View/Download this article in PDF format.

Unlike personal credit scores that indicate how likely individuals are to repay a loan by looking at our history, when financial institutions assign a credit rating to a corporation (or to specific bonds corporations issue), they are assessing how likely the company will be able to return an investor’s capital by looking at the future.

Credit rating agencies like Moody’s Investors Service, Fitch Ratings, or Standard and Poor’s analyze a corporation’s position in the market, cash flow to debt ratio, debt leverage, management profiles, profitability compared to its peer group, various industry factors, and more before assigning a rating. As a result of such scrutiny, investors can better assess the prospects of a project’s potential success or failure.

A loan guarantee is a promise by the DOE to a lender that the federal government will fully cover any default or debt that a borrower incurs. Like a parent co-signing an auto loan, the DOE essentially co-signs a huge loan for a selected company. Unlike a normal loan, however, if the company defaults under the DOE loan guarantee program, the U.S. treasury doesn’t necessarily have the first right, or lien, to recoup taxpayer money by seizing the company’s assets. That means taxpayers could lose big.

A company’s credit rating will benefit from a DOE loan guarantee because their credit is then covered by the full faith and credit of the United States government. The better rating only means, however, that it’s safer for other private investors to lend to that company, and not that it’s any less risky for taxpayers. It is imperative, therefore, that the DOE closely examine a thorough and current credit rating of a company before issuing a final loan guarantee.

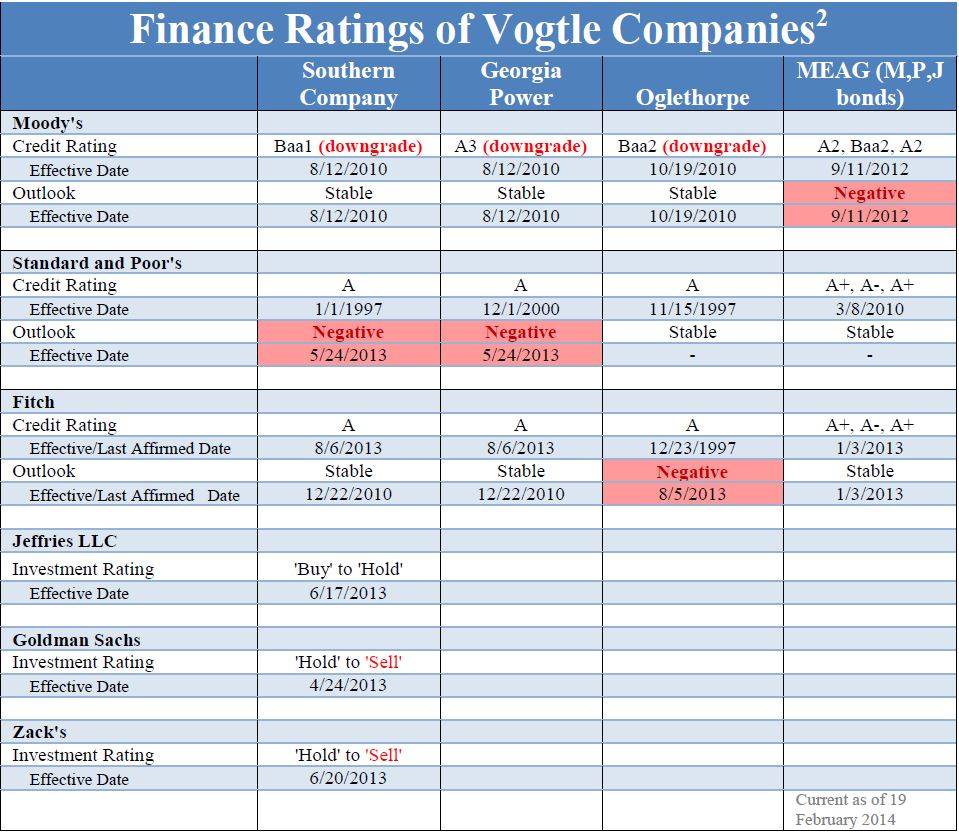

The DOE is considering finalizing $8.33 billion in loan guarantees to the co-owners of Plant Vogtle for the construction of two nuclear reactors in Georgia. Since construction on the project began, it has experienced substantial cost overruns and schedule delays. As a result, each of the project partners have had their credit rating downgraded or their outlook changed to ‘Negative’ (implying a possible downgrade to come). Meanwhile, Southern Company, the parent company of the project’s largest owner, has been recording losses over $1 billion due to mismanagement of another project in Kemper County, Mississippi. If the DOE finalizes the loan guarantee offer for Plant Vogtle reactors 3&4, taxpayers will be on the hook for a massive project with questionable finances.

Below are the credit ratings of the Plant Vogtle partnering companies and recent commentary from top investment firms regarding their stocks.

For more information, please contact Autumn Hanna at (202) 546-8500 x112

or autumn [at] taxpayer.net