Our Mission

Since 1995, Taxpayers for Common Sense has served as an independent, nonpartisan watchdog dedicated to protecting the nation’s fiscal future. We provide oversight, demand accountability, and work to ensure a government that treats taxpayers fairly by confronting waste, exposing special-interest giveaways, and pushing for lasting fiscal responsibility.

Our Story

In 1995, two policy veterans decided they’d had enough of the way Washington spent the public’s money. Jill Lancelot and Rafael DeGennaro had seen too many headlines about boondoggles and too many quiet giveaways buried in legislative fine print. They imagined a different kind of watchdog—one that would read the bills, follow the money, and call out waste wherever it hid. Senator William Proxmire, famous for his “Golden Fleece” awards, wrote the first check. His only instruction: keep shining a light.

Co-founders Jill Lancelot and Raphael DeGennaro with the late Senator William Proxmire and

Representative Ron Kind (D-WI).

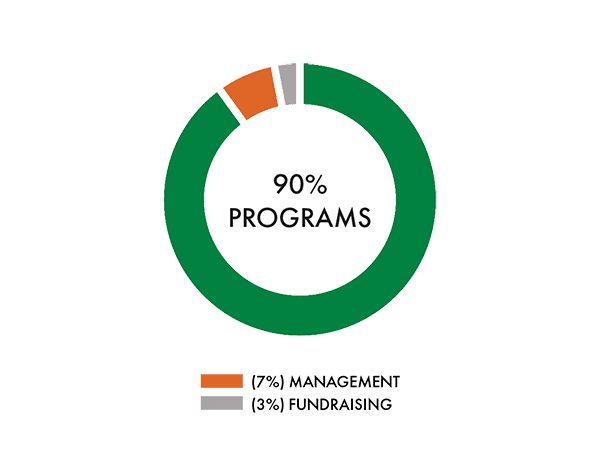

From day one, our mission has been straightforward but uncompromising—taxpayer dollars must serve the broad national interest, not narrow political agendas. Budgets are more than spreadsheets; they’re value statements that shape communities, the economy, and national security. Genuine reform endures only when it can win support from every point on the political spectrum. To protect that broad appeal, our independence is ironclad. We accept no government money, take nothing from interests that could profit from our work, and triple-check every line of research for accuracy and fairness.

1990s–2000s: Early Wins and National Recognition

In our first decade, we became a go-to source on reforming special interest spending, exposing and ultimately helping end the infamous Bridge to Nowhere project, and pioneering public earmark databases that pressured Congress into full disclosure. We partnered with conservation and consumer groups in the Green Scissors project to cut wasteful and environmentally harmful spending, and were instrumental in killing costly boondoggles from the Auburn Dam to FutureGen. We helped stop giveaways through the Royalty in Kind program and won administrative and legislative battles to curtail costly subsidies for roadbuilding and money-losing timber sales in our national forests.

We launched the Road to Ruin reports that documented wasteful transportation projects and gave support to local groups fighting them. We helped create Inspectors General for Iraq and Afghanistan war spending and tracked the billions in bailout dollars going to banks. Our investigative work also helped end the F-22 Raptor fighter jet program proving that persistence, good data, and bipartisan appeal can beat entrenched interests.

We launched the Road to Ruin reports that documented wasteful transportation projects and gave support to local groups fighting them. We helped create Inspectors General for Iraq and Afghanistan war spending and tracked the billions in bailout dollars going to banks. Our investigative work also helped end the F-22 Raptor fighter jet program proving that persistence, good data, and bipartisan appeal can beat entrenched interests.

2010s: Expanding the Watchdog Role

Building on that foundation, we took on even bigger fights. We influenced defense spending debates and fought parochial subsidies in agriculture, transportation, and energy and natural resources. We helped eliminate the billion-dollar ethanol tax credit in bipartisan fashion. We exposed the costly consequences of egregious methane waste, securing bipartisan wins in Congress and the White House to ratchet down this fiscally reckless practice. We came up with a trillion dollars in cuts for the “Super Committee.” We led coalitions to rein in Pentagon budget gimmicks like the Overseas Contingency Operations fund, exposed federal oil and gas leasing practices that underpriced taxpayer assets, and challenged politically driven spending such as the border wall and poorly targeted disaster aid. We also deepened our expertise in flood insurance reform and climate-related fiscal risks, broadening our reach while staying rooted in fiscal responsibility.

Ryan Alexander, former president of Taxpayers for Common Sense, with 2010 “Mr. Smith Goes to Washington” awardee Representative Jeff Flake (R-AZ).

2020s: Fiscal Accountability in a Time of Crisis

The COVID-19 pandemic brought unprecedented federal spending, and we tracked every dollar while continuing our core work on defense, agriculture, energy, and disaster policy. We launched the Common Sense on Climate campaign to highlight taxpayer costs from climate impacts, expanded our digital reach with the Budget Watchdog AF (All Federal) podcast, and grew our staff and regional presence. In recent years, we have:

- Fought costly nuclear weapons modernization programs, such as the Sentinel ICBM.

- Called for transparency over unrequested Pentagon budget increases.

- Secured reforms to oil and gas leasing and bonding rules to protect taxpayers from cleanup costs.

- Challenged high-cost, low-return energy subsidies for biofuels, clean coal, and carbon capture.

- Advocated for proactive disaster spending focused on resilience rather than repeated bailouts.

- Continued to dissect the Farm Bill’s escalating costs, pushing for safety nets based on need, not special interest greed.

- Pushed for budget process reforms and raised alarms about the rapidly rising debt.

Our Legacy

Through all of it, we’ve stayed true to our founding principles—ending wasteful programs under both Republican and Democratic administrations, working with both sides of the aisle in Congress, guarding our independence, and grounding every recommendation in solid research. Whether testifying before Congress, partnering with investigative journalists, or producing the Weekly Wastebasket, we’ve worked to build a government that inspires trust, lives within its means, and serves the public interest.

We believe wasteful spending costs more than money. It erodes public trust and crowds out genuine priorities. Transparency isn’t a luxury; it’s a right and a duty. And the only lasting path to reform is bipartisan cooperation—we work with anyone, left, right, or center, who’s serious about stewardship of public funds. A government worthy of the public’s confidence is possible. It starts with common sense—and it starts with taxpayers themselves. Our job is to keep Washington honest.

For thirty years, we’ve shown that one independent voice, armed with facts and persistence, can make a difference. Wasteful spending isn’t inevitable—it’s a choice. And so is accountability. As long as Washington spends taxpayer dollars, we’ll be here to hold it accountable.

JOIN OUR FIGHT FOR COMMON SENSE GOVERNMENT

We don’t take money from corporations, unions, the government, or anyone with a financial stake in our work.

WE’RE REGULARLY CITED BY