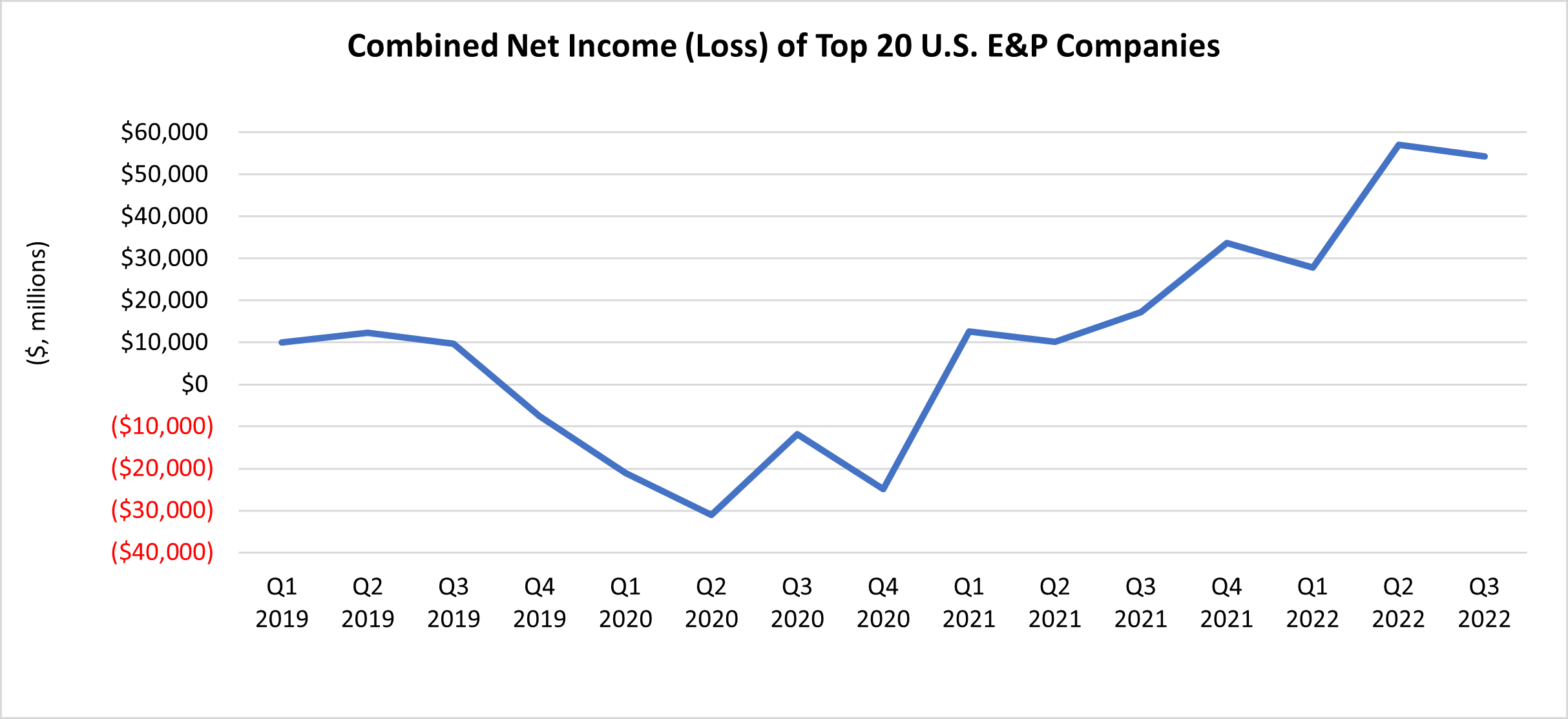

During the third quarter of 2022, the top 20 U.S. oil and gas exploration and production (E&P) companies, ranked by market capitalization, reported combined profits of $54.2 billion, more than triple what they reported over the same period last year. ExxonMobil, the largest U.S. E&P firm, reported a record high quarterly net income of $19.7 billion, the highest that the company has ever reported.

Net Income (Loss) of Top 20 U.S. E&P Companies ($, millions)

| 2022 | 2021 | ||||||

| Companies | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 |

| Exxon Mobil | $19,660 | $17,850 | $5,480 | $8,870 | $6,750 | $4,690 | $2,730 |

| Chevron | $11,231 | $11,622 | $6,259 | $5,055 | $6,111 | $3,082 | $1,377 |

| ConocoPhillips | $4,527 | $5,145 | $5,759 | $2,627 | $2,379 | $2,091 | $982 |

| EOG Resources | $2,854 | $2,238 | $390 | $1,985 | $1,095 | $907 | $677 |

| Occidental Petroleum | $2,546 | $3,555 | $4,676 | $1,337 | $628 | ($97) | ($346) |

| Pioneer Natural Resources | $1,984 | $2,371 | $2,009 | $763 | $1,045 | $380 | ($70) |

| Devon Energy | $1,893 | $1,932 | $989 | $1,506 | $838 | $256 | $213 |

| Hess | $515 | $667 | $417 | $265 | $115 | ($73) | $252 |

| Continental Resources | $1,013 | $1,209 | $598 | $743 | $369 | $289 | $260 |

| Diamondback Energy | $1,184 | $1,416 | $779 | $1,002 | $649 | $311 | $220 |

| Coterra Energy (formed by merger of Cabot Oil & Gas

& Cimarex Energy |

$1,196 | $1,229 | $1,640 | $939 | $63 | $31 | $126 |

| $113 | $128 | ||||||

| Marathon Oil | $817 | $966 | $1,304 | $649 | $184 | $16 | $97 |

| Apache | $357 | $903 | $1,847 | $409 | ($83) | $339 | $397 |

| Ovintiv | $1,190 | $1,367 | ($241) | $1,384 | ($72) | ($205) | $309 |

| Chesapeake Energy | $883 | $1,237 | ($764) | $1,434 | ($345) | ($439) | $5,678 |

| Antero Resources | $560 | $1,087 | ($156) | $901 | ($549) | ($523) | ($15) |

| Southwestern Energy | $450 | $1,171 | ($2,675) | $2,361 | ($1,857) | ($609) | $80 |

| Range Resources | $373 | $453 | ($457) | $891 | ($350) | ($156) | $27 |

| Murphy Oil | $528 | $351 | ($113) | $168 | $108 | ($63) | ($287) |

| SM Energy | $481 | $323 | $49 | $425 | $86 | ($223) | ($251) |

| Total | $54,243 | $57,092 | $27,789 | $33,715 | $17,164 | $10,116 | $12,583 |

Enabled by strong cash flows in Q3, top oil and gas producers have also passed along some of their massive earnings with shareholders this quarter through dividends and stock buyback programs. ExxonMobil distributed $8.2 billion through dividends and share buybacks this quarter. Chevron reported $6.5 billion of dividends and share repurchases just this quarter. And Occidental and Pioneer and Natural Resources have repurchased $1.8 billion and $500 million in shares, respectively.

The strong recovery from the pandemic proved that the oil and gas industry is mature, resilient, and highly profitable. Despite making record profits each quarter, the oil and gas industry on average receives $3.2 billion in tax breaks and $3.6 billion in sweetheart leasing terms every year. And oil and gas companies have been exploiting concerns about gas prices and energy security to call for further taxpayer subsidies and increased access to federal lands. As oil and gas companies prioritize returns to their investors, the federal government should protect taxpayers’ interest by ending unnecessary and wasteful subsidies.

For more on our analysis of the top 6 oil and gas companies, click here