The FY2025 budget reconciliation bill, known as the One Big Beautiful Bill Act (OBBBA) and signed into law on July 4, put the final nail in the coffin for a suite of energy tax credits created by the Inflation Reduction Act (IRA). But carbon capture and storage (CCS) didn't just survive the cuts, it walked away with an even sweeter deal thanks, for the most part,to the expansion of the 45Q tax credit.

Structured like a production tax credit, Section 45Q provides a subsidy for every ton of carbon dioxide (CO₂) captured from power plants or other industrial sources and permanently stored underground in geological formations. The IRA had already expanded and extended the credit by lowering the minimum capture threshold, increasing the credit amount, and extending eligibility to facilities that begin construction before the end of 2032.

Since its creation in 2008, 45Q has offered different credit levels depending on how the captured carbon is used—higher for permanent geological sequestration, lower for enhanced oil recovery (EOR) and other uses. EOR, a technique used for decades to boost oil and gas production by injecting CO2 into depleted wells, is the most common and only commercially viable use of captured carbon. For the first time, the OBBBA increases the credit for EOR and other uses to match the full sequestration rate—up to $180 per ton starting in 2025 for facilities placed in service after the bill's enactment.

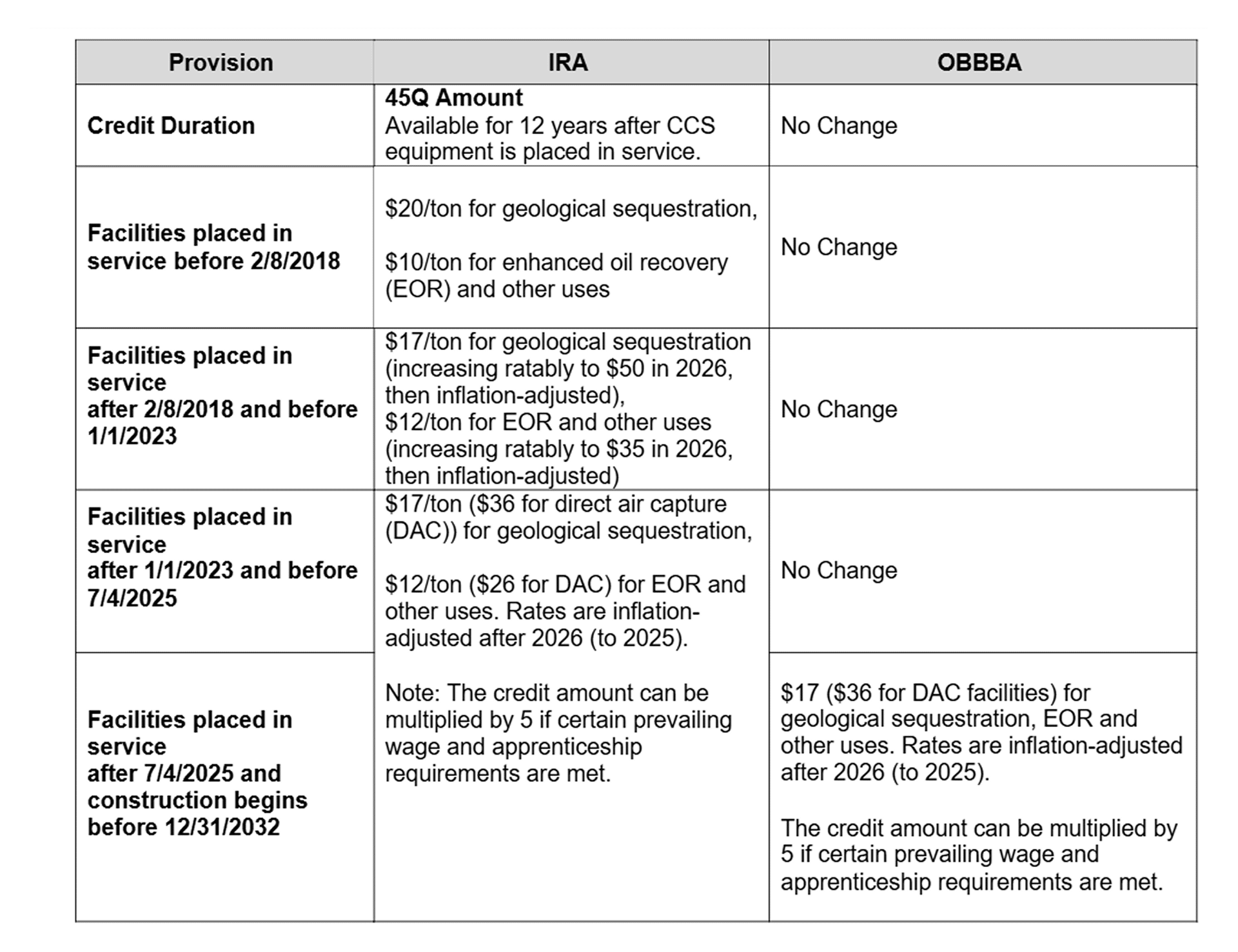

Before OBBBA, facilities placed in service after 2022 could claim $17 per ton ($36 for direct air capture, or DAC) for geological sequestration, and $12 per ton ($26 for DAC) for EOR or other uses. Under OBBBA, the base credit amount for EOR and other uses increases to $17 per ton ($36 for DAC) to match the rate for geological sequestration—for facilities placed in service after 2022.

The 45Q credit picked up increasingly generous handouts as the reconciliation process unfolded. The House-passed bill left the credit amount unchanged. The Senate Finance Committee proposal raised the EOR and other use credit to $17 per ton, starting in 2026. The Senate-passed bill—and ultimately the final law—accelerated that increase to begin in 2025, but limited it to facilities placed in service after enactment. The final version, like all previous ones, keeps the current expiration date and adds new "foreign entity of concern" (FEOC) restrictions for facilities claiming the credit.

According to the Joint Committee on Taxation (JCT), expanding 45Q under OBBBA—(combined with the effect of FEOC provision)—will cost taxpayers an additional $14.2 billion over FY2025-2034. That's on top of the $36 billion price tag of the tax credit before the expansion, per Treasury tax expenditure estimates.

45Q was originally introduced to promote CCS as a tool to reduce emissions. But CCS has failed to prove itself at scale. It depends heavily on taxpayer subsidies, raises red flags about private property rights through the threat of eminent domain, and poses long-term public health and safety risks. Now, with OBBBA's expansion of 45Q, taxpayers are being asked to bankroll even more of a costly and ineffective endeavor—as the deficit grows.

Comparison of 45Q Credit Provisions: IRA vs. OBBBA

Additional Boost for CCS and Oil and Gas

The final OBBBA also includes a provision that further benefits the CCS industry. While the House and Senate versions differ slightly on which revenue streams qualify, both allow income from CCS-related activities to count as "qualifying income" for publicly traded partnerships (PTPs).

Prior to OBBBA, publicly traded partnerships were generally taxed as corporations. However, if at least 90 percent of a PTP's gross income came from qualifying sources—such as rents, capital gains from real property, or income from the exploration, production, processing, refining, transportation, or marketing of minerals or natural resources—it could avoid corporate-level taxation and instead pass income through directly to partners.

Under OBBBA, CCS facilities that meet 45Q's minimum capture thresholds and capture at least 50% of total carbon output can now count income from electricity generation (for power plants), storage of electricity, and carbon capture itself as qualifying income for PTP status. There is no construction deadline for eligibility. This provision allows CCS developers and investors to structure projects as PTPs to avoid corporate-level taxation.

- By Peabody Energy, Inc. - Provided by Peabody Energy, CC BY 3.0, https://commons.wikimedia.org/w/index.php?curid=36846290