It’s April Fool’s Day, but instead of trying to trick you we thought we’d let you know about the tricks lawmakers play on you virtually every day. And while most tricks played today are relatively harmless, the tricks below can be very costly to taxpayers.

Overseas Contingency Operations (OCO) funding for Defense and State continues to be the major trick by which the Pentagon receives tens of billions of extra dollars each year while the rest of the federal government lives within the limits of the Budget Control Act of 2011 (BCA.) Operating as a major slush fund for the Pentagon, under the Budget Resolutions passed last week by the House and Senate, OCO would add more than $90 billion to the $499 billion already set for the Pentagon by the BCA. This means if OCO was a separate agency it would be the second largest department of the federal government. First largest? The Pentagon, of course!

Congress and agricultural special interests promised $16.6 billion in Farm Bill Savings as means to get the $956 billion legislation enacted last year. Leaving aside the odd congressional math that a nearly $1 trillion bill will yield savings, it turns out budgetary tricks in the bill are coming back to haunt taxpayers. The biggest commodity programs already cost $4.3 billion more than CBO projected for just 2014. And cost projections for two new shallow loss entitlements are projected to be $7.4 billion more than anticipated. But this comes as no surprise as promises to cut spending in the future for increased spending now have a long history in farm bills.

The National Sea-based Deterrence Fund is a new trick, devised by shipbuilding boosters in the Congress to shift the cost of a new ballistic missile submarine out of the Navy’s budget. The Navy wants to modernize several items and that’s tricky in a time of flat Pentagon budgeting. At a hearing last year before the Senate Armed Services Committee, a Navy official raised the idea of “some other strategic fund” to cover the cost of SSBN(X), and the Armed Services committees established this special fund in the “Procurement, Defense-wide” account. From a budgeting standpoint, this makes no sense. It isn’t reducing the cost of the submarine. It doesn’t lower the top line of Pentagon spending. In fact it will create pressure to increase it. But it will temporarily relieve the pressure on the Navy’s budget.

Loan Guarantees are essentially when the federal government backs a loan, like a parent cosigning on a teenager’s car. But in this case Mom or Pop brings the full faith and credit of the U.S. Treasury to the table, so it’s a pretty good deal for the lender. The problem is these guarantees show little to no cost on the federal budget but carry significant risk—to the tune of hundreds of billions in potential defaults. Case in point, the DOE Title 17 Energy Loan Guarantee Program, which has been the focus of much scrutiny since solar panel manufacturer Solyndra went out of business costing taxpayers $500 million. But these losses could soon look like scraps, if the recent deal for an $8 billion nuclear reactor at Plant Vogtle goes belly up. The project is already $2.2 billion over budget and roughly 34 months behind schedule.

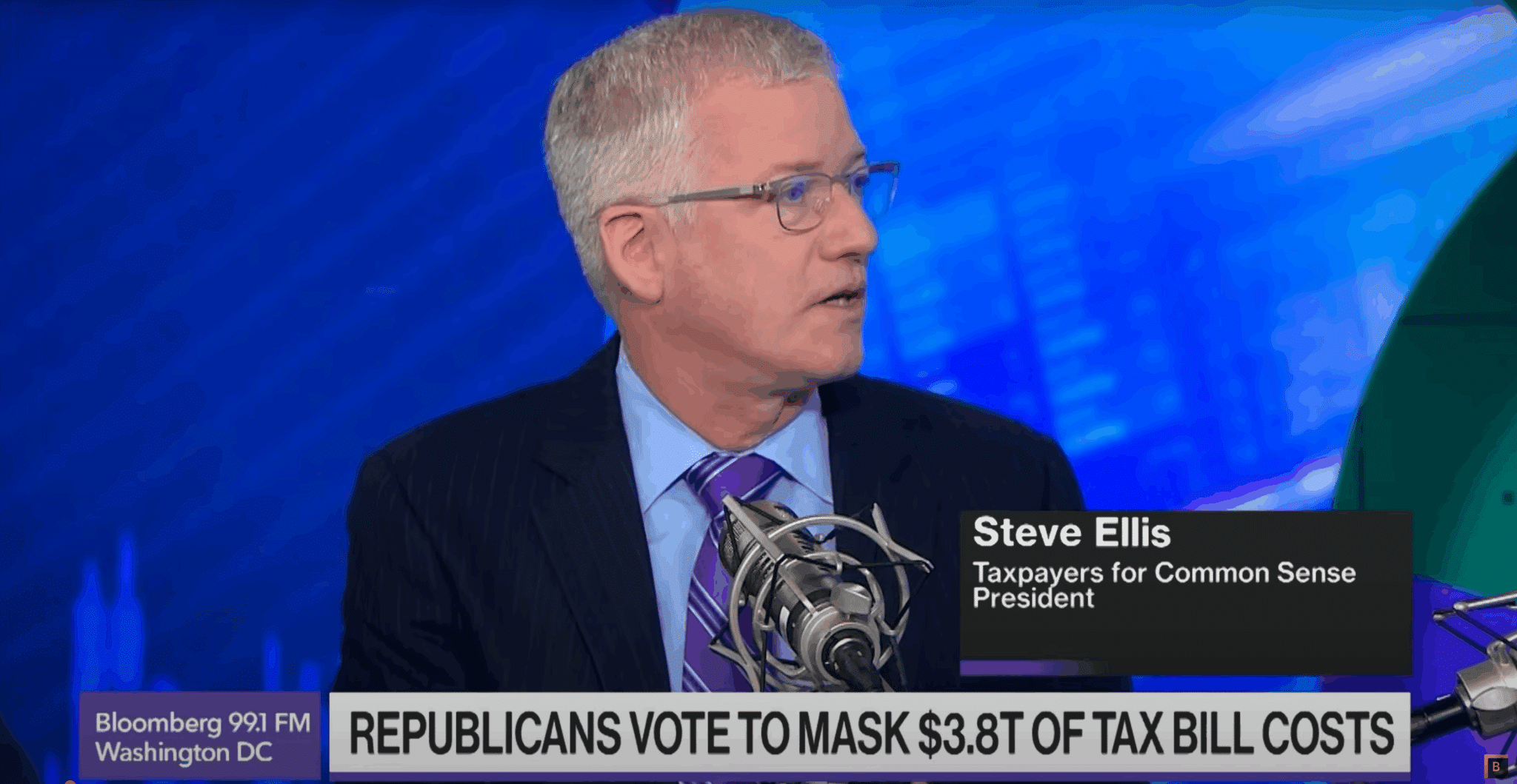

Temporary extensions are often used to mask the cost of provisions. A tax break for NASCAR track owners extended for two years five times in succession has the same impact on the Treasury as a ten year extension, except in Congressional math it doesn’t. Budget scorekeepers assume it will expire after two years, costing significantly less in the ten year budget scoring window, and assume expiration again when it’s “extended” two more years. It’s not just in tax policy, often programs are purported to be temporary when in reality they are permanent.

Pension smoothing, advance appropriations, timing shifts, rosy predictions of revenue from spectrum auctions, low-balled project costs, fake emergencies, savings from eliminating waste, fraud and abuse, predictions of robust growth and reduced future costs: these are all gimmicks that policymakers routinely use to trick taxpayers into thinking programs and policies are less costly than they actually are. The problem is, there is no tricking the more than $18 trillion debt facing the country.