On January 13, the federal government leased 4,116 acres of public land in North Dakota and Montana for oil and gas development at the recently reduced federal royalty rate of 12.5%. The result is an estimated $5.4 million in lost royalty revenue over the life of these leases.

This sale adds to mounting losses—TCS estimates that taxpayers have already lost roughly $600 million in projected royalty revenue from leases sold since July 4, when the One Big Beautiful Bill Act (OBBBA) reduced the onshore royalty rate to 12.5%—below what states and private landowners typically charge.

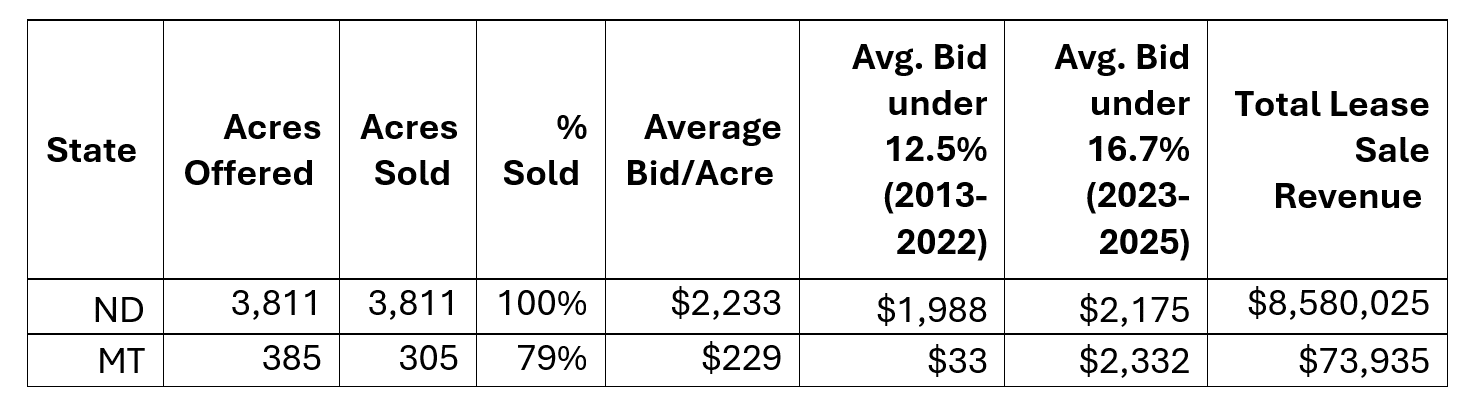

Today’s sale offered 18 parcels of public land in North Dakota—totaling 3,811 acres—and 2 parcels in Montana—totaling 385 acres. All available land was leased except for one, 80-acre parcel in Liberty County MT.

North Dakota has been the third-largest producer of federal oil and fifth-largest producer of federal gas over the last decade. Lease sales in the state have been consistently competitive and oil and gas development generates important revenue for federal and state taxpayers.

In contrast, federal leasing in Montana accounts for little of total federal oil and gas production. Historically, much of the public land leased for oil and gas development in the state was sold at the legal minimum bid or noncompetitively. In the decade before August 2024, not a single lease sale in the state received an average per acre bid above $100.

Leasing decisions are driven by development potential and market conditions. Competitiveness in today’s sale varied widely. The lowest bids, the legal minimum of $10 per acre and $52 per acre, were for two parcels in Bottineau County ND, which accounts for less than 1% of federal oil and gas production in the state. The highest bids, 3 parcels leased for $15,002 per acre, were located in Dunn County ND, the third largest producer of oil and gas in the state. Operators lease where there is development potential—a factor that is highly dependent on the specific parcels of land offered in a sale.

Competitive, market-based royalty terms do not deter industry interest nor production decisions. The sale’s average bid of $2,233 per acre leased in North Dakota is on par with historical leasing trends in the state—both for leases offered at a 12.5% royalty rate and more recent leases offered at the 16.67% royalty rate. The one parcel leased in Montana for $229 per acre is lower than recent years, but as results are driven by parcel-specific information is unwise to form conclusions.

The lower royalty rate did not make these leases more competitive. It simply reduced future royalty revenue. In North Dakota alone, taxpayers lost an estimated $1.2 billion in revenue from FY2013 to FY2022 under the 12.5% rate. With record-high production across the U.S., losses will continue or even grow worse. Because revenue is shared between the federal treasury and states, North Dakotans also lose funds for schools, infrastructure, and other local priorities. While production is much lower in Montana, outdated rates from FY2013 to FY2022 still cost state and federal taxpayers $110 million and allowed thousands of acres of public land to be locked into nonproducing leases, preventing other uses.

The Bureau of Land Management estimates that the parcels sold today could yield 1.7 million barrels of oil and 3.9 billion cubic feet of natural gas over their lifespan. Based on the White House budget office’s 2026 price projections—used to estimate federal royalty revenue from onshore leases—that production could be worth roughly $130 million. At the 12.5% rate, taxpayers would receive about $16 million each year, roughly $5.4 million less than we would under a 16.67% rate.

Oil and gas developed on federal lands belong to the American people, and leasing terms should ensure these resources aren’t given away for less than they’re worth.

*Correction: The total foregone royalty revenue has been updated from $572,622 to to $5.4 million due to a calculation error.

- Photo by David Brown: https://www.pexels.com/photo/machine-for-the-extraction-of-petroleum-18905774/