How is President Trump going to protect waste of taxpayer money on high risk construction after eliminating a common sense flood standard?

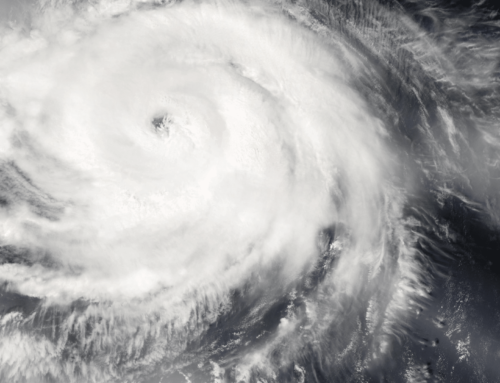

The twelfth anniversary of Hurricane Katrina is right around the corner and New Orleans is in the news again for flooding.

But this flooding didn’t come from a tropical depression or even from the Mississippi River. No, it came from the sky in the form of rain. In this case, mismanagement and failed drainage pumps are mostly to blame, but nevertheless 600 federal flood insurance claims have already been filed. This is just further evidence: Floods happen. They just do.

It doesn’t have to be a huge storm like Sandy or Katrina, it can be lots of precipitation over a long period or a powerful burst of rain. And while New Orleans is particularly vulnerable to flooding, in just the past year Major Disasters from flooding have been declared (reverse chronological order) in WY, ND, MO, ID (twice), UT, WA, CA (twice), PA, MN, IA (twice), WI, and LA. You can be sure Louisiana will be getting another declaration soon. In all, a quarter of the states in the lower 48 have had major flooding events in the last year.

Because flooding can happen anywhere, the country has to be prepared everywhere. That’s why it is distressing that this week the Trump administration outright cancelled the Federal Floodplain Risk Management Standard established a few years ago. In a nutshell, this common sense rule stated that if there is federal funding for new construction or rebuilding, that it should either not be in the floodplain or if it is, it should be elevated above flood heights and/or be insured. There were requirements for planning and exceptions for national security to boot.

This rule would in effect “pre-spond” to future disasters with smarter building and citing. That will reduce taxpayer costs. And if a community doesn’t want to be less vulnerable, then they don’t have to take the cash. The federal share of disaster assistance has been increasing, from less than 30 percent after Hurricane Hugo in 1989, to 75 percent after Sandy. That’s why even beyond the rule, our nation’s disaster policies need to be reformed. Assistance should be provided on a sliding scale contingent on the level of preparation at the state and local level. States and localities should be required to pursue private insurance for public infrastructure before becoming eligible for federal aid. While means-tested premium assistance should be made available, overall federal flood insurance rates must be more commensurate with risk, and the federal government should put policies into place to encourage the further development of a private market.

The National Flood Insurance Program is nearly $25 billion in debt to taxpayers. The authorization for the program expires at the end of September. Now is the time to enact critical reforms to the program to put it on sounder financial footing. The private sector flood insurance market – while small – is growing. That would help shift some of the burden off taxpayers.

The apparent rationale for trashing the Obama administration floodplain rule was its climate change focus. But as outlined above, flooding is happening in a lot of places that have little or nothing to do with climate change. The Trump administration needs to work with all interested parties to develop a sensible and modern federal flood standard and ensure tax dollars are not being wasted on unsustainable development.

Taxpayers have a right to protect their investments.