Last week, the House Committee on Natural Resources held a hearing on rules changes recently proposed by the Department of the Interior. The revised rules would change the way royalties are calculated for oil, gas and coal companies drilling on public lands. One of the issues raised by panelists at the hearing was the lack of transparency in the way the Interior Department sets the value of these energy resources in order to determine the royalties owed. This is a sentiment my organization, Taxpayers for Common Sense, has echoed many times before. Like most federal programs, a lack of transparency usually coincides with a lack of oversight and, ultimately, lost revenue.

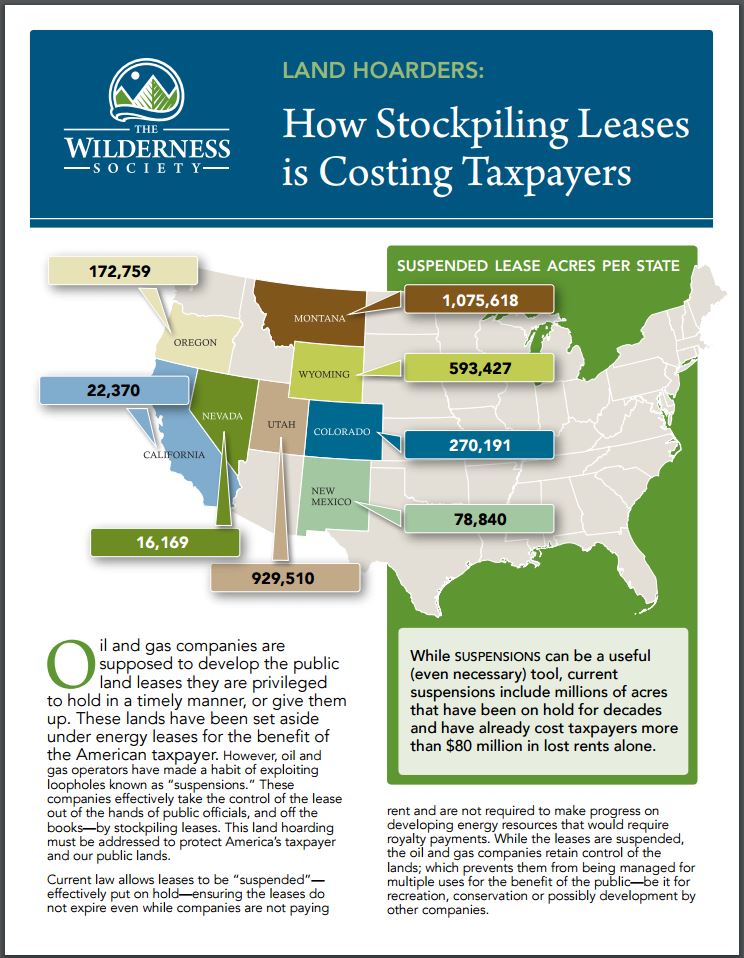

In 1990, there were already 1 million acres of federal land under suspended leases. By 2010, this total exceeded 3 million acres. Many of the leases under suspension in 1990 are still suspended today.

When the Interior Department agrees to suspend a lease, the company is relieved of its obligations under the lease terms, losing taxpayer revenue from rental and royalty payments. Yet the company maintains control of the taxpayer-owned land even though it is not paying for this right. Obviously, the lost rent and royalty can start to add up when you have millions of acres of land held under suspension from development or other uses for decades. The new report released this week looks at Bureau of Land Management data and estimates the foregone rental payments alone for oil and gas lease suspensions exceed $80 million. And keep in mind that rental rates on federal onshore oil and gas leases have not been increased since 1987, when they were set at $1.50 per acre in the first five years of a lease, and $2.00 per acre for each year after that. If these rates were pegged to inflation, they would be more than double what companies are paying (or not paying) today.

A closer look at some individual suspensions confirms that the Interior Department is not reviewing these suspensions to ensure timely development. Companies provide specific justifications for why a lease should be suspended, and in some cases, the stated reasons are resolved years before the suspension is finally lifted. And then there are the lease suspensions that have been in effect since before 1990. It's difficult to believe these companies are not just sitting on these leases for competitive reasons.

A closer look at some individual suspensions confirms that the Interior Department is not reviewing these suspensions to ensure timely development. Companies provide specific justifications for why a lease should be suspended, and in some cases, the stated reasons are resolved years before the suspension is finally lifted. And then there are the lease suspensions that have been in effect since before 1990. It's difficult to believe these companies are not just sitting on these leases for competitive reasons.

It is the responsibility of the Bureau of Land Management to prevent this kind of speculation and abuse of taxpayer-owned resources. Yet federal data clearly suggests the oil and gas industry is taking advantage of the suspension process. Taxpayers have already lost millions in much needed revenue to this broken system; the question is, how much longer will this practice be allowed to continue?

Photo credit: Tim Evanson via flickr