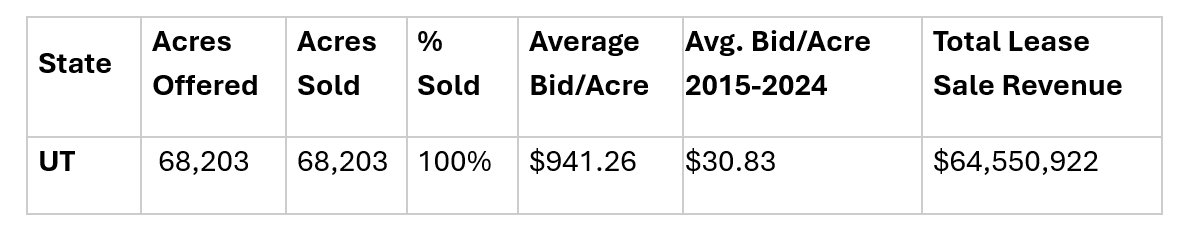

On December 10, the federal government leased 68,203 acres of public land in Utah for oil and gas development at the recently reduced federal royalty rate of 12.5%. The result is an estimated $35 million in lost royalty revenue over the lifespan of these leases.

This adds to mounting losses—TCS calculates that taxpayers have already lost $489 million in projected royalty revenue from leases sold since July 4, when the One Big Beautiful Bill Act (OBBBA) reduced the onshore royalty rate to 12.5%—below what states and private interests charge.

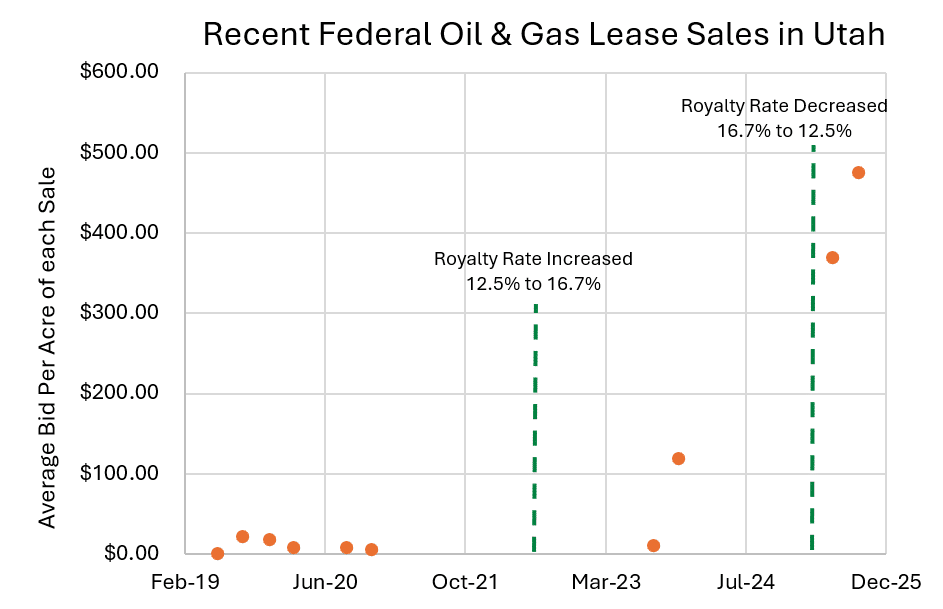

Today’s highly competitive lease sale is part of a multi-year trend demonstrating increased interest in leasing federal lands in Utah for oil and gas development. This trend spans changes in leasing terms and is instead likely driven by factors such as production potential and global oil prices — so taxpayers should not be asked to pay for needless industry giveaways like below-market royalty rates.

Today’s lease sale offered 48 parcels of land in Uintah County, covering more than 68,000 acres of federal land, for oil and gas development. Last year, Uintah was the 10th highest producing county in the U.S. for federal oil and 8th for federal gas. All available parcels were sold at an average bid of $941 per acre, the highest in Utah in over a decade and thirty times the state’s ten-year average.

Leasing decisions are driven by a number of factors—both parcel-specific, like production potential and proximity to existing infrastructure, and by the global energy market, like oil and gas prices. While today’s auction set a new state record, it is part of a broader trend that predates recent changes to the onshore oil and gas leasing system. Today is the fourth Utah lease sale in a row to set a record high average bid per acre. The previous record high was $477 per acre in September 2025, also under the 12.5% royalty rate. Before that, the high was $370 per acre in June 2025 and before that $118 per acre in December 2023, both of which were under a 16.67% royalty rate. Over this period, federal oil production in the state has also skyrocketed, up 17% 2022-2023 and up another 19% 2023-2024.

A previous oil and gas lease sale held in Utah this June demonstrates how auction results are tied to specific parcels and market conditions, not linked to royalty rates. In the June lease sale, the Bureau of Land Management added an additional 11 parcels, totaling 20,045 acres, that had been originally offered in a 2023 sale but were not leased. No company had renominated the lands for leasing. On the day of the sale, no bids were received for any of the 11 parcels added to the sale and the only two parcels that sold were those that had been nominated and initially scoped for the June sale.

Recent lease sales suggest that industry is willing to pay competitive rates to secure parcels they want, regardless of the royalty rate and other leasing terms. Lowering royalty rates only shortchanges taxpayers by reducing future royalty revenue. In Utah alone, taxpayers lost an estimated $720 million in revenue from FY2013 to FY2022 under the 12.5% rate. With record-high production across the U.S., losses will continue or even grow worse. Because revenue is shared between the federal treasury and states, Utah taxpayers will also lose funds for schools, infrastructure, and other local priorities.

The Bureau of Land Management estimates that the parcels sold today will result in roughly 428 wells. Using average production on federal lands in Utah over the last decade, these parcels could yield 400,000 barrels of oil and 8.3 billion cubic feet of natural gas every year of active production. Based on the White House Budget Office’s 2025 price projections—used to estimate federal royalty revenue from onshore leases—that production could be worth roughly $184 million annually. At the 12.5% rate, taxpayers would see about $10.5 million each year—$3.5 million less than they would under a 16.67% rate. Over a conservative 10-year lifespan, that’s about $35 million in lost revenue.

- Department of Interior, Utah Bureau of Land Management