled back, leases across the country that came with the higher 16.67% royalty rate sold for record high bids—five times higher than the pre-reform 10-year average—especially in states with high oil and gas production, such as New Mexico. The only lease sale held in Colorado under the 16.67% royalty rate offered and sold one parcel at $2,501 per acre—more than the highest bid a single parcel received on Tuesday. Unfortunately for taxpayers, the leases issued Tuesday were sold at the outdated 12.5% rate, locking in a century-old rate for decades.

The federal oil and gas leasing program has long lagged behind the private market and rates charged on state lands. Outdated terms hadn’t even kept pace with inflation until 2022, when long-overdue reforms modernized the system by raising royalty rates, updating fees, and ending giveaways like noncompetitive leasing. But this summer, OBBBA rolled back many of those improvements. Now, once again, taxpayers are being shortchanged as companies lock in decades of drilling under terms that don’t reflect the true value of America’s oil and gas resources.

In Colorado alone, taxpayers missed out on $811 million in revenue from FY2013 to FY2022—before the royalty rate was raised. With record-high production across the U.S., losses will continue or even grow worse. Because revenue is shared between the federal treasury and states, Colorado taxpayers will also lose funds for schools, infrastructure, and other local priorities.

The Bureau of Land Management estimates that the parcels sold Tuesday will result in 191 wells. Using average production on federal lands in Colorado over the last decade, these parcels could yield 179,000 barrels of oil and 15.4 billion cubic feet of natural gas every year of active production. Based on the White House Budget Office’s 2025 price projections—used to estimate federal royalty revenue from onshore leases—that production could be worth roughly $113 million annually. At the 12.5% rate, taxpayers would see about $14 million each year—$4.7 million less than they would under a 16.67% rate. Over the average 12-year lifespan of oil and gas wells in Colorado, that’s about $56.8 million in lost revenue.

- Robert Coy, Adobe Stock