– Download Full Report –

Table of Contents

- Executive SummaryRecommendations

- Introduction

- Fair Market Value

- Coal Leasing Program

- Other Concerns

- Conclusion

- Appendix One: Company Profiles

Taxpayers for Common Sense, a non-partisan budget watchdog organization, prepared this report in collaboration with Pamela Baldwin, federal lands consultant and former Congressional Research Service attorney.

Executive Summary

The predominant leasing process currently used by the Bureau of Land Management (BLM), the agency within the Department of the Interior (DOI) that manages the federal coal leasing program, does not obtain fair market value for taxpayers. It seldom generates competitive bids, and studies indicate that the resulting losses are substantial. Additional and potentially larger losses may be in store if certain current leasing practices continue and markets for exported federal coal expand.

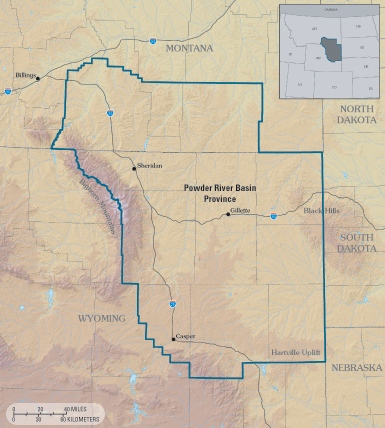

Estimates of losses from BLM practices from 1983 to date run as high as almost $29 billion. The DOI Inspector General (IG) documents that “even a 1-cent-per-ton undervaluation in the FMV calculation could result in a $3 million revenue loss” in the average lease sale in the Powder River Basin (PRB) of Montana and Wyoming. Still more revenues are lost as part of the royalty collection processes when the full value of exported coal is not considered, possibly as much as $40 to $100 million in recent years.

Congress has repeatedly and expressly directed federal agencies to ensure a fair return to the government for the development of public assets, such as coal. Yet, DOI’s coal leasing program has been the subject of repeated cycles of audits, studies, moratoria, legislation, and new regulations, all attempting to uncover and cure problems that cost the government and taxpayers money. New concerns over current and future revenue losses have resulted in another round of audits and studies of agency regulations and practices. So why are taxpayers still losing money on federal coal?

The evidence points to a leasing system put in place by BLM. Known as Lease by Application (LBA), a system has supplanted the competitive system envisioned by Congress. It improperly skews the valuation of lease tracts, garners significantly reduced bids, and shrouds crucial information in secrecy. Under this system, BLM allows coal companies to play a large role in delineating tracts for leasing, a process that has resulted in tracts that do not generate competitive bids. The problem has been most evident in the Powder River Basin of Wyoming, where over the past 23 years alone, BLM has leased 7.9 billion tons of coal.

BLM has also failed to account for the growing foreign markets for federal coal, especially in Asia. BLM states that coal leases “meet the nation’s energy needs,” provide “a reliable, continuous supply of stable and affordable energy for consumers throughout the country,” and help “to reduce our nation’s dependence on foreign energy supplies.” Yet, the growth plans of coal companies like Peabody and Arch depend on the export of coal to Asia. According to Peabody Energy Chairman Gregory Boyce, Peabody is “opening the door to a new era of U.S. exports from the nation’s largest and most productive coal region to the world’s best market for coal.” The U.S. Energy Information Administration reports 125 million tons of coal were exported during 2012, more than twice 2007 levels. Likewise, the price of exported coal has more than doubled from 2007 through 2011.

In the last year, two new Congressionally-directed reviews have been requested. First, Senator Ed Markey (D-MA), former Ranking Member of the House Natural Resources Committee, has asked the Government Accountability Office (GAO) to review the federal coal leasing program, focusing on how fair market value (FMV) for federal coal is determined and the relationship of FMV processes to exports of federal coal. Second, the Senate Energy and Natural Resources Committee Chairman and Ranking Member, Senators Ron Wyden (D-OR) and Lisa Murkowski (R-AK) have asked DOI to investigate and ensure that adequate royalties are paid on federally-leased coal, especially in the context of sales for the export of coal.

In response, the DOI is auditing coal sales from the Powder River Basin, and has asked the Inspector General to investigate allegations regarding Powder River basin coal sales to affiliated export purchasers or broker. Separately, the IG investigated the coal leasing process, the coal lease inspection and enforcement program, and the venting of methane gas from coal mines. The report resulting from this latter IG investigation was released on June 11, 2013, and included a series of recommendations for changes to various aspects of the coal leasing program. The other reports are pending.

In the context of recent Congressional focus on federal coal leasing, this paper is meant to provide a basis for analyzing the current laws, regulations, and agency practices, as well as recommend areas for additional oversight and actions needed to ensure adequate compensation to federal taxpayers for extraction of coal on federal lands. The increased attention and scrutiny from the latest round of reviews must be used to catapult real reforms of the coal leasing program.

The following recommendations must be implemented to ensure that taxpayers receive fair value for the coal resources they own:

1. Sustained congressional oversight is needed. Several inquiries have been recommended and are underway. Depending on the extent of these reports, additional information should be obtained on a variety of aspects of the federal coal leasing program, as described below.

2. Fair Market Value must be obtained for coal extracted on federal lands.

- No pending or new leases sales should be completed until ongoing investigations are finished and all recommendations are considered and implemented, particularly those recommendations that affect fair market value appraisals.

- BLM’s methods for appraising fair market value must be reviewed and evaluated. If the pending GAO report does not address the validity of BLM’s methods, Congress should either obtain an additional GAO review or require external audits of each FMV appraisal and minimum bid calculation prior to future lease sales.

- Any adjustments made to the methods for calculating FMV (including the pending IG recommendation that BLM consider export market potential) should be accompanied by a plan to ensure that old comparable sales are not being used to establish minimum bids, and that new methods are evaluated. For example, it could be specified that a limited number of sales of a limited number of tons of coal shall be held under the new procedures and then evaluated. If acceptable returns are achieved, these sales could constitute a new set of “comparables” to serve as the basis of sales going forward.

- BLM should make fair market value appraisals and appraisal methods public, opening them to public review and comment, similar to the State of Montana.

- Congress should obtain a GAO study of the relationship between a coal mine’s reserves and the amounts bid for new leases, and consider whether new leases that are most likely to be of interest to companies with significant reserves should be limited.

3. The lease by application system should be examined. The decertification of all Coal Production Regions and associated transition from competitive leasing procedures to the industry-led lease by application process raise serious concerns about whether that system is in taxpayers’ interest. Congress should obtain a GAO review of:

- Whether current leasing levels, including pending lease by application sales, are in the national interest and contribute to obtaining fair market value for federal coal, and whether pending LBAs should be completed.

- Whether tracts leased since 1990 would have been more likely to attract more or higher bids if they had been delineated differently, including whether sequential single bid tracts could have been consolidated to constitute competitive tracts, whether there might be improper, actionable decisions in the nomination and approval sequences of limited interest tracts, and whether new guidelines are needed to ensure delineation of genuinely competitive tracts.

- Whether another bidding system would increase competition or bid amounts. For example, if multiple leases are offered at once, but it is announced in advance that only a certain percentage of tracts with the highest bids relative to the value of the coal will be sold.

4. Use of lease modifications should be reviewed. Congress should obtain a GAO study of the use of lease modifications since the Energy Policy Act of 2005 expanded the acreage allowed to be included in modifications, including how many modifications have been applied for and granted, what acreage and amount of coal was applied for and granted, whether any of the modifications included coal that might have generated competitive interest, and any recommendations for changes.

5. Protections against speculative leasing should be enforced. Given the declines in U.S. coal demand and increasing leasing levels, Congress should obtain an GAO review of existing leases and lease terms to ensure that the Mineral Leasing Act’s diligent development requirements are being enforced.

6. Create safeguards for royalty calculations.

- Congress and DOI must ensure royalty payments are calculated on the full value for federal coal. Congress must ensure royalty payments are not based on a low domestic price of the sale/transfer from one corporate subsidiary to another, which then sells the coal abroad for a much higher price.

- A full audit and review of the royalty collection program for coal must be completed. Key questions must be answered including: what percentage of coal leases and leased acreage have been granted reduced royalties, what are those rates and are the reductions appropriately justified, and what percentage of gross proceeds of coal leases for royalty calculations are reduced for washing and transportation expenses. Following the audit, DOI should take legal action as appropriate to ensure that taxpayers receive a fair return.

- The Office of Natural Resource Revenue (ONRR) must proceed with new rules clarifying valuation, and Congress must exercise active oversight to ensure these rules are implemented. ONRR should ensure that royalty payments are not based on a low sale price to a corporate subsidiary or affiliate rather than the ultimate sale for a higher price, especially within the export market context.

- Royalty rates should be increased to match offshore rates for oil and gas extraction on federal lands.

- A special approval process by ONRR should be required for allowances or deductions for coal washing and transportation that exceed a specified percentage of coal product value.

Introduction

Coal is an important energy fuel in America. More than 90 percent of coal mined in America is used to generate electricity. The Powder River Basin (PRB), located in eastern Montana and Wyoming, is estimated to contain about one third of all U.S. coal reserves and produce 42 percent of U.S. coal. Eighty percent of the PRB reserves belong to the federal government. Wyoming, with 13 active mines in the PRB, accounted for 83 percent of all federal coal produced and 86 percent of federal coal revenues in 2011. With federal coal playing such a significant role in the nation’s energy supply, the proper management of the federal program is of great significance, particularly in the PRB.

Yet federal coal leasing has been the source of controversy for decades. The first significant leasing of federal coal occurred in the 1960s, but largely for speculative reasons. As criticisms of the BLM’s management of the program mounted, DOI imposed a moratorium on leasing to provide time to review the program and make needed changes. Since then Congress has stepped in repeatedly to try to fix the coal leasing program and to help ensure a fair return to taxpayers.

Yet federal coal leasing has been the source of controversy for decades. The first significant leasing of federal coal occurred in the 1960s, but largely for speculative reasons. As criticisms of the BLM’s management of the program mounted, DOI imposed a moratorium on leasing to provide time to review the program and make needed changes. Since then Congress has stepped in repeatedly to try to fix the coal leasing program and to help ensure a fair return to taxpayers.

After World War I, Congress enacted the Mineral Leasing Act of 1920 (MLA) that directs the Secretary of the Interior to set up leasing systems for the development of federally owned deposits of war-related minerals such as oil, gas, coal, sulfur, and phosphate. The MLA requires the payment of rents, bonuses, and royalties to the government.

In the 1960s and 70s, federal coal leasing expanded but little actual mining occurred. To address growing concerns, including speculative leasing and failure to obtain fair value, Congress enacted the Federal Coal Leasing Amendments Act of 1976 (FCLAA), which amended the MLA to require competitive bids and to specify that no bid may be accepted that does not represent fair market value, as well as establish diligent development requirements to reduce speculation and institute minimum royalty rates. Implementing regulations were adopted in 1979 and 1982. This language was added to replace more flexible language that had authorized the Secretary to negotiate sales as provided in regulations. Those negotiated sales had resulted in serious problems and a congressional commission made recommendations for reforms.

The MLA requires that a royalty of “not less than” 12 ½ percent be paid on the value of the coal as defined by regulation, but royalties may be less for coal from underground mines. However, the Secretary may also “waive, suspend, or reduce the rental [payment], or minimum royalty or reduce the royalty on an entire leasehold or on any tract or portion thereof … whenever in his judgment it is necessary to do so in order to promote development, or whenever in his judgment the leases cannot be successfully operated under the terms provide therein.” The MLA directs that monies received from sales, bonuses, royalties and rentals from leasing be shared 50/50 with the states other than Alaska. Forty percent of the federal share goes into the Reclamation Fund that funds construction and maintenance and operation of water resource projects in most western states.

Despite Congressional direction, problems with BLM’s management of the coal program continued, culminating in the alleged leaking of proprietary data to coal companies during the highly controversial lease sales of 1.6 billion tons of PRB coal in 1982. The subsequent investigation by the GAO found that undervalued federal coal and minimal bidder participation (many tracts attracted only one bidder) resulted in the leases being sold for $100 million less than the fair market value. Both the GAO and the Congressionally-appointed Linowes Commission made recommendations for reforms to the coal program. However, although a few changes were made to the program in 1985, there has been little meaningful oversight of the program since then.

Despite Congressional direction, problems with BLM’s management of the coal program continued, culminating in the alleged leaking of proprietary data to coal companies during the highly controversial lease sales of 1.6 billion tons of PRB coal in 1982. The subsequent investigation by the GAO found that undervalued federal coal and minimal bidder participation (many tracts attracted only one bidder) resulted in the leases being sold for $100 million less than the fair market value. Both the GAO and the Congressionally-appointed Linowes Commission made recommendations for reforms to the coal program. However, although a few changes were made to the program in 1985, there has been little meaningful oversight of the program since then.

Today, a shift in domestic coal markets has set off a new controversy surrounding the federal coal program, once again focused on the PRB. Domestic markets for coal have declined due to the depletion of Central Appalachian coal, rising production costs, and competition from other fuels, such as cheap natural gas. Coal companies appear to be focusing on increasing exports of federal coal, primarily to Asian markets, where energy prices are significantly higher. At the same time, a recent study by the United States Geologic Survey (USGS) indicates that the remaining PRB reserves are smaller than previously believed and may be exhausted much earlier than projected.

Fair Market Value

As noted above, the requirement that no bid can be accepted which is less than the FMV, as determined by the Secretary, of the coal subject to the lease is at the heart of the FCLAA reforms enacted by Congress in 1976. Accurate determinations of coal value are critical to the revenues realized by the government. “Value” or “fair market value” enters into the lease sale and management processes at several points, and is the basis for evaluating lease sale bids and lease prices paid, which, in turn, influence coal prices and calculations of royalty revenues.

Many documents (including BLM’s Handbook 3070-1, Economic Evaluation of Coal Properties) and analysts have noted that prices obtained through a competitive system are the best evidence of the true value of a comparable property, and a competitive system is the best check to ensure that true value is obtained.

Developing fair valuations for tracts can be both difficult and controversial. Appraisals necessarily involve subjective valuations of the elements that comprise the value of a property. There are legitimate problems with attempting to apply the same valuation processes used for competitively bid leases to lease tracts that genuinely lack competitive appeal. Regulations, agency guidance, and practices affect how “value” and “FMV” are determined in connection with coal lease sales. BLM prepares a pre-sale estimate of the FMV of a tract that is used to set a minimum bid that would be accepted. Under the current regulations, when a sale is conducted, sealed bids are submitted, and a sale panel reviews them. The panel determines, among other things, whether the high bid meets or exceeds the BLM estimate of value of the tract, and makes recommendations to the authorized officer who will make the final decision.

Once a tract has been sold, the price paid becomes the FMV. If the highest qualified bid comes in higher than the estimated pre-sale minimum, that bid becomes, by definition, the FMV. Final lease sale values can then be used as comparables for estimating values of new tracts. Thus, when value estimates are low, it is thereby possible to lock in a rolling system of continuing undervalued leases. The reverse, however, does not seem to always play out. As articulated in a report issued by Tom Sanzillo (‘the Sanzillo report’), shortly after the BLM awarded Arch Coal a lease for the South Hilight tract for $1.35 per ton, it awarded the comparable South Porcupine tract for just $1.11 per ton.

The possibility that failure to capture the full fair market value in pre-sale estimates could result in lower value tracts and lost revenues has been confirmed by the GAO and other analysts. In 1983, after controversial PRB lease sales, the GAO concluded that the 1982 sales had probably lost $100 million. In 2012, an independent report, applying the same adjustment factors used by GAO in its 1983 report, concluded that up to almost $29 billion has probably been lost on sales since then. Both reports question the appropriateness of the use of the usual appraisal measures in the context of limited interest lease tracts and conclude that more guidance on standards and practices for market assessment is desirable.

Exports and Fair Market Value. While exports are still relatively low, and west coast ports adequate to handle increased exports to Asia have yet to be built, both exports and the prices paid for them doubled from 2007 through 2011. It is likely coal that is being sold now is being sought, at least in part, as reserves for profitable export in the future. The domestic coal market demand is down and projected to stay down by most analysts. Not surprisingly, several of the companies – Alpha Natural Resources, Arch, Cloud Peak, and Peabody – bidding for federal leases and mining federal coal have asserted their plans to export significant tonnages of PRB coal. Some of these same companies are also principle sponsors of export terminals. Because coal leases are issued for an initial term of 20 years that can be extended, leasing decisions made today will lock in prices and terms for decades to come. Therefore, understanding and consideration of market trends and projections is vital.

BLM in the 3070-1 Handbook directs that markets in general and the export market in particular be considered, but the Sanzillo and the IG reports assert that BLM appraisals have not adequately done so. According to the IG, “it appears that several state offices overlook the export potential, thus possibly undervaluing the public’s coal.” The IG recommended that BLM and DOI’s Office of Valuation Services (OVS) fully account for export potential, and BLM concurred. The target date for implementation of this valuation is not until August 31, 2014, however, and at least one coal lease sale is scheduled to occur before then with others possible.

Coal Leasing Program

In response to the direction from Congress in 1976 to require competitive bids for leases, BLM adopted detailed regulations for competitive lease sales.

The MLA establishes a framework for the leasing of coal on the public lands. The Secretary is to delineate tracts for leasing from among those lands classified for coal leasing. Tracts are to be of a size the Secretary “finds appropriate and in the public interest and which will permit the mining of all coal which can be economically extracted…” Tracts are then offered for lease at sales held either on the motion of the Secretary or upon the request of any qualified applicant. The Secretary must award leases by competitive bidding, except for certain sales expressly authorized to be negotiated sales. Lands to be leased must be included in a comprehensive land-use plan and be compatible with that plan, and the Secretary is to consider the effects mining might have on an impacted community or area, and other factors. Leasing is to achieve the maximum economic recovery of the coal within the tract. Public hearings in the area shall be held by the Secretary prior to the lease sale.

The MLA establishes a framework for the leasing of coal on the public lands. The Secretary is to delineate tracts for leasing from among those lands classified for coal leasing. Tracts are to be of a size the Secretary “finds appropriate and in the public interest and which will permit the mining of all coal which can be economically extracted…” Tracts are then offered for lease at sales held either on the motion of the Secretary or upon the request of any qualified applicant. The Secretary must award leases by competitive bidding, except for certain sales expressly authorized to be negotiated sales. Lands to be leased must be included in a comprehensive land-use plan and be compatible with that plan, and the Secretary is to consider the effects mining might have on an impacted community or area, and other factors. Leasing is to achieve the maximum economic recovery of the coal within the tract. Public hearings in the area shall be held by the Secretary prior to the lease sale.

The BLM’s implementing regulations authorize the establishment of “coal production regions” (CPRs). A “regional coal team” (RCT) was to be established for each CPR. An RCT consists of the BLM State Director (or representative) for each state in the region, the Governor (or representative) of each state in the CPR, and a representative of the Director of BLM. The RCT “guides” all phases of the competitive leasing planning process, including identifying leasing areas, recommending leasing levels to the secretary, issuing calls for expressions of leasing interest, and handling preliminary tract delineations, regional tract ranking, tract selection, environmental analysis and sale scheduling.

The regulation’s applicable definition of “producing” is actually severing coal. A lease is considered to be producing if the operator/lessee is processing or loading severed coal, or transporting it from the point of severance to the point of sale. Yet, despite the clear definition, BLM concluded by 1990 that there were no coal production regions in America. Even the huge and valuable PRB Region was decertified in this Alice in Wonderland scenario – even though that Region currently provides 42 percent of the coal used for electricity in the United States, and is the source of 83 percent of total federal coal production.

Lease By Application

Decertification short-circuited the full competitive system, eliminating the first step on which all the other regulations depend, and allowing the alternative LBA system to be the new general rule.

The LBA system eliminates the formal process by which BLM sets leasing levels, a process that involved extensive public participation and directed the consideration of many facets of the coal resource, uses of the public lands, and current and future market factors. Under the LBA system, BLM fails to take into account changing markets, including the decline in domestic demand as well as the increase in profitable coal exports, and has not attempted to adjust the level of coal it is leasing. This failure contributes to the rolling system of under valuations, and shortchanges the government and the public.

The LBA system eliminates the formal process by which BLM sets leasing levels, a process that involved extensive public participation and directed the consideration of many facets of the coal resource, uses of the public lands, and current and future market factors. Under the LBA system, BLM fails to take into account changing markets, including the decline in domestic demand as well as the increase in profitable coal exports, and has not attempted to adjust the level of coal it is leasing. This failure contributes to the rolling system of under valuations, and shortchanges the government and the public.

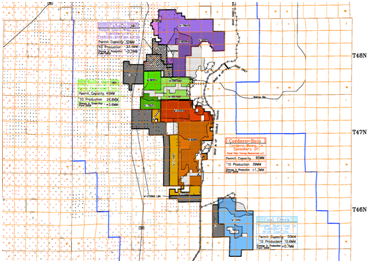

Under the LBA system, BLM allows coal companies to play a large role in delineating tracts for leasing, a process that typically results in tracts that do not generate competitive bids because the location and configuration limit their appeal to companies other than the one that applied for a tract to be sold. This role of companies in delineating tracts of limited interest seems to conflict with the MLA, under which the opportunity for applicants to request a lease sale applies only to the holding of the sale itself, not to the delineation of tracts. Even though there may be little competition for a tract because of limited mining companies, it may be possible to design competitive tracts to be attractive to at least two bidders or intentionally design them to only attract one.

BLM asserts that they do not simply accept a tract for leasing as it is described in an application, but rather the agency uses:

“… a wide variety of information, including geologic data that delineates the location, quality, and quantity of coal within a given area, to determine the most appropriate tract configuration that would encourage competition and help achieve maximum economic recovery of the resource.”

However, most tracts are adjacent to deposits already leased by a company and the tracts are often of a size or design that precludes another company from economically mining them and bidding on them. The recent IG Report states that that investigation found that “over 80 percent of the sales for coal leases in the PRB received only one bid in the past 20 years. No coal lease has had more than two bidders on a sale….This lack of competition also applies to the coal producing regions in other States.” The IG did not, however, make recommendations to address this concern, and neither Congress nor the GAO has looked at this issue since the transition to the LBA system.

Coal mines are expensive to establish and permit, and are generally sited near the highest quality tracts of coal, then expanded from there through the leasing of “maintenance tracts.” In the PRB, there are currently 16 coal mines, owned and operated by seven companies – a limited pool of bidders who are generally only interested in the coal beside their existing mines. Although there is inherently somewhat limited competitive interest in coal tracts in the PRB, as mines expand (see map), they begin to encroach upon each other, increasing the prospects for competition. There are, in fact, examples where competition has occurred in the PRB and could reasonably guide appraisals of FMV.

Coal mines are expensive to establish and permit, and are generally sited near the highest quality tracts of coal, then expanded from there through the leasing of “maintenance tracts.” In the PRB, there are currently 16 coal mines, owned and operated by seven companies – a limited pool of bidders who are generally only interested in the coal beside their existing mines. Although there is inherently somewhat limited competitive interest in coal tracts in the PRB, as mines expand (see map), they begin to encroach upon each other, increasing the prospects for competition. There are, in fact, examples where competition has occurred in the PRB and could reasonably guide appraisals of FMV.

The evidence shows that BLM, instead of deciding whether there is sufficient demand for coal and designing tracts to maximize competition, defers to industry, which avoids competition and designs tracts to maximize company share value and strategic positioning in the market. This view is also articulated in a report prepared for XCEL Energy by mining and geological consultant John T. Boyd Company:

As a practical matter, most companies will attempt to define LBA tracts that, because of

location or geometry, are of interest only to the nominating company. This minimizes

competitive bidding on the tract, and may result in a lower cost lease. Where competition

has existed for coal leases (mostly in the southern Gillette area but recently in the

central portion of the coalfield) relatively high bonus bids in the range of $0.90 –

$1.10/ton have resulted. BLM has, even in non-competitive cases, required “Fair Market

Value” bids in this range, particularly in the Southern PRB.

Allowing coal companies to take the lead on delineating tracts as a general rule has the potential to set up a vicious cycle: offering tracts of limited interest results in sales with limited numbers of bidders, which in turn justifies the avoidance of the competitive system.

Decertification of the PRB Region was recommended by the Powder River RCT in 1987. The RCT also recommended that it (the RCT) should continue to exist after decertification to award leases under the LBA system. The Director of BLM, Cy Jamison, approved the decertification and the other recommendations of the RCT. These included the stipulation that only maintenance tracts would be leased under the LBA system and that requests for new mines or broader leasing would be considered by the RCT on a case by case basis. The RCT argued that “most industry interests could be accommodated [by the LBA process]” and “widespread leasing would not be necessary.”

Production from the PRB Region greatly increased after its decertification as a coal producing region. In 1983, before decertification, the PRB coal region produced 151 million tons of coal; by 1993, production had jumped to 275 million tons annually and by 2010, the PRB region was producing 470 million tons of coal. Since 1990, the BLM reports a significant amount of coal has also been sold. The Wyoming BLM state office indicates that 7.9 billion tons have been sold and another 3.4 billion tons are pending – all proposed to be sold under LBA procedures. And absent new legislation or other direction to the agency, the LBA system will apparently be used for future sales of the remaining federal coal.

Other Concerns

Lease Modifications. The MLA allows the Secretary to modify an existing lease to avoid “bypass” coal – stranded coal not sufficient in quantity to be sold competitively. Lease modifications are not conducted through competitive sales, but through a separate application process that is open to public review and comment.

The Energy Policy Act of 2005 expanded the amount of acreage that can be added to an existing lease by a lease modification from 160 acres to 960 acres – a quantity that might represent significant value to a company with equipment already in the area. Because lease modifications are not offered for competitive bidding through the LBA process, it is even more important that BLM establish the correct FMV.

The Energy Policy Act of 2005 expanded the amount of acreage that can be added to an existing lease by a lease modification from 160 acres to 960 acres – a quantity that might represent significant value to a company with equipment already in the area. Because lease modifications are not offered for competitive bidding through the LBA process, it is even more important that BLM establish the correct FMV.

The recent IG Report concluded that $60 million had been lost in the 45 lease modifications since 2000 that it examined. The BLM faulted that conclusion because the IG had valued the coal at the same rate as the main lease to which additional deposits were added. BLM thought it should be valued at a lower rate as coal for which there was no competitive interest – one choice for valuation. If coal is being added to an existing lease because it is by definition coal for which there is no competitive interest, determining its value to the company requesting it might be appropriate – a second valuation alternative. The course taken by the IG – valuing the coal at the same rate as the lease being modified – is a third alternative. This difference of opinion highlights the need for further thinking and guidance regarding valuing coal deposits both for lease modifications and also for maintenance tracts.

Lease Speculation. As mentioned above, in 1976, Congress enacted statutory protections to protect against speculative leasing and ensure that leased federal coal is developed. The MLA establishes lease terms as 20 years and “for so long thereafter as coal is produced annually in commercial quantities from that lease.” However, “[a]ny lease which is not producing in commercial quantities at the end of ten years shall be terminated.” Continued operations may be suspended if interrupted by strikes, the elements, or casualties not attributable to the lessee, if suspension is in the public interest and advance royalties are paid.

There has not been a review of BLM’s enforcement of anti-speculative requirements since 1994, when the GAO found that BLM had taken actions that do not further diligent development goals.

The increased federal leasing rates coupled with declining mine production and declining domestic demand call into question the ability to stop speculative leasing, especially given the potential rise in coal prices due to increased exports in the future.

Transparency and Fair Market Value. It is difficult to verify the adequacy of BLM’s FMV analyses because the data BLM used are not publicly available, as the Sanzillo report has asserted. Before determining the FMV, the Secretary is to provide an opportunity for and consideration to public comments on that issue, but that statutory direction cannot be construed to require the Secretary to make his judgment on FMV public before the issuance of the lease in question. Nothing prohibits making FMV appraisals public after a sale, but concerns about corporate proprietary information and the potential to harm the competitive position of the government have been expressed as justification for not releasing information and data on how appraisals are determined. While the BLM does request public comment on FMV calculation and methodology, it does not share its valuation data or methodology, prohibiting substantive comments.

The State of Montana, by contrast, releases its FMV calculations for public review and comment before lease sales. In the case of Montana’s 2010 lease sale of the state-owned Otter Creek tracts, the Montana Department of Natural Resource Conservation (DNRC) contracted with Norwest Corporation to prepare an appraisal of the FMV of the tracts. Norwest used BLM’s Handbook H-3070-1, Economic Evaluation of Coal Properties to calculate the value of the coal as $0.0539 per ton or $30.8 million using the Comparable Lease Sales Approach and $0.0652 per ton or $37.3 million using the Income Approach. Norwest noted that these values are lower than similar federal lease sales because of the lack of existing mining equipment and rail service at Otter Creek.

The State of Montana, by contrast, releases its FMV calculations for public review and comment before lease sales. In the case of Montana’s 2010 lease sale of the state-owned Otter Creek tracts, the Montana Department of Natural Resource Conservation (DNRC) contracted with Norwest Corporation to prepare an appraisal of the FMV of the tracts. Norwest used BLM’s Handbook H-3070-1, Economic Evaluation of Coal Properties to calculate the value of the coal as $0.0539 per ton or $30.8 million using the Comparable Lease Sales Approach and $0.0652 per ton or $37.3 million using the Income Approach. Norwest noted that these values are lower than similar federal lease sales because of the lack of existing mining equipment and rail service at Otter Creek.

The DNRC released the Norwest valuation to the public and requested public comment in advance of the lease sale. The DNRC then used the appraisal and public comments to design a minimum bid package to secure fair market value for the coal leases. The winning bid by Ark Land Company, a subsidiary of Arch Coal, approved on March 18, 2010, was $85,845,110 – significantly higher than the initial appraised FMV.

Exposing all of this information to public review may have contributed to the higher bid the state received, and certainly provided a more transparent process that could be a model for federal lease sales.

Who Should Appraise Coal Value? The IG also concluded that the performance of coal appraisals by BLM staff rather than by OVS staff violates Secretarial Order 3300 and that lease sales would be enhanced if OVS conducted appraisals. The IG noted that “even a 1-cent-per-ton undervaluation in the FMV calculation could result in a $3 million revenue loss” in the seven coal lease sales conducted in Wyoming’s PRB since 2011. Each cent-per-ton undervaluation of the 3.4 billion tons of coal proposed to be leased would result in a $34 million revenue loss – half to the federal treasury and half to the state of Wyoming.

Secretarial Order No. 3300, issued on May 21, 2010 established OVS, which was to have “sole responsibility for contracting for valuation services for the Department’s bureaus and offices.”

The issue is whether this general authority of OVS and the Office of Minerals Evaluation to contract for mineral appraisals applies only to individual real estate transactions by which property is acquired or conveyed by the United States, or whether the authority also encompasses ongoing mineral valuations that are the basis for mineral leasing programs.

Rents, Royalties, and Revenues

Establishment of FMV for lease sales is just one of the processes that are intended to secure a fair return for publicly owned mineral resources. Once FMV is estimated, the lease sale is held and bonus bids are paid. Then royalties must be collected on coal actually produced. Significant deductions are allowed that are relevant to the final amount of royalties owed, especially in the export context.

The MLA requires $3 per acre rent payments, but the principal source of intended revenues is royalties. The major amendments to coal leasing enacted in 1976 directed that royalties on federal coal be “not less than 12 ½ percent,” but may be lower for underground mining operations. However, because this represented a significant increase in royalties at the time and the GAO expected that requests for royalty reductions would increase as a result of the increased rates, the statute also authorizes the Secretary to waive, suspend, or reduce a rental, or minimum royalty, or reduce the royalty on an entire leasehold or on any tract or portion thereof … whenever in his judgment it is necessary to do so in order to promote development, or whenever in his judgment the leases cannot be successfully operated under the terms provide therein… The GAO recommended that the DOI develop policies and procedures for uniform processing of such requests and also noted the tension between carrying out the new statutory direction for higher royalties versus encouraging production:

“Of course, these decisions must be tempered by congressional intent to raise Federal royalty rates to significantly higher levels than were in effect prior to the Federal Coal Leasing Amendments Act of 1976. A decision that freely permits royalty reductions may undermine FCLAA’s mandate and cause de-facto reductions of the statutory minimums. Conversely, a stringent policy that makes reductions virtually impossible might lead to situations where Federal coal is lost to future recovery.”

Decades later, this need for royalty reduction is no longer justified as the 12.5 percent rate for surface coal is not a dramatic increase to existing rate.

Decades later, this need for royalty reduction is no longer justified as the 12.5 percent rate for surface coal is not a dramatic increase to existing rate.

Royalty rate reductions are determined separately from lease renewal or other lease term periods, and in fact may not be specified in the terms of an initial lease issuance or in lease readjustment terms. Two essential MLA elements must both be met to qualify for a rate reduction: 1) the royalty rate reduction must encourage the greatest ultimate recovery of coal; and 2) the royalty rate reduction must be in the interest of conservation of natural resources. Even if these elements are demonstrated, a rate reduction may be granted only when it is necessary to promote development or if the lease cannot be successfully operated under the lease terms. Royalty rates may be reduced to as low as two percent.

The recent IG report examined six royalty rate reduction requests in four state offices. However the IG noted that BLM staff may lack the expertise to evaluate a company’s financial statements and documentation when the reduction request rests on a claim of financial hardship.

The Washington Office of BLM cannot provide statistics on the number of leases with reduced royalties, the rates involved, and the amounts of royalties foregone. BLM advises that such statistics would have to be collected from BLM State offices, where records on individual leases are kept. Congress should request information about what percentage of all coal leases have reduced royalty rates, as well as what the royalty rates applied to coal product actually are and how they are justified, since reduced rates obviously reduce royalty returns. Most studies on lost revenues have focused on BLM valuations for bids and comparables rather than on the extent of royalty revenues foregone because of rate reductions or other reasons.

Calculation and Collection of Royalties

The 1982 Linowes report stated that management of royalties from the nation’s energy resources had been a failure for more than twenty years. It recommended system changes including the creations of an independent body to supervise collection of royalties. In response, Congress enacted reforms in the oil and gas context, and Secretarial Order 3071 (1982) created the Minerals Management Service (MMS), with responsibility for royalty management. However, the MMS also was faulted for inadequate royalty management and scandal that resulted in the creation of the Office of Natural Resource Revenues (ONRR) in 2010.

Coal extracted from federal lands, except coal unavoidably lost (unless the lessee receives compensation for it) is subject to royalty. The royalty is computed on the basis of the quantity and quality of federal coal in marketable condition measured at the point determined jointly by BLM and ONRR. With some exceptions, the lessee is to pay the royalty rate specified in the lease at the time the coal is used, sold, or otherwise finally disposed of. It is important to ONRR’s collection activities to receive accurate and complete information from BLM as to the royalty rates in effect for particular leases. This did not always happen in the past, and it is not known to what extent there may or may not be problems in this regard currently, since ONRR relies initially on a lessee to report the correct and applicable royalty rate. In addition, any document indicating a royalty rate reduction is separate from the lease document itself.

After the royalty collection duties of the MMS were transferred to ONRR, the regulations on valuation of coal product for royalty purposes were repromulgated. The regulations define many terms, including “arm’s length contract,” a phrase on which many of the valuations are premised, and several presumptions are created. The definitions of arms-length, ownership, and control are especially relevant in the current export controversy because royalty calculations can vary significantly depending on those factors. Non arms-length royalties are more difficult to verify because there are many alternative elements and proofs of value that can be used and considered. The non arms-length approach could make it easier to misreport data or to conceal intentional discrepancies. Misreporting would also be easier if a multistep process is involved, such as transporting the coal product to washing preparation sites or to a distant selling point or both. These elements are involved in moving coal to ports for export.

Royalties for coal leases are calculated on a cents-per-ton basis (typically older leases) or as an ad valorem percentage royalty. The regulations state that leases still on a cents-per-ton basis cannot take an allowance for transportation costs, removal of impurities, coal washing, or any other processing or preparation of the coal. Ad valorem leases – those based on the value of the coal as opposed to a cents per ton calculation, including leases converted from a cents-per-ton basis, can claim allowances for such activities, and the deductions can be substantial.

Determining Value. Determining the value of coal product for ad valorem leases is the basis for calculating royalties owed. ONRR has published proposed regulations for the valuation of advance royalties, to be coordinated with changes to BLM regulations and clarification of respective agency responsibilities. “Value” refers to the gross proceeds accruing to a lessee if the proceeds are the total consideration actually transferred directly or indirectly from a buyer to a seller. Value can be evidenced by an arms-length contract and the lessee has the burden to show the contract was arms-length.

If value cannot be determined through an arms-length contract, alternative means of determining value are set out, that must be applied in the order in which they are listed and value “shall be based upon the first applicable criterion. The first of these is if the gross proceeds accruing to the lessee (presumably as stated by the lessee) are within the range of proceeds under comparable arms-length contracts, considering “[p]rice, time of execution, duration, market or markets served, terms, quality of coal, quantity, and such other factors as may be appropriate to reflect the value of the coal.”

If value cannot be determined through an arms-length contract, alternative means of determining value are set out, that must be applied in the order in which they are listed and value “shall be based upon the first applicable criterion. The first of these is if the gross proceeds accruing to the lessee (presumably as stated by the lessee) are within the range of proceeds under comparable arms-length contracts, considering “[p]rice, time of execution, duration, market or markets served, terms, quality of coal, quantity, and such other factors as may be appropriate to reflect the value of the coal.”

Other benchmarks that may be used are: the prices reported for that coal to a public utility commission; prices reported for that coal to the Energy Information Administration of the Department of Energy; other relevant matters including, but not limited to, published or publicly available spot market prices, or information submitted by the lessee concerning circumstances unique to a particular lease operation or the saleability of certain types of coal; and if reasonable value cannot be determined using this methods, then a net-back method or any other reasonable method shall be used to determine value. Value determined by these means is more subjective than value determined by an arms-length contract.

If a lessee determines value by means other than the arms-length contract, the lessee must retain all data relevant to the determination, and the data is subject to review and audit. In language that is used consistently in many sections, if ONRR determines that a lessee has not properly determined value, the lessee is liable for the difference between the proper value, less the value the lessee used, plus interest. This language is much closer to being a correction than it is a penalty. Once value is shown to establish the gross proceeds subject to royalties, an ad valorem lessee may claim applicable coal washing allowances and transportation.

“Coal washing” is defined as any treatment to remove impurities from coal, including flotation, air, water, or heavy media separation; drying; or related handling or combination of activities. An ad valorem lessee may deduct actual costs incurred to wash coal unless the value of the coal was based on like-quality unwashed coal. Costs that are normally associated with mining operations and are necessary to place coal in marketable condition will be allowed as a cost of washing. Coal washing costs are recognized as allowances when the washed coal is sold and royalties are reported and paid.

Deductions for the costs of coal washing can be quite large, but “under no circumstances will the authorized washing allowance and the transportation allowance reduce the value for royalty purposes to zero.”

Deductions for the costs of coal washing can be quite large, but “under no circumstances will the authorized washing allowance and the transportation allowance reduce the value for royalty purposes to zero.”

Similarly, an allowance is allowed for transportation costs for ad valorem leases where the value for royalty purposes has been determined at a point remote from the lease or mine. The allowance is for actual costs to transport the coal from a federal lease to a sales point which is remote from both the lease and mine or to transport the coal from a federal lease to a wash plant that is remote from both the lease and mine and from the wash plant to a remote sales point. For coal that is not washed at a wash plant, the transportation allowance is authorized for the total production which is transported, and is recognized when the coal “is sold and royalties are reported and paid.” Similarly too, under no circumstances will the authorized washing allowance and the transportation allowance reduce the value for royalty purposes to zero. It appears that no further deduction is allowed for the additional enhancement beyond marketable condition.

By contrast, any deduction for transportation expenses with respect to the development of oil and gas leases against royalty value may not exceed 50 percent of the value of the resources without the permission of ONRR after a review of data demonstrates that the costs claimed are reasonable and necessary.

It is not known what percentages of lease values have been allowed as deductions on actual leases. Crucial information regarding coal valuation may also be difficult for the public to obtain:

“Certain information submitted to ONRR by a lessee to support valuation proposals, including transportation, coal washing, or other allowances under §1206.265 is exempted from disclosure by the Freedom of Information Act, 5 U.S.C. 522. Any data specified by the Act to be privileged, confidential, or otherwise exempt shall be maintained in a confidential manner in accordance with applicable law and regulations.”

The extent of deduction allowed and the percentage of gross proceeds the government actually receives is another area that GAO or the IG should probe further.

Conclusion

Taxpayers are not receiving a fair return for the extraction of publicly owned coal. An overall lack of transparency and accountability at the BLM, along with systemic changes that impeded a competitive leasing process, have led to decades of taxpayer losses and the problems continue to run rampant today. If coal mining increases, as predicted with expanded need for coal exports, the problem will only get worse.

Unless significant changes are made to the BLM leasing process and Congress exercises more enforcement and oversight over the federal coal program taxpayers will continue to lose millions in revenue. At a time of ballooning deficits and sky-rocketing debt, taxpayers cannot afford to giveaway federal assets—it’s time to collect what we are rightfully owed.

APPENDIX ONE: COMPANY PROFILES

ALPHA NATURAL RESOURCES INC.

The Bristol, Virginia based Alpha Natural Resources Inc., founded in 2002 and made public in 2005, was the third largest publicly traded U.S. coal producer in 2012. In that year, Alpha extracted 106 million tons of coal from 107 mines in Northern and Central Appalachia and the Powder River Basin, but recorded a loss of $2.44 billion. Approximately 42 percent of all 2012 revenues were a result of coal exports. The mining company’s coal production has decreased significantly in 2013. In the first six months of the year, Alpha Natural Resources sold 44.5 million tons of coal generating $2.67 billion, a 19 percent decrease in sales and a 29 percent decrease in revenue compared to the same period in 2012. The mining company now operates 88 mines and 24 processing plants in Virginia, West Virginia, Kentucky, Pennsylvania, and Wyoming.

Alpha Natural Resources acquired its two mines in the PRB, Belle Ayr and Eagle Butte, through its merger with Foundation Coal in July 2009. The two surface mines produced 46.7 million tons in 2012, 44 percent of all coal sold by Alpha. Approximately 18.7 million tons of coals were extracted from the two mines in the first two quarters of 2013.

ARCH COAL INC.

Founded in 1969, the Saint Louis based Arch Coal Inc. operates 32 mines at 17 mining complexes in eight states across the U.S. In 2012, the company produced 136 million tons of coal (13.4 percent of U.S. coal production) and sold 141 million tons of coal representing roughly 14.4 percent of the U.S. coal supply. Arch’s coal exports hit a record high in 2012 reaching 13.6 million tons. “We see exports as a long-term development opportunity,” states Arch in its 2012 annual report. Despite having an average profit of $174 million in the previous four years, the company recorded a loss of $684 million in 2012. In addition to decreasing its capital expenses which contributed to the loss, Arch notes that it should decrease its long term indebtedness which totaled $5.1 billion in December 2012 to improve its financial health.

Arch Coal divides its operations into four sectors, but its PRB sector extracts and sells more coal than the other three combined (74 percent of sales in 2012). The company acquired its two active PRB mines – Coal Creek and Black Thunder – in June 1998 from Atlantic Richfield Company, marking Arch’s expansion into the western U.S. The Black Thunder Mine which extracts around 100 million tons of coal a year from seven pit areas is the company’s single most productive complex. In November, 2009, Arch Coal acquired the rights to extract coal from the part of the Otter Creek Tracts located in southeastern Montana in the PRB owned by Great Northern Properties Limited Partnership. Through its subsidiary Ark Land Company, Arch Coal won Montana’s auction for the lease of Otter Creek Tracts on state land in March 2010. Mining operations have not commenced at Otter Creek. Arch Coal’s 3.5 billion tons of coal reserves in the PRB including the Otter Creek reserves represent 63.8 percent of its total 5.49 billion tons of coal reserves.

CLOUD PEAK ENERGY

Headquartered in Gillette, Wyoming, Cloud Peak Energy is one of the largest U.S. coal companies. Founded in 1993, Cloud Peak is a spinoff of Rio Tinto Energy America (RTEA)—Rio Tinto Plc’s American business arm. Cloud Peak engages in the exploration, mining, and production of coal solely in the Powder River Basin of the United States. Within the PRB, Cloud Peak produces coal at three coal tracts and is the lead developer of two major projects. These include Antelope Mine, Cordero Rojo Mine, Spring Creek Mine, Youngs Creek Project, and Crow Big Metal Project. Cloud Peak holds more than 1.2 billion tons of coal reserves and is positioning itself “to serve Asian export and domestic customers.” In 2012, Cloud Peak exported near record amounts of coal overseas. Over the past five years, Cloud Peak has averaged nearly $1.5 billion in total revenue and $168 million in net profits.

PEABODY ENERGY CORPORATION

Headquartered in St. Louis, Missouri and founded in 1883, Peabody Energy Corporation is the world’s largest private coal company. Peabody engages in the exploration, mining, and production of coal. It owns majority interests in 28 coal companies throughout the U.S. and Australia that do business in six continents worldwide. Peabody holds more than 9 billion tons of coal reserves. Within the Powder River Basin, Peabody produces coal at three major mining operations. These include the North Antelope Rochelle Mine that produces “more coal than most companies and nations,” Caballo Mine, and Rawhide Mine. Peabody’s PRB coal reserves amount to more than one-third (38 percent) of the company’s total worldwide coal reserves. In 2012, Peabody exported record amounts of coal overseas. Over the past five years, Peabody has averaged nearly $7 billion in total revenue and $509 million in net profits.

For more information, contact Autumn Hanna, Taxpayers for Common Sense at (202) 546-8500 or autumn@taxpayer.net.