Click here to view this fact sheet in PDF format.

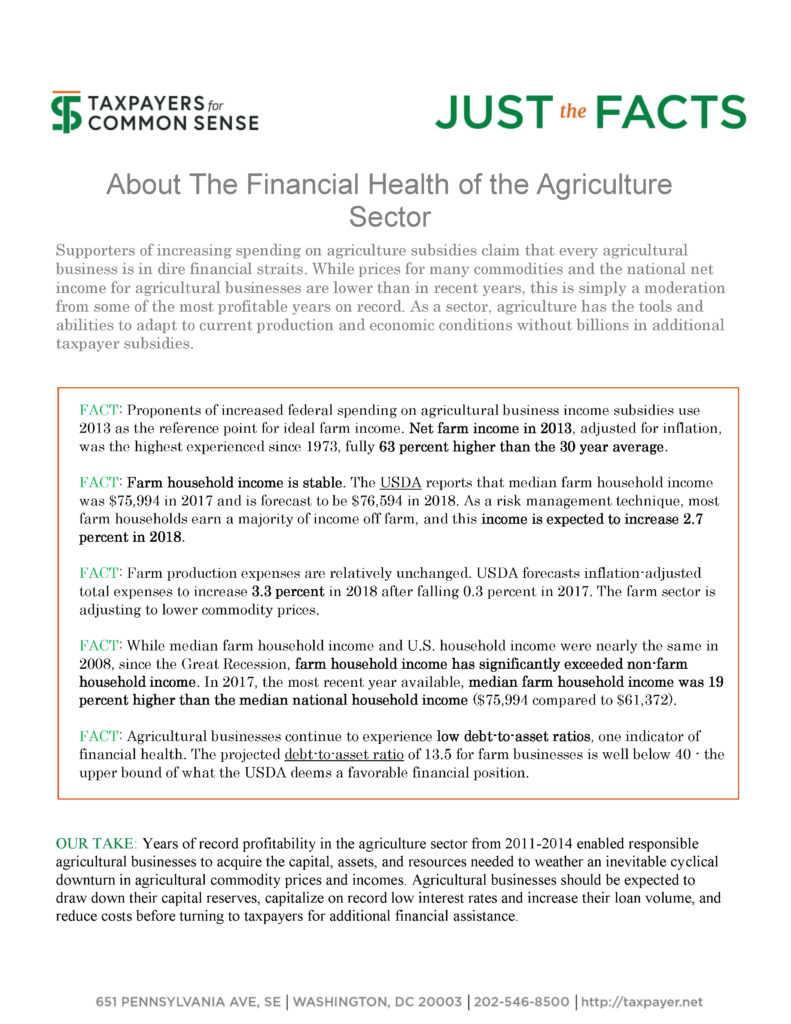

Supporters of increasing spending in the 2018 Farm Bill claim that every agricultural business is in dire financial straits. While prices for many commodities and the national net income for agricultural businesses are lower than in recent years, this is simply a moderation from some of the most profitable years on record. As a sector, agriculture has the tools and abilities to adapt to current production and economic conditions without billions in additional taxpayer subsidies.

Click the image below to view this fact sheet in PDF format .

.