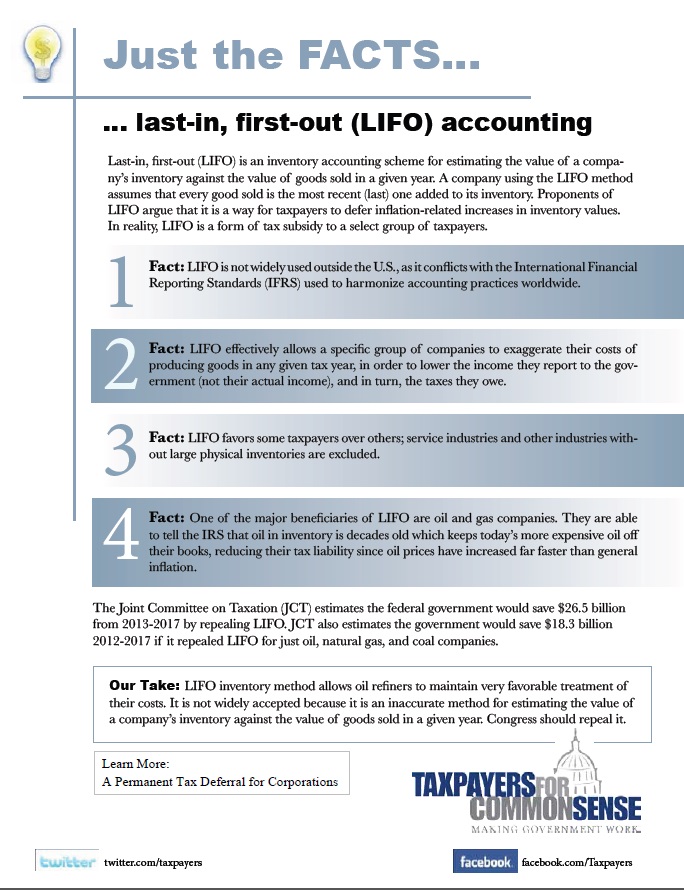

Last-in, first-out (LIFO) is a method for estimating the value of a company’s inventory against the value of goods sold in a given year. A company using the LIFO method assumes that every good sold is the most recent (last) one added to its inventory.

LIFO makes the federal tax code more inefficient by encouraging the accumulation of inefficient levels of inventories over other capital investments. It favors some taxpayers over others. LIFO is not widely used outside the U.S., as it conflicts with the International Financial Reporting Standards (IFRS) used to harmonize accounting practices worldwide.

The Joint Committee on Taxation (JCT) estimates the federal government would save $26.5 billion over the next 5 years by repealing LIFO.

Background

LIFO is the conceptual offspring of the “base stock method,” which traces its origins back to the United Kingdom more than a century ago. The base stock method assumes a company always maintains a minimum quantity (base stock) of inventory, which should be treated as a fixed asset valued at its original acquisition cost. The U.S. Supreme Court struck down the base stock method for tax purposes in 1930. Congress enacted LIFO in the Revenue Act of 1939.

Roughly one-third of U.S. companies use LIFO today. The use of LIFO has been on the decline for years,[1] especially as momentum has built for universal adoption of the IFRS, which bans the use of LIFO. More than 100 countries have adopted IFRS, and the U.S. Securities and Exchange Commission has proposed adoption of IFRS for all U.S. public companies.[2]

A taxpayer’s gross profit from the sale of goods is determined by subtracting the cost of goods sold from gross receipts. Taxpayers for whom the production, purchase, or sale of merchandise is a material income-producing factor must maintain inventory records to determine the cost of goods sold during the taxable period. Cost of goods sold generally is determined by adding the taxpayer’s inventory at the beginning of the year to the purchases made during the year and subtracting the taxpayer’s inventory at the end of the year. The methods used to account for inventory include the first-in, first-out (“FIFO”) method, which assumes that the items in ending inventory are those most recently acquired by the taxpayer, and the LIFO method, which assumes that the items in ending inventory are those earliest acquired by the taxpayer.

The following example illustrates the advantaged created by LIFO when costs are rising. Assume that a producer has 1,000 units in inventory that cost $100 each, produces an additional 1500 units at a cost of $120 during the year and sells 1200 units for $150. Gross receipts are $180,000.

Under the FIFO method, the producer is treated as having sold the 1000 units with a cost of $100 each and 200 of the newer units with a cost of $120. Its cost of goods sold is $124,000 and total income from the sales is $56,000. In contrast, income under the LIFO method is only $36,000 since cost of goods sold is computed by treating the 1200 units sold as all being from the most recent production costing $120 a unit. The difference in income is deferred until production drops below sales so that the old units are treated as sold or costs decline below the costs at which the oldest inventory was produced

Present law permits a number of variations in LIFO accounting. Under dollar-value LIFO, inventory is measured in terms of a dollar-value rather than the number of units. This permits a pooling of dissimilar items into a single inventory calculation. The dollar-value method allows a low cost inventory attributable to specific goods to continue even though goods of that type are no longer actually carried in inventory.

Why LIFO?

LIFO effectively allows a specific group of companies – those with physical inventories – to exaggerate their costs of producing goods, in order to lower the income they report to the government (not their actual income) in order to pay less in taxes. Congress should repeal LIFO for the following reasons:

-

LIFO only about taxes. When Congress passed LIFO, it included a “conformity requirement” that companies use the same inventory accounting method in their financial reporting to shareholders as their reporting to the IRS. This, in theory, would prevent companies from reporting different income to the federal government for tax purposes than they report to shareholders. However, companies that use LIFO circumvent this problem by supplying additional disclosures in their financial statements that report their “LIFO reserve” or “inventory valuation allowance.” These measure the difference between the company’s net income when using the LIFO method versus the FIFO method. In other words, a company reports this difference in order to provide a more accurate picture of its balance sheet to its shareholders. Companies do not utilize LIFO in other nontax business calculations, such as management compensation. If Congress repeals the tax benefits of LIFO, it will likely disappear completely from general accounting practices.

-

LIFO creates demonstrably false assumptions about company inventories. Under LIFO, as long as a company’s sales do not exceed its purchases (and it maintains a constant or growing inventory), its inventory is considered to have never been sold. A company that has used LIFO for many years and maintained its inventory levels will theoretically have goods in its inventory dating back to when it started using LIFO, which could have been more than 30 years ago or more. In practice, few if any of the physical goods that companies added to their inventories in the last century are still in their warehouses, yet these goods rather than more expensive modern ones are still in tax inventory. In fact, most companies use FIFO inventory accounting[3] because it more closely depicts the physical movement of goods, as companies generally use the oldest items in their inventories first.

-

LIFO distorts business decisions. Studies of LIFO’s effect on business decision-making suggest that the opportunity for tax avoidance distorts the inventory choices of firms that use LIFO. In short, LIFO firms are more likely to purchase extra inventory than FIFO firms. One study concludes: “that additional year-end LIFO inventory purchases appear to be made for tax reasons suggests that permitting the LIFO method to be used for tax purposes leads to inventory management inefficiencies.”[4] Citing this finding, authors of a critique of LIFO take it one step further, “For firms to purchase additional inventory despite the incremental costs shows how significant the tax benefits can be and further demonstrates the distortion in firm behavior LIFO can cause.”[5]

-

LIFO covers more than just inflation. LIFO allows companies to defer payment on increases in the value of their goods even if those increases have nothing to do with general inflation – the express purpose of LIFO. Oil and gas companies use the LIFO accounting method. The price of oil is affected by a variety of factors – such as security issues and global shifts in demand – that have increased the cost of oil far more than the general rate of inflation. From 2005 to 2013, the wellhead price of domestic oil rose nearly 130 percent, compared to a 32 percent rise in the producer price index for all manufacturing and a 21 percent rise in consumer prices.[6] But because oil and gas companies use LIFO, there is no distinction between an increase in inventory values as a result of inflation or other factors.

[1] OCTOBER 16, 2006, Is It Time to Liquidate LIFO?, by Edward D. Kleinbard, George A. Plesko, and Corey M. Goodman at http://www.taxanalysts.com/www/features.nsf/Articles/93826E71D9A58FB28525726B006E2140

[2] Proposed Rule: Roadmap for the Potential Use of Financial Statements Prepared in Accordance with International Financial Reporting Standards by U.S. Issuers (Release No. 33-8982; November 14, 2008) at http://www.sec.gov/rules/proposed/2008/33-8982.pdf

[3] “Roughly 95 percent of firms with inventories use FIFO accounting for tax purposes,” according to “Treasury I” inventory analysis for the Reagan Administration during the 1986 tax reform effort.

[4] The Year-End LIFO Inventory Purchasing Decision: An Empirical Test, Micah Frankel and Robert Trezevant, The Accounting Review, Vol. 69, No. 2 (Apr., 1994), pp. 382-398

[5] See #1

[6] Calculated from U.S. Bureau of Labor Statistics data