The President’s FY2017 Budget – TCS Analysis

With 20 years of experience, TCS staff will be combing through the Presiden’ts fiscal year (FY) 2017 budget and posting our observations and analyses on this page in a continuously updated blog. You can find TCS work on the President’s budgets in previous years here.

Issues Areas |

|

| Agriculture | |

| Budget &Tax | |

| Earmarks & Appropriations | |

| Energy | |

| National Security | |

| Natural Resources | |

| Transportation & Infrastructure | |

February 12, 2016

February 11, 2016

4:30pm – An Explosion of Nuclear Energy Funding

4:30pm – An Explosion of Nuclear Energy Funding 4:18pm – Ramping Up Abandoned Coal Mine Clean-Up

4:18pm – Ramping Up Abandoned Coal Mine Clean-Up 3:35pm – Cutting Nuclear Nonproliferation in a Time of Terrorism

3:35pm – Cutting Nuclear Nonproliferation in a Time of Terrorism 3:05pm – Clean Coal Takes a Bite Out of Fossil Energy R+D

3:05pm – Clean Coal Takes a Bite Out of Fossil Energy R+D-

1:54pm – European Reassurance Initiative: Because

1:54pm – European Reassurance Initiative: BecauseFunding 22% of NATO Isn’t Enough?

February 10, 2016

5:46pm – Inland Waterways Trust Fund Drying Up

5:46pm – Inland Waterways Trust Fund Drying Up 5:15pm – Driving Up Spending, Under the Radar

5:15pm – Driving Up Spending, Under the Radar 5:05pm – The Army’s on OCO Life Support

5:05pm – The Army’s on OCO Life Support 4:47pm – Stop Siphoning of Federal Dollars From Federal Waters

4:47pm – Stop Siphoning of Federal Dollars From Federal Waters 2:42pm – Shipbuilding: Still Dragging LCS Like an Anchor

2:42pm – Shipbuilding: Still Dragging LCS Like an Anchor 2:10pm – F-35 Is 40% of All Major Aircraft Acquisition in FY17

2:10pm – F-35 Is 40% of All Major Aircraft Acquisition in FY17 2:00pm – Timber Proposal Misses the Forest for the Trees

2:00pm – Timber Proposal Misses the Forest for the Trees 12:38pm – Digging into the Department of Energy

12:38pm – Digging into the Department of Energy 12:05pm – F-35: Navy Maintains Balance in Combat Aircraft Budget

12:05pm – F-35: Navy Maintains Balance in Combat Aircraft Budget

11:20am – Learning Biofuels Lessons

11:20am – Learning Biofuels Lessons

February 9, 2016

5:30pm – When a Cut Isn’t a Cut: Army Corps of Engineers

5:30pm – When a Cut Isn’t a Cut: Army Corps of Engineers 5:12pm – F-35: Navy and Marine Corps Orders Really Add Up

5:12pm – F-35: Navy and Marine Corps Orders Really Add Up 5:04pm – Budget Themes

5:04pm – Budget Themes 4:11pm – Plus Up for DOE Loan Guarantees

4:11pm – Plus Up for DOE Loan Guarantees 3:51pm – What Sequestration?

3:51pm – What Sequestration? 3:44pm – Fun With Numbers (OCO Style)

3:44pm – Fun With Numbers (OCO Style) 3:05pm – Stuck Between a Rock and Hard(rock) Place

3:05pm – Stuck Between a Rock and Hard(rock) Place 2:40pm – Riding on the Clean Coal Train

2:40pm – Riding on the Clean Coal Train 2:10pm – Inside the Department of the Interior Budget

2:10pm – Inside the Department of the Interior Budget 1:50pm – Overseas Contingency Operations STILL 5th Largest Agency

1:50pm – Overseas Contingency Operations STILL 5th Largest Agency 1:25pm – Fun with Numbers (Budget Style)

1:25pm – Fun with Numbers (Budget Style) 1:13pm – Increased Emphasis on Cyber Security

1:13pm – Increased Emphasis on Cyber Security 1:05pm – Fossil Fuel Tax Fix

1:05pm – Fossil Fuel Tax Fix 12:45pm – F-35 Funding: Still One Big, Blueberry Pie

12:45pm – F-35 Funding: Still One Big, Blueberry Pie 12:29pm – Common Sense Cuts to Crop Insurance

12:29pm – Common Sense Cuts to Crop Insurance 12:07pm – (Don’t) Forget the MOX

12:07pm – (Don’t) Forget the MOX 11:45am – TCS Statement on the Budget

11:45am – TCS Statement on the Budget 11:00am – President Obama’s Last Budget Is Live!

11:00am – President Obama’s Last Budget Is Live!

February 10, 2016

1:30pm

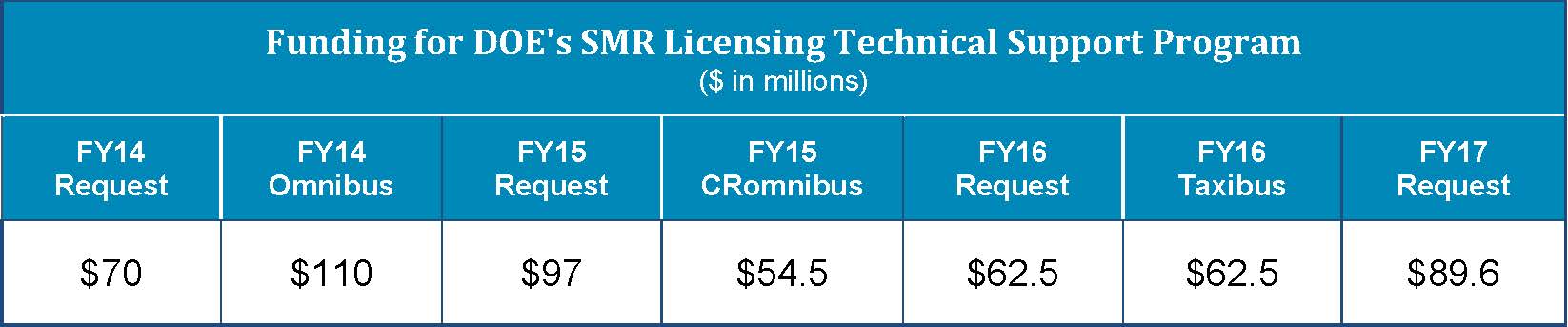

Unstinting Support for Small Modular Reactors

As we noted below, one of the big winners in recent Presidential budgets has been the Department of Energy’s (DOE’s) Nuclear Energy program – its requested budget has grown by more than a third, from $735 million in FY14 to $994 million in FY17. Included in the program’s bloated, nearly $1 billion budget for this year is a large bump in funding for the Small Modular Reactor (SMR) Licensing Technical Support line item. At $89.6 million, the request is $27.1 million (43%) more than both the requested and appropriated amount for FY16.

The administration’s emphatic support for SMRs in this year’s budget is as unsurprising as it unjustifiable. SMRs, in theory, are mass-producible reactors that generate less than 300 MWe. By comparison, traditional reactors produce around 1,000 MWe. Funding to develop the concept and help companies attempt to license their SMR designs has been requested in every budget since FY11. Despite the hundreds of millions that have been spent, the commercial prospects for the “mini-nukes” are still as bleak as when TCS gave DOE’s SMR program a Golden Fleece award in 2013. In a report issued in August, 2015, the Government Accountability Office (GAO) documents huge regulatory uncertainties and highlights a number of technical and economic boundaries for even the most advanced SMR concepts – small light water reactors.

In fact, even though the SMR Licensing and Technical Support program handed out awards of up to $452 million combined to two companies in 2013, nuclear industry heavyweights have backed away from SMRs, including one of the award recipients – Babcock & Wilcox (B&W).

Less than a year after B&W’s subsidiary mPower won the DOE award, B&W began looking to sell off part of the company. Unable to find anyone interested in taking even a minority stake in mPower, B&W announced it would cut its funding for the project in April, 2014. In all its wisdom, DOE decided to keep funding mPower through November, 2014, according to the GAO report. In total, taxpayers lost $111 million on the venture. The demise of mPower is reflected in the steep drop in funding for DOE’s program from FY14 to FY15 (see below).

The other award recipient, NuScale, is moving forward with its design, but that didn’t stop its parent company, Fluor Corporation, from divesting part of its ownership in the project. Thankfully, according to DOE officials, most of the unspent money that was intended for mPower has been rescinded, and none of it will be funneled to NuScale. That’s welcome news, because taxpayers can’t afford to lose any more on a DOE fantasy, and SMRs are still a bad bet.

February 11, 2016

4:30pm

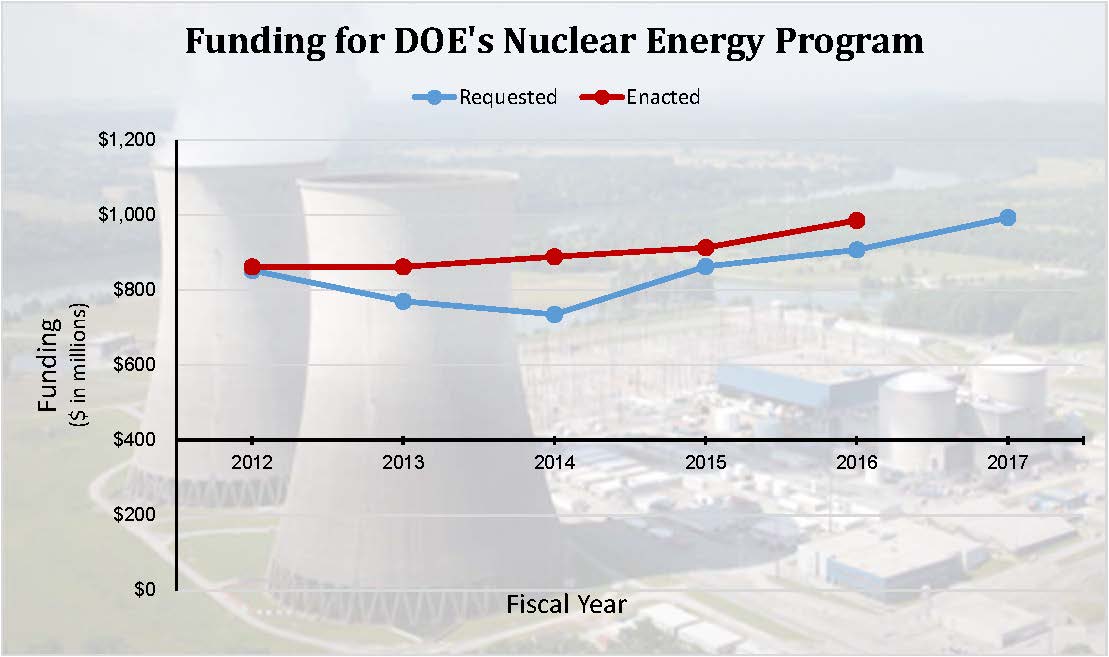

An Explosion of Nuclear Energy Funding

It is abundantly clear to anyone who monitors the annual budget process that the law of physics – “what goes up, must come down” – doesn’t apply to federal spending. Despite all the moaning and groaning about budget caps and the dreaded sequester in recent years, some line items have become completely untethered to fiscal reality. With sizeable increases in funding year after year, the Nuclear Energy program at the Department of Energy (DOE) seems particularly adept at defying gravity.

For FY17, DOE has requested almost $1 billion for Nuclear Energy – $993.9 million to be precise, which represents $7.7 million more than what it received in the FY16 Taxibus, and $86.3 million more than last year’s request. The 10 percent increase over last year, however, pales in comparison to the growth of the budget over time.

Since the President’s FY14 budget, DOE’s request for Nuclear Energy has increased by $258.4 million. That is, in just three years, the program’s requested budget has spiked more than 35 percent. Congress of course has the final word on funding levels, and appropriations for Nuclear Energy have actually far exceeded the President’s requested levels (before rescissions) in recent years – by an average of $94 million (see below).

The high funding levels only matter, however, because of where the funding is going. Line items like Nuclear Energy Enabling Technologies and Reactor Concepts RD&D serve to support the subsidized and mature nuclear industry. Helping nuclear companies bring new technology to market (through things like the Energy Technology Commercialization Fund for which $20 million is requested) forces taxpayers to pick up costs that should be shouldered by industry.

One of DOE’s Nuclear Energy ventures in particular – the troubled Small Modular Reactor (SMR) Licensing Technical Support – is so wasteful, it deserves its own post, so make sure to stary tuned.

|

| Notes: FY13 appropriations were provided through a year-long continuing resolution; enacted amount shown reflects the program’s FY12 funding level. FY14 enacted amount does not include a $80.121 million rescission. |

4:18pm

Ramping Up Abandoned Coal Mine Clean-Up

The budget request for the Department of the Interior’s Office of Surface Mining and Reclamation Enforcement (OSMRE) is attempting to make some significant changes to the Abandoned Mine Lands (AML) fund. The AML fund generates revenue from a fee on coal production on federal lands that it then disburses to states with abandoned coal mines, as governed by the Surface Mining Control and Reclamation Act (SMCRA) of 1977. “Non-certified states” (that have not completed abandoned mine clean-up) receive these funds via mandatory grants, and the remaining funds are available for discretionary appropriations.

States and tribes must have an approved coal mine reclamation regulatory program in place to receive mandatory AML funding. In 2015, 25 states and tribes received AML funding, five of which are “certified,” meaning they have already completed reclamation of their abandoned mines. Of the $226.6 million disbursed from the AML fund in 2015, $58.8 million went to states that no longer have abandoned mines to clean up. Congress approved $61.5 million more in AML funds for “certified” states for FY16.

In the FY17 budget, OSMRE is proposing to terminate AML funding for certified states. Amendments to SMCRA in 2012 and 2013 limited how much AML funding could be available to certified states, but the Fixing America’s Surface Transportation Act (FAST) Act passed by Congress in December 2015 abolished those limits and made an additional $241.9 million in AML funds available to certified states. OSMRE’s budget notes that very little of the AML funds received by certified states have gone toward coal mine reclamation, and estimates that terminating these payments would save taxpayers $520 million over 10 years.

In addition to the termination of AML funding for states that no longer have abandoned mines to reclaim, OSMRE is also using this budget to request accelerated grants from unappropriated discretionary AML funds for states with mines that were abandoned before SMCRA created the AML fund in 1977. The budget also proposes to make $1 billion available over five years for “sustainable revitalization” of depressed coalfield communities.

Lastly, OSMRE proposes returning the reclamation fee charged on coal production to historic levels. Amendments to SMCRA in 2006 reduced reclamation fees from 35 cents/ton to 28 cents/ton on surface mining, from 15 cents/ton to 12 cents/ton on underground mining, and from 10 cents/ton to 8 cents/ton for lignite mining. OSMRE estimates that raising the fees to the pre-2006 levels would generate an additional $49 million in 2017 for the AML fund.

We’re encouraged to see attention to this issue which has a history of abuse. Wyoming has recently used some of its AML fund money to renovate a basketball arena and build a science building at the University of Wyoming. It’s a waste of taxpayer dollars to use AML fund money in states without high priority mine abandoned mine sites.

3:35pm

National Nuclear Security Administration (NNSA): Why are they Cutting Nuclear Nonproliferation Programs in a Time of Terrorism?

Any logical analysis of the current threats to the United States would put terrorism high on the list. In fact, in his foreword to the 2015 National Military Strategy of the United States, the then-Chairman of the Joint Chiefs of Staff General Martin Dempsey said,

“Today’s global security environment is the most unpredictable I have seen in 40 years of service. … We now face multiple, simultaneous security challenges from traditional state actors and transregional networks of sub-state groups – all taking advantage of rapid technological change.”

The National Military Strategy itself, goes on to say,

“Nuclear, chemical, and biological agents pose uniquely destructive threats. They can empower a small group of actors with terrible destructive potential. Thus combatting WMD as far from our homeland as possible is a key mission for the U.S. military.”

So it seems as if the National Nuclear Security Administration (NNSA) never got the memo and certainly never read the military strategy. Because in an overall program that increased by 2.9%, the one program they chose to cut was Defense Nuclear Nonproliferation – the very folks who are responsible for keeping nuclear materials out of the hands of the bad guys. In fact, the nonproliferation office budget request of $1.8 billion is 6.8% lower than what they received in FY16.

The NNSA budget lines for “Weapons Activities” and “Naval Reactors” on the other hand, both receive increases over last year’s funds. The $9.2 billion for Weapons Activities – designing and procuring nuclear weapons – is a 4.5% increase. And Naval Reactors – designing and building the nuclear reactors for U.S. Navy vessels – received $1.4 billion or a 3.2% increase over last year.

At TCS we’ve said this before: modernizing the nuclear triad won’t keep us safe from terrorists. But robust funding for the Defense Nuclear Nonproliferation office just might.

3:05pm

Clean Coal Takes a Bite Out of Fossil Energy R+D

The Department of Energy (DOE) requests $600 million (a five percent reduction) for fossil energy research and development (R+D). $26.5 million of that total would go to Fuel Supply Impact  Mitigation, a new funding category for FY17 formerly listed as “Natural Gas Technologies” in previous years. The program, which funds “technologies to reduce surface and subsurface footprint, emissions, and water use in order to enable safe and responsible development of unconventional domestic oil and natural gas resources,” receives a decrease of $16.5 million from the FY16 enacted level.

Mitigation, a new funding category for FY17 formerly listed as “Natural Gas Technologies” in previous years. The program, which funds “technologies to reduce surface and subsurface footprint, emissions, and water use in order to enable safe and responsible development of unconventional domestic oil and natural gas resources,” receives a decrease of $16.5 million from the FY16 enacted level.

The Program Direction fund, which received $114 million at FY16 enacted levels, is split up in the FY17 request into a smaller Program Direction line funded at $61 million, with the remainder used to bump up National Energy Technology Laboratory (NETL) funding into two new line items: NETL Research and Operations, funded at $76 million, and NETL Infrastructure, funded at $68 million. The combination of these two reorganized NETL funds are $23 million more than the FY16 enacted level for NETL.

The remaining large portion of DOE’s $600 million for Fossil Energy R+D funds would be used to fund “clean coal” carbon capture and sequestration (CCS) projects that have cost taxpayers billions despite recent evidence that CCS technologies won’t be commercially viable for decades. With no return on these investments in sight for DOE, continued CCS funding is bad news for taxpayers.

The requests for clean coal funding include:

- $170 million for Carbon Capture – continued scale-up of second generation technologies by supporting three large-scale pilot tests and a focus on lowering the capital cost of carbon capture systems

- $91 million for Carbon Storage – funding for commercial-scale characterization and small-scale field projects, development of laboratory-and bench-scale technologies, and monitoring, verification, accounting, and assessment tool development

- $48 million for “Advanced Energy Systems” – to develop a new generation of fossil-fueled energy conversion systems integrated with CCS that may be capable of producing competitively priced electric power.

- $59 million for “Crosscutting Research and Analysis” – modeling of phenomenon for complex energy conversion and carbon capture processes tools and techniques

- For a total of $368 million for CCS and Advanced Power Systems* ($9 million less than FY16 enacted levels, and $980,000 less than the FY16 request)

*Note that DOE has changed the line item names and for its CCS projects in this FY17 budget request from “Coal Carbon Capture and Storage and Power Systems” to “CCS and Advanced Power Systems.”

1:54pm

European Reassurance Initiative: Because the U.S. Funding 22% of NATO Isn’t Enough

Cast your mind back a couple of years to when Congress was larding up the Overseas Contingency Operations (OCO) account above the Administration’s request – to about $85 billion – and the Pentagon was trying to find ways to spend it.

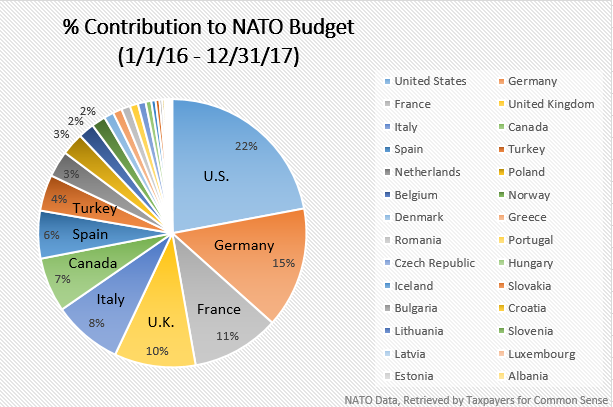

One of the new programs invented to absorb some of that tsunami of cash was the so-called European Reassurance Initiative (ERI.) It was less than a billion dollars back then, but at TCS we wondered how this new program would differ from what the United States already does to reassure our European allies – pay 22% of total bill at NATO. (The next closest contributor to overall costs is Germany at 14.6%, then the French at 10.6%, and the Brits at 9.8%.) You can find the full list of what percentage each of the 28 NATO allies contribute here.

These percentages are based on a complicated formula based on the size of each member-nation’s economy. We’ll leave it to others to quibble about whether we’re carrying the freight for the rest of the Alliance, but we can’t ignore the fact that the ERI is rapidly becoming NATO-lite.

We’ll let the Pentagon’s ERI budget justification documents speak for themselves on this topic:

“Through projects funded in support of the FY 2017 ERI, the Department seeks to continue reassurance of NATO Allies and bolster the security and capacity of U.S. partners for the purpose of deterring adversarial threats. The President has stated that the United States, along with its NATO Allies, will continue to take actions that increase the capability, readiness, and responsiveness of NATO forces to address any threats or destabilizing actions from aggressive actors. The FY 2017 ERI funding allows the DoD to reinforce the defenses of NATO members and non-NATO partners in the region that feel most threatened by Russian aggression. Moreover, this initiative messages the strength of the U.S. commitment to security in Europe.”

This is the core of the justification to spend another $3.4 billion of U.S. taxpayer dollars in Europe. At TCS, we think the initiative that “messages the strength of the U.S. commitment to security in Europe” is, and has been for the last 60+ years, NATO.

February 10, 2016

5:46pm

Inland Waterways Trust Fund Drying Up

Barge industry representatives who’ve been trolling for a bailout of the Inland Waterways Trust Fund (IWTF) can’t be too pleased with the administration’s Army Corps of Engineers Civil Works budget. As part of the request the administration once again proposes an annual per-vessel fee on commercial navigation users (barge companies) to help these companies meet their legal obligation to cover 50% of the cost of construction and rehabilitation of the dams and locks that make safe commercial navigation possible. This 50-50 split between users and federal taxpayers has been the law since 1986 and funds are currently generated from a 29-cent-per-gallon tax on diesel fuel barge operators use on these waterways. Supplementing this tax with a per-vessel fee has been proposed numerous times before. The new wrinkle is that the administration is proposing to tap these funds to cover 25% of the annual operations and maintenance (O&M) costs of the system. Currently barge companies are financially off-the-hook once a project is finished; taxpayers foot 100% of the O&M bill (to the tune of nearly $600 million per year).

Industry contributing more funds to continue their ability to navigate on the inland waterways is critical since the fund is drying up.

The fund is in such dire straits that the entire $33.75 million generated this year is going to cover the industry’s cost-share for just one project, replacing the Olmsted Lock and Dam on the Ohio River.

5:15pm

Driving Up Spending, Under the Radar

Driving Up Spending, Under the Radar

|

| Photo credit: jypsygen via flickr |

In addition to the new transportation spending proposed in the budget (funded by the new tax on oil), the transportation portion of the budget plays some numbers games to avoid the sequestration caps. By shifting spending from the discretionary category to the mandatory category, the budget makes it look like the discretionary total decreases, when in fact overall spending increases. Transportation Investment Generating Economic Recovery Program (TIGER)/ National Infrastructure Investments grants received $500 million in discretionary funding last year. The Budget requests $1.25 billion this year, in mandatory spending. Grants to Amtrak climbs from $1.39 billion in discretionary last year to $1.9 billion, now in mandatory spending (not subject to BCA caps). Total spending at USDOT would actually jump from $76.1 billion in FY16 to $95.4 billion in FY17. (H/T Eno Center for Transportation for flagging initial gimmick)

5:05pm

The Army’s on OCO Life Support

We write a lot about the Overseas Contingency Operations accounts being a hard habit to break. “Free” money, kind of like the King Coins they were passing out in New Orleans yesterday on Fat Tuesday (such irony that the federal budget came out on Fat Tuesday, eh?)

Well guess what? Maybe it’s time to give up OCO for Lent as a test case for giving it up forever!

Of all the military services, it seems the Army would have the hardest time living without OCO money. Looking at the major budget lines for the Army, this comes into sharp focus.

Procurement — 16% of the Army’s procurement request is in OCO as compared to an average of 8.6% across the Pentagon.

Personnel — 4% of the Army’s personnel request is in the OCO line. Compare that to 2.7% across the Pentagon.

Operations & Maintenance — a whopping 31% of O&M for the Army is in the OCO accounts. Across all Pentagon accounts, the figure is just 8.5%.

All this makes us wonder if the Army will ever be able to wean itself off the OCO money.

4:47pm

Stop Siphoning of Federal Dollars From Federal Waters

The FY2017 Interior budget requests that the Congress repeal revenue distribution provisions of the Gulf of Mexico Energy Security Act (GOMESA). GOMESA, passed in 2006, gives a large share of  federal income from offshore oil and gas revenues to just a few coastal states. It transfers literally billions of dollars in income from resources owned by all taxpayers to four state governments, with little oversight. Although we have already lost more than a billion dollars through these revenue transfers, the rate of losses will soon increase dramatically. Starting in FY 17, a much broader range of leases will be subject to revenue sharing, and up to $500 million will be taken from federal revenues annually.

federal income from offshore oil and gas revenues to just a few coastal states. It transfers literally billions of dollars in income from resources owned by all taxpayers to four state governments, with little oversight. Although we have already lost more than a billion dollars through these revenue transfers, the rate of losses will soon increase dramatically. Starting in FY 17, a much broader range of leases will be subject to revenue sharing, and up to $500 million will be taken from federal revenues annually.

TCS has long urged the repeal of revenue sharing provisions of GOMESA, so that all taxpayers can benefit from the income generated by oil and gas leases on offshore federal waters. It is particularly urgent that the repeal be achieved before the diversion of federal revenues balloons to $500 million/year.

2:42pm

Shipbuilding: Still Dragging LCS Like an Anchor

Shipbuilding is a growth industry these days. Beyond all the gnashing of teeth that the plan for the Navy is to “only” have 308 ships by FY21, there is a real resurgence in shipbuilding. (Remember that old Elvis Costello song about the British shipbuilding industry? No? You should really listen to it. We’ll wait until you’re done.)

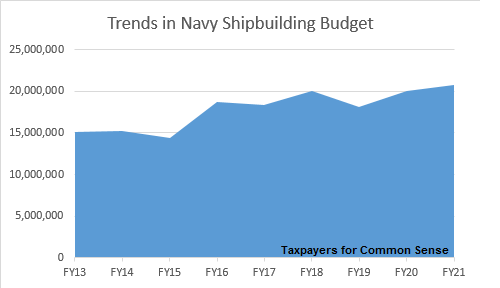

Anyhooooo, as we were saying, no matter what various politicians may have you believe, funding for shipbuilding is on the upswing. In fiscal years 2013, 2014, and 2015 shipbuilding hovered in the neighborhood of $15 billion per year. Then, in the Navy’s FY16 budget request, we saw a significant uptick in the Shipbuilding and Conversion accounts to $18.7 billion. It appears this wasn’t an anomaly as the FY17 request is for roughly $18.3 billion. The reasons for this are obvious: the Navy is starting to spend significant amounts of procurement funds on the replacement for the Ohio Class of ballistic missile submarines ($773 million,) the new Ford Class aircraft carrier takes approximately a $1.4 billion bite from the total, the Virginia Class fast attack submarines are a little more than $3 billion in procurement this year, and so it goes…

But one place where even the Secretary of Defense believes the Navy should be saving money is the Littoral Combat Ship. In a letter to the Secretary of the Navy, written last December and promptly leaked, Secretary Carter directed the reduction of the planned procurement from 52 ships down to 40. (At TCS we believe the production line for this ship, which the previous Secretary of Defense Chuck Hagel once said could only sail in a “permissive environment,” could be shut down much earlier. But cutting the buy to 40 is a big step in the right direction.) The letter from the Secretary of Defense to the Secretary of the Navy specifically directed that the Navy cut the planned buy in FY17 from two hulls to one. The budget as presented, however, is for another two LCS for a total of slightly more than $1 billion. It seems the Secretary of Defense lost that particular surface war.

But the next time someone tells you the Navy’s shipbuilding account is being gutted, you show them this chart:

2:10pm

F-35 Is 40% of All Major Aircraft Acquisition in FY17

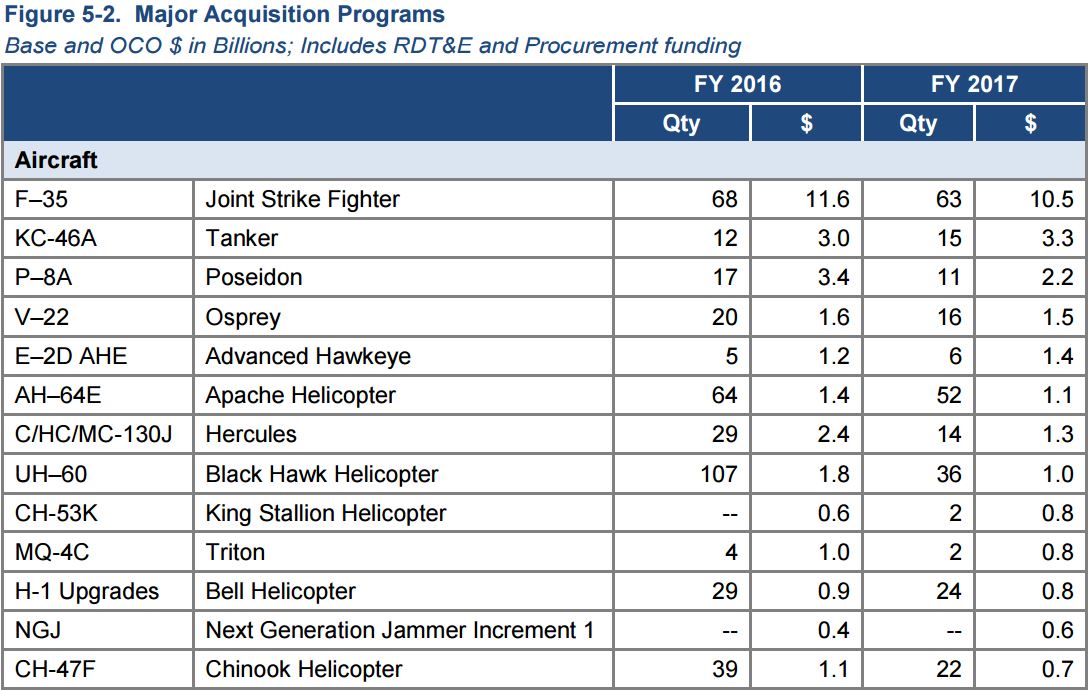

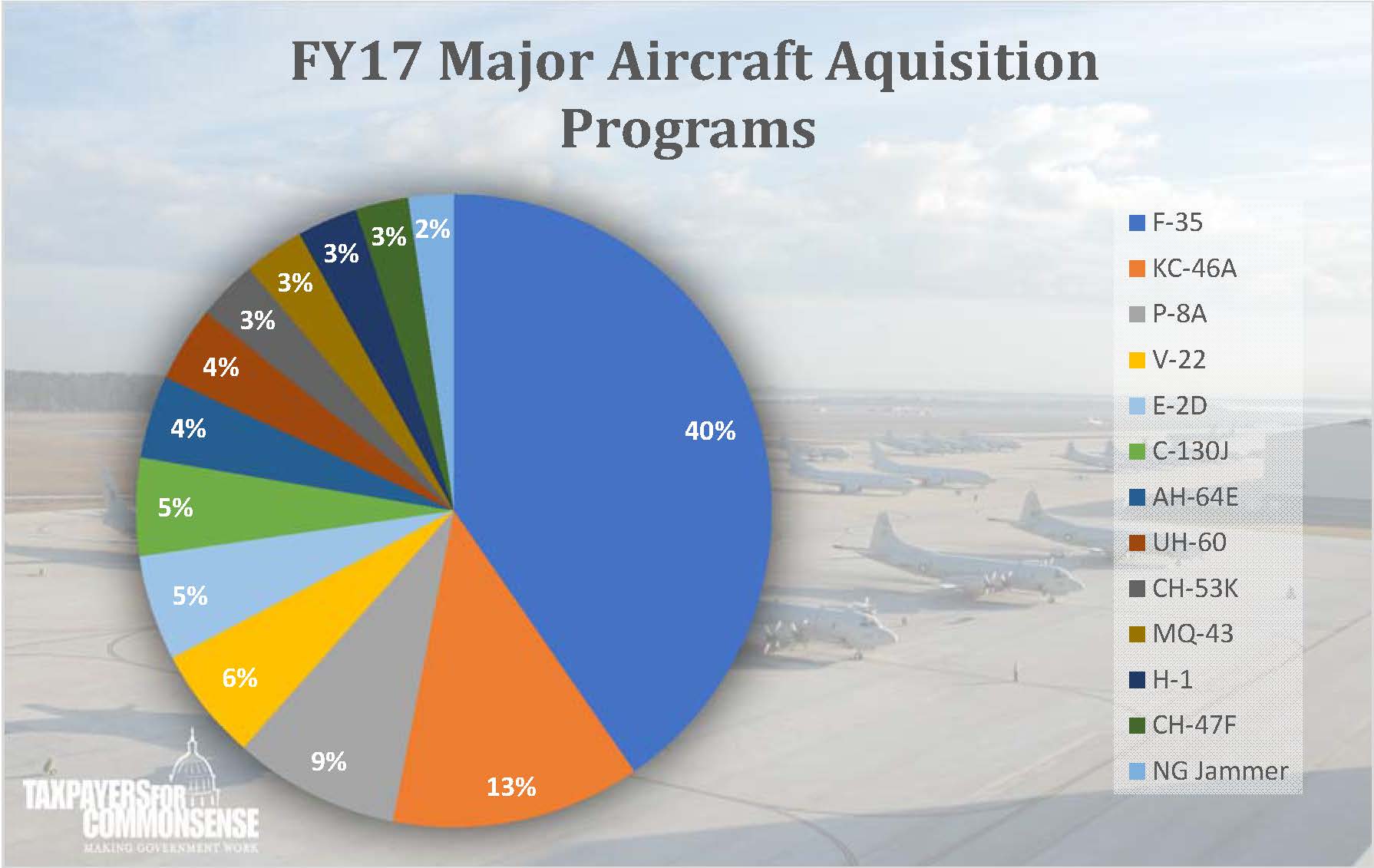

We took a look what the entire Pentagon plans to spend on its “Major Aircraft Acquistion Programs.” (This is table 5-2 in the Pentagon’s FY17 Budget Submission for those of you who like to check your source documents.)

This table gives the amount being spent – in both procurement and research & development – on major aircraft programs across all the military services. This year 13 different aircraft programs meet the Pentagon’s very specific definition of Major Acquisition Programs. And the statistics are much the same as they were last year – a huge chunk of the acquisition pie is going to the F-35. Last year it was 36% and this year it’s 40%

To make the numbers come to life, we’ve crafted this eye-catching chart.

Let that sink in for a minute: just the F-35 is 40% of all the investment the Pentagon is putting into major aircraft programs for the future. It continues to be the aircraft that ate the Pentagon.

2:00pm

Timber Proposal Misses the Forest for the Trees

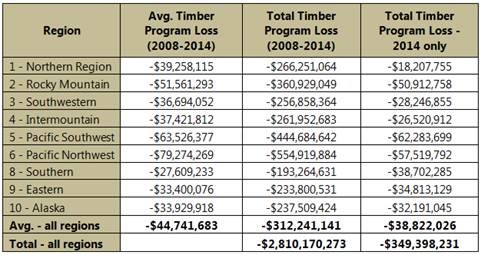

The U.S. Forest Service (USFS)’s FY17 budget proposal for timber-related spending amounts to $694 million, slightly less than the FY16 enacted level of $717 million. This total is made up of three  line items from the USFS’ National Forest system budget: Forest Products (the lion’s share of which is used to administer timber sales) which gets $360 million in the request, Land Management Assessment and Monitoring, which gets $184 million, and Roads (the majority of which are constructed for timber extraction by private companies) which receives $150 million.

line items from the USFS’ National Forest system budget: Forest Products (the lion’s share of which is used to administer timber sales) which gets $360 million in the request, Land Management Assessment and Monitoring, which gets $184 million, and Roads (the majority of which are constructed for timber extraction by private companies) which receives $150 million.

The USFS expects to sell 3.2 billion board feet of timber at these funding levels, which is a huge red flag for taxpayers. The USFS loses hundreds of millions of dollars each year selling timber from our national forests, $300 million in 2014 alone. The federal timber program cost in excess of $2.8 billion from 2008-2014. In Alaska’s Tongass National Forest, the USFS lost taxpayers $21.7 million per year from 2008-2013, a total loss of $130.5 million.

Instead of ensuring that taxpayers receive a fair return for our publicly-owned timber resources, the USFS is administering the timber program at a significant loss. Before losing millions more in taxpayer dollars, the USFS should ensure that timber sales not only break-even but provide taxpayers with the revenue we are due for the resources we own.

12:38pm

Digging into the Department of Energy

The Department of Energy (DOE) receives $32.5 billion ($30.2 billion in discretionary funding and $2.3 billion in new mandatory funding) in the FY17 request. That’s $2.9 billion more than the fiscal year 2016 enacted level and $2.6 billion more than the FY16 budget request.

The Department of Energy (DOE) receives $32.5 billion ($30.2 billion in discretionary funding and $2.3 billion in new mandatory funding) in the FY17 request. That’s $2.9 billion more than the fiscal year 2016 enacted level and $2.6 billion more than the FY16 budget request.

The largest portion of DOE’s budget is dedicated to the National Nuclear Security Administration (NNSA), which receives $13 billion, a $357 million increase from FY16 enacted levels and a $319 million increase over the FY16 request.

$5.9 billion of DOE’s budget would be dedicated to doubling clean energy research and development over the next five years. $600 million (a five percent decrease from FY16 enacted levels) is requested for Fossil Energy Research and Development, which is largely used for “clean coal” carbon capture and sequestration (CCS).

The Advanced Research Projects Agency- Energy (ARPA-E) program would receive $500 million (a 20% increase from last year’s levels), and DOE requests $4 billion in additional loan guarantee authority for the Loan Guarantee Program to be split $2 Billion for Renewable and Energy Efficiency and $2 Billion for Advanced Fossil Energy portions of the program. The Office of Energy Efficiency and Renewable Energy requests $279 million to develop bioenergy technologies, a $217 million increase from the FY 2016 enacted level – “to develop and demonstrate conversion technologies to produce cellulosic ethanol and other advanced biofuels, such as algae-derived biofuels and “drop-in” replacements for diesel and jet fuel, for civilian and military uses.”

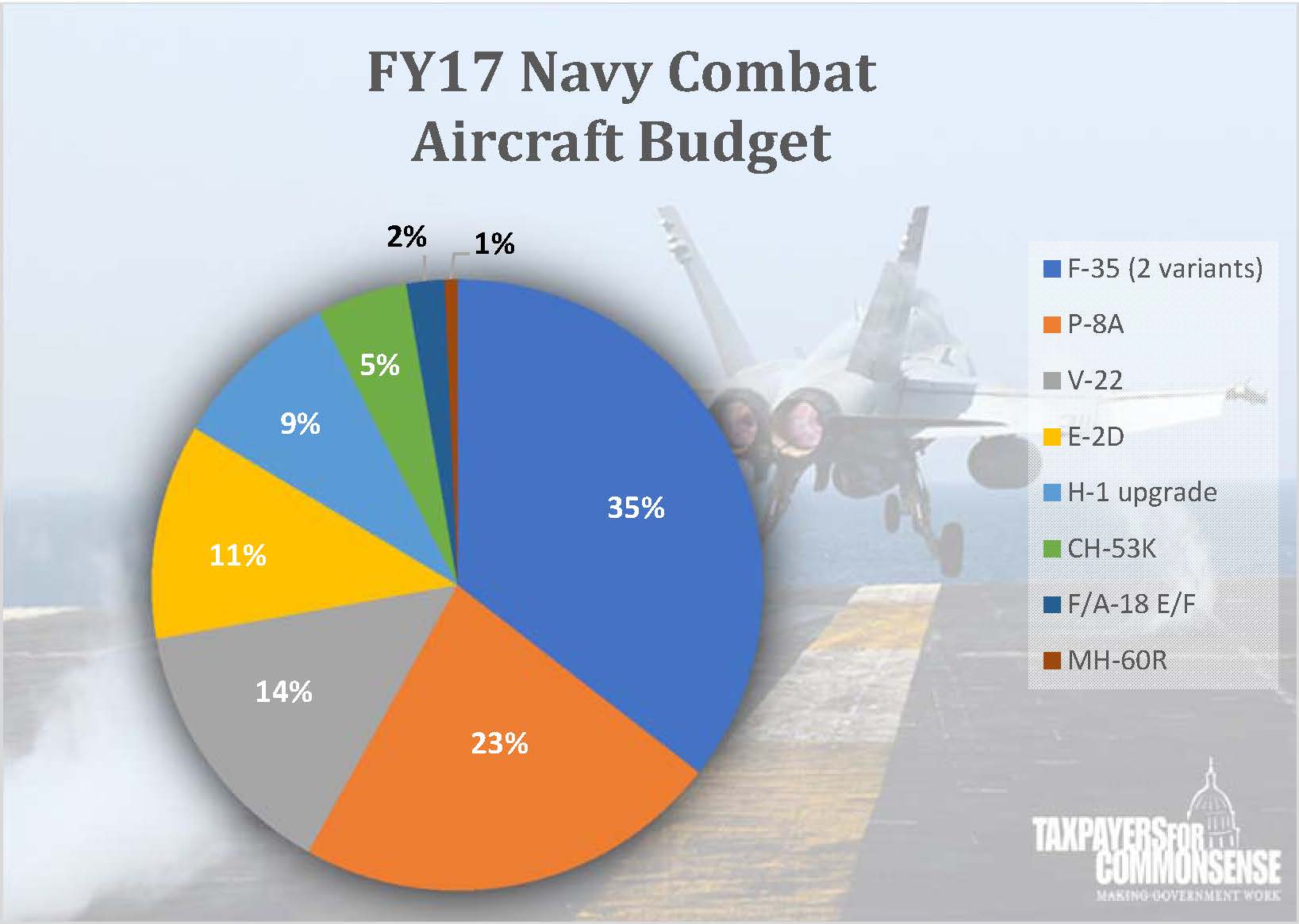

12:05pm

Navy Maintains Balance in Combat Aircraft Budget

Before you read this blog entry, be sure to scroll down and look again at the entry entitled “F-35 Funding: Still One Big Blueberry Pie.” The chart in that blog post shows how the Air Force, for the fifth fiscal year in a row, chooses to spend its entire Combat Aircraft budget line on a single airframe.

Compare that to the same line item in the Department of the Navy (DoN) budget request. (Note: the DoN purchases aircraft for both the U.S. Navy and the U.S. Marine Corps.)

And while the combined buy of the Navy and Marine Corps variants of the F-35 are taking a considerable and increasing portion of the pie, the Department of the Navy continues to balance the needs for other airframes in its budget request.

11:20am

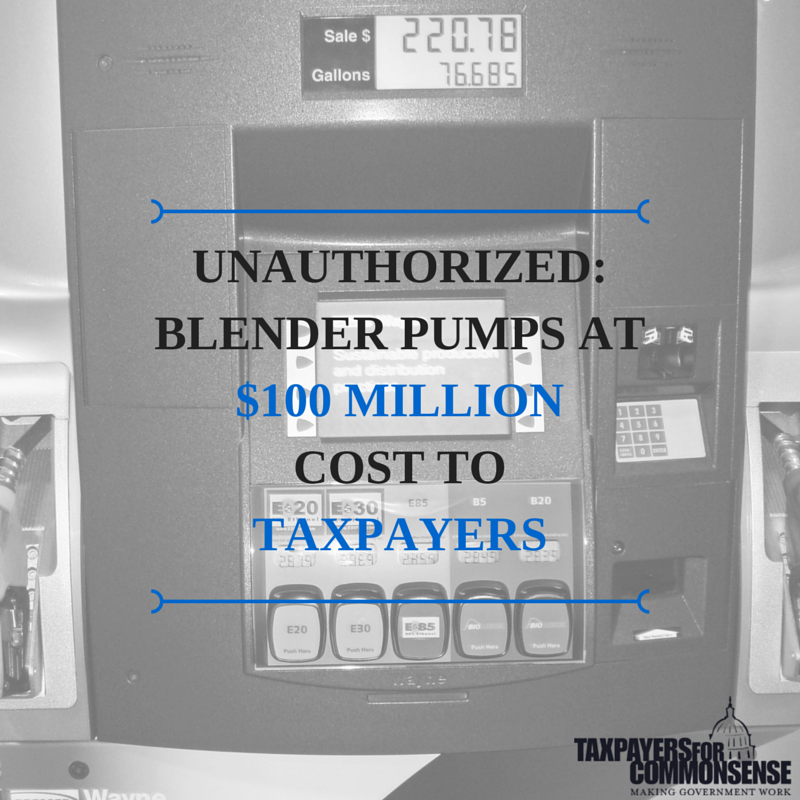

Learning Biofuels Lessons

You would think that after five years of Congress shutting down the U.S. Department of Agriculture’s (USDA) unilateral spending on various biofuels programs that the agency and Administration at large would get the hint. But yet again, President Obama has proposed even more subsidies for an industry that has enjoyed nearly four decades of federal support. In FY15 and FY16, President Obama proposed new spending on tax credits and loan guarantees, respectively, for biofuels infrastructure projects (such as those for ethanol blender pumps that dispense blends of ethanol higher than 10 percent) in addition to the plethora of federal subsidies already propping up the industry. In 2011, at the behest of the ethanol lobby, USDA began unilaterally changing rules for the Rural Energy for America Program (REAP), a program designed to support renewable energy systems such as those for wind and solar, to also subsidize ethanol blender pumps. After $3.3 million in taxpayer dollars were squandered, Congress finally squashed this practice in the 2014 farm bill. Strike 1, strike 2, strike 3, and you are supposed to be OUT. But last year, USDA found another end-around Congress by spending $100 million of taxpayers’ dollars on ethanol blender pumps through a new Biofuels Infrastructure Partnership (BIP), which earned Secretary Tom Vilsack a TCS Golden Fleece award in July 2015.

You would think that after five years of Congress shutting down the U.S. Department of Agriculture’s (USDA) unilateral spending on various biofuels programs that the agency and Administration at large would get the hint. But yet again, President Obama has proposed even more subsidies for an industry that has enjoyed nearly four decades of federal support. In FY15 and FY16, President Obama proposed new spending on tax credits and loan guarantees, respectively, for biofuels infrastructure projects (such as those for ethanol blender pumps that dispense blends of ethanol higher than 10 percent) in addition to the plethora of federal subsidies already propping up the industry. In 2011, at the behest of the ethanol lobby, USDA began unilaterally changing rules for the Rural Energy for America Program (REAP), a program designed to support renewable energy systems such as those for wind and solar, to also subsidize ethanol blender pumps. After $3.3 million in taxpayer dollars were squandered, Congress finally squashed this practice in the 2014 farm bill. Strike 1, strike 2, strike 3, and you are supposed to be OUT. But last year, USDA found another end-around Congress by spending $100 million of taxpayers’ dollars on ethanol blender pumps through a new Biofuels Infrastructure Partnership (BIP), which earned Secretary Tom Vilsack a TCS Golden Fleece award in July 2015.

Apparently the Administration still has not learned its lesson despite evidence from a range of independent analysts (such as the Congressional Budget Office and the Government Accountability Office) concluding biofuels have not lived up to their promises of lower greenhouse gas emissions and American energy independence. Regardless, USDA and other agencies continued to propose the following biofuels spending levels in FY17:

Apparently the Administration still has not learned its lesson despite evidence from a range of independent analysts (such as the Congressional Budget Office and the Government Accountability Office) concluding biofuels have not lived up to their promises of lower greenhouse gas emissions and American energy independence. Regardless, USDA and other agencies continued to propose the following biofuels spending levels in FY17:

- $43 million for biofuels’ use in the U.S. military,

- Continuation of the production tax credit for cellulosic ethanol (derived from agricultural wastes, woody biomass, etc.) despite its failure to come anywhere close to meeting its federal Renewable Fuel Standard mandate,

- $600 million for the Department of Energy (DOE) “to develop regional low-carbon fueling infrastructure including electric vehicles, biofuels, and other low-carbon options,” (in other words, yet another slush fund for ethanol blender pumps?),

- $15 million for USDA’s Bioenergy Program for Advanced Biofuels (same funding level in the 2014 farm bill), which despite its title has spent over half of its 2009-2014 funding on mature biofuels including corn ethanol and biodiesel,

- Various research programs at USDA and DOE, among many others.

February 9, 2016

5:30pm

When a Cut Isn’t a Cut: Army Corps of Engineers

The president and Congress once again demonstrate they operate from vastly different blueprints when designing the budget for the Army Corps of Engineers Civil Works division. The president’s budget requests $4.62 billion for this agency that’s charged primarily with constructing projects promoting commercial navigation, flood control and storm damage reduction, as well as environmental restoration on most of our nation’s major, and not-so-major, waterways. But this amount is nowhere near what will ultimately be appropriated.

.png)

The FY17 budget request, like others before it, calls for a significant decrease in funds for the Corps’ Civil Works program through an elimination of low priority construction projects or studies ($808 million dollars) and a reduction in operations & maintenance ($432 million). This is a significant increase in these same cuts from last year, $493 in low priority construction projects or studies and $199 million in Operations & Maintenance.

When it comes time to write the budget bills you can bet Congress will once again appropriate much more than the President requested while eliminating amounts for specific projects, trimming funds for all projects, or adding funds to others. They’ll also likely continue their practice of providing hundreds of millions in slush-y funds ““for work that either was not included in the administration’s request or was inadequately budgeted.” Congress spent more than $1 billion on these “slush-y funds” in FY2015 and $1.312 billion in FY2016

5:12pm

F-35: Navy and Marine Corps Orders Really Add Up

It’s definitely Fat Tuesday for the folks at Lockheed Martin, makers of the F-35. As followers of the Pentagon budget know, F-35 “Joint Strike Fighter” is “joint” because all three services who fly tactical jets plan to eventually have a version of the airframe. And the three versions are very different from one another – leading to some of the huge expense already incurred in development of the program.

So what do the Navy and Marines want to spend on their two versions of the plane this year?

The Navy, even after a dressing down by the Secretary of Defense in December, continued with its plan to buy just four of the F-35C, for slightly less than a billion dollars in procurement ($971.5 million, because we like to be exact here at TCS.) Their long term plan was adjusted to increase the rate of buying the airplanes, as the Secretary of Defense had chided them to do.

The Marine Corps is all in. They are requesting 16 of the F-35B, (short takeoff/vertical landing) version of the airframe. This will cost a whopping $2.27 billion in procurement dollars in FY17.

Add those up and $3.2 billion of the Navy’s total Combat Aircraft budget request of $9.1 billion is devoted to the Joint Strike Fighter.

So you know when the defense contractors gathered to slice up the King Cake for Mardi Gras, Lockheed Martin got the baby.

5:04pm

Budget Themes

The FY17 budget request continued two breaks with budgets past that started with the FY16 request. The first is obvious as soon as you look at the document. Up until FY16 the cover of the budget and accompanying documents was one solid color. The blue or green (or whatever) hue would give an indication as to what the fiscal year was. The FY16 budget cover was a bridge. And the FY17 cover has the recently Presidentially-renamed Denali gracing the cover (nee Mt. McKinley).

Another more substantive, beneath the surface change that started in the FY16 request and continues is that the main budget document has several thematic areas that are used to describe the contents of the budget (e.g. Innovation to Forge a Better Future; Opportunity for All; National Security and Global Leadership). This tells a story of the proposals and initiatives in the budget with anecdotal references to funding levels at different agencies would achieve those goals. Before FY16, budgets had a thematic message to introduce the budget but then had separate chapters with a few page summary of each department or independent agency and their funding level in the main budget document. There are other places to find the budget numbers, most notably in the Appendix, but they are broken down by funding area and more difficult to find in the aggregate.

4:11pm

Plus Up for DOE Loan Guarantees

Changing course from the last four budget requests, the President’s FY 2017 budget includes $4 billion of new energy loan guarantee authority under Title 17 of the Energy Policy Act of 2005. TCS has been a longtime critic of the DOE loan guarantee program made famous by the high-profile bankruptcy of the solar company Solyndra. This new amount will be added to the existing $30+ billion in untapped loan guarantee authority. Currently, the authority is divvied up into renewable and energy efficiency, advanced nuclear, and advanced fossil fuels. DOE solicits applicants in each of these areas.

TCS has raised specific concerns about a particularly large set of loan guarantees for Project Vogtle, an over-budget and behind-schedule, nuclear project that could cost taxpayers more than 10 times what we lost on Solyndra. TCS was further concerned that the Vogtle Project received a zero credit subsidy cost, meaning the project posed no risk to taxpayers. This calculation of zero risk calls into question the entire methodology of the credit subsidy cost calculation, because all projects (like nuclear reactors!) carry some risk.

3:51pm

What Sequestration?

As in previous budgets, the President’s FY17 budget request proudly states: “Starting in 2018, the President’s Budget once again proposes to end sequestration for both defense and non-defense spending, and replace the savings by closing tax loopholes for the wealthy and cutting inefficient spending.”

First off as we have frequently explained, sequestration only occurs if Congress chooses to spend more than the caps established by the Budget Control Act (or for FY17 the Bipartisan Budget Agreement) after the Super Committee’s failure. There are no meat axes, no mindless across-the-board cuts in discretionary spending. As the Congressional Research Service indicated at the end of last year, since FY13 spending reduction has been achieved “…through reductions in the overall discretionary caps, rather than a sequester, for discretionary spending.”

So there is no dreaded sequester, but there are budget caps. And the President (and many lawmakers on both sides of the aisle) would like to bust those caps to spend more on defense or non-defense programs or both. But you have to remember that this President and Congress promised taxpayers an additional $1.2 trillion in deficit reduction in the BCA. If policymakers want to find a different way to achieve that goal, fine, but the President needs to put his shoulder to the wheel if he thinks failed past initiatives to eliminate certain tax expenditures and spending programs are going to suddenly be realized as offsets.

P.S. The word “sequestration” is used 25 times in the roughly 100 pages of text of the main budget document.

3:44pm

Fun With Numbers (OCO Style)

As we noted in an earlier posting, one of the ways this or any administration can make its budget look better is by making the most positive “projections” possible.

So, wading through the tables we found “Effect of Budget Proposals on Projected Deficits.” And even deeper within that table we found the exceedingly rosy projections on what planned out year reductions to the Overseas Contingency Operations or OCO requests will do to reduce the deficit. Now, let’s leave aside the fact that every time this President tries to reduce OCO spending, the Congress lards it back up. Since it’s “off budget” it doesn’t count against the budget caps put in place by the Bipartisan Budget Agreement late last Fall or the Budget Control Act of 2011. It’s “free money” as far as Congress is concerned (kind of like the Mardi gras coins we’re using to illustrate this example) although we don’t believe the taxpayers see it exactly that way.

Alright, now that we have that out of our system, what does the President’s budget say the federal government will save by planned reductions in OCO? Wwweeelll, nothing this year. (Naturally!) But starting just as soon as the President is out of office, we should start saving about $37 billion in FY18. That quickly ramps up: $55 billion in savings, $63 billion, $67 billion, in each successive year until it clocks in at $88 billion in FY26. Through the ten year budget window the President’s budget states that deficits will be cut by $636 billion. Now that would be a mighty big pile of King Coins.

If only.

3:05pm

Stuck Between a Rock and Hard(rock) Place

The Department of Interior’s FY2017 budget request includes a proposed fee on hardrock mining that would be used to clean up hazardous mining sites in the same way that the Abandoned Mine Lands fee is used to clean up abandoned coal mines. Additionally, as it does every year, Interior’s budget request would charge a five percent royalty on certain hardrock minerals: silver, gold and copper.

TCS has long criticized the 1872 General Mining Law that failed to designate a royalty requirement for hardrock mining on federal lands – allowing public assets to be mined for free without providing a return for taxpayers for more than 140 years. It is estimated that taxpayers lose $160 million per year in unpaid royalties on these minerals.

2:40pm

Riding on the Clean Coal Train

Similar to years past, the FY17 budget provides more than $560 million for fossil fuel research. Most of this funding is requested for the development and deployment of carbon capture and storage technologies (CCS). CCS technologies are used to separate carbon dioxide (CO2) from fossil fuels then pump it deep inside the earth storing it indefinitely. The technology is technically challenging and carries exorbitant costs. “Clean” coal is a modern equivalent of Alchemy and various forms of CCS have been the recipient of millions of dollars in taxpayer subsidies since the 1980s, gaining little or no results in return. Handing out more subsidies, especially in these tight budget times, for CCS is simply fiscally irresponsible.

2:10pm

Inside the Department of the Interior Budget

The Department of the Interior requests a total of $12.9 billion for FY2017, $300 million less than the 2016 enacted level, and the same as its FY 2016 budget request. Interior requests $1.3 billion for the Bureau of Land Management (BLM), a 17% increase from the 2016 enacted level, which would be partially offset by new inspection fees for oil and gas totaling $48 million in 2017. $175 million of Interior’s budget would go to the Bureau of Ocean and Energy Management, and $205 million would go to the Bureau of Safety and Environmental Enforcement – both of which oversee offshore oil and gas production.

$186.6 million of BLM’s budget goes to oil and gas management activities, an increase of $27.6 million from 2016 enacted levels. $11 million from BLM also goes to coal management on federal lands. $97 million of Interior’s budget would go to renewable energy projects on public lands and waters.

As in previous years, Interior’s budget request calls for a five percent royalty on certain hardrock minerals (silver, gold, and copper). They also request the termination of payments from the Abandoned Mine Land Trust Fund to coal-producing states that have already completed mine cleanup.

1:50pm

Overseas Contingency Operations STILL 5th Largest Agency

At TCS we’re well known for shining a skeptical light on budget gimmicks like the off-budget OCO account. Let’s call it what it is – a slush fund for the Pentagon. For the past couple of years we’ve been pointing out that if the defense portion of OCO was an actual federal agency, it would be one of the largest in terms of discretionary spending. And the numbers are in for the Fiscal Year 2017 request.

.jpg?v=1455119605632)

If OCO was its own agency, it would be the 5th largest in the federal government with the request for this year at $58.8 billion. This beats the Department of Homeland Security in 6th place by a wide margin – the DHS request this year is a “mere” $40.6 billion.

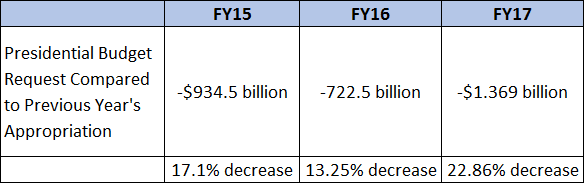

1:25pm

Fun with Numbers (Budget Style)

One way Presidents make their budgets look rosier and proposals affordable is play with future projections. It’s hard to call them on this and the only impartial counter-balance is the Congressional Budget Office numbers. Thankfully the CBO updated their budget outlook just last month. One surprise is that even though spending and tax legislation for fiscal year 2016 was wrapped up before the new year, CBO and OMB have different views of how the year is going to turn out.

The President’s budget request puts the FY16 deficit at $616 billion and predicts GDP will come in at $18.472 trillion. CBO puts the FY16 deficit at $544 billion and projects GDP at $18.494 trillion. But that’s practically history. Starting in FY17 (this budget request) they flip with the administration projecting a lower $503 billion deficit to CBO’s $561 billion, and GDP projection of $19.303 trillion (OMB) versus CBO’s $19.297. Sure that’s only $6 billion difference in GDP, but by 2026, the gap is much bigger. OMB puts the FY26 deficit at $793 billion; CBO $1.366 trillion (a $574 billion difference). OMB’s GDP projection for that year is $28.301 trillion; CBO $27.660 trillion (a $335 billion difference). Not surprisingly, CBO thinks the debt held by the public in 2026 will be more than $2.5 trillion greater than the White House estimate ($23.817 trillion against $21.302 trillion).

That’s a big difference that only time will tell.

1:13pm

Increased Emphasis on Cyber Security

Across the federal government, the President’s budget request seeks to invest $19 billion on cybersecurity programs, an increase of about 35% from the fiscal year 2016 totals. According to the Budget Overview produced by the Office of Management and Budget, this $19 billion is, “to support a broad based cybersecurity strategy for securing the Government, enhancing the security of critical infrastructure and important technologies, investing in next generation tools and workforce, and empowering Americans. In particular, this funding will support the Cybersecurity National Action Plan, which takes near term actions and puts in place a long term strategy to enhance cybersecurity awareness and protections, protect privacy, maintain public safety as well as economic and national security, and empower Americans to take better control of their digital security.”

This “National Action Plan” includes $174 million for outreach to the private sector, and research and development to address cybersecurity challenges is funded to the tune of $318 million. From the publicly available documents, it’s unclear how many agencies will share that pot of money.

Included in this government-wide request for cybersecurity funding is the creation of a new $3.1 billion “revolving” fund called the Information Technology Modernization Fund (ITMF.) The purpose of this new fund is, “to retire the Government’s antiquated IT systems and transition to more secure and efficient modern IT systems, funding to streamline governance and secure Federal networks, and investments to strengthen the cybersecurity workforce and cybersecurity education across society.” To make the fund “revolve” agencies would be required “to repay the initial technology investment through efficiencies gained from modernization.” OMB predicts that this mechanism will enable “$12 billion worth of modernization projects over 10 years.” We’ll see, our experience is that revolving funds don’t revolve too well and modernization doesn’t always yield the projected savings.

Also included is $7 billion at the Department of Defense to, “invest in the capabilities needed to disrupt our adversaries’ mailicious activities, deter them from taking action in the future, and hold them accountable for their actions.”

The Department of Homeland security is budgeted to receive $746 million to head up the work on the “Continuous Diagnostics and Mitigation Program” that will assist all federal agencies to manage cybersecurity risks. The DHS “National Cybersecurity and Communications Integration Center receives an additional $213 million to “identify, assess, and respond to cyber threats.”

The Justice Department is budgeted to receive $682 million to investigate cyber intrusions and to prosecute those behind the intrusions.

The General Services Administration is funded to coordinate and centralize information technology purchasing for the smaller federal agencies.

“Strengthening the Cybersecurity Workforce” is given $62 million for scholarships and other programs to serve the country as civil servants, set a core curriculum for cyber graduates who wish to join federal service and provide grants to academic institutions.

Research and development to address cybersecurity challenges is funded to the tune of $318 million but it’s unclear how many agencies will share that pot of money.

That leaves about $6 billion that we still need to find in the massive budget documents. So we’ll keep digging and unearthing details.

1:05pm

Fossil Fuel Tax Fix

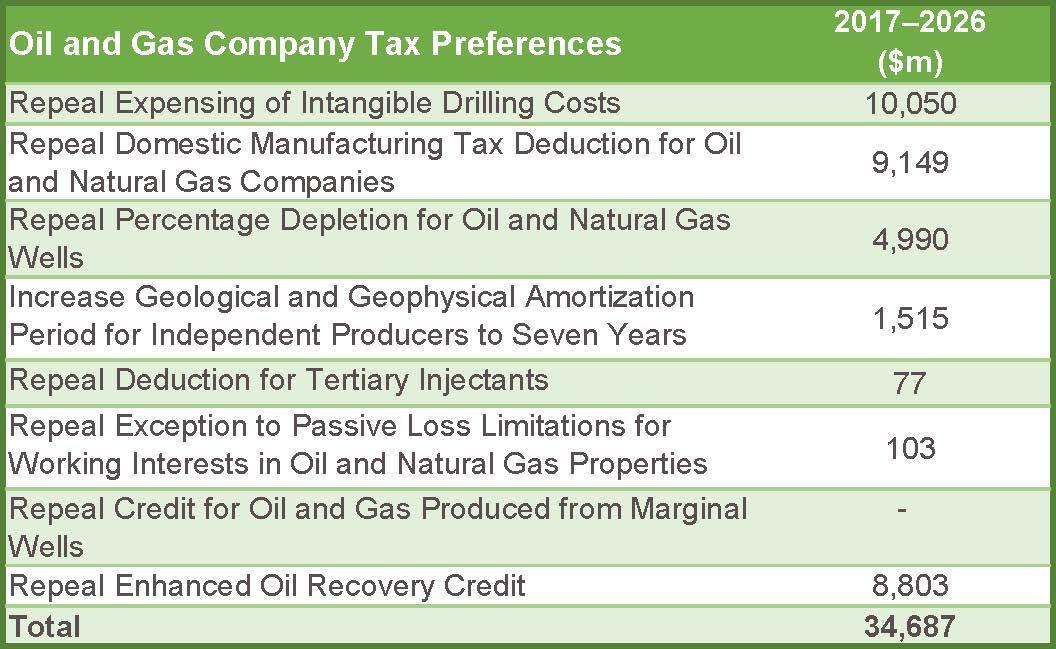

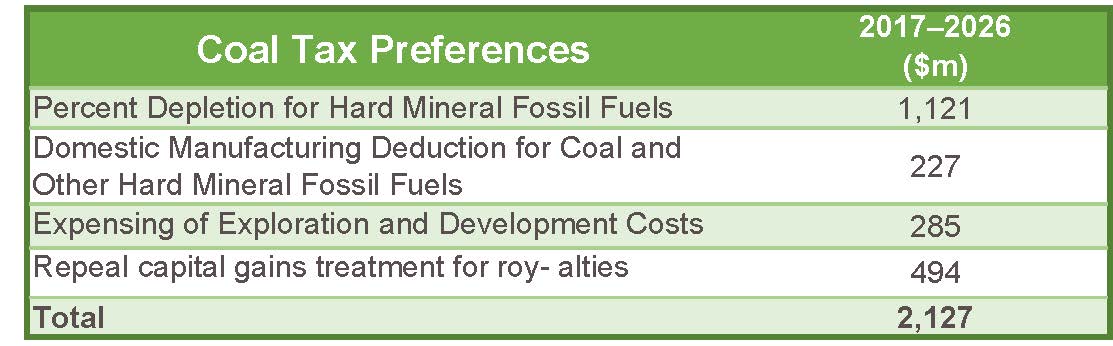

Since FY2010, the President has called for the repeal of several fossil fuel tax expenditures in his budget request every year. Like previous years, the FY2017 request proposes the elimination of eight oil and gas tax preferences and four tax preferences for coal companies. The proposed eliminated tax preferences below would total approximately $37 billion in revenue over the next ten years (2017-2026).

12:45pm

F-35 Funding: Still One Big, Blueberry Pie

Once again, the Air Force is putting all its combat aircraft eggs into a single basket. We’re going to mix our foodie metaphors here by reprising the TCS “blueberry chart” from last year.

.jpg)

The Air Force is requesting $4.8 billion in procurement dollars for the F-35 in its “Combat Aircraft” request. This marks the fifth fiscal year in a row the Air Force has not asked for a single dime for any other Combat Aircraft program. In fact, the last time another aircraft received any funding in this budget line was FY12 when the F-22 Raptor received $104 million in contrast to the $3.8 billion that was requested for the F-35.

This $4.8 billion breaks down to $4.4 billion to purchase 43 aircraft as well as another $400 million for advance procurement. More proof, if any more was really needed, that the Air Force is mortgaging its combat aircraft future on the F-35.

12:29pm

Common Sense Cuts to Crop Insurance

While we’re still waiting for the release of detailed agency-by-agency documents, the United States Department of Agriculture (USDA) has posted a summary of its budget request. Encouragingly the request identifies 10-year savings of more than $18 billion from common sense reforms to the most expensive federal program targeted toward farmers, the highly subsidized federal crop insurance program.

The president would rein in the more than $8 billion-a-year program by reviving two proposals included in the FY16 budget request. The first would reduce subsidies for insurance policies that include the Harvest Price Option (HPO). Under crop insurance farmers receive subsidies to buy policies that guarantee up to 85% of their expected revenue. HPO is a provision that automatically adjusts payouts under these policies when prices at harvest are higher than what farmers expected in the Spring when they bought the policies. HPO policies are one of the reasons taxpayer costs for the crop insurance program have ballooned recently, to as much as $14 billion in 2012. Eliminating HPO would simply ensure that farmers got paid at the level they were insuring for when they bought the policy. The second would reform prevented planting coverage, which is a policy provision that allows a payment to go to farmers who are unable to plant due to weather. Prevented plantings have been identified as a source of potential abuse, namely when farmers are “prevented” from planting in areas that no reasonable farmer would have planted in the first place because there would be no yield.

Congress should support these provisions and go one step further by eliminating subsidies for HPO polices by adopting H.R. 892 The Harvest Price Subsidy Reduction Act introduced by Rep. Duncan (R-TN), and its companion S.463 sponsored by Senator Flake (R-AZ), or adopting a complete overhaul of the highly subsidized federal crop insurance program by adopting the AFFIRM Act H.R. 3973 and S. 2224, sponsored by Rep. Kind (D-WI) and Senator Flake.

12:07pm

(Don’t) Forget the MOX

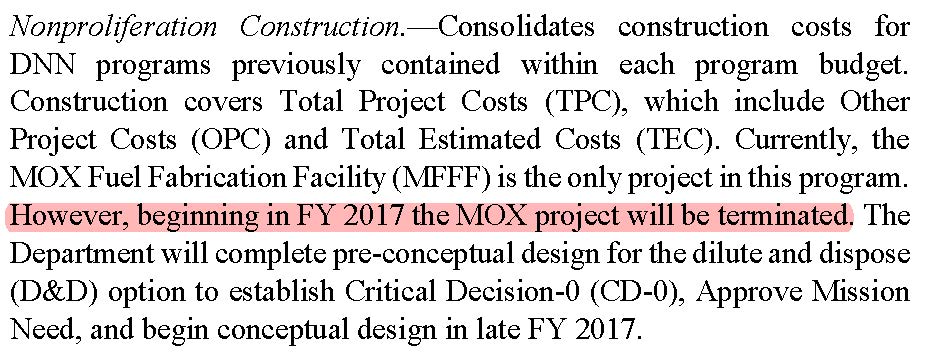

At long last, the FY17 budget is putting a fork in the beleaguered Mixed Oxide Fuel Fabrication Facility. Funded under the Department of Energy’s Nonproliferation Construction Account, the President’s budget request states “starting FY 2017 the MOX project will be terminated.”

The MOX reprocessing facility planned to convert plutonium into fuel for use in commercial nuclear reactors. But billions of dollars over budget and a fraught with technical problems, the project was going nowhere fast. TCS has raised concerns over the MOX project for years and we are pleased the budget proposes the project’s termination.Here’s the actual language from the DOE Budget Appendix:

11:45am

TCS Statement on the Budget

TCS Statement on the Budget

Below is a statement from Ryan Alexander, President of Taxpayers for Common Sense, on President Obama’s FY 2017 budget request.

| The President sent Congress his final budget request today, $4.14 trillion for fiscal year 2017 containing a wish list of policies, many of which are guaranteed to never become law.

Presidential budget requests are political documents that lay out an administration’s priorities. Initial review reveals this budget to be especially aggressive, particularly for a lame duck President facing a legislature controlled by the opposition in his last year. Congress does not typically treat budget requests as blueprints for legislation, and both the President and Congress know that. But this year, Congressional Republicans rejected the President’s last budget sight unseen a few days ago and – dispensing with tradition – announced they won’t even invite the Administration’s budget chief to testify about the budget request. So while taxpayers know President Obama’s budgetary aspirations and will know Congressional Republicans priorities when they craft their upcoming budget resolution, it is difficult to discern where there might be areas of agreement. As always it seems the budget numbers work perhaps only when seen in the rosiest, most optimistic light, because the spending priorities depend on robust revenue projections from new tax provisions and robust economic growth, which is far from a certainty. This allows the President to avoid prioritizing among spending programs. Like every year, there is also a laundry list of projects and programs that the President wants to cancel, but we expect most of those programs to survive in the final appropriations bills. The 2,383 page budget package has just been released, and we at Taxpayers for Common Sense will dig through it looking for interesting policy items and proposals. And while the budget cannot be read as a blueprint for policy, it does provide a benchmark, both to evaluate past budget priorities but also to follow as the year progresses. The real work will be in the coming months after the administration and Congress finish work on politically unrealistic budgets. It is always hard to get past the posturing of an election year, particularly a Presidential one. But after the budgetary turmoil of various patches and revisions to the Budget Control Act of 2011, it is past time for policymakers to enact good spending and tax policy to the benefit of all Americans. We need sober policy that takes into account the needs and challenges of the country in the context that in the coming years deficits are predicted to rise and spending to service the debt soar. |

11:05am

President Obama’s Last Budget Is Live!

Marking his final budget request – a statement of vision for the federal government – the President has released his FY2017 budget. There are thousands and thousands of pages scattered across the federal agencies that make up the full request. The big top-line numbers and the formal budget package, however, can be found at the White House’s Office of Management and Budget. Below are links to some of the materials for your convenience:

Cuts, Consolidations, and Savings

Photo credit: stockmonkeys.com

Related Posts

Most Read

Recent Content

Statement

Jul 3, 2025 | 1 min readIn The News

Jul 2, 2025 | 2 min read

Stay up to date on our work.

Sign up for our newsletter.

"*" indicates required fields