On November 6, the federal government leased 8,240 acres of public land in New Mexico and Oklahoma for oil and gas development at the recently reduced federal royalty rate of 12.5%. The result is an estimated $34 million in lost royalty revenue over the lifespan of these leases.

America's public lands and natural resources belong to taxpayers and must be managed responsibly. Taxpayers lose when the federal government leases our federal lands at rock-bottom prices to private companies that extract and sell the oil and gas for profit.

For decades, the federal oil and gas leasing program lagged behind the private market and rates charged on state lands. Outdated terms hadn't even kept pace with inflation. In 2022, long-overdue reforms modernized the system by raising royalty rates, updating fees, and ending giveaways like noncompetitive leasing. But this summer, the FY2025 budget reconciliation bill rolled back many of those improvements—slashing the federal royalty rate from 16.67% back to its 1920s rate of 12.5% and reinstating a loophole allowing companies to bypass competitive auctions. Once again, taxpayers are being shortchanged as companies lock in decades of drilling under terms that don't reflect the true value of America's oil and gas resources.

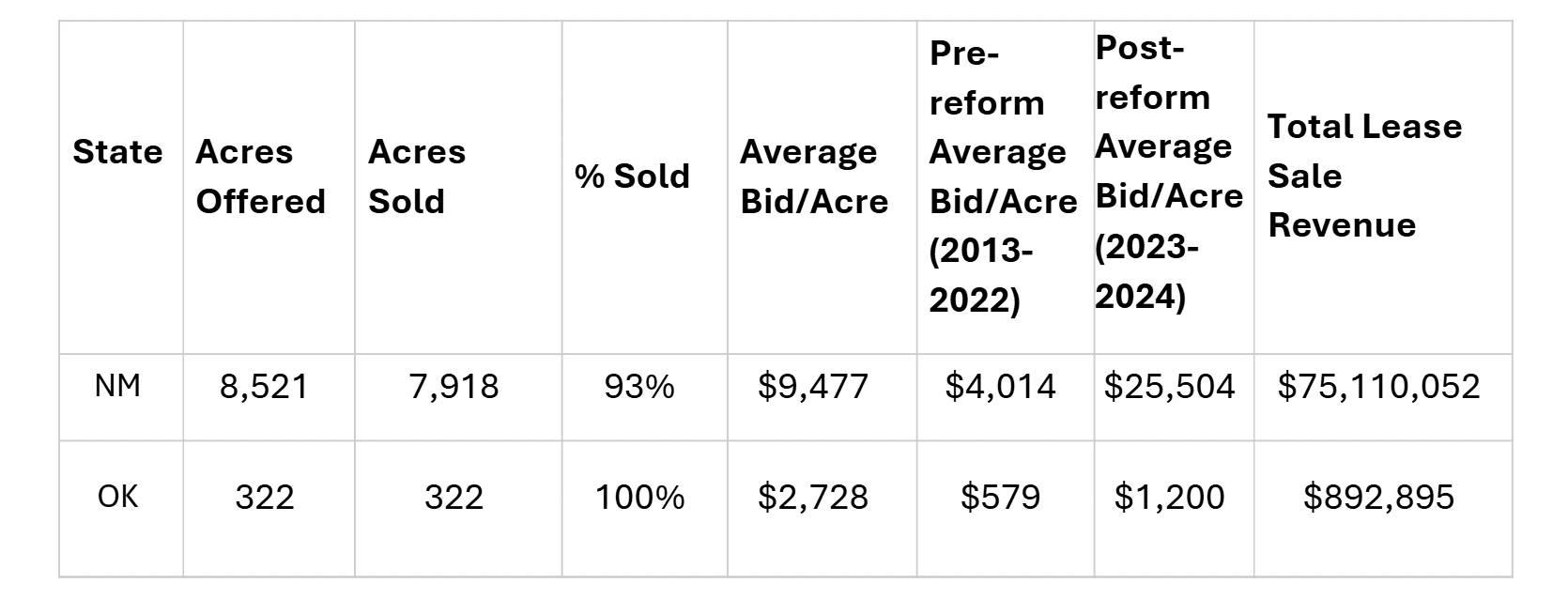

Today's lease sale offered 17 parcels in New Mexico and 4 in Oklahoma. New Mexico is the nation's largest producer of federal oil and gas, accounting for 79% of federal oil production and 55% of federal gas production last year. Oklahoma accounted for less than 1% of federal oil and gas production in 2024.

Lease sales in New Mexico are often competitive. Yet one quarter of the land leased in today's sale was sold at the minimum bid of $10 per acre, with another 10% selling for just $11-$12 per acre. The overall average bid per acre of $9,477 was inflated by a single parcel that drew $180,000 per acre. Oklahoma's four parcels, all leased to a single operator, sold for an average of $2,728 per acre.

Unfortunately for taxpayers, every lease was issued at the outdated 12.5% rate, locking in a century-old rate for decades.

Competitive, market-based royalty terms do not affect industry interest or production decisions. While today's New Mexico bids were higher than the average over the last decade, they were still lower than bids received at auctions in 2023 and 2024 under the 16.67% royalty rate. The lower royalty rate did not make the leases more competitive—it only reduced future royalty revenue. In New Mexico alone, taxpayers lost an estimated $8 billion in revenue from FY2013 to FY2022 under the old 12.5% rate. With record-high production across the U.S., losses will continue to mount. Because revenues are shared with states, New Mexico communities will also lose funding for schools, infrastructure, and other priorities.

The Bureau of Land Management estimates that the parcels sold today will yield about 8 million barrels of oil and 35 billion cubic feet of natural gas over their lifetime. Based on the White House Budget Office's 2025 price projections—used to estimate federal royalty receipts—that production could be worth roughly $825 million. At the 12.5% rate, taxpayers would see about $103 million in royalty revenue over the leases lifetimes—$34.4 million less than they would under a 16.67% rate.

Today's lease sale adds to mounting losses under the outdated 12.5% rate. TCS calculates that taxpayers have already lost $367 million in projected revenue from leases sold since July 4, 2025, due to the reduction of the federal onshore royalty rate.

New Mexico plays an important role in American energy production, but taxpayers should not be shortchanged. The oil and gas developed on federal lands belong to the American people, and leasing terms should ensure these resources aren't given away for less than they're worth.