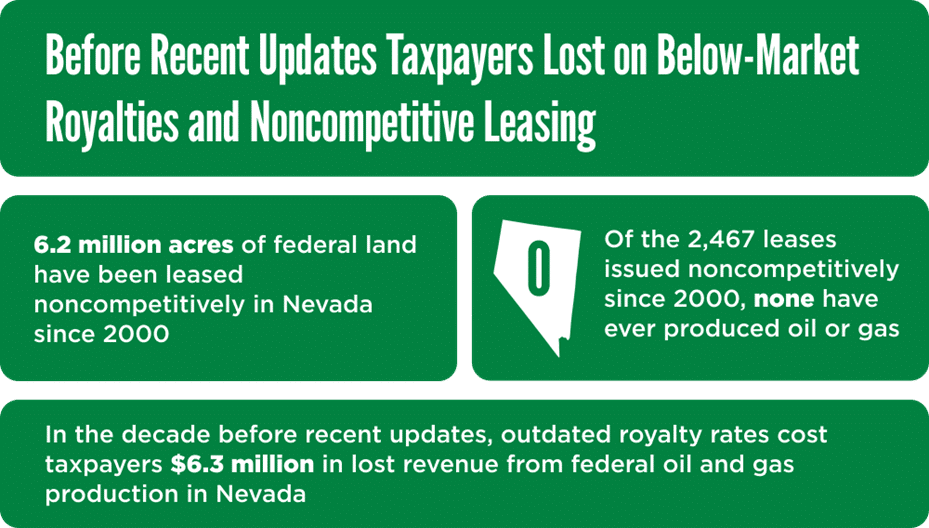

The federal onshore oil and gas leasing system is legally required to ensure taxpayers are fairly compensated when private companies develop publicly owned natural resources in Nevada. Competitive leasing—where companies bid against each other for access to federal mineral rights—and fair royalty rates once production begins are central to achieving this goal.

But for years, a loophole allowed companies to bypass competition entirely by acquiring leases on federal lands in Nevada noncompetitively, often for little or no compensation. Royalty rates had lagged since 1920, further compromising fair returns for taxpayers on oil and gas production. Thankfully, Congress closed the noncompetitive leasing loophole in 2022 and updated the century-old royalty rate to 16.67%—bringing it in line with high oil- and gas-producing states like Texas and New Mexico. Now, the FY2025 budget reconciliation bill threatens to bring it back the loophole and slash the updated royalty rate.