For the past decade, biofuels have been sold as a way to help achieve U.S. energy independence, reduce greenhouse gas emissions, and spur rural economic development. However, the industry has fallen short of achieving these goals while spurring numerous unintended consequences and long-term liabilities that have resulted in more harm than good. Taxpayers have also paid out billions of dollars in subsidies, special interest tax breaks, and other supports to biofuels crop farmers, biodiesel companies, oil and gas companies that blend biofuels into gasoline or diesel, and several others along the supply chain. On top of this, biofuels enjoy a guaranteed market: 36 billion gallons must be blended into fuel as mandated by the government through the Renewable Fuel Standard (RFS). Corn ethanol and advanced biofuels are two primary types of renewable fuels that receive both taxpayer subsidies and a guaranteed market through the RFS. As the industry attempts to move away from food-based feedstocks (primarily corn) toward the next generation of biofuels produced from agricultural residues and waste streams, defining the characteristics of a truly advanced biofuel has become incredibly important. Determining which types of fuels qualify as advanced biofuels will not only send a powerful signal to markets, but will also influence the taxpayer cost of supporting them and potential unintended consequences that may result from their production processes.

Federal Energy Legislation Supporting Biofuels

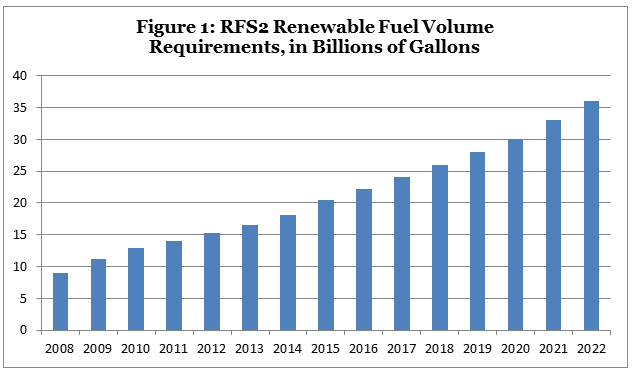

In the U.S., biofuels policy is supported by three major pieces of legislation, the 2005 and 2007 energy bills, and the 2014 farm bill. The 2005 energy bill[1] established several supports for advanced biofuels, including the renewable diesel and biofuels infrastructure tax credits, but more importantly, it was the first time the U.S. mandated consumption of renewable fuels. The first Renewable Fuel Standard (RFS) required 7.5 billion gallons of renewable fuels to be blended with gasoline or diesel by 2012. In the 2007 energy bill, the Energy Independence and Security Act, the RFS was greatly expanded to require 36 billion gallons of biofuels to be consumed by 2022. The RFS2, as it is referred to, requires the following number of gallons of renewable fuels to be blended with gasoline and diesel each year (see Figure 1).

Definition of Biofuels Mandated Under the Renewable Fuel Standard

The RFS2 specifies that two different categories of renewable fuels – conventional corn starch ethanol and advanced biofuels – be used in increasing amounts through 2022. Both must be produced from “renewable biomass” to qualify as RFS-approved feedstocks.[2] However, it is important to note that some of these regulations – primarily the first bullet below – have not been properly implemented and enforced over the past seven years by the Environmental Protection Agency (EPA), leading to new production of corn, for instance, on wetlands, native grasslands, highly erodible land, and other sensitive acres.[3] Renewable biomass was defined in the 2007 energy bill as one of the following:

- Planted crops and crop residue harvested from agricultural (non-forested) land cleared or cultivated at any time prior to December 19, 2007,

- Planted trees and tree residue from actively managed tree plantations on non-federal land cleared at any time prior to December 19, 2007,

- Animal waste material and animal byproducts,

- Slash and pre-commercial thinnings that are from non-federal forestlands, but not forests or forestlands that are ecological communities, old growth forests, or late successional forests,

- Biomass obtained from the immediate vicinity of buildings and other areas regularly occupied by people, or of public infrastructure, at risk from wildfire,

- Algae, or

- Separated yard waste or food waste, including recycled cooking and trap grease.

Table 1 further distinguishes conventional corn starch ethanol from advanced biofuels in the RFS2 by comparing their statutory definitions and examples of each. It also specifies the percentage reduction in greenhouse gas (GHG) emissions that each biofuel must achieve to qualify as an RFS2-approved biofuel.

| Type of Biofuel | Annual Production Mandate by 2022 | Definition of Biofuel | Examples | Minimum Reduction in Greenhouse Gas Emissions |

|---|---|---|---|---|

|

Conventional ethanol |

15 billion gallons/year |

Ethanol derived from corn starch |

– Corn starch ethanol |

20%, but due to a grandfathering clause, nearly every ethanol facility was able to circumvent this minimal requirement[i]

|

|

Advanced biofuels |

21 billion gallons/year | “Renewable fuel, other than ethanol derived from corn starch, that has lifecycle greenhouse gas emissions (GHG) that are at least 50% less than baseline GHG emissions” |

– Cellulosic ethanol |

50% |

The 21 billion gallons of advanced biofuels are further divided into three distinct categories in Table 2, including cellulosic ethanol, biomass-based diesel, and “other” advanced biofuels:

| Type of Advanced Biofuel | Annual Production Mandate by 2022 | Definition of Advanced Biofuel | Examples | Minimum Reduction in Greenhouse Gas Emissions |

|---|---|---|---|---|

| Cellulosic ethanol | 16 billion gallons/year | Renewable fuel derived from any cellulose, hemicellulose, or lignin | – Ethanol produced from waste materials like crop residues, food waste, or woody biomass | 60% |

| Biomass-based diesel | At least 1 billion gallons/year, set annually by EPA | Biodiesel produced from vegetable oil or “a diesel fuel substitute produced from nonpetroleum renewable resources [including] animal wastes, including poultry fats and poultry wastes, and other waste materials, or municipal solid waste and sludges and oils derived from wastewater” |

– Biodiesel produced from soybeans, other vegetable oil, algae, animal fats, used cooking oil, etc. – Other diesel fuel substitutes produced from municipal solid waste, animal wastes, etc. |

50% |

| “Other” advanced biofuels | 4 billion gallons/year | Any other fuel that meets the definition of an “advanced biofuel” |

– Ethanol from non-corn feedstocks such as sugar – Butanol from renewable biomass (including butanol derived from corn, currently under review at EPA)[5] – May also include biomass-based diesel (see above) |

50% |

Current Status and Future of the RFS2

Since production of next-generation biofuels from non-food feedstocks has not taken off as some had hoped, the RFS2 mandate has primarily been filled with corn ethanol. EPA has significantly revised the cellulosic ethanol mandate downward every year since 2010 due to inadequate production. The National Academy of Sciences (NAS) and the Congressional Budget Office (CBO) estimated that cellulosic ethanol will fail to meet its RFS2 mandate of 16 billion gallons by 2022 due to technical and economic barriers; NAS and CBO also found that corn ethanol may increase – rather than decrease – GHG emissions, one of the primary goals of the mandate.[6]

With the cellulosic mandate unlikely to be met in either the short- or long-term, other advanced biofuels must be produced domestically or imported to fill renewable fuel volumes unless the EPA or Congress adjusts the mandate downward. The three biofuels mostly likely to fill the advanced biofuels carve-out in the near-term include:

(1) Soy biodiesel, one of the only “advanced biofuels” being produced domestically in considerable quantities, or other types of biodiesel,

(2) Sugarcane ethanol, an advanced biofuel primarily exported from Brazil, and (3) Biofuels produced from corn other than corn ethanol (like corn oil biodiesel or corn biobutanol).

All three, except for corn biobutanol which is under review at EPA, have already met EPA’s 50 percent GHG reduction threshold and can thus fulfill part of the advanced biofuels mandate.[7] Since corn ethanol is nearing its 15 billion gallon mandate, companies are looking to produce other corn-based biofuels that could fulfill more of the RFS’ advanced biofuels mandate in an effort to gain more market share. If EPA rules that corn biobutanol is able to reduce GHG emissions by 50 percent to qualify as an advanced biofuel, corn-based fuels will likely continue to fill most of the RFS mandate unless volumes are decreased. If corn-based biofuels increase their market share, commodity markets would be disrupted even further as more of the U.S. corn supply would be used for biofuels production instead of livestock feed, food, or exports, as currently 40 percent of the corn crop is used for corn ethanol production.

Definition of Biofuels Eligible for Farm Bill Energy Program Subsidies

Biofuels and biomass sources are also subsidized through the federal farm bill’s nine energy title programs which provide loan guarantees, grants, annual payments, research and development funding, and other subsidies to the industry. Since the farm bill’s definition of “renewable biomass” is less strict than RFS’s definition, some forms of biofuels and bioenergy qualifying for farm bill subsidies wouldn’t otherwise qualify as RFS-approved biofuels, particularly “advanced biofuels.”

The 2008 farm bill’s definition of “renewable biomass,” which determines which types of materials can qualify for energy title subsidies, includes the following:

- Materials, pre-commercial thinnings, or invasive species from National Forest System land and public lands which are byproducts of preventive treatments that would not otherwise be used for higher-value products and those that are harvested in accordance with applicable law and land management plans, or

- Any organic matter that is available on a renewable or recurring basis, including:

- Renewable plant material (feed grains, other agricultural commodities, other plants and trees, or algae), or

- Waste material (crop residue, other vegetative waste material like wood waste and wood residues, animal waste and byproducts, food waste, and yard waste).

The 2014 farm bill also allowed woody biomass from the following sources to qualify for Biomass Crop Assistance Program subsidies:

- collected or harvested directly from the National Forest System, Bureau of Land Management land, non-Federal land, tribal lands (as long as a conservation plan is in place) or as a result of certain preventative treatments.

Several programs, such as the Bioenergy Program for Advanced Biofuels (BPAB), prohibit corn ethanol from receiving subsidies since, as the program title suggests, payments are intended for next-generation, “advanced” biofuels produced from non-food crops. However, program loopholes allowed 23 percent of the program’s 2009-2014 subsidies to flow to corn ethanol facilities.[8] Importantly, the farm bill, unlike the RFS, fails to require biofuels or bioenergy sources to reduce GHG emissions to qualify for subsidies, so corn-based biofuels and other biofuels with low GHG-reducing potential (or even higher GHG emissions) still receive taxpayer subsidies.

Definition of Biofuels Eligible for Federal Tax Subsidies

Biofuels and biomass industries are also subsidized through the federal tax code. Table 3 provides descriptions of fuels and materials qualifying for production, mixture, infrastructure, and other tax credits. Importantly, like farm bill energy subsidies, biofuels are not required to reduce GHG emissions by a certain amount to qualify for federal tax credits. However, in Dec. 2013, former Senate Finance Committee Chairman Baucus (D-MT) proposed the creation of new “clean transportation” fuel and renewable energy tax credits which would partially take carbon emissions into account. Unfortunately, his proposal would have recreated subsidies like the Volumetric Ethanol Excise Tax Credit (VEETC), which expired in 2011 after years of TCS opposition, by providing subsidies for corn ethanol produced at facilities powered by biomass. House Ways and Means Committee Chairman Dave Camp (R-MI) also proposed the elimination of biofuels and biomass subsidies in Feb. 2014, but ultimately put the savings toward deficit reduction instead of the creation of new subsidies. Neither of these proposals, however, was voted on by Congress.

| Tax Credit | Description |

|---|---|

| Alternative Fuel Vehicle Refueling Property Credit* | Facilities dispensing certain alternative fuels can receive a refueling property credit in the form of a 30% tax break. Eligible facilities include gasoline stations, those installing biodiesel or 85% ethanol (E85) blender pumps, or repowering sites for electric vehicles. Stations dispensing natural gas, liquefied natural gas (LNG), and liquefied petroleum gas (LPG) are also eligible.[9] |

| Credit for Alternative Fuel Mixtures* | 50 cent-per-gallon credit for mixtures “containing at least 0.1% gasoline, diesel, or kerosene. Qualified alternative fuels are: compressed natural gas (based on 121 cubic feet), liquefied natural gas, liquefied petroleum gas, P-Series fuel, liquid fuel derived from coal through the Fischer-Tropsch process, and compressed or liquefied gas derived from biomass.”[10] |

| Master Limited Partnerships[11] | “An MLP is typically a limited liability company (LLC) treated as a partnership for taxation purposes and traded on a public exchange… Investors are treated for tax purposes as if they directly earned the MLP’s income. By avoiding double taxation, MLPs have access to lower cost of capital, which allows them to build and operate low-return assets to provide a sufficient rate of return to attract investors.”[12] Of the 130+ entities benefiting from the MLPs’ special tax treatment, most are in the oil and gas industry, but in 2008, the transportation and storage of ethanol, biodiesel, and other alternative fuels also became eligible.[13] |

| Biomass Production Tax Credit* | 1.1 cents and 2.3 cents per kilowatt-hour production tax credit for open- and closed-loop biomass conversion to power sources. Open-loop biomass includes sources such as “agricultural livestock waste, cellulosic waste material, mill and harvesting residues, waste pellets, crates, manufacturing and construction wood wastes, tree trimmings, orchard tree crops, vineyard, grain, legumes, sugar, and other crop byproducts or residues” while closed-loop sources include “any organic matter from a plant which is planted exclusively for purposes of being used at a qualified facility to produce electricity.”[14] |

| Production Tax Credit for Cellulosic Ethanol and Plant Depreciation Deduction Allowance* | $1.01-per-gallon production tax credit for cellulosic ethanol and “additional depreciation tax deduction allowance equal to 50% of the adjusted basis of the property.”[15] “Second generation biofuel is defined as liquid fuel produced from any lignocellulosic or hemicellulosic matter that is available on a renewable basis or any cultivated algae, cyanobacteria, or lemna”[16] (such as agricultural residues, wood waste, perennial grasses, etc.), with no requirements for minimum GHG reductions. |

|

Volumetric Biodiesel Excise Tax Credit and Renewable Biodiesel Tax Credit* |

The biodiesel production tax credit of $1 per gallon supports eligible feedstocks such as “virgin oils, esters derived from corn, soybeans, sunflower seeds, cottonseeds, canola, crambe, rapeseeds, safflowers, flaxseeds, rice bran, mustard seeds, and camelina, and animal fats,”[17] with no requirements for minimum GHG reductions. |

Sources: Joint Committee on Taxation, President’s FY15 budget request

* Note: While some of these tax breaks expired at the end of 2014, they are typically renewed in end-of-the-year tax extenders packages, sometimes retroactively.

Recommendations

Since the federal RFS mandate has failed to meet its objectives and is causing more harm than good, it should be eliminated once and for all. In addition, winners and losers should no longer be chosen via the farm bill, tax code, and other government programs so energy sources can compete without unnecessary market intrusions. Taxpayers deserve energy and agricultural policy that limits long-term liabilities and unintended consequences instead of promoting unnecessary risk-taking at the government’s expense.

For more information, please contact Taxpayers for Common Sense at 202-546-8500.

[1] The Energy Policy Act of 2005. P.L. 109-58. http://www.gpo.gov/fdsys/pkg/PLAW-109publ58/pdf/PLAW-109publ58.pdf

[2] http://www.fas.org/sgp/crs/misc/R40155.pdf

[3] http://www.nwf.org/~/media/PDFs/wildlife/farm%20%20bill/RFS_factsheet_v1_10-11-13.pdf

[4] http://www.epa.gov/oms/renewablefuels/420r10006.pdf

[5] http://www.epa.gov/otaq/fuels/renewablefuels/new-pathways/rfs2-pathways-review.htm

[6] http://www.cbo.gov/publication/45477, http://www.nap.edu/catalog.php?record_id=13105

[7] http://www.epa.gov/otaq/fuels/renewablefuels/compliancehelp/endicott-determination.pdf

[8] http://www.taxpayer.net/library/article/bioenergy-program-for-advanced-biofuels-fact-sheet

[9] http://www.law.cornell.edu/uscode/text/26/30C

[10] www.afdc.energy.gov/laws/law/US/417+&cd=2&hl=en&ct=clnk&gl=us

[11] In April 2013, Senator Coons (D-DE) introduced the Master Limited Partnerships Parity Act which would expand the number of activities in ethanol, biodiesel, and other alternative fuels production that can qualify for MLPs. Currently, only transportation and storage of these fuels qualify for MLPs, but Sen. Coon’s legislation would also allow production of renewable fuels to qualify for MLPs. http://www.coons.senate.gov/issues/master-limited-partnerships-parity-act

[12] http://www.forbes.com/sites/williampentland/2013/06/10/mlp-parity-act-disrupting-distributed-energy/

[13] Kinder Morgan, one of the only owners of a short ethanol pipeline, pioneered the use of an MLP to lower its tax liability before changing its corporate structure in 2014. Valero is considering using one for its ten ethanol plants, and Buckeye Partners and Magellan Midstream Partners, L.P., both current users of MLPs, considered building an ethanol pipeline from IA to NJ. http://www.coons.senate.gov/issues/master-limited-partnerships-parity-act, http://www.dividendyieldhunter.com/Master_Limited_Partnerships.html, http://fuelfix.com/blog/2013/05/01/valero-might-form-an-mlp/

[14] http://www.hsblawfirm.com/media/pnc/9/media.589.pdf

[15] www.afdc.energy.gov/laws/law/US/413+&cd=2&hl=en&ct=clnk&gl=us, www.afdc.energy.gov/laws/law/US/10515+&cd=1&hl=en&ct=clnk&gl=us

[16] www.afdc.energy.gov/laws/law/US/413+&cd=2&hl=en&ct=clnk&gl=us