In 2008, Medicine Bow Fuel & Power LLC (MBFP) – a subsidiary of Texas-based DKRW Advanced Fuels LLC – applied for a loan guarantee to build a $2 billion “coal-based power generation and industrial gasification” plant in Medicine Bow, Wyoming.

In addition to the project’s multiple delays and reliance on unproven technology, the DKRW’s finances suggest that giving the company a loan guarantee would be a risky investment for taxpayers.

The planned Medicine Bow coal to liquid (CTL) facility is backed by Medicine Bow Fuel & Power LLC, a wholly-owned subsidiary of DKRW Advanced Fuels LLC (DKRW-AF). DKRW-AF, in turn, is 24 percent owned by Arch Coal, and 75 percent owned by DKRW Energy, a company started in 2002 by four former Enron executives and funded by Och-Ziff Capital Management Group.

In 2006, Arch Coal, the potential supplier of coal for the Medicine Bow plant, invested $25 million in DKRW Advanced Fuels, thereby acquiring a 25 percent equity stake in the company. In its annual reports since then, Arch Coal has published DKRW losses in proportion to its equity stake, allowing DKRW’s total losses to be calculated. The reports show that in the period from 2006-2013, DKRW failed to record a profitable year and lost approximately $62 million over that same time period.

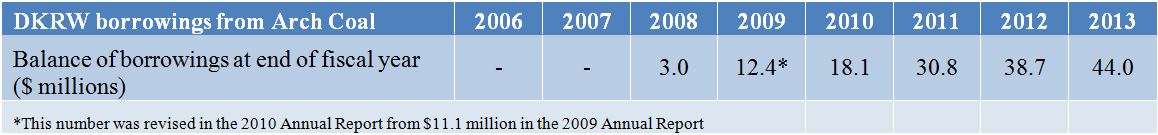

In addition to its consistent losses, DKRW has also accrued substantial debt over the last six years. To keep the company afloat, DKRW began borrowing from Arch Coal in 2008. In each consecutive year, DKRW was able to secure an increase in the credit line from Arch Coal and an extension on the debt's repayment.

Arch Coal's financial reports indicate that starting in 2009, DKRW may also have been borrowing from other investors.i The additional amount it may have borrowed is unknown, but by the end of 2013, DKRW's debt to Arch Coal totaled $44 million.

Throughout this time period, DKRW failed to make any substantial progress on the Medicine Bow plant.

In the third quarter of 2013, the CTL developer’s deepening financial hole and dim prospects led Arch Coal to acknowledge that its investment in DKRW was unrecoverable. In its 2013 Annual Report, Arch Coal recorded both the $44 million of DKRW debt and its remaining equity in the company (around $13.7 million) as an “impairment loss” – a recognition that the equity and debt assets had ceased to have any market value, according to accounting standards2; one of DKRW’s primary investors had concluded that the company had no prospect of success.

In February 2014, DKRW canceled its agreement with its Medicine Bow construction contractor, Sinopec Engineering Group. The deal had been signed just over a year earlier, in November, 2012. At that time, DKRW executives hoped to finalize financing by the end of the year and start construction on the plant in early 2013. The funding never came through and construction never began, prompting the decision by DKRW to break ties with Sinopec.

Following the split, JP Morgan concluded that Sinopec's financial position actually improved as a result. The firm noted that undertaking the project might have left the company “exposed to greater issues including construction delays and cost overruns, hence financial losses.” The message was clear: being associated to DKRW was riskier than any gains Sinopec might potentially have made through the contract.

i Arch Coal. Form 10-K, 2009 Annual Report.” p. F-17, F-18

ii International Accounting Standards. “IAS 36: Impairment of Assets.” 1 January 2012. http://www.ifrs.org/IFRSs/IFRS-technical-summaries/Documents/IAS36-English.pdf