The House has passed its budget reconciliation package and, well, it’s a lot. The “One Big Beautiful Bill Act” includes a grab bag of political favors, industry giveaways, and some truly baffling budget priorities—peppered with a few austerity hits for good measure. And it would add more than $3 trillion to the national debt.

Beyond that $3 trillion headline, the devils are in the details. Some provisions from the original draft bill were cut, while some opportunities to save taxpayer dollars were left out from the start. Other questionable provisions were included from the start or airdropped in at the eleventh hour. Let’s dig into some of the Ins and Outs of this legislative monster.

Priorities, Reimagined (Badly)

In: Eliminating the $200 excise tax on firearm silencers—it’s in the “support working families” section. Presumably because there is no “support the businesses owned by members of Congress” section in the bill.

In: A $150 million appropriation for the Department of the Interior to plan “events, celebrations, and activities” for America’s 250th Anniversary, plus $40 million for a “National Garden of American Heroes.” As the federal debt crowds out private investment, at least we can take comfort in granite busts and pyrotechnics.

Out: No inclusion of a plan to eliminate the carried interest loophole, one of the most notorious tax breaks for private equity fund managers that lets them treat income as capital gains which is taxed at a much lower rate.

Out: Employee Retention Credit pending claims made after January 2024. ERC was a COVID-era program meant to help businesses keep workers on payroll. Encouraged by some noteworthy promoters (ahem) and vague eligibility rules, the ERC became more than just a ripe target for fraud—it turned into a full-blown harvest. The IRS also has six years to audit ERC claims and enhances penalties on abusive ERC promoters.

The Great Food Fight

In: An overhaul to SNAP (Sustainable Nutrition Assistance Program aka Food Stamps) that effectively caps benefits by requiring any updates to the USDA’s “Thrifty Food Plan” to be cost-neutral. Translation: no increases unless inflation justifies them, regardless of whether the price of, say, eggs skyrockets faster than the Consumer Price Index (CPI). According to CBO, this will reduce projected outlays by $37 billion over the decade. For context, the maximum monthly allotment for a single adult in 2025 will be $292, or $3,504 per year.

In: Expanded work requirements. Able-bodied adults between 55 and 64, and even some parents of school-age children, will now have to work at least 80 hours per month or enroll in job training to receive SNAP benefits.

Out: Work requirements for receiving farm business subsidies. Still missing in action. And now it’s worse—because…

In: A massive expansion of the farm subsidy trough. Individual payment limits rise by $30,000 to $155,000 annually—plus another $155,000 specifically for peanuts. These caps will now also grow with inflation. Coupled with expanded price guarantees and other supports, this adds up to a $52 billion increase in taxpayer-funded farm subsidies. All without closing the “management-only” loophole that lets non-farming passive investors cash in. If you’re nowhere near a tractor but good at Zoom calls, congratulations—you may already qualify!

Bombs, Nukes, and Budgeting Backlogs

In: $1.5 billion for “risk reduction activities” for the Sentinel intercontinental ballistic missile (ICBM) program. That’s code for “we’re digging a lot of expensive holes in the ground for missiles.”

In: Another $500 million to patch up the aging Minuteman III ICBM—despite the Air Force’s previous argument that extending its lifecycle wasn’t viable.

In: $2 billion for the nuclear-armed sea-launched cruise missile (SLCM-N)—a low-yield nuke designed to be “more usable.” Because making nuclear weapons more usable is obviously a great idea.

Out: Trimming the Pentagon’s 20% excess base capacity and $137 billion deferred maintenance backlog. Congress hasn’t approved base closures in twenty years and might need a refresher on how it works.

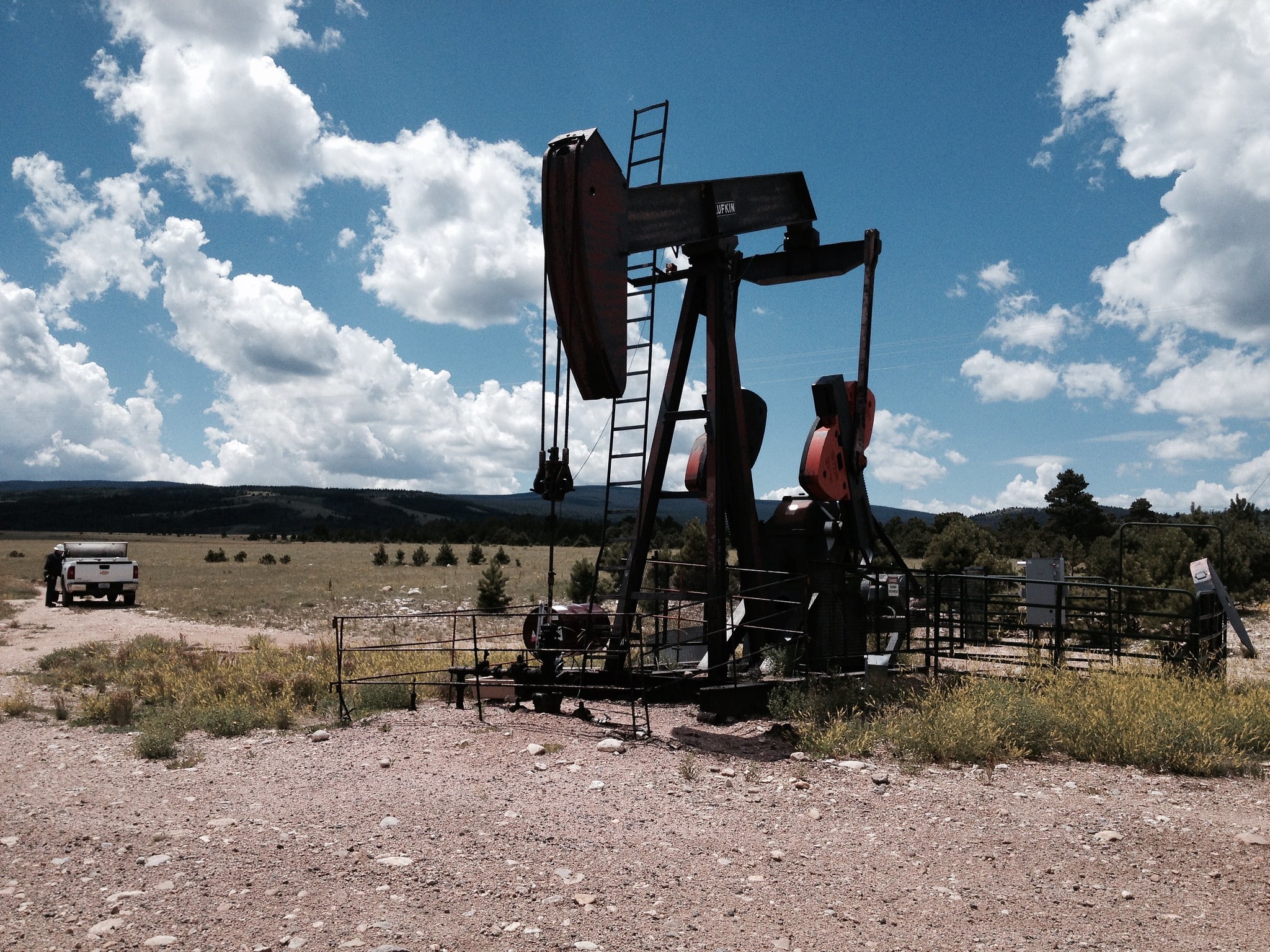

Seeking Natural Resource Revenue Raisers

In: Four mandated oil and gas lease sales in Alaska’s Arctic National Wildfire Refuge, even though the only other sales held in the region generated little industry interest and little revenue for taxpayers. TCS estimates that future leases sale would at best raise between $3 and $30 million for federal taxpayers—a very, very small slice of the trillion-dollar bill cost.

In: Reduction of the royalty rate for onshore oil and gas development on federal land from 16.7% back down to the old rate of 12.5%. Yet, somehow, this change—which by definition would decrease the percentage of revenue shared with federal taxpayers and local communities from the sale of federally-owned oil and gas resources—is sold as part of a suite of reforms to increase revenue on federal lands—we aren’t buying it.

Out: A common sense fee on excessive methane emissions from the oil and gas industry that was estimated to raise $7.2 billion over the next decade and help bring more domestic natural gas to market.

Bureaucracy and Backtracks

In: A statutory moratorium on state regulation of artificial intelligence (AI). Because clearly, the best way to handle transformative and potentially dangerous technology is to tie the hands of anyone who wants to study or govern it.

In: An insidious new provision lets the IRS strip nonprofits of tax-exempt status over alleged ties to terrorism—based on secret evidence and a “guilty until proven innocent” standard.

Out (then in): An earlier draft would have rescinded $8 million from the Department of Energy Office of Inspector General. Fortunately, someone realized defunding watchdogs isn’t a great look. The provision was removed—but not before sending a clear message about where oversight ranks in the priority list.

Oh, and by the Way…

In: A $4 trillion increase to the statutory debt ceiling.

Out (of the Treasury): An estimated $3.8 trillion in revenue over the next ten years—lost due to tax cuts and credits included throughout the bill.

Final Thoughts

This reconciliation bill reads less like a budget plan and more like a legislative variety show. It hikes the debt ceiling by $4 trillion while tossing aside $3.8 trillion in revenue. It expands subsidies even for farmers who don’t farm, cuts food assistance for people who actually eat, and offers tax breaks for silencers—in the name of “working families.” It also trumpets a $150 billion Pentagon spending spree, with a $25 billion cherry on top for the president’s unworkable Golden Dome plan.

Rather than reforming what’s broken—like the widely abused Employee Retention Credit or loophole-riddled farm subsidies—Congress opts for fireworks and statue gardens. There’s no plan to fix long-term liabilities or rein in waste. Or to responsibly reform the tax code. Just a lot of political sugar poured over a lopsided, hollowed-out budget.

It’s not a path to fiscal responsibility. It’s a pageant of misplaced priorities— sold as reform and paid for by taxpayers.

Editorial note: An earlier version stated the ERC had not been modified. This has been updated.

- Unsplash - Alexander Schimmeck