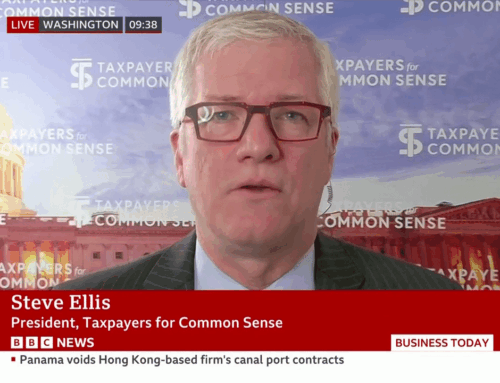

Republicans returned to Washington this week, sleeves rolled up and ready to transform tax bill promises into legislative reality. Spoiler: it’s already looking dicey. The early choices make one thing clear—deficit-busting tax cuts and more spending on favorite programs are in, while promises of real offsets to its hefty cost might just go up in smoke. Taxpayers need lawmakers to deliver a bill that actually balances the books, promotes sound tax policy for average Americans, and doesn’t pile even more debt onto future generations—but so far, it looks like the plan is to add trillions more to the national tab.

Budget reconciliation is a special legislative process originally designed to help Congress align revenue and spending (i.e. reconcile) with the annual budget resolution it adopts. It bypasses the Senate filibuster and limits debate, allowing passage with a simple majority—but it was meant to be for technical corrections, not as a vehicle for costly new tax cuts and spending hikes masked by budget gimmicks.

After a two-week recess, House committees have started writing their pieces of this one “big, beautiful” mega-bill. The plan is to extend the 2017 tax cuts, add more tax cuts, jack up funding for border security and the Pentagon, and somehow make the numbers work. Committees like Homeland Security, Armed Services, and Transportation have already marked up their bills. These are the easy wins for Republicans: more cash for Coast Guard ships, more money for border enforcement, and a parade of new spending for favored programs and politically connected constituencies.

What’s also clear is that spending offsets could play second fiddle. It took less than 24 hours for lawmakers to walk back a proposal for a $20-per-vehicle annual fee to help prop up the chronically bankrupt Highway Trust Fund. Rep. Mike Turner (R-OH) voiced his opposition to efforts to require federal employees hired before 2013 to contribute 4.4 percent of their salary toward their pension (the same rate already required of new hires). And with the administration signaling they won’t accept an Agriculture Committee proposal to require states cover up to 25 percent of SNAP (food stamp) benefits (instead of zero percent), Agriculture Committee Chairman Thompson (R-PA) conceded there is no way they will come anywhere close to achieving their $230 billion reconciliation savings target.

Lawmakers are once again proving that spending is easy while delivering savings is hard—especially when much of that spending benefits political allies, donors, or parochial projects back home.

The real fireworks are coming. The Energy and Commerce Committee, which has jurisdiction over Medicaid and parts of Medicare, has been told to find $880 billion in savings—a target the Congressional Budget Office says is mathematically impossible without cutting benefits. Meanwhile, Agriculture is supposed to cut $230 billion, but they’re actually working to add $50 billion in new crop subsidies and insurance. That means they’d need to find $280 billion in cuts, mostly from the only thing left—food assistance programs. This is a non-starter for some on the committee, but probably too little for hardline conservatives.

The Natural Resources Committee is promising at least $1 billion in new revenue by leasing more federal land for energy and mineral development—including four new oil and gas leases in the Arctic National Wildlife Refuge—even though past sales there flopped and industry interest has flatlined. The bill would also slash oil and gas royalty rates back to pre-IRA levels and reopen a loophole that lets companies avoid bidding in competitive auctions, claiming this will spur drilling and fill federal coffers. But production is already at record highs, with the U.S. producing more crude oil than any other nation for the last six years. And updated, market-based royalty rates have delivered some of the highest revenues for state and federal coffers in decades. These proposed changes are little more than industry giveaways.

Then there’s Ways and Means—the tax-writers. Their job? Extend the 2017 tax cuts, sprinkle in as many of the president’s tax cut campaign promises as possible, and somehow keep the price tag from blowing up the deficit. Good luck with that.

Now it looks like the pressure is already causing the wheels to at least loosen, if not fall off entirely. Both Energy and Commerce and Ways and Means have already delayed their markups by at least a week. With pressure mounting, the Speaker’s goal of getting the reconciliation bill not just out of committees, but approved on the Floor, by Memorial Day is looking overly ambitious.

Lawmakers have been dusting off their favorite budget gimmicks: excessive dynamic scoring, wishful thinking about economic growth, and counting on oil and gas royalties that never seem to materialize. The Big Kahuna of gimmicks—the “current policy baseline” trick where lawmakers pretend that extending massive tax cuts costs nothing—will be everywhere this month. And let’s not forget the fantasy that tariff revenue will somehow balance the budget; in reality, tariffs bring in only a tiny fraction of what’s needed and would have to be set at absurdly high levels to even come close—making this idea not just wrong-headed, but downright delusional.

Expect the bill to deliver on tax cuts, especially for businesses, with a focus on making the remaining Trump 1.0 business cuts permanent. The individual tax cut extensions are likely to maintain the status quo for most households, so don’t expect much improvement there. Lawmakers may toss in some campaign promises, like no tax on tips or overtime, but these will probably be “temporary” to keep the sticker shock down.

The bottom line: taxpayers can’t afford for Congress to keep cutting taxes and boosting spending without making tough choices about offsets. Especially when so many of these cuts and spending hikes are tailored to reward political friends, not average Americans. Right now, the only thing getting reduced is the credibility of anyone promising real deficit reduction. The conclave of tax cutters has gathered, but don’t expect any white smoke announcing anything close to responsible budgeting anytime soon. Taxpayers deserve better than this—less smoke, more fire, and a real plan to right-size the deficit before the whole thing goes up in flames.

- Photo by Sixteen Miles Out on Unsplash