On May 22, the U.S. House of Representatives passed the FY2025 budget reconciliation bill, known as the One Big Beautiful Bill Act. Title XI—crafted by the House Ways and Means Committee—is the bill’s costliest section and would add nearly $4 trillion to the national debt over the next decade. The majority of the bill’s cost comes from the extension of tax credits included in the Tax Cuts and Jobs Act of 2017. To partially offset these costs, the House-passed bill eliminates or phases out many of energy tax credits that were created or expanded by the Inflation Reduction Act of 2022 (IRA).

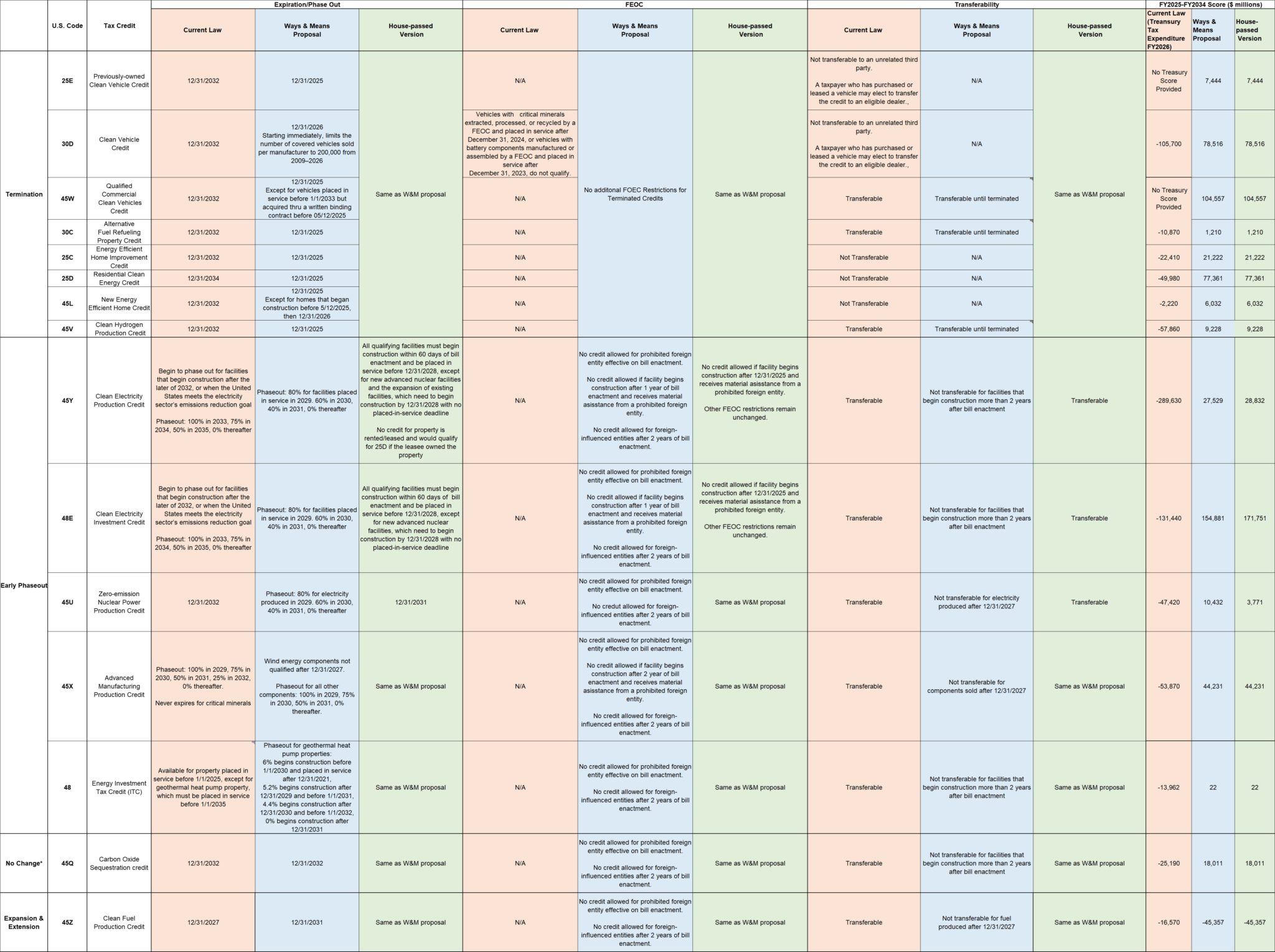

Summary of Changes to the IRA Tax Credits in the House-Passed Reconciliation Bill

Expansion and Extension of the 45Z Clean Fuel Production Credit

The Section 45Z Clean Fuel Production Credit is a per-gallon biofuel tax credit designed to subsidize production of transportation fuels with low or no greenhouse gas (GHG) emissions. This credit came into effect at the beginning of 2025 and is intended to replace a suite of recently expired biofuel tax credits (Section 40, 40A, 40B, 6426, and 6427). The House-passed bill would extend the expiration date of Section 45Z from the end of 2027 to the end of 2031, as well as lessen lifecycle GHG assessment standards. The latter change would significantly broaden eligibility for the credit and effectively allow first-generation, food-based biofuels like corn ethanol and biodiesel to qualify. The bill would also limit eligibility to biofuel feedstocks grown in the United States, Mexico, or Canada. According to the Joint Committee on Taxation (JCT), the extension and expansion of 45Z would cost taxpayers $45 billion from FY2025 to FY2034.

No Changes to the 45Q Carbon Oxide Sequestration Tax Credit

Structured like a carbon production tax credit, Section 45Q provides a credit for every ton of carbon dioxide (CO₂) captured from power plants or other industrial sources and permanently stored underground in geological formations. The IRA expanded and extended the credit by lowering the minimum capture threshold, increasing the credit amount, and extending eligibility to facilities that begin construction before the end of 2032. The Treasury Department estimates that 45Q will cost taxpayers $36.2 billion over FY2024-FY2033. The House-passed bill makes no changes to the increased credit amount or extended eligibility period established by the IRA. The only modifications included in the bill are new restrictions related to “foreign entities of concern” (FEOC) and limits on credit transferability.

Termination of Certain Energy Tax Credits

The following tax credits would be terminated for property placed in service or acquired after December 31, 2025, unless otherwise noted:

- Section 30D Clean Vehicle Credit

- This credit would expire for most vehicles after 2025, but a per-manufacturer cap of 200,000 vehicles sold between 2009 and 2026 applies. Manufacturers that do not hit the cap may continue to claim the credit until the end of 2026.

- Section 25E Previously-Owned Clean Vehicle Credit

- Section 45W Qualified Commercial Clean Vehicles Credit

- This credit would terminate after 2025, except for vehicles acquired under a binding contract signed before May 12, 2025.

- Section 30C Alternative Fuel Refueling Property Credit

- Section 25C Energy Efficient Home Improvement Credit

- Section 25D Residential Clean Energy Credit

- Section 45L New Energy Efficient Home Credit

- This credit would end after 2025, with a limited exception for homes that began construction before May 12, 2025.

- Section 45V Clean Hydrogen Production Credit

Early Sunset/Accelerated Phaseout of Existing Credits

- Section 45Y Clean Electricity Production Credit

- Projects must begin construction within 60 days of the bill’s enactment and be placed in service by December 31, 2028. New advanced nuclear facilities and the expansion of existing facilities are exempt from the 60-day rule but must begin construction by December 31, 2028.

- Section 48E Clean Electricity Investment Credit

- Construction must begin within 60 days of enactment and projects must be placed in service by December 31, 2028. Similar to 45Y, new advanced nuclear facilities and expansions are exempt from the 60-day rule but must begin construction by December 31, 2028.

- Section 45U Zero-emission Nuclear Power Production Credit

- The expiration date of this credit is moved up from the end of 2032 to the end of 2031.

- Section 45X Advanced Manufacturing Production Credit

- The credit for most components is phased out in 2030 and expires at the end of 2031 instead of 2032. However, the credit for wind components expires after 2027 instead of 2030 and the credit for critical minerals retains its original phaseout timeline.

- Section 48 Energy Investment Tax Credit (ITC)

- The phaseout for geothermal heat pump property is accelerated, expiring in 2031 instead of 2035.

Foreign Entity of Concern & Transferability Restrictions

Under current law, FEOC restrictions apply only to the Section 30D Clean Vehicle Credit and the Section 48D Advanced Manufacturing Investment Credit. The House bill would expand FEOC restrictions to a broader set of energy tax credits.

Taxpayers who are deemed a specified foreign entity would become ineligible to claim the affected tax credits as soon as the bill is signed into law. Those in a lesser category—such as foreign-influenced entities or recipients of material assistance from a prohibited foreign entity—would remain eligible for up to two additional years, depending on the specific FEOC classification and credit. After that period, eligibility would end unless the taxpayer has restructured their operations to eliminate foreign influence from their supply chain.

The House bill would apply FEOC restrictions to the following credits:

- Section 45Y Clean Electricity Production Credit (more stringent material sourcing requirement starting at the end of 2025)

- Section 48E Clean Electricity Investment Credit (more stringent material sourcing requirement starting at the end of 2025)

- Section 45U Zero-emission Nuclear Power Production Credit

- Section 45X Advanced Manufacturing Production Credit

- Section 48 Energy Investment Tax Credit (ITC)

- Section 45Q Carbon Oxide Sequestration Credit

- Section 45Z Clean Fuel Production Credit

The IRA authorized “transferability” for various energy tax credits, which allows entities to transfer all or a portion of an eligible credit to an unrelated taxpayer. The House bill would apply the two-year transferability restrictions to the following credits:

- Section 45X Advanced Manufacturing Production Credit

- Section 48 Energy Investment Tax Credit (ITC)

- Section 45Q Carbon Oxide Sequestration Credit

- Section 45Z Clean Fuel Production Credit

Special Tax Treatment of Carbon Capture and Hydrogen-Related Income

The House proposal includes a provision that would allow income from the transportation and storage of hydrogen and certain carbon capture and storage (CCS) activities to qualify as “qualifying income” for certain publicly traded partnerships (PTP).

Under current law, PTPs whose interests are traded on public exchanges are generally taxed as corporations. However, if at least 90 percent of a PTP’s gross income comes from qualifying sources—such as rents, gains from the sale of real properties, or income from the exploration, production, processing, refining, transportation, or marketing of minerals or natural resources—it can be treated as a partnership instead. This allows the entity to avoid corporate-level taxation by passing through its income to partners..

Under the House proposal, income from the transportation or storage of liquefied or compressed hydrogen would be considered qualified income. For CCS facilities that meet the minimum capture threshold under Section 45Q, income from electricity generation (for power plants), electricity storage, or carbon capture itself would qualify for the credit as long as the facility captures at least 50 percent of its carbon output.

The addition of CCS and hydrogen-related income to the list of qualifying sources for PTPs is estimated to cost taxpayers $2 billion from FY2025–FY2034.

What’s In and What’s Out – How the Bill Changed from Committee Draft to Final Passage

The final House bill retains most of the provisions from the original Ways and Means draft concerning IRA energy tax credits. These include the early termination of tax credits for clean vehicles and energy efficiency upgrades, the Section 45V Clean Hydrogen Production Credit, and the Section 30C Alternative Fuel Refueling Property Credit. It also preserves the Section 45Q Carbon Oxide Sequestration Credit, the early phaseout of the Section 45X Advanced Manufacturing Production Credit and the expansion of the Section 45Z Clean Fuel Production Tax Credit.

Some last-minute revisions made during the House Rules Committee markup on May 21 include:

- Earlier Sunset of Section 45Y Clean Electricity Production and Section 48E Clean Energy Investment Tax Credits, with Special Carveout for Nuclear Facilities:

Under current law, 45Y and 48E would start phasing out for facilities that begin construction after the end of 2032 or the year that the United States meets its electricity sector emissions reduction target. The original Ways and Means proposal would have initiated the phaseout in 2029 for all qualifying facilities. The House-passed version does not include a phaseout schedule, but instead requires nearly all qualifying facilities to begin construction within 60 days of the bill’s enactment and be placed in service by December 31, 2028.

New advanced nuclear facilities and the expansion of existing ones, however, would only need to begin construction by December 31, 2028 to qualify for 45Y. For 48E, the same construction deadline applies, but eligibility is limited to new advanced nuclear facilities and has no placed-in-service requirement.

- Reversing the Early Phase-Out of Section 45U Zero-Emission Nuclear Power Production Credit:

The original Ways and Means proposal would have phased out the 45U credit starting in 2029. The House-passed version, however, abandons that schedule and instead allows the credit to remain available through the end of 2031—just one year earlier than under current law.

The 45U credit was projected to cost taxpayers $30 billion over FY2022–FY2031 when it was first created. The Ways and Means version would have reduced that cost by $10.4 billion over FY2025–FY2034. The final House-passed bill walks that back, resulting in $6.7 billion less in projected savings over the next decade.

- More Stringent FEOC Material Sourcing Requirements for 45Y and 48E:

As opposed to the Ways and Means proposal, the final bill would accelerate the deadline for entities receiving material assistance to clean up their supply chains. For 45Y and 48E credits, affected entities would need to comply by the end of 2025, rather than one year after the bill’s enactment. By contrast, the only other credit subject to material assistance restrictions, Section 45X Advanced Manufacturing Production Credit, would retain a two-year compliance deadline under both versions of the bill.

- Restoration of Credit Transferability for Section 45Y Clean Electricity Production Credit, Section 48E Clean Energy Investment Tax Credit, and Section 45U Zero-Emission Nuclear Power Production Credit:

The IRA also authorized “transferability” for various energy tax credits, which allows entities to transfer all or a portion of an eligible credit to an unrelated taxpayer. The House Ways and Means proposal would have repealed this provision for most energy tax credits two years after the bill’s enactment. However, the final House-passed bill narrows the repeal, eliminating transferability only for Sections 48, 45Q, 45X, and 45Z—while preserving it for Sections 45U, 45Y, and 48E, contrary to the original proposal.

The chart below details the changes that the House reconciliation bill makes to the IRA energy tax credits: