Since the COVID-19 pandemic, consumer costs have been on the rise. Over the same timeframe, the taxpayer costs of federal programs have also risen, contributing to our ballooning national debt and annual federal deficits. While the federal Renewable Fuel Standard (RFS)—a government mandate enacted in 2007 requiring the U.S. to use tens of billions of gallons of biofuels each year—does not directly increase federal spending, the RFS does increase food, feed, fuel, and other consumer costs. On top of these cost increases, taxpayers get hit again with a maze of federal tax breaks, loans, grants, and other subsidies for the mature U.S. biofuels industry.

The RFS requires transportation fuel suppliers to blend a certain level of ethanol, biodiesel, and other biofuels in the gasoline and diesel that they sell each year. Traditionally, the RFS has included four categories of volume requirements: cellulosic biofuel, biomass-based diesel, total advanced biofuels (includes cellulosic biofuel, biomass-based diesel, and other, unspecified advanced biofuels) and total “renewable fuel” (includes all qualifying biofuels, with the extra mandate met by conventional biofuels like corn ethanol). The Environmental Protection Agency (EPA) is responsible for overseeing the program and, as of 2023, for determining annual RFS volumes, known officially as Renewable Volume Obligations (RVOs).

On June 13, the EPA made it rain on consumers’ and taxpayers’ parade, proposing record levels of biodiesel and renewable diesel volume requirements to satisfy an industry that is heavily reliant on taxpayer subsidies and a government-mandated market.

In the case of biomass-based diesel, which includes soy biodiesel and renewable diesel (still largely derived from soybeans but may also be derived from used cooking oil, grease, animal fats, and canola oil), the EPA proposed increasing the mandate by 67% from 2025 to 2026. Specifically, the mandates, if finalized, would require 5.61 billion gallons and 5.86 billion gallons of biomass-based diesel to be blended with diesel fuel in 2026 and 2027, respectively, up from 3.35 billion gallons in 2025.

The proposed volumes also continue to set aside 15 billion gallons for conventional corn ethanol—the maximum amount allowed under federal law. However, because corn ethanol is not expected to fully meet its 15-billion-gallon mark, biomass-based diesel is expected to make up 1.22 billion gallons of the “conventional” biofuel mandates in 2026 and 1.3 billion gallons in 2027.

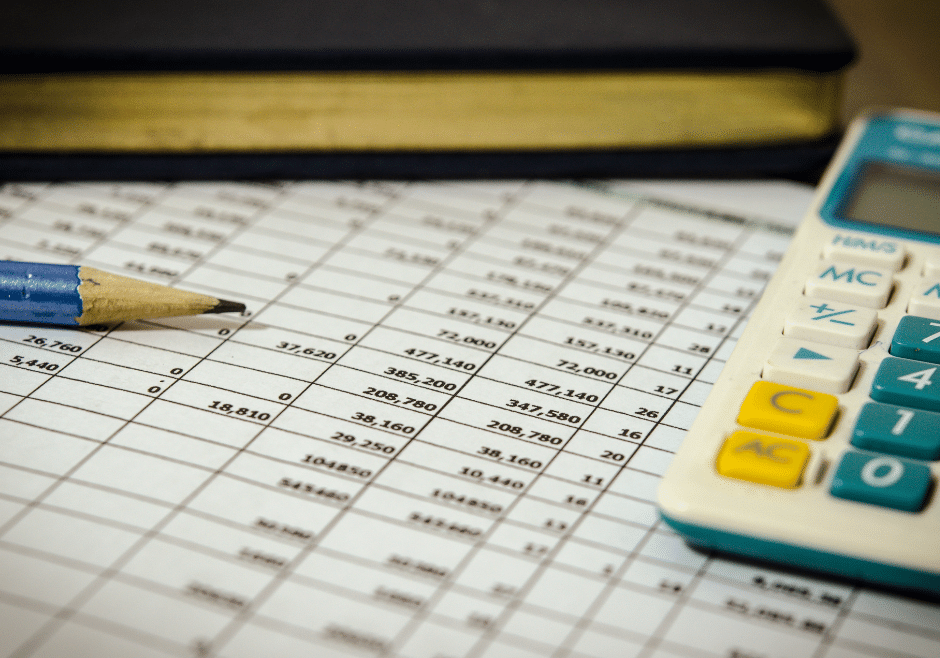

Specifically, EPA proposed the following government-mandated biofuel amounts for 2026 and 2027:

| EPA Proposed RVO Government Biofuel Mandates for 2026-2027 (billions of gallons) | ||

| 2026 | 2027 | |

| Cellulosic biofuel | 1.3 | 1.36 |

| Biomass-based diesel | 5.61 (plus extra 1.22) = 6.83 | 5.86 (plus extra 1.3) = 7.16 |

| Other advanced biofuel | 0.19 | 0.19 |

| Conventional renewable fuel (corn ethanol) | 13.78 | 13.66 |

| Total renewable fuel | 22.1 | 22.37 |

| Notes: Listed volumes are EPA?s estimates for how many billions of gallons would comprise the overall Renewable Identification Numbers (RIN) mandates. | ||

A few initial reactions to EPA’s proposal:

-

- Government-created industries: The proposal would force more biodiesel and renewable diesel into the market than what the U.S. industry can realistically produce. In 2024, the EPA reported that the supply of biomass-based diesel (biodiesel plus renewable diesel) totaled 5 billion gallons. However, a portion of this came from imported biofuel. Jumping from 5 billion gallons of supply in 2024 to 6.83 billion gallons in 2026 may increase consumer costs at the pump and/or force the U.S. to import more biomass-based diesel, which would be the opposite of the RFS’s goal of encouraging domestic production and improving energy security.

- Behind the 8-ball: Cellulosic biofuels and overall U.S. biofuel production has regularly failed to keep up with RFS targets. In 2007, Congress mandated a total of 16 billion gallons of non-food-based cellulosic biofuels to be produced by 2022. The U.S. has fallen woefully short of this mandate, as well as the overall RFS mandate of 36 billion gallons to be produced by 2022 across biofuels categories. In other words, even though the industry is heavily subsidized, the EPA’s proposed 2026 volumes are just 8% of the cellulosic mandate and 61% of the overall RFS mandate Congress originally envisioned. Either way, that’s a failing grade.

- Food-Based Fuel Remains King: Conventional, first-generation biofuels like corn ethanol and soy biodiesel were once promised to be a “bridge” to advanced and cellulosic biofuels. However, as the RFS has failed to spur meaningful production of non-food-based biofuels, this promise has failed to come to fruition and taxpayers have continued to suffer the consequences of diverting more food toward biofuel production. For example, the EPA predicts the proposed RVOs will increase the price of corn by $0.03 per bushel and soybean oil by $0.33-$0.36 per pound—cost increases that will trickle down to an average 0.18% increase in food expenditures for American consumers.

- Subsidies squared: For taxpayers, the worst part of the EPA’s proposal is that most U.S. biofuels will likely receive a tax break in 2025 and beyond. Under Congress’s current FY2025 budget reconciliation bill, H.R. 1, long-standing, common sense strings attached to biofuels policy would be removed, resulting in biofuels like corn ethanol—which taxpayers have subsidized for nearly a half century—receiving tax credits for the first time since 2011. The more EPA puts its foot on the pedal forcing more biofuels into the U.S. fuel supply, the more taxpayers will be on the hook to fork over special interest tax breaks in the form of the clean fuel production credit, known as 45Z. Congress’s recent proposals may reduce tax receipts by more than $45 billion or more over the next decade, according to the Joint Committee on Taxation (JCT).

Forcing fuel refiners to blend a government-mandated volume of biofuels has in turn forced U.S. consumers and taxpayers to pay a triple whammy of higher costs: (1) at the pump for non-advanced, food-based biofuels, (2) at the grocery store buying anything with corn or soybeans in it (or meat, with livestock relying on these crops as a primary feed source), and (3) on tax day, with bloated subsidy bills adding more to our national debt. After decades of subsidies and government mandates, it’s about time the biofuels industry stood on its own two feet.

TCS plans to submit more extensive comments to the EPA on the 2026-2027 biofuels RVO proposal.