On June 16, the Senate Finance Committee released the tax portion of the FY2025 budget reconciliation bill, known as the One Big Beautiful Bill Act. The Senate draft text would significantly slash the suite of energy tax credits created by the Inflation Reduction Act (IRA) but contains several provisions that would expand tax subsidies for the carbon capture and oil and gas industry.

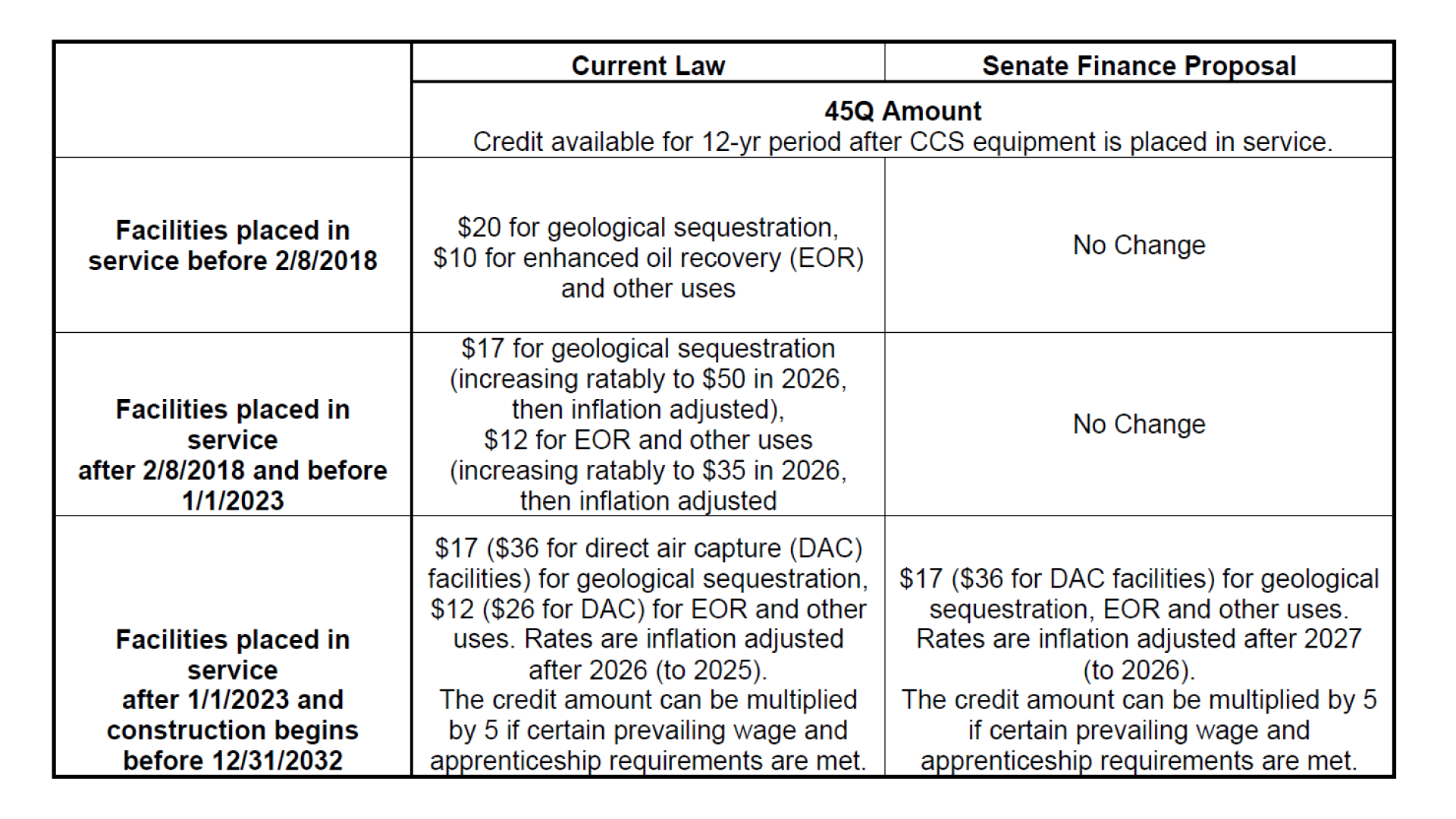

Structured like a carbon production tax credit, Section 45Q provides a credit for every ton of carbon dioxide (CO₂) captured from power plants or other industrial sources and permanently stored underground in geological formations. The IRA expanded and extended the credit by lowering the minimum capture threshold, increasing the credit amount, and extending eligibility to facilities that begin construction before the end of 2032. Since it was first created in 2008, 45Q has always offered different credit amounts based on the end uses of the captured carbon—higher amount for geological sequestration, lower amount for enhanced oil recovery and other uses. EOR is a technique that boosts production by injecting carbon into depleted wells to eke out more oil and gas. The Senate Finance proposal would, for the first time, increase the 45Q credit for EOR and other end uses to match the rate for geological sequestration—up to $180 per ton. By contrast, the House-passed bill leaves the credit amount unchanged. Both versions maintain the current expiration date but would apply new foreign entity of concern (FEOC) restrictions to facilities claiming the credit.

Under current law, facilities that are placed in service after 2022 can claim $17 ($36 in the case of a direct air capture, or DAC facility) for every ton of carbon captured and then stored in geological sequestration, and $12/ton (or $26/ton in the case of a DAC facility) if carbon is used for enhanced oil recovery (EOR) or other uses. The credit amount is inflation adjusted and can be multiplied by 5 if certain prevailing wage and apprenticeship requirements are met. The Senate proposal would increase the credit amount for EOR and other uses to $17/ton ($36/ton in the case of a DAC facility) to match the credit amount for geological sequestration for facilities placed in service after 2022.

The Treasury Department estimates that 45Q will cost taxpayers $36.2 billion over FY2024-FY2033. JCT estimates that this expansion of 45Q (combined with the effect of the foreign entity of concern restrictions) would cost taxpayers an additional $14.2 billion over FY2025-2034, on top of the $36 billion price tag.

45Q was first introduced to incentivize the adoption of CCS to reduce emissions. However, CCS’s lack of scalability, heavy dependence on taxpayer subsidies, threats to private property rights through eminent domain, and long-term risks to public health and safety make it a costly and ineffective endeavor—at taxpayers’ expense. Both the House and the Senate are missing out on the opportunity to protect taxpayers and raise revenue by not eliminating 45Q in reconciliation, especially when a bipartisan proposal that would repeal 45Q was already introduced earlier this year.

Additional Boost for CCS and Oil and Gas

The Senate draft also includes a provision similar to one in the House-passed bill that further benefits the CCS industry. Although the two versions differ on exactly which sources of income would qualify, both proposals would treat income from CCS-related activities as “qualifying income” for publicly traded partnerships (PTPs).

Current law generally requires PTPs with publicly traded partnership interests to be taxed as corporations. However, if at least 90 percent of a PTP’s gross income is derived from qualifying sources—such as rents, capital gains from real properties, or income from the exploration, production, processing, refining, transportation, or marketing of minerals or natural resources—it is taxed as a partnership instead. This allows PTPs to avoid corporate-level taxation by passing through their income directly to partners.

Both the Senate proposal and the House-passed bill would allow CCS facilities that meet 45Q’s minimum capture thresholds and capture at least 50% of total carbon output to count any income from electricity generation (for power plants), storage of electricity, and carbon capture as qualifying income for PTPs. There would be no construction deadline for these facilities to qualify. This provision would allow CCS facilities and investors to form tax-shielding PTPs to avoid corporate taxation.

The biggest boost to the oil and gas industry is a provision in the Senate finance draft that would allow intangible drilling costs to be deducted when calculating Corporate Alternative Minimum Tax (CAMT). The House-passed bill does not include a similar provision.

Under current law, the corporate alternative minimum tax (CAMT) imposes a 15% minimum tax on the adjusted financial statement income (AFSI) of large corporations with average annual financial statement income exceeding $1 billion, effective in 2023. Corporations pay the larger of the minimum tax or the regular corporate tax. The AFSI allows for tax depreciation, net of operating losses, and other adjustments that reduce the base of the CAMT.

The Senate Finance proposal would allow operators of oil and gas, and geothermal wells to deduct intangible drilling costs (IDCs) from AFSI when calculating CAMT, without any regard for depletion expenses that’s taken into account in the financial statement with respect to IDC. Expensing of IDCs is a long-standing oil and gas subsidy established in 1913 that allows all of the non-salvageable costs for drilling an oil or gas well (e.g. wages, fuel, and drilling sit preparation) to be deducted the year these costs are incurred, while other industries must expense costs slowly over the life of an asset.

This provision would effectively allow oil and gas drillers to avoid the CAMT altogether. Although the JCT estimates that this provision would cost $427 million over the next decade, a prior JCT analysis of the H.R. 662 Promoting Domestic Energy Production Act, a bill that includes the same provision, allowing IDC to be deducted for purpose of determining CAMT will cost taxpayers $1.1 billion over a decade.