View/Download this article in PDF format.

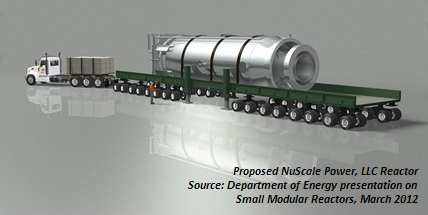

The Department of Energy (DOE) is asking Congress to provide hundreds of millions in subsidies to commercialize small modular nuclear reactors (SMR). First proposed in the 2011 budget, the Administration has committed to providing more than $500 million for licensing support and research and development for these downsized reactors. A fraction of the size of commercial scale reactors, SMRs would be manufactured by assembly line and transported by truck, ship, or rail to their destinations. With designs ranging in size from one-third the size of a large-scale plant down to the size of a hot tub, SMRs will also produce significantly less power: 300 megawatts electrical (MWe) or less compared to 1,000 MWe for a typical commercial scale reactor.

SMRs will likely never be a good investment, but in the current fiscal climate taxpayers must be especially concerned with any dollars DOE doles out. High-risk, high-cost, and highly questionable, small modular reactors don’t just look like a bad investment they are a ridiculous waste. For a range of reasons, subsidies for SMRs equal nothing more than another handout for the nuclear power industry.

Appendix One: Company Profiles

Appendix Two: Legislation

SMRs: High-risk, Unknown Costs

To date, there are no reliable cost estimates for SMRs. Nuclear vendors are notorious for underestimating costs, and there is no actual experience manufacturing or building SMRs. Since the 1950s, the nuclear industry worldwide has consistently pushed for larger reactors on the theory the economics would improve if the high fixed costs of building nuclear plants could be spread over more kilowatt hours. SMRs represent a reversal of this reasoning and call into question the extensive federal support now being offered to promote a “nuclear renaissance” based on standardizing and sticking to a few large reactor designs. While commercial scale reactors of 1,000 MWe or greater could cost at least $8 billion, DOE officials have projected the first SMRs will cost approximately $1 billion per 100-150 MWe. When asked about operation and maintenance costs compared to commercial scale reactors, the federally-owned Tennessee Valley Authority (TVA) said it expects it to be higher. The Department of Energy has already provided nearly $200 million for these so-called mini reactors while their commercial viability remains in question. DOE has committed up to $452 million over the next five years to support the licensing and deployment of up to two SMR reactor designs by the Nuclear Regulatory Commission (NRC).

To date, there are no reliable cost estimates for SMRs. Nuclear vendors are notorious for underestimating costs, and there is no actual experience manufacturing or building SMRs. Since the 1950s, the nuclear industry worldwide has consistently pushed for larger reactors on the theory the economics would improve if the high fixed costs of building nuclear plants could be spread over more kilowatt hours. SMRs represent a reversal of this reasoning and call into question the extensive federal support now being offered to promote a “nuclear renaissance” based on standardizing and sticking to a few large reactor designs. While commercial scale reactors of 1,000 MWe or greater could cost at least $8 billion, DOE officials have projected the first SMRs will cost approximately $1 billion per 100-150 MWe. When asked about operation and maintenance costs compared to commercial scale reactors, the federally-owned Tennessee Valley Authority (TVA) said it expects it to be higher. The Department of Energy has already provided nearly $200 million for these so-called mini reactors while their commercial viability remains in question. DOE has committed up to $452 million over the next five years to support the licensing and deployment of up to two SMR reactor designs by the Nuclear Regulatory Commission (NRC).

Federal Subsidies for Small Modular Reactors

Federal support for SMRs is provided through a subsidy program for commercial nuclear power that can be traced back to the 1950s when federal subsidies for nuclear power reached astronomical levels. Not only did the government develop reactor and enrichment technology for the private sector, it also assumed legal responsibility for nuclear waste disposal, something never done for any other industry. In addition, the government issued multimillion-dollar development grants for many reactor technologies (most since abandoned) and distributed research reactors around the world.

At the same time, the U.S. Navy started developing smaller nuclear reactors for naval ships and the Army’s Nuclear Power Program constructed eight experimental mini-reactors for use in rural operations. Since then, interest in using SMRs within the military and for domestic energy applications has grown. From 1999 to 2004, DOE’s Nuclear Energy Research Initiative awarded research and development grants to public, private, and non-profit entities in support of SMR development.

Two federal initiatives currently provide support for the commercialization of SMRs: the recently created DOE Small Modular Reactor Program and the private-public partnership program at DOE’s Savannah River site in South Carolina. To date, nearly $200 million in federal funds have been provided for SMRs through the Small Modular Reactor Program. Congress approved more than $90 million for DOE’s SMR program in FY2012 and nearly the same for FY2013 (See Table 1). The President’s FY2014 budget proposal of $735 million for the Office of Nuclear Energy included another $90 million for SMRs.

Below are brief descriptions of the DOE SMR Program and the Private-Public partnership program at DOE’s Savannah River site.

DOE’s Small Modular Reactor Program

The SMR Program is funded through two separate annual budget lines including: “SMR Licensing Technical Support” and “Reactor Concepts Research, Development, and Demonstration.” The Licensing Technical Support (LTS) program “provide[s] support for design, certification, standards, and licensing.” Moreover, the Advanced Concepts R&D program provides taxpayer support to the nuclear industry through free reactor design and technological development.

In March 2012, the Department of Energy announced a public-private funding opportunity aimed at commercializing SMR technologies through the Licensing Technical Support program. Within the announcement, DOE stated it would select up to two SMR proposals to receive up to $452 million in cost-share funding for reactor licensing support, dependent on Congressional appropriations. The funds are intended to help the SMR designs reach a commercial operation date before 2022. The award period would span five years from 2012 and 2016 and require taxpayers to provide up to 50% of project costs. In response to the funding opportunity announcement, four companies applied: Westinghouse Electric Company, Generation mPower LLC (subsidiary of Babcock & Wilcox and Bechtel Power Corp.), SMR LLC (subsidiary of Holtec International Corp.), and NuScale Power LLC (subsidiary of Fluor Power Corp.) (See Table 2 or Appendix One for more information on individual applicants).

In November 2012, DOE selected Babcock & Wilcox’s (B&W) 180 MWe SMR design and its utility partner, the Tennessee Valley Authority as the first applicant to be awarded cost-share funding. DOE announced that B&W would be awarded at least $150 million over the lifetime of the program. Yet, the final award amount could reach the full $226 million—if appropriated. Babcock & Wilcox announced it had signed a contract with TVA to start preparing an NRC construction permit application for its four proposed reactors at TVA’s Clinch River site in February 2013. Yet, according to the Nuclear Regulatory Commission, TVA initially intended to submit its application in late 2012. A B&W-TVA press release says the companies plan to submit an application in 2015—three years behind schedule.

Due to selecting only one applicant after the first solicitation and lower than expected appropriations, DOE announced a second solicitation in March 2013. The second solicitation would amount to the second half of the total $452 million committed by DOE for the Licensing Technical Support program. In response to the second funding opportunity announcement, all three of the SMR developers that did not get selected under the first solicitation reapplied. As of September 1, 2013, three additional companies have also announced submitting applications: Hybrid Power Technologies, General Atomics (subsidiary of General Dynamics), and National Project Management Corp. (See Table 2 or Appendix One for more information on individual applicants). DOE is expected to announce its selections for the second solicitation in early 2014.

While the first and second solicitations both have the potential to reach a final award of up to $226 million each, stark differences exist between the objectives of the two solicitations. Under the first round, the selected SMR design was required to possess a utility partner and reach a commercialization date before 2022. DOE would support both the SMR design owner and utility partner in gaining both reactor design certification and a combined operating and construction license from the NRC. By contrast, the second round is intended to support only the reactor design certification and does not require the SMR design owner to possess a utility partner for later deployment. The second round also extends the program until 2017 and targets a commercial operation date of approximately 2025.

Savannah River Nuclear Development Site

In March 2012, DOE’s Savannah River site and Savannah River National Laboratory (SRS) signed three Memorandums of Agreement (MOA) for public-private partnerships with small modular reactor companies to commercialize SMR technologies. Located in South Carolina, DOE’s SRS provides support ranging from technology demonstration to design certification and licensing assistance. This support is in addition to the SMR program.

In one Memorandum of Agreement, SRS plans to invite the National Nuclear Security Administration (NNSA) to discuss incorporating mixed oxide fuels (MOX) into SMR LLC’s design. When soliciting proposals for public-private partnerships, SRS said it intends to develop SMR designs that are capable of using fuel based from surplus plutonium and spent reactor fuel as a potential alternative to storing spent nuclear fuel at Yucca mountain.

Created in 1950, the federally-owned, privately-managed Savannah River complex was established to manufacture materials needed for nuclear weapons development during the Cold War. Since then, the 310-square mile complex has ceased producing weapons materials and housed much of DOE’s experimental nuclear research and development including mixed oxide fuels, environmental management, and waste storage technologies to the benefit of private industry. Savannah River has an annual budget of approximately $2.5 billion.

Current Applicants Seeking Federal Subsidies

Eight small modular reactor companies have applied for support from DOE to date, but none of the different reactor designs have been licensed by the NRC. NRC and DOE aim to award the first design certification license by 2018 and final combined construction and operating license by the early 2020s. Currently, all companies are in the pre-application phase with NRC working towards initial design certification.

The majority of the SMR designs would develop an integral pressurized light water reactor (iPWR) while others would develop a fast neutron reactor (FNR), combined FNR and high-temperature reactor (HTR), or a hybrid helium gas reactor with a fossil fuel-fired combustion turbine (Hybrid). (See Table 2 or Appendix One for more information on individual applicants)

NRC Not Ready For SMRs

The United States Nuclear Regulatory Commission has stated it is not fully prepared to license SMRs. In 2008, NRC estimated it would have a regulatory review process in place to license the first SMRs within five years. However, in May 2012 the NRC stated “If an appreciable fraction of total SMR initiatives materialized, it would create an untenable situation for the NRC.”

This is because the regulatory framework for licensing SMRs does not fully exist. It has yet to be determined whether many of the proposed qualities of SMRs, such as generation capacity, modularity, and security features, are covered under the current licensing process for new nuclear reactors. Most of all, NRC hasn’t decided whether it will license individual reactors or issue a combined license for a multi-reactor facility—for example General Atomics’ ’four pack’ or NuScale’s ’twelve-pack.’ In December 2012, NRC projected to complete certification for B&W, NuScale, and Westinghouse’s reactor designs in 2017, however, as of July 2013, the timelines for those certifications are listed as ‘Under Review.’

There are questions whether NRC will uphold current regulatory standards for SMRs. The Nuclear Energy Institute (NEI) argues NRC should reduce decommissioning cost assurances (i.e. funds set aside for cleanup after the reactor is shut down); annual fees paid to NRC; the number of control room operators on site; and insurance requirements in the event of a nuclear accident.

“The current insurance and indemnity requirements … for multiple reactor modules that collectively exceed 100 MWe may not provide adequate assurance to the public that all claims resulting from a nuclear incident at such a facility would be compensated.”

– Michael Johnson, Director of Office of Nuclear Reactors, NRC. SECY-11-0178. December 2011.

Under current law, SMR operators would provide the same decommissioning cost assurances as all other U.S. reactors. NEI proposes SMR operators apply for a short-term exemption and ultimately change the law in the long term. Under the Omnibus Budget Reconciliation Act of 1990, all nuclear reactor licensees are also required to pay an annual fee that makes up the majority of NRC’s budget authority. This fee is divided equally among the nation’s 100 nuclear reactors. NEI proposes changing this requirement and linking annual fees to output levels, which would significantly reduce rates for SMR operators.

Questions about safety and security requirements have also been raised. Since many of the SMR designs being developed include “passive safety” features, industry is in discussions with NRC about adjusting requirements. Proposals include reducing the required number of plant operators on site and decreasing the size of the emergency planning zone. Reducing security checkpoints at SMR plants is also being considered as a cost-cutting effort.

Although significantly smaller than traditional reactors, SMRs will still require significant insurance in the event of an accident. New nuclear reactors are currently covered by the Price-Anderson Act for accidents valued at more than $12.6 billion. Price-Anderson may fall dramatically short in the case of SMRs, however. Under the Act, reactors that produce 100 MWe or greater must hold the maximum amount of private insurance available ($375 million) as well as a “retrospective insurance plan.” Smaller reactors producing less than 100 MWe must also hold the maximum amount of private insurance (between $4.5 and $75 million), but are not required to hold the additional plan. Multi-reactor facilities consisting of reactors between 100 MWe and 300 MWe that produce less than 1300 MWe are treated as a single entity for insurance purposes. The Act does not address combinations of reactors under 100 MWe, such as Gen4 or Fluor’s reactor designs, or potential combinations of reactors with fossil fuel-fired facilities.

Summary: Taxpayer Concerns

In these tight budget times, federal taxpayers cannot afford yet another giveaway to the heavily-subsidized nuclear power industry. Continued taxpayer support for SMR licensing in addition to R&D giveaways amounts to just another subsidy in a suite of federal supports for the nuclear industry. More than 100 reactors operated by 30 companies exist in the United States; the nuclear industry, not federal taxpayers, must lead the way if SMRs are to reach commercial viability.

Even the nuclear industry has said they can move forward without subsidies. Senior Vice President of Holtec International Pierre Oneid said his company aims to commercialize its SMR design whether or not it receives a federal cost-share subsidy.

– James Hammond. “Holtec, NuHub to Partner on Small Reactor Grant.” GSA Business. April 2012.

In the Department of Energy’s materials on SMRs, the agency argues there is a “need and a market” in the United States for SMRs. In reality, no one is clamoring to buy an SMR because there is no assurance the electricity will be remotely competitive with power from other sources. New nuclear power today is uncompetitive by a very wide margin. To compete with today’s natural gas prices, SMRs would have to produce electricity at half the projected cost of conventional reactors. There is not the slightest indication they can do so.

During times of economic stress, the nuclear industry has a tradition of rushing forth to proclaim a new technology just around the corner that will sweep current problems aside. Unfortunately, these visions have an equally long tradition of expensive failure, most often at taxpayers’ expense. The Department of Energy’s efforts to spend taxpayer dollars on small modular reactors will simply continue this legacy of failure and must be rejected.

For more information, please contact Autumn Hanna at (202) 546-8500 x112 or autumn[at]taxpayer.net

Appendix One: Company Profiles

Babcock and Wilcox Company

Generation mPower, LLC (GmP) is a jointly-owned subsidiary of Babcock & Wilcox Nuclear Energy Inc. (B&W) and Bechtel Power Corporation. Established in 1867, B&W is a public utility component manufacturer and government contractor based in Charlotte, NC with more than 12,000 employees. B&W made nearly $170 million in net profits in 2011. Bechtel is one of the largest engineering and construction companies in the United States with more than 50,000 employees. Founded in 1898, Bechtel Power Corporation is headquartered in San Francisco, CA.

GmP was founded in 2010 and intends to commercialize its 180 MWe small modular reactor by October 2021. GmP is partnering with the federally-owned Tennessee Valley Authority (TVA) which aims to construct a ‘four pack’ of SMRs at TVA’s Clinch River site in Tennessee. Prior to these plans, GmP had intended to construct up to six reactors the TVA site and reach a commercial operation date by 2018, however Gmp altered it plans in 2012—dependent on plant licensing from NRC. GmP’s reactor is proposed to be 83 feet tall by 13 feet wide, have a four-year refueling lifecycle, and construction period of three years. As of May 2012, more than $200 million has been spent on the development of GmP’s SMR design. Most recently, GmP signed a contract with TVA to start preparing the NRC construction permit application for the proposed reactors at TVA’s Clinch River site. GmP aims to submit its design certification application in 2014.

Babcock & Wilcox has designed and built seven of the 100 current operating nuclear reactors in the United States. TVA currently operates six commercial reactors and will advise GmP throughout the NRC licensing process. According to a recent presentation, TVA has been working on the commercialization of SMRs since 2009. GmP’s plans are backed by the Generation mPower Industry Consortium and advisory council—a collection of more than a dozen public utility suppliers.

Fluor Power Corporation

NuScale Power, LLC is a majority-owned subsidiary of Fluor Power Corporation with close ties to the Idaho National Engineering and Environmental Laboratory (INEEL) and Oregon State University (OSU). Founded in 1912, Fluor is a global engineering and construction company headquartered in Irving, TX. Fluor has more than 43,000 employees worldwide and net profits of nearly $600 million in 2011. Overall, Fluor’s largest contribution to the project has been providing $30 million to NuScale (simultaneously becoming a majority owner) for continued research and development in 2011. Fluor itself has little or no experience designing nuclear reactors.

Founded in 2007, NuScale Power LLC aims to commercialize its 45 MWe reactor by 2024 —five years later than initially proposed. NuScale’s SMR design is a product of a more than decade long partnership between the federally-managed Idaho National Engineering and Environmental Laboratory and Oregon State University—dating back to 2000. Soon after the company was founded, NuScale was awarded exclusive rights to the SMR design which had been developed through this partnership with funding from DOE. Soon after, NuScale signed a memorandum of understanding with Kiewit Contractors Company that Kiewit will provide construction services once NuScale’s SMR design has been approved by NRC. As of February 2012, approximately $130 million has been spent on the development of NuScale’s SMR design.

NuScale is one of three companies awarded a public-private partnership to commercialize its SMR design at DOE’s Savannah River site in South Carolina. Once NuScale has demonstrated its 45 MWe reactor, it intends to build a ’twelve pack’ to produce a total of 540 MWe at one facility. In one 2008 presentation, NuScale proposed combining up to 30 reactors at one facility. NuScale’s 45 MWe SMR design is proposed to be 65 feet high by 14 wide, last up to 60 years, and have a two-year refueling interval.

NuScale’s plans are backed by a Customer Advisory Board, a collection of more than a dozen public utility suppliers and organizations, and the Western Initiative for Nuclear, a coalition of Western Governors, Energy Northwest, and the Utah Association of Municipal Power Systems. Recently, Rolls-Royce announced its support for NuScale’s SMR design as well.

*Noteworthy: Fluor Corporation is a joint-owner of the corporation (Savannah River Nuclear Solutions, LLC) that manages and operates the Savannah River site facilities.

Gen4 Energy Incorporated

Founded in 2007 and headquartered in Denver, Colorado, Gen4 Energy Inc. (formerly Hyperion Power Generation Incorporated) is a private company focused on commercializing its 25 MWe small modular reactor design. A participant in DOE’s Technology Transfer Program, Gen4 SMR design is the sole product of the federal Los Alamos National Laboratory (LANL). Exclusive rights to the 25 MWe reactor design developed by LANL were awarded to Gen4 soon after it was founded and nearly a dozen LANL employees continue to work on SMR design today.

Gen4 is one of three companies with a public-private partnership agreement with DOE’s Savannah River Site to commercialize its small modular reactor design. Gen4’s design is the smallest of the federally supported SMR designs, describing its reactor as “about the size of a typical backyard hot tub.”

Unlike the other four applicants, Gen4 announced in early 2012 it would not pursue DOE’s SMR cost-share funding opportunity. “While we will not pursue the Licensing [public-private partnership], we are excited to continue our work under our Memorandum of Agreement with DOE to deploy our advanced reactor at Savannah River,” stated David Carlson, Gen4 Energy’s Chief Operating Officer. Gen4’s reactor design is proposed to last ten years after which the entire reactor module must be replaced.

Holtec International Incorporated

SMR, LLC is a wholly-owned subsidiary of Holtec International Incorporated. Established in 1986 and headquartered in Jupiter, FL, Holtec is a public utility components manufacturer specializing in waste storage facilities with operations worldwide. While Holtec is a global leader in power plant waste management and has supported the construction of nuclear reactors in the past, it has little to no experience designing nuclear reactors.

Founded in 2011, SMR LLC aims to apply for design certification in 2016 and commercialize its 160 MWe reactor in the mid-2020s. In addition to the cost-share funding opportunity, SMR LLC is one of three companies awarded a public-private partnership to further develop its reactor design at DOE’s Savannah River site in South Carolina. Notably, within SMR LLC’s memorandum of agreement with DOE, the company agrees to discuss incorporating MOX fuel into its design with the National Nuclear Security Administration. SMR LLC’s reactor is proposed to have a four-year refueling cycle and last up to 80 years. Most recently, Holtec altered its reactor design to decrease generation capacity to 145 MWe and refueling intervals of three years.

SMR LLC’s plans are supported by the State of South Carolina, NuHub, URS Corporation, CB&I, SCE&G, PSEG Power, Exelon, Entergy, and First Energy which have agreed to share operation responsibilities if and when the demonstration project is constructed.

Westinghouse Electric Company

Formed in 1886, Westinghouse Electric Company is a service provider to nearly every corner of the nuclear power industry. Westinghouse is a subsidiary of Toshiba Nuclear Energy Holdings Inc. with more than 14,000 employees and is headquartered in Monroeville, PA with operations worldwide. Westinghouse has significant experience designing and building nuclear reactors. Currently, 48 of the 104 operating nuclear reactors in the United States have been designed and built by Westinghouse with another 14 proposed reactors under consideration.

Westinghouse announced plans in February 2011 to commercialize its 225 MWe small modular reactor by 2021. The design is largely based off Westinghouse’s AP1000 reactor design which was approved by the Nuclear Regulatory Commission in December 2011. Westinghouse’s SMR design is proposed to be 89 feet tall by 39 feet wide, have a refueling period of two years, and a lifespan of 60 years. In addition to power generation for public utilities, Westinghouse envisions its SMRs to supply on-site power for coal-to-liquid operations, as well as tar sands and oil shale development operations. Prior to current plans, Westinghouse had initially planned develop a 200 MWe reactor design. Westinghouse aims to submit its design certification application in September 2013.

Westinghouse intends to build its first SMR in partnership with public service utility Ameren Missouri, at Ameren’s Callaway Energy Center. Westinghouse’s plans are also backed by Burns & McDonnell, General Dynamics Electric Boat, and the “NexStart SMR Alliance”—a coalition of more than a dozen public utility suppliers.

In May 2013, Westinghouse announced plans to partner with China’s State Nuclear Power Technology Corporation (SNPTC) to accelerate deployment of its SMR design in the U.S. and China. SNPTC will lead efforts to license Westinghouse’s SMR design in China.

Hybrid Power Technologies

Since its formation in 2005, this private company based in the Kansas City, KS has been developing the technology and design for hybrid power plants that use both nuclear and fossil fuel sources.

In its SMR design, Hybrid Power Technologies (HBT) proposes using a 600 MWt graphite-cooled thermal reactor to power a 1000 MWt integrated combined cycle gas turbine (CCGT). HBT’s design aims to improve the efficiency of a traditional CCGT by mitigating the energy normally lost by the process of running a gas turbine. The entire unit is expected to have 52% net efficiency and generate 850 MWe of power —300 MWe of which would be generated from the small modular reactor.

The size of HBT’s SMR design makes it considerably less ‘modular’ than others. As a result, the company proposes using barges, compared to rail or truck delivery systems, to transport the parts needed to construct its 170 ft. tall unit. The SMR is estimated to cost $1.388 billion and have a life span of 40 years.

General Dynamics Corporation

Established in 1955 and based in San Diego, CA, General Atomics (GA) is a subdivision of General Dynamics, one of the world’s largest technology developers. General Dynamics has averaged more than $1.9 billion in profits over the past five years.

Since the 1980s, General Atomics has attempted to commercialize a gas-turbine modular helium reactor with a generation capacity of approximately 240 MWe to no success. GA has also proposed a smaller version of this reactor called the remote-site modular helium reactor with a generation capacity of 10-25 MWe, but the design remains in the research and development phase. Lastly, GA is well known within the nuclear power industry for its 16 MWe research reactor that has operated at many sites around the world for nearly 50 years.

In February 2010, General Atomics announced a modified version of its long researched gas-turbine modular helium reactor. With the new design, estimated at $1.7 billion, GA applied for the second round of DOE SMR licensing support. Approximately the “size of a school bus,” the reactor would generate 265 MWe with the option of combining four reactors at a single facility to potentially produce 1060 MWe. The reactor proposes to use reprocessed nuclear waste, such as depleted uranium, and plutonium to power its reactor.

GA is partnering with Chicago Bridge and Iron Company, Mitsubishi Heavy Industries, and the Idaho National Laboratory to commercialize its small modular reactor design. GA’s SMR design would have a 42 month construction timeline and a 30 year refueling period.

National Project Management Corporation

Recently formed and headquartered in Oswego, NY, National Project Management Corporation (NPMC) is a private company that proposes to commercialize its 165 MWe small modular reactor design with the support of multiple domestic and international entities. Acting as a U.S. representative for an international consortium, NPMC announced in late July 2013 that it had applied for the maximum DOE cost-share subsidy.

NMPC proposes to commercialize a gas-turbine modular helium reactor (GT-MHR). Similar to the General Atomics’ proposed GT-MHR design, NMPC’s SMR design proposes to use nuclear waste to power its reactor.

From the early 1990s through the 2000s, South Africa and several industry partners attempted to commercialize the pebble bed modular reactor, but the project was cancelled in 2010. The project lacked a customer, consistently missed deadlines, and would have cost an estimated $4.2 billion more to complete on top of the $1.3 billion the partners had already spent.

NPMC is partnering up with Pebble Bed Modular Reactor Company (subsidiary of Eskom), National Grid Plc based in the United Kingdom, the New York state government, the City of Oswego, the Port Authority of Oswego, Empire State Development, and the New York State Energy Research and Development Authority. NMPC’s SMR would be constructed in Oswego, NY where it could be transported by rail or ship across the U.S. and worldwide. In addition to federal support, New York State has committed nearly $300 million to the development of NPMC’s SMR design.

Appendix 2: Legislation

In the 112th Congress, six pieces of legislation were introduced in order to provide federal support for small modular reactors. Most notably, Senator Mark Udall (D-CO) introduced the Nuclear Energy Research Initiative Improvement Act of 2011 (S. 1067) that would have earmarked $250 million to SMRs between 2012 and 2016. Furthermore, three of the six bills call for public-private cost-share agreements as the main funding mechanism for a small modular reactor program. Below are brief summaries of each piece of legislation.

- November 1, 2011 – Rep. Thomas Rooney (R-FL) – H.R. 3302: Restore America Act of 2011

- Rep. Rooney’s bill would require the Nuclear Regulatory Commission (NRC) to provide a report to Congress with policy recommendations for streamlining licensing of SMRs and then administer those recommendations within one year. The bill had no cosponsors.

- June 16, 2011 – Sen. Kent Conrad (D-ND) – S. 1220: Fulfilling U.S. Energy Leadership Act of 2011

- Sen. Conrad’s bill would require NRC to establish a program to streamline the licensing of a standard SMR design through public-private cost-share agreements within ten years. The bill had no cosponsors.

- June 3, 2011 – Rep. Jim Matheson (D-UT) – H.R. 2133: FUEL Act

- Rep. Matheson’s bill would require DOE to carry out a SMR RD&D program to support the commercialization of SMRs through public-private cost-share agreements. The bill had no cosponsors.

- May 25, 2011 – Sen. Mark Udall (D-CO) – S. 1067: Nuclear Energy Research Initiative Improvement Act of 2011

- Sen. Udall’s bill would require DOE to carry out a nuclear RD&D program including SMRs with annual appropriations of $50 million for five years, totaling $250 million. The bill had three cosponsors: Sens. Jeff Bingaman (D-NM), Lisa Murkowski (R-AK), and Amy Klobauchar (D-MN).

- March 8, 2011 – Sen. Jeff Bingaman (D-NM) – S. 512: Nuclear Power 2021 Act

- Sen. Bingaman’s bill would require DOE to carry out a SMR RD&D program to support the commercialization of two SMR reactor designs through public-private cost-share agreements so industry can obtain a design certification NRC by January 1, 2018. The bill had seven cosponsors: Sens. Mary Landrieu (D-LA), Lisa Murkowski (R-AK), Mark Pryor (D-AR), Mark Udall (D-CO), Michael Crapo (D-ID), James Risch (R-ID), and Roy Blunt (R-MO).

- March 3, 2011 – Rep. Devin Nunes (R-CA) – H.R. 909: Roadmap for America’s Energy Future

- Rep. Nunes’ bill—similar to Rep. Rooney’s bill—would require NRC to provide a report to Congress with policy recommendations for streamlining licensing of SMRs and then administer those recommendations within one year. The bill had 73 Republican cosponsors.

Get Social