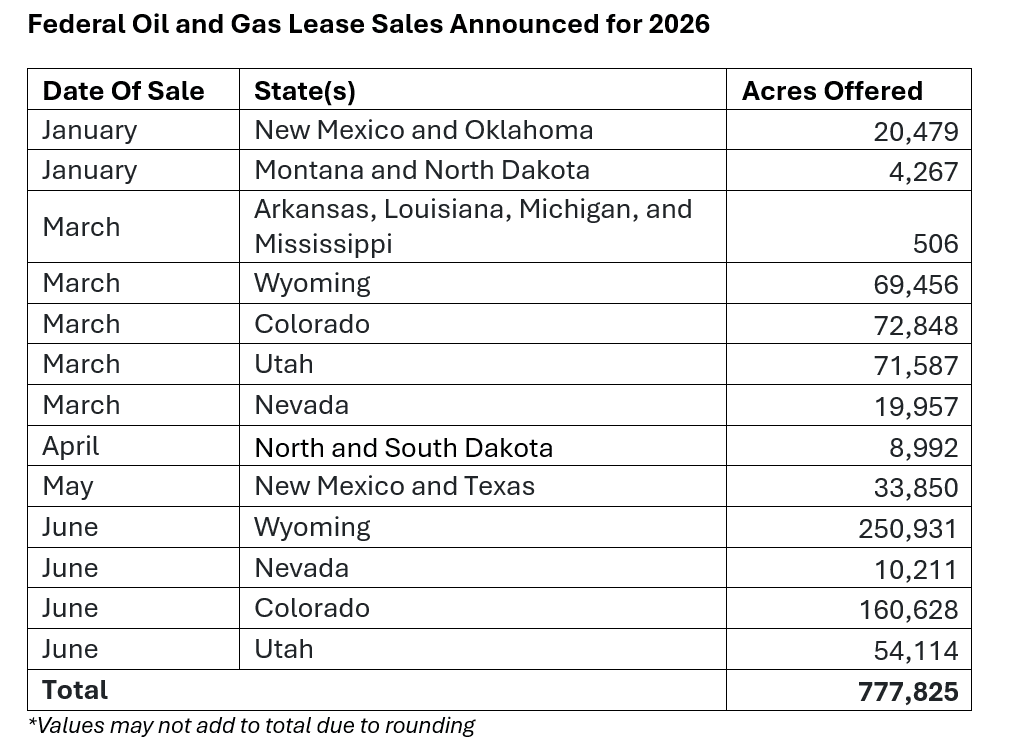

The administration has announced plans to offer a combined 777,835 acres of federal land across 14 states for oil and gas development. The proposed sales, running through June 2026, account for just a portion of expected auctions next year but would already surpass what has been offered in any year since 2020. These sales are being proposed under recently weakened leasing terms that lower royalty rates and reduce financial protections for taxpayers.

Expect More Lease Sales (and More Parcels to be Available Noncompetitively)

Under the Mineral Leasing Act (MLA), the Department of the Interior (DOI) is required to hold lease sales "at least quarterly and more frequently if the Secretary of the Interior determines such sales are necessary" in each state where eligible lands are available.

This summer, the FY2025 budget reconciliation bill (P.L. 119-21) expanded on this requirement, explicitly requiring DOI to hold a minimum of four lease sales each fiscal year in Alaska, Colorado, Montana, Nevada, New Mexico, North Dakota, Oklahoma, Utah, and Wyoming. In these states, DOI must offer at least 50% of available, nominated parcels at each quarterly lease sale. If a sale is canceled, delayed, deferred, or receives no bids on 25% or more of the offered acreage, DOI is required to hold a replacement sale. In practice, this requirement is likely to significantly increase the number of lease sales and re-offerings of parcels that already failed to attract interest. Between 2015 and 2024, 38% of all onshore lease sales would have triggered a replacement sale. In 2025, two lease sales met that threshold, and the Wyoming and Colorado Quarter 4 replacement sales will re-offer the same parcels that received no bids in the original auctions.

Congress also expanded the amount of acreage that can be leased for oil and gas development by reinstating noncompetitive leasing. Parcels that receive no bids at auction are re-listed the following day and awarded to the first applicant willing to pay an administrative fee of at least $75 and the first year's rent—no bonus bid required. From 2001 to 2020, BLM issued more than 6,400 noncompetitive leases covering over 11 million acres, accounting for 28% of all leased federal land. With mandated quarterly lease sales and replacement sales increasing the pool of no-bid parcels, even more land will be available through noncompetitive leasing.

Expect Record High Acreage Offered at Auctions

2026 will be the first full year of lease sales proposed and held under the Trump Administration. Many of the sales held in 2025 were initiated under the previous administration. While some lease sales were expanded—like when BLM added 11 new parcels to a June sale in Utah (none of which sold)—many offered the same parcels first proposed in 2024.

Already, the Trump administration has proposed historically large lease sales. The combined 777,825 acres across 14 states would exceed what has been offered in any year since 2020, and several individual sales would set new records at the state level.

The largest proposed sale would take place in Wyoming, offering more than 250,000 acres in June. Combined with another proposed sale in March, these two auctions would exceed the total acreage offered in the state in all of 2025 (214,000 acres) and more than double what was actually leased (146,000 acres). Wyoming is the largest producer of federal natural gas over the last decade (FY2015-2024) and the second-largest producer of federal oil, behind New Mexico.

The second-largest proposed sale, offering more than 160,000 acres in Colorado, would represent a sharp departure from historical leasing patterns in the state. Combined with another proposed sale in March, the administration is proposing to offer roughly four times the acreage offered in the state in 2025 (59,000 acres) and more than five times what was actually leased (38,000 acres). Colorado ranks third in federal gas production and sixth in federal oil production over the last decade.

Also of note is the more than 30,000 acres of federal land the administration plans to offer in Nevada, which would be the largest sale in the state since 2020. Nevada has historically seen limited industry interest in federal lease sales and often generates minimal revenue for taxpayers. The most recent sale in June 2025 received zero bids, and the prior sale in March 2025 leased roughly 20,000 acres, with 17,500 going to a single bidder for the legal minimum of $10 per acre.

Expect Outdated Lease Terms to Drive Growing Losses for Taxpayers

As the administration expands lease sales, taxpayers face increasing financial risk. This summer, Congress rolled back recent improvements to the federal leasing system—slashing the royalty rate from 16.67% back to its 1920s rate of 12.5% and reinstating noncompetitive leasing, allowing companies to bypass competitive auctions. Now, the administration is proposing to repeal recently modernized bonding requirements designed to protect taxpayers from paying to cleanup orphaned wells on federal land.

Each new lease issued under these terms locks in lower returns and higher risk for decades. TCS estimates that taxpayers have already lost nearly half a billion dollars in projected revenue from leases sold since July 4, 2025.

Oil and gas resources developed on federal lands belong to the American people, and leasing terms should ensure these resources are managed responsibly and not given away for less than they are worth.