It’s Halloween, so it seems apt to review some tricks that have been played on taxpayers through the year as well as a few treats they have received. For the faint of fiscal heart, be aware that some of these are quite frightening.

The year kicked off with a partial government shutdown that tricked taxpayers out of nearly six million federal workdays, cost at least $2.3 billion and shaved 0.4 percent off the first quarter GDP.

The fiscal horror show continued as The Bipartisan Budget Act of 2019 ended up goring taxpayers for $300 billion in one fell swoop. Add that to the 2017 tax cut and the federal deficit soared to nearly $1 trillion or 4.6 percent of GDP in FY2019. That shouldn’t be happening in an expanding economy. As a percentage of GDP the national debt is the highest it has been since right after World War II.

Taxpayers are being tricked out of revenues from federal oil and gas. Federal lands and waters contain abundant oil and gas resources, but the Department of the Interior is getting taxpayers frightfully low compensation for our resources. Yet the current fee system, along with its rates of return, are antiquated costing taxpayers billions in foregone revenue each year from both onshore and offshore federal oil and gas production. Special interests and poor management have meant loopholes and fees that are set at the legal minimum and have been for decades. One particularly devilish loophole in offshore production has cost taxpayers $18 billion in lost royalties through 2018. Laughably low onshore royalty and rental rates have costs taxpayers billions more. A few lawmakers have offered taxpayers a treat by proposing to reform these policies. Let’s hope these efforts aren’t lost in the dark.

And then there’s the just ghoulish …

Taxpayers continue to be haunted by farm bills past. When the 2014 farm bill drove a stake through the heart of the Direct Payments program, reformers thought we were finally done sending farm owners government checks every year regardless of their financial situation. But the Trump Administration has raised the program from the dead. Looking to prevent hordes of pitchfork and torch wielding farmers from storming the 2020 election gates, the administration has unleashed $28 billion in hush money for some farming and ranching businesses affected by the president’s trade war. But this Frankenstein’s monster of farm programs has doubled the cost of the agricultural safety net, increased financial dependency on Washington, and threatens to undermine decades of progress toward a more responsible and productive federal role in agriculture.

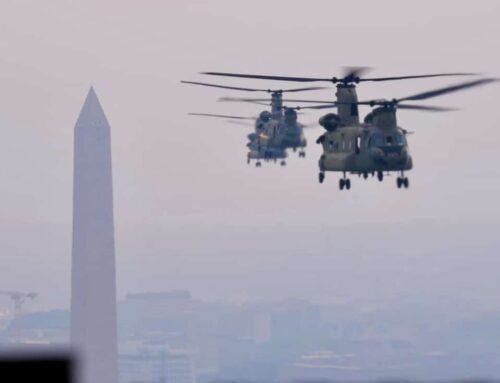

Now for a few treats from the national security realm.

California Rep. Jared Huffman (D-CA) offered a successful amendment to repeal a provision of a previous Pentagon policy bill that, unbelievably, kept alive a decades-old and indefensible zombie provision requiring the purchase and shipment of coal from Pennsylvania to be used to heat a single military base in Germany. We’ve been writing about this ridiculous, protectionist provision for years. We pulled together a group of taxpayer-minded groups to write a letter of support for this amendment, which you will find here, and were glad to see the amendment pass.

Tennessee Rep. Cohen’s offered a common sense, and ultimately successful, amendment requiring the Secretary of Defense to seek the return of payments made to Lockheed Martin for “non-Ready-For-Issue” spare parts. This is in response to a recent report of the Pentagon Inspector General. This is smart policy and the right thing to do so we were very pleased to see it accepted. It’s a rare victory in the long, tortured history of over-spending on the F-35.

That’s just a quick wrap-up of a few items we noticed this year. With government funding set to run out November 21st you can expect plenty of special interest goblins to emerge looking to treat themselves. Taxpayers for Common Sense will continue to work to put those greedy gremlins to bed and help us all wake from our current fiscal nightmare.