The taxpayer cost of the federal crop insurance program has recently ballooned to record levels. The Congressional Budget Office (CBO) estimated the highly subsidized program cost taxpayers a record $16.66 billion in FY23 alone and will cost an average of $12 billion annually over the next decade. The program has become the costliest farm income subsidy program. Meanwhile, net farm income recently reached record highs, with agriculture remaining profitable despite disasters and high input costs.

Common sense reforms to the federal crop insurance program can save taxpayers tens of billions of dollars, while also benefiting beginning farmers and the environment. The Assisting Family Farmers through Insurance Reform Measures Act (AFFIRM Act) and the Crop Insurance Transparency Act would help achieve these ends. The Government Accountability Office (GAO) found common sense reforms would “not negatively impact the crop insurance program or its actuarial soundness.” A 2023 GAO report continued the drumbeat, calling for common sense reforms to the highly subsidized program.

Top 10 Federal Crop Insurance Statistics:

-

- Cost: Crop insurance includes unlimited premium subsidies for agricultural producers (doubled in cost over the past decade to a record $12 billion in FY22), administrative and operating (A&O) subsidies for private insurance companies ($2.5 billion/year), and federal reinsurance (insurance for the companies in years losses exceed premiums) that lead to an average 14% rate of return for companies in the program. The 2023 GAO report found that some crop insurance agents and companies are receiving more than $1 million in subsidies each year to sell just one crop insurance policy. The AFFIRM Act would reduce A&O subsidies to $900 million annually and reduce the federally guaranteed rate of return to 8.9% to bring costs in line with other types of insurance.

- Overly generous share of premiums covered by taxpayers: On average, for every $1 of crop insurance protection, taxpayers cover 60 cents while farmers pay 40 cents.

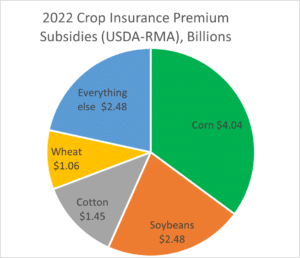

- Handful of beneficiaries: In 2022, 78% of crop insurance premium subsidies flowed to just four crops (corn, soybeans, cotton, and wheat).

- Nontransparent: The AFFIRM Act would require public disclosure of crop insurance subsidies, similar to other federal programs. The farm bill currently makes it illegal for taxpayers to know which individuals and businesses are receiving federal crop insurance subsidies.

- No income limit: Unlike every other social safety net program, subsidized federal crop insurance lacks income limitations. The GAO found that some subsidy beneficiaries include millionaires, billionaires, and non-farmers such as physicians, executives, lawyers, and those with foreign residences. The AFFIRM Act would prohibit premium subsidies for businesses experiencing $250,000 in annual adjusted gross income (after expenses are accounted for). They could still purchase federal crop insurance policies but would pay for risk protection with their own resources.

- Limitless subsidies: Independent analysts and academics concluded that a small percentage of agricultural producers would be impacted by proposals to rein in unlimited crop insurance premium subsidies. In 2015, GAO identified a crop insurance premium subsidy recipient farming on average 150,000 acres annually, more than 300 times larger than the average U.S. farm of 441 acres; GAO also found other beneficiaries receiving an average of $2.6 million in premium subsidies from 2009 to 2013. The AFFIRM Act would rein in unlimited crop insurance subsidies, bringing subsidy limits in line with other farm programs to $125,000 annually. It would also apply common sense work requirements to ensure subsidy recipients are actively engaged in the farming operation.

- Impacts: Crop insurance subsidies distort markets, increase land prices and farm consolidation, spur conversion of sensitive, carbon-rich land to cropland, and result in less uptake of unsubsidized, risk-reducing practices such as agricultural conservation and crop diversification.

- Subsidies for revenue and profit margin guarantees: In addition to subsidizing losses due to yield declines (from drought, floods, etc.), taxpayers also provide subsidized payouts to producers at times when they reap a bountiful crop. The AFFIRM Act would eliminate taxpayer subsidies for Harvest Price Option (HPO) policies to ensure subsidies are better focused and fiscally responsible.

- Complex: New additional policy add-ons and shallow loss programs within crop insurance have added complexity and taxpayer costs, in addition to shifting unnecessary risks of loss onto taxpayers’ backs.

- Disaster aid cherry on top: Federally subsidized crop insurance was created to eliminate the need for unbudgeted, ad hoc disaster “emergency” spending, which is unstable and unpredictable for both farmers and taxpayers. Since adoption of the 2018 farm bill, however, Congress has appropriated more than $20 billion in “emergency” disaster aid to agricultural producers, including businesses that had already purchased crop insurance.

For more information, please visit https://www.taxpayer.net/category/agriculture/.

You can download the full federal crop insurance program fact sheet here or read it below.