Silencing Sequester Scaremongers with $2 trillion in Deficit Reduction

Washington policymakers are quick to decry the budget caps put in place by the Budget Control Act of 2011 (BCA), failing to note that Congressional and Presidential inaction on deficit reduction is the reason the caps are in place. Some lawmakers rail against the across-the-board cuts known as sequestration, conveniently ignoring that sequestration is only a process unleashed if lawmakers choose to exceed the spending caps they set. There is no sequestration if Washington makes the tough, but necessary decisions to spend below the caps or alleviate them with tough but common sense choices. Rather than rhetoric and saber-rattling, lawmakers should come up with responsible fiscal solutions including cutting programs that don’t work and eliminating tax breaks that persist because of political influence, rather than resorting to creative attempts to avoid budget discipline and promises of future fiscal fidelity.

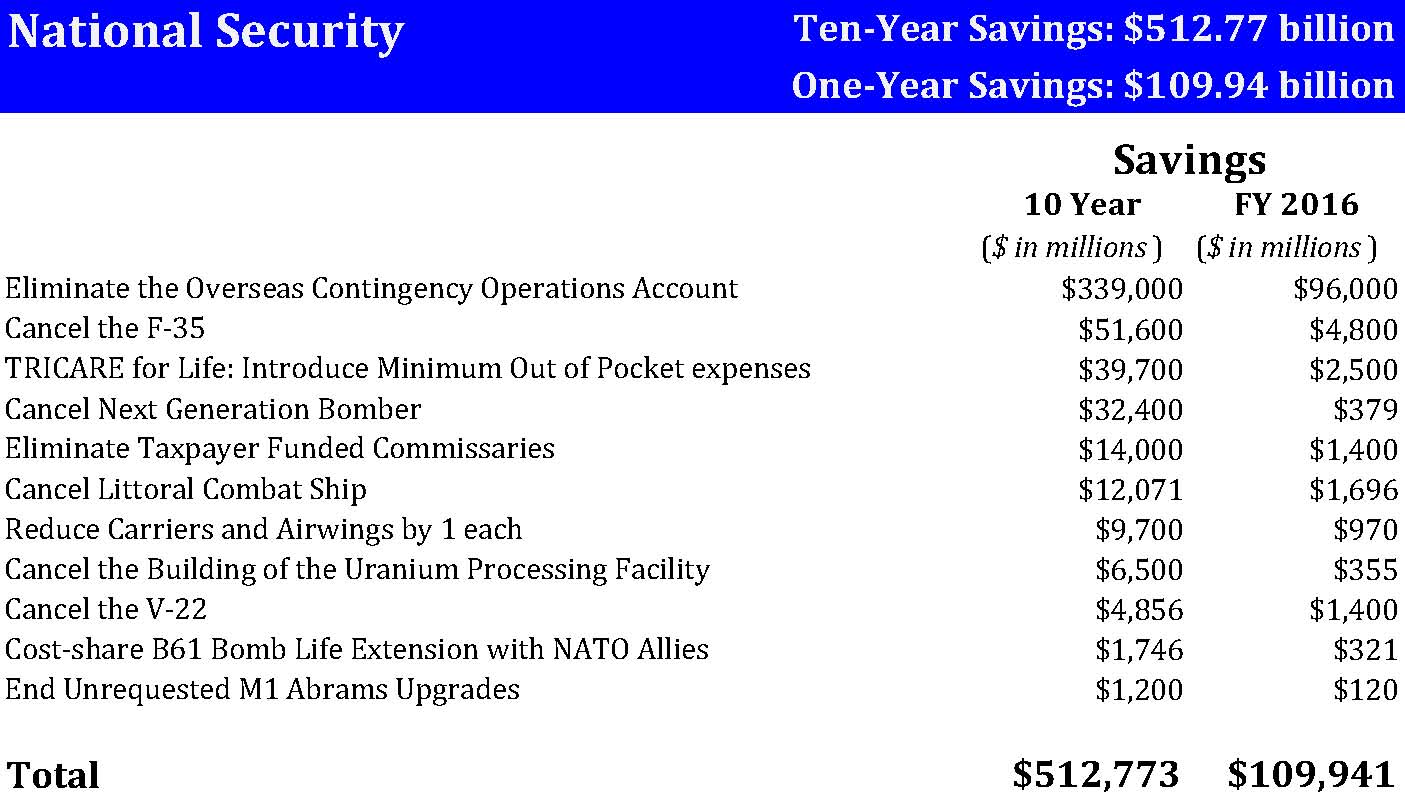

In his Fiscal Year 2016 budget request the President increased discretionary spending by $74 billion, blowing past the budget caps. The increase was equally divided between defense and non-defense spending. Not to be outdone, the House and Senate agreed to budget resolutions that technically abided by the caps but only through evasive maneuvers including adding $38 billion to uncapped Overseas Contingency Operations to increase defense spending. That of course is $1 billion more than the President proposed for defense spending.

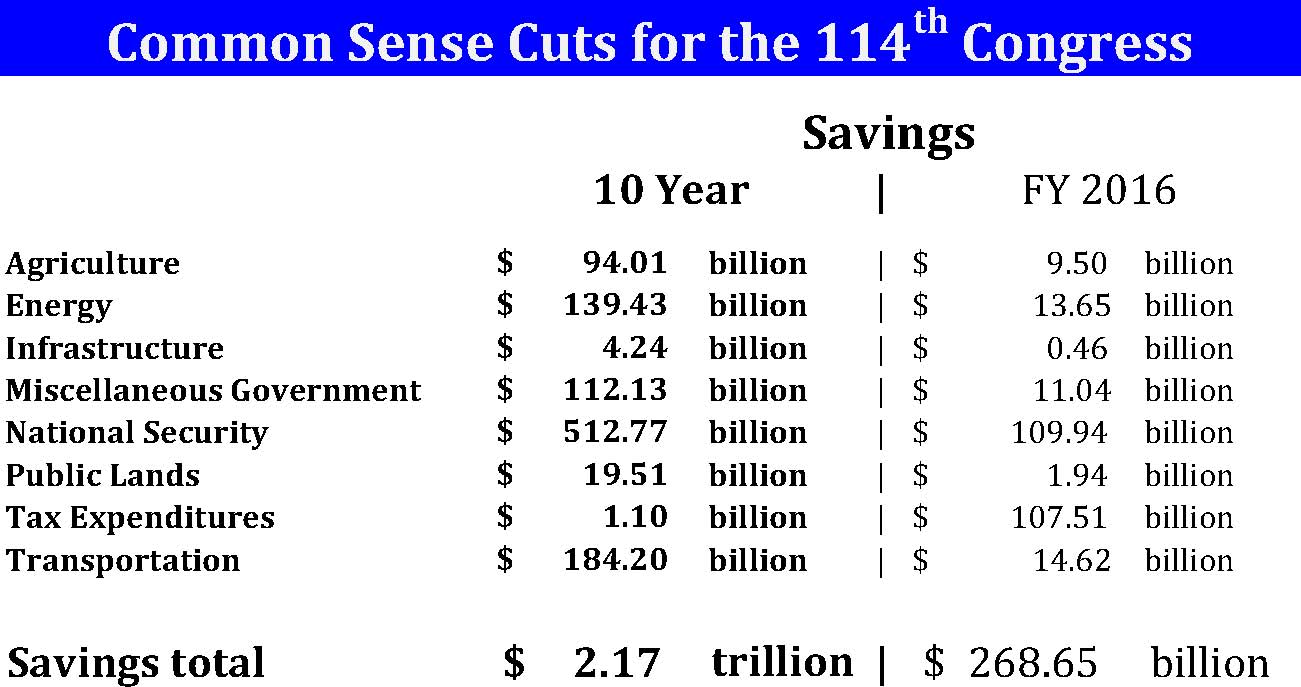

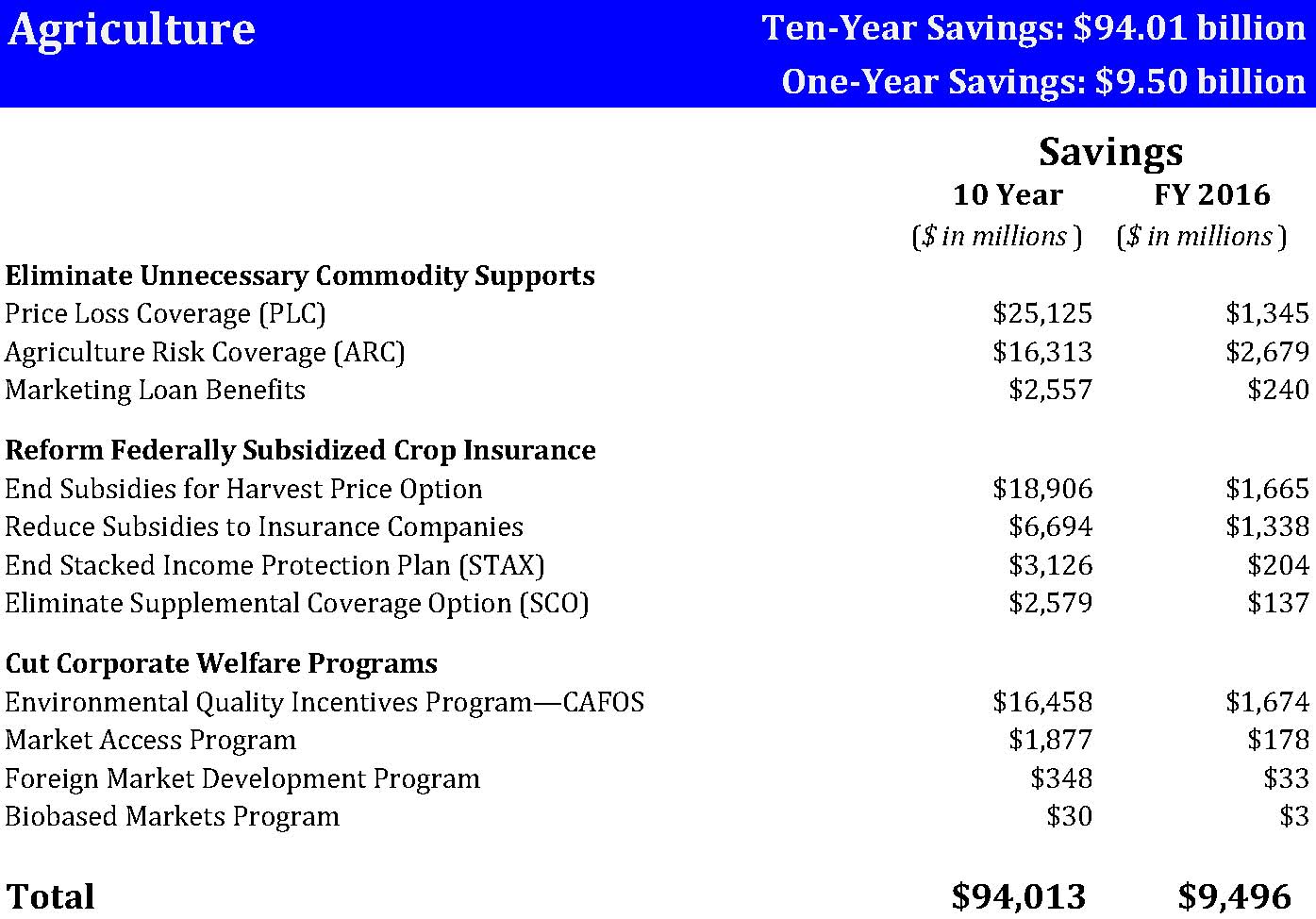

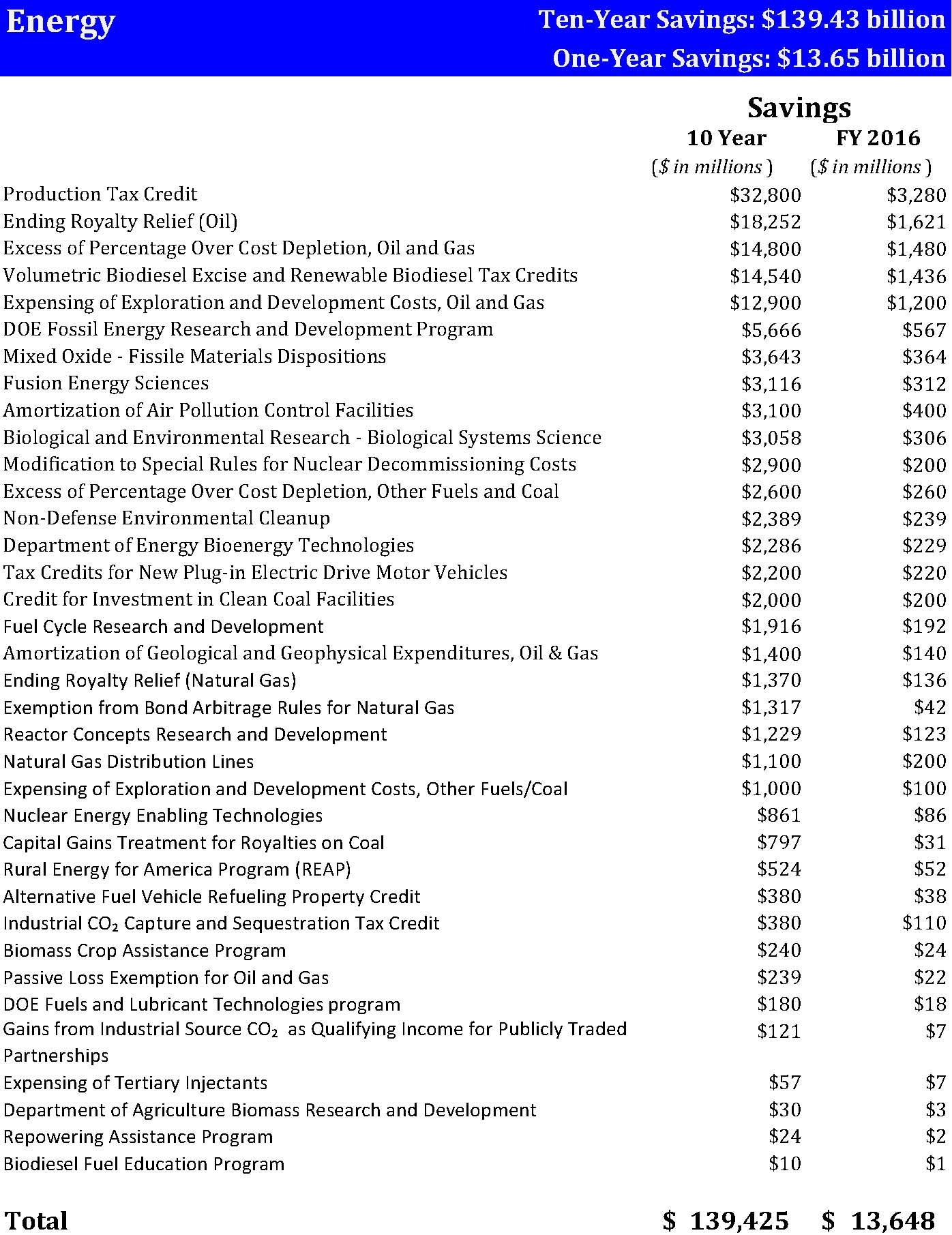

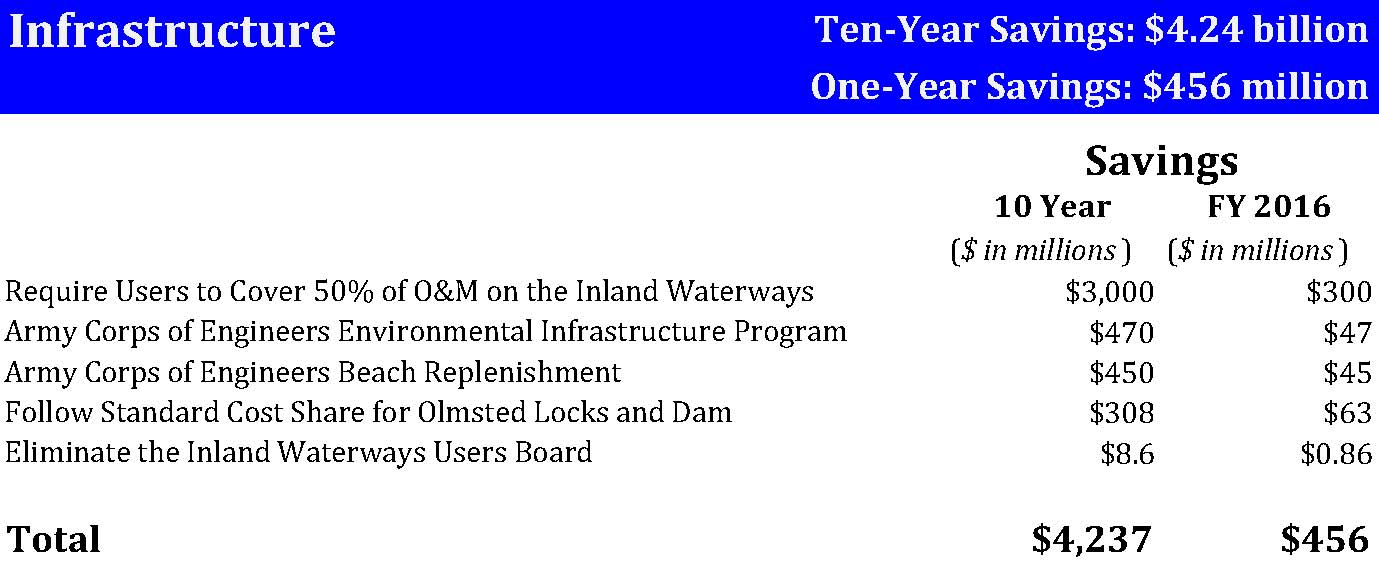

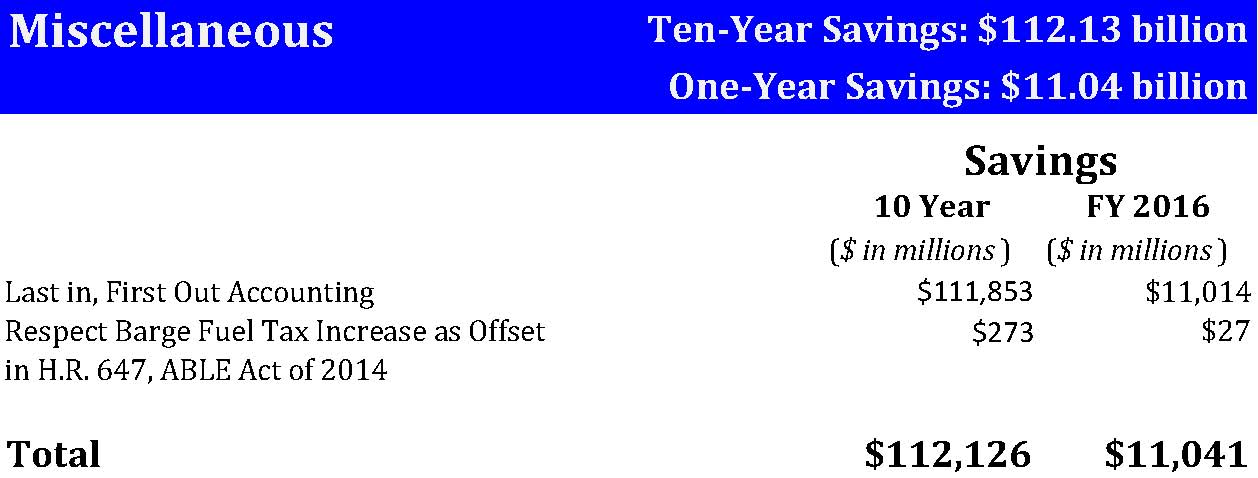

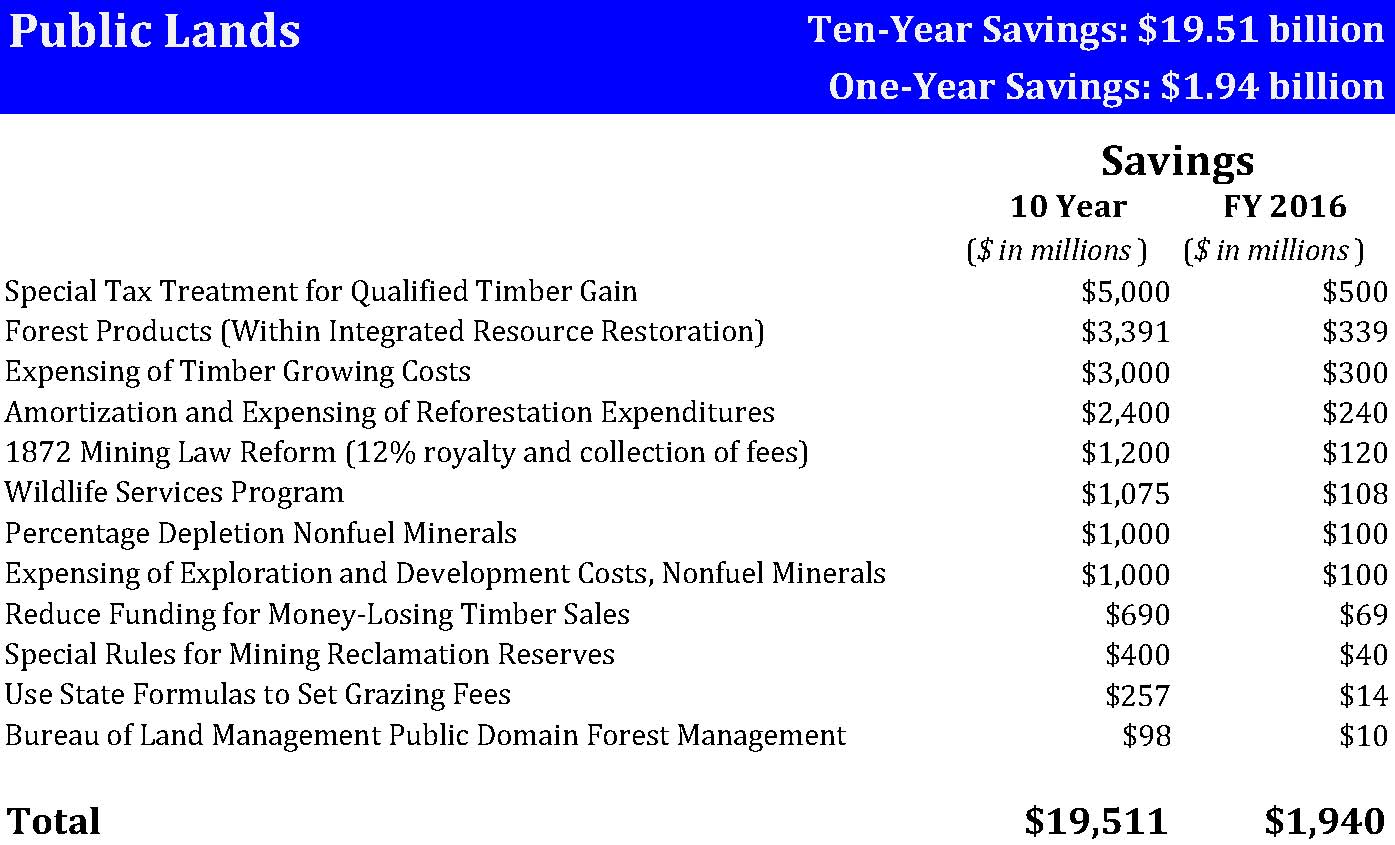

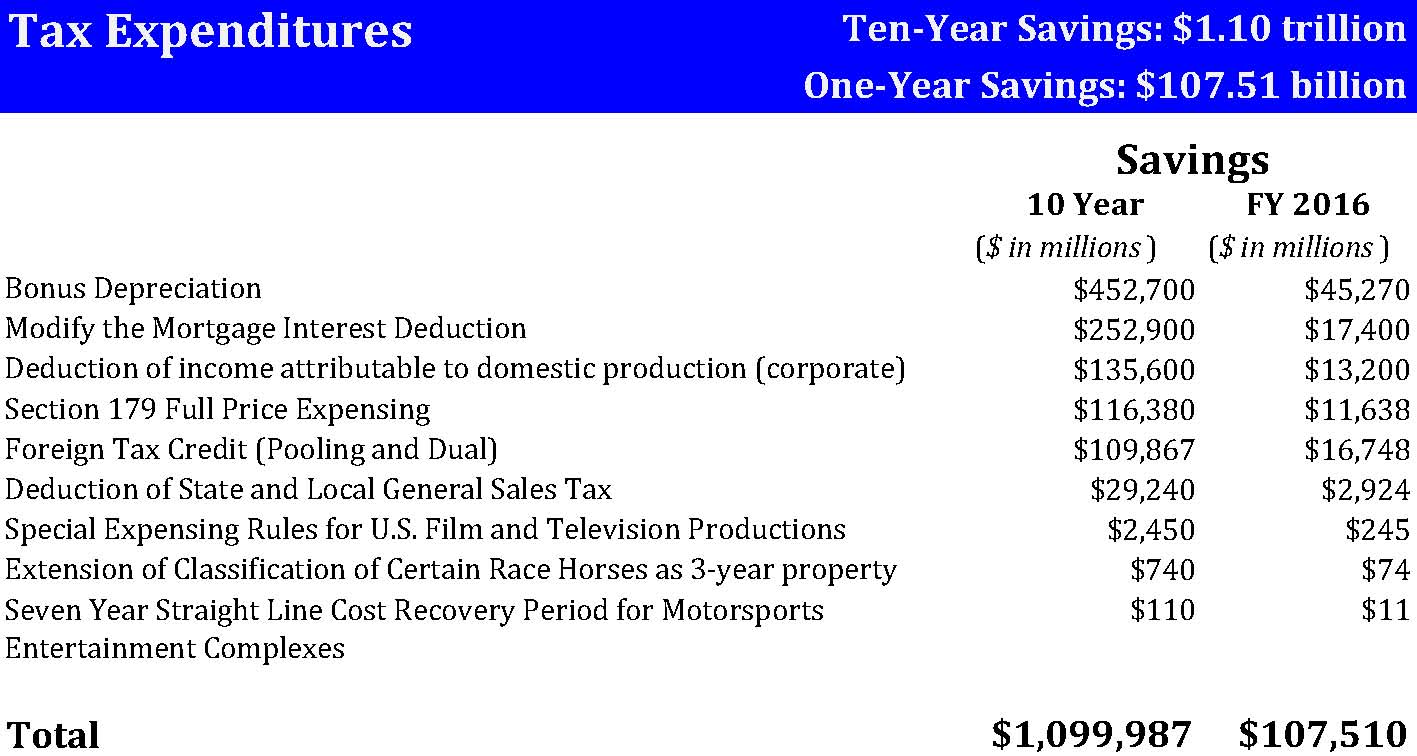

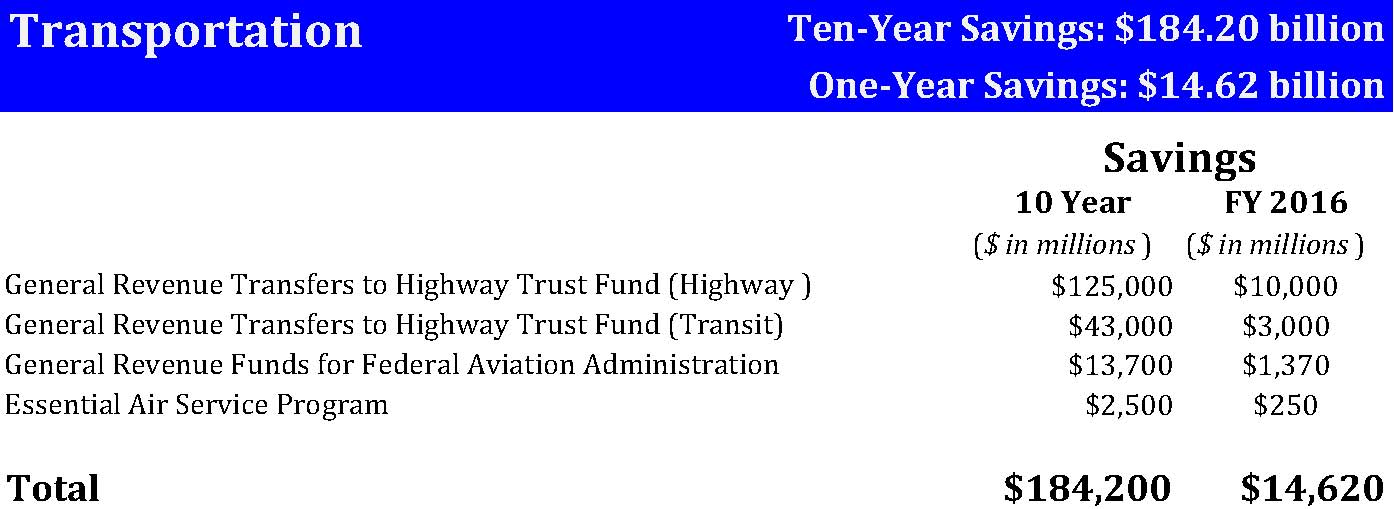

To help Congress and the President come up with fiscally responsible solutions, Taxpayers for Common Sense has drafted Common Sense Cuts for the 114th Congress: Silencing Sequester Scaremongers with $2 trillion in Deficit Reduction. That’s right, $2 trillion in deficit reduction over ten years, and to help with the near term, we detail nearly $270 billion worth of immediate savings in fiscal year 2016 alone. The cuts range from national security programs to energy tax breaks, agriculture policy reforms, and more.

This is not intended to be an exhaustive list of TCS proposals, but rather a sampling of some of the work policymakers should do if they want to responsibly undo some or all of the BCA mandated budget caps. There is no threat of sequestration if Congress and the President do their jobs and craft a better, more fiscally responsible and more credible budget plan.