The last major COVID-19 package was the $2 trillion CARES Act that was signed into law in March, more than six months ago. At that time the estimate of pandemic related deaths in the U.S. was 3,833, today it is more than 200,000. 186,101 Americans had been infected by the virus then, it stands at more than 7 million today. A lot has happened since March, but a lot has not.

That’s not to say there has been no fiscal intervention with the economy since the CARES Act was enacted. The money flowed out over several months, and the Federal Reserve used a whole bag of tricks in their arsenal to float the economy – particularly Wall Street.

But here in Washington, it’s stagnation nation. Both parties have passed multiple COVID-19 response legislations that exceed a trillion dollars. But not the same legislation, which is how you make law. That means that Republicans and Democrats, the Senate and the House have recognized something needs to be done, they just haven’t agreed on the scale or the target. When you get to this stage, politicians need leadership, they need direction. What they’re getting from the White House is whiplash. On one side, Treasury Secretary Mnuchin is trying to swing a deal. On the other side White House Chief of Staff Mark Meadows appears to be squelching deals. And President Trump alternately cheerleads and slams the door.

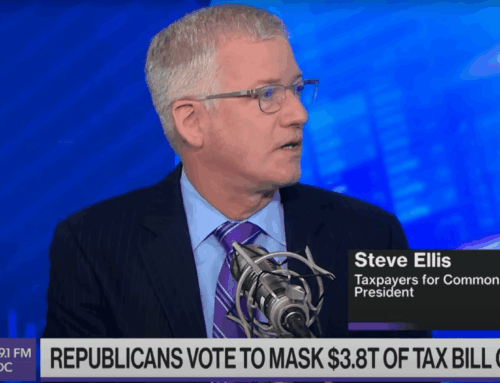

We’re budget watchdogs and strongly believe that deficits and debt matter. We’ve been critical of past big spending deals that weren’t responsible. Of poorly designed expensive tax cuts instead of fundamental tax reform. Of wasteful spending and tax subsidies big and small. But you work on that stuff in the semi-normal times so that when something really bad happens – like a pandemic and the economic disruption it creates – the nation has a fiscal cushion for the large debt burden that follows.

That didn’t happen. There is no cushion. What we have is a pandemic and economic disruption, which has not abated, and to which the country has to respond. Federal Reserve Chairman Powell said as much recently. He noted that after growth in early summer, the pace of recovery has slowed, with the new jobs number in September at less than half the level of gains in earlier months. Only half the 22 million jobs lost earlier in the pandemic have come back. He said: “Too little support would lead to a weak recovery, creating unnecessary hardship for households and businesses. Over time, household insolvencies and business bankruptcies would rise, harming the productive capacity of the economy, and holding back wage growth.” His concern was that a “prolonged slowing the pace of improvement over time could trigger typical recessionary dynamics, as weakness feeds on weakness.”

That’s economist-speak for policymakers better do something. But what?

Back in March we wrote to Congress about how to respond in a fiscally responsible manner. These five guiding principles should be their road map forward. And most important, we can’t afford empty gestures or weak tea. We need real, targeted relief!

- Do what’s necessary, not what’s advantageous

- Deficits do matter in the long run

- Prioritize response on mechanisms with the greatest positive effects

- Emergency legislation should not make permanent change or create long-term liabilities

- Transparency and accountability are key

We know there’s an election less than a month away. But the contract these policymakers signed with their constituents doesn’t end until January 2021. Put aside the bickering and the partisan one-upmanship and put people and the economy first. It may seem like a novel concept, but it’s in the job description.

In other words: Do. Your. Job.