This edition of the Weekly Wastebasket is Part 1 of 2 — read part 2 here.

Earth Day is fast approaching. While celebrations across the country will likely look different this year (if they happen at all) thanks to COVID-19, President Biden has rightfully prioritized climate action. Past inaction and missteps have cost taxpayers dearly and will continue to do so.

Biden will host a 40-nation Climate Summit beginning next Thursday, April 22, and plans to announce broad U.S. emission reduction targets beforehand. The president has been hot for climate policy. On his first day in office, the U.S. rejoined the Paris agreement. And within Biden’s first three months, his administration proposed several hundred billion dollars in climate-related subsidies, tax credits, mandates, research, and more. Many landed in his infrastructure package – the America Jobs Plan – and his Fiscal Year 2022 discretionary budget request.

Consistent, comprehensive climate policies are badly needed. But before we unpack Biden’s (and similar Congressional) actions, we should first learn lessons about why the U.S. has so far missed the mark on climate. This week’s Wastebasket (Part 1) explains why many past federal policies have failed to achieve real, lasting climate solutions, wasting billions of taxpayer dollars along the way. Next week’s Wastebasket (Part 2) will tackle the opposite side of the coin – what the U.S. can do to get climate policy right, including prioritizing equitable, effective, and accountable climate solutions with a positive return on investment.

But first, a history lesson.

While the U.S. took some steps to address greenhouse gas (GHG) emissions over the past 20 years, the impact was often cancelled out due to inconsistencies. For instance, President Obama was on board with international climate commitments, Trump not, and now Biden is.

Policy whiplash bled into other policies as well, including vastly different approaches to GHG regulation at the U.S. Environmental Protection Agency (which later got caught up in court). Other impacts of administrations changing climate gears include policy shifts on methane waste, the roadless rule, and elevation standards for federally funded construction in floodplains.

Meanwhile, unresolved decisions on nationwide cap-and-trade policies versus a carbon tax, for instance, meant other policies that failed to address climate change – or worse yet, contributed to the problem –went largely unabated. More on this next week, but some examples include:

Counterproductive policies and perverse incentives that have made climate change worse

- Perverse incentives for oil and gas, bioenergy, and others – While President Biden has proposed to eliminate wasteful oil and gas tax breaks, they – in addition to the $3 billion per year biodiesel tax credit and other special interest tax breaks – remain on the books, doing more harm than good for the climate, and taxpayers.

- Agriculture and flood insurance subsidies – Federal flood and crop insurance programs promote building and planting, respectively, in risk-prone areas at taxpayer expense. Taxpayers then cover large portions of climate-related losses from floods and droughts, to the tune of tens of billions of dollars per year. Worse yet, annual agriculture subsidies disincentivize soil carbon sequestration and other conservation practices that reduce farmer vulnerability to disasters.

False solutions – policies intended to benefit the climate but in reality, increase taxpayer costs & risks

- Renewable Fuel Standard (RFS) – The RFS failed to spur the next generation of non-food-based biofuels with significant climate benefits, as once intended. The program was instead filled primarily with soy biodiesel and corn ethanol, which is unlikely to change.

- DOE Loan Guarantees – The program subsidized risky technologies at taxpayer expense (like billions of dollars guaranteed for nuclear power plants that have yet to be built). Similar “clean energy” policies are being proposed by both Congress and President Biden.

Policies failing to hold polluters accountable & achieve positive return on taxpayer investment

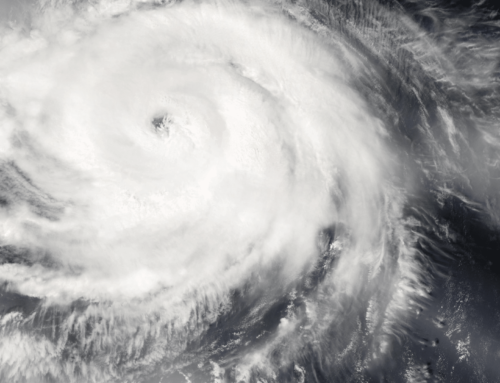

- Disaster and ad hoc aid – Taxpayers have primarily responded to hurricanes and wildfires with ad-hoc aid, while programs promoting smarter pre-sponding, risk reduction, and resilience took a backseat. Similarly, no-strings-attached agriculture ad hoc aid has failed to prepare the U.S. for the next inevitable downturn or disaster.

Learning lessons from the past will be key to getting climate policy right in the future. Now is prime time for Congress and the administration to assess opportunity costs and future prioritization of taxpayer dollars toward real, lasting climate solutions.

Stay tuned next week when we dive in further.