Statement from Stephen Ellis, president of Taxpayers for Common Sense, on House Passage of the “One Big Beautiful Bill Act”

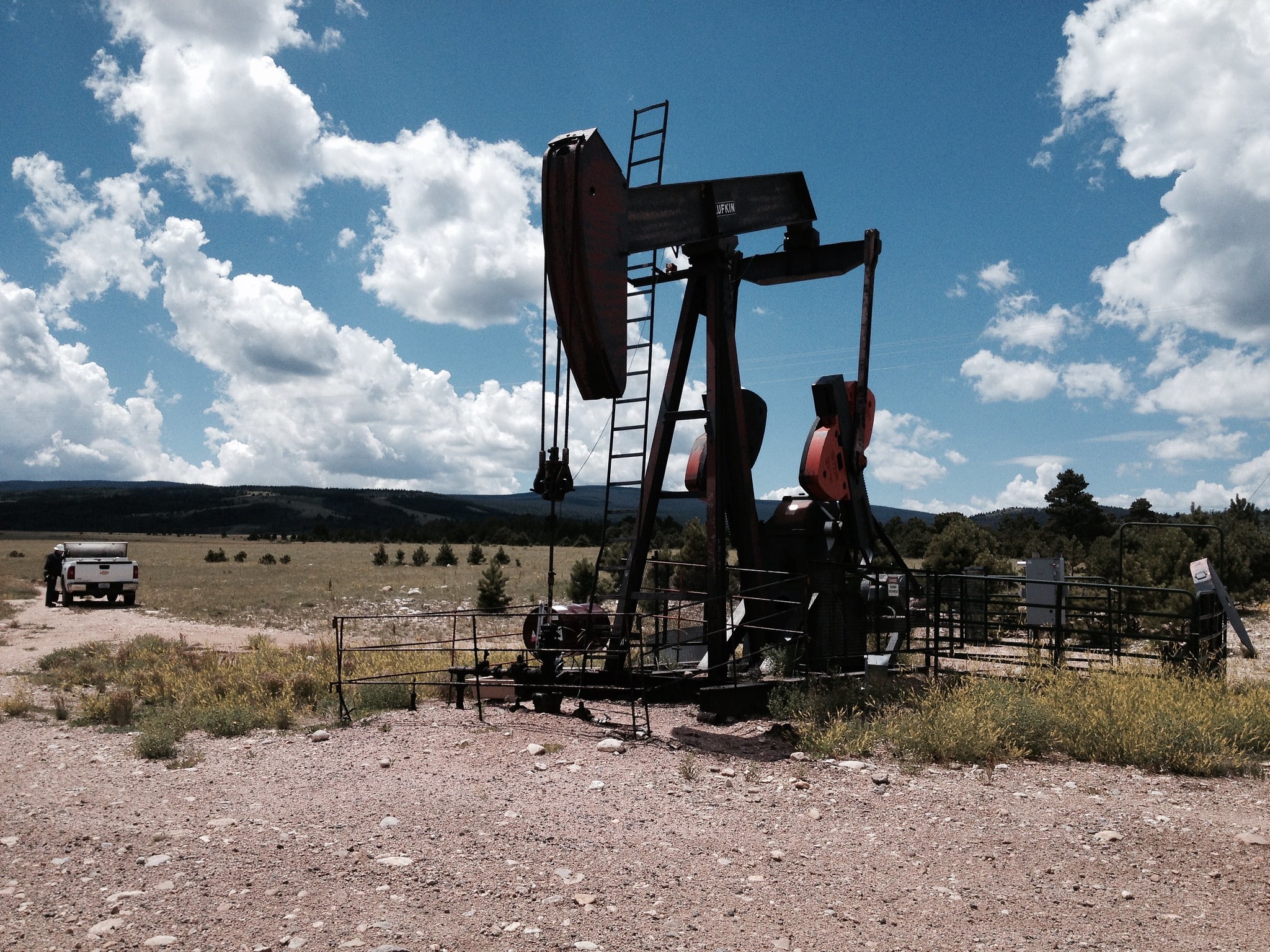

Today’s House passage of the “One Big Beautiful Bill Act” is a masterclass in legislative overreach disguised as fiscal discipline. While the bill’s title may be tongue-in-cheek, there’s nothing funny about piling on deficit-exploding tax cuts, giveaways to special interests, and long-term liabilities for taxpayers. The legislation is ugly – it doubles down on ineffective subsidies, expands outdated agricultural supports, offers up federal lands and resources at rock bottom prices, mandates costly Pentagon programs, and rescinds oversight funding that could actually save money. All while adding trillions to our already unsustainable $36 trillion debt.

Reconciliation was created as a tool for enforcing fiscal discipline—not evading it. But the process has been warped beyond recognition. What was once a narrow, fast-track mechanism to reduce deficits has become a tool to end-run the majority of Congress and any semblance of regular order to enact political wish lists, rely on accounting tricks, and secure giveaways that deepen our debt.

This is not just bad budgeting—it’s bad economics. Mounting federal debt doesn’t disappear; it competes with private investment, drives up interest rates, and acts as a drag on long-term growth. The recent weakness in bond markets and rising interest costs have already revealed the risks of this debt-fueled bill. Instead of tightening the fiscal screws, this package loosens them. Congress should be focused on rooting out waste, eliminating unnecessary spending, and protecting the nation’s fiscal health.

We urge the Senate to reject this reckless approach and return to the hard work of responsible budgeting.

Check out our FY 2025 Budget Reconciliation Resource Page for the latest updates and insights.

- Architect of the Capitol