The third quarter of 2013 brought more multi-billion dollar profits for the oil and gas industry. So far this year, just six of the largest oil companies recorded more than $82 billion in profits—making it still one of the most lucrative industries in the world. The industry as a whole spends on average $300,000 per day lobbying Congress and employs more than 700 lobbyists, more than one per member of Congress. Not surprisingly, U.S. taxpayers continue to subsidize the oil industry despite their billion-dollar profits.

Profits and Investment Healthy

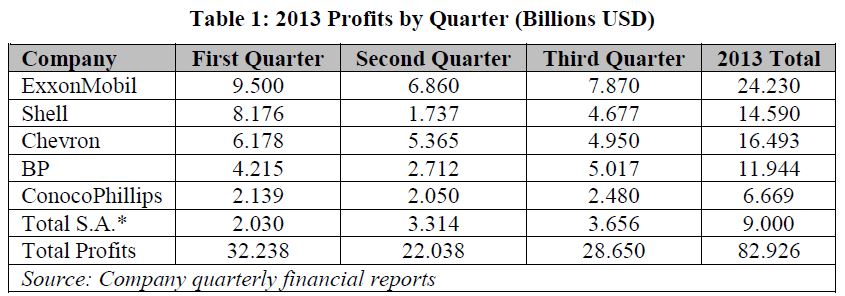

The oil industry continues to post healthy profits. ExxonMobil reported $7.9 billion in profits during the last quarter, equal to an average of $87 million in profit per day. Chevron and BP both reported close to $5 billion in profits, and Shell earned $4.7 billion. Total S.A. reported $3.7 billion during the third quarter, and ConocoPhillips reported $2.5 billion. So far this year, these six companies have earned more than $82 billion in profits. For a breakdown of the companies’ profits by quarter, see Table 1.

Big Oil is investing record levels in exploration and development. So-called “mega-projects” have begun in regions like the Arctic previously thought to be “too remote or risky.” Shell expects to spend $45 billion on exploration in 2013, which will mark its “peak investment” year. ExxonMobil has spent $33 billion on exploration in the first nine months of the year. And BP, with nearly $12 billion in profits this year, plans to complete 18 new wells in November.

Federal Subsidies Continue

From preferential treatment in the tax code to insurance liability caps, the oil industry still enjoys significant taxpayer subsidies. Our Green Scissors 2012 report identifies more than a dozen subsidies for oil and gas companies. Repealing the percentage depletion deduction, which allows independent producers a flat deduction of gross income from each well, would save the federal government $5.3 billion from 2012-2017. Repealing the last-in, first-out method of inventory for oil, natural gas, and coal companies would generate $18.3 billion in revenue for the federal government for the same period. If Congress repealed the deduction for intangible drilling and development costs in the case of oil and natural gas wells it would produce $8.4 billion in added revenue.

Oil Industry Spends More than $300,000 per Day on Lobbying

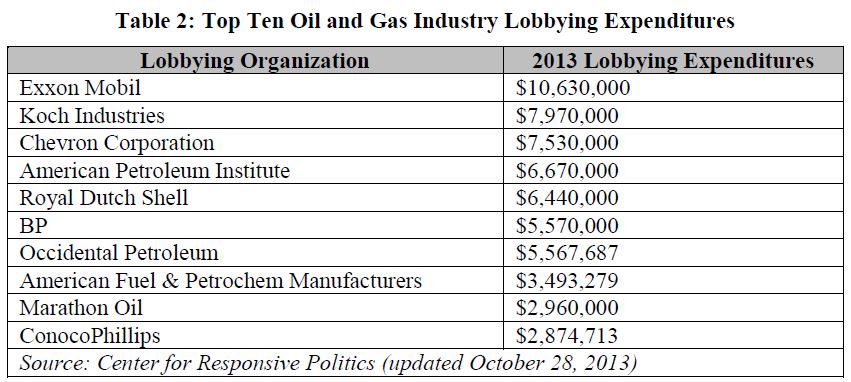

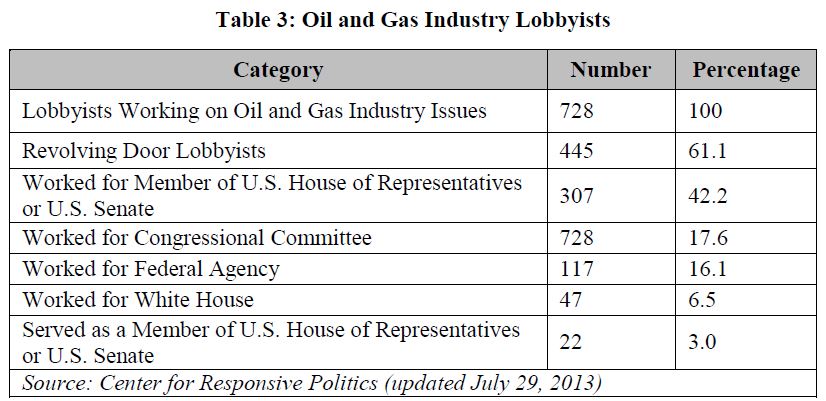

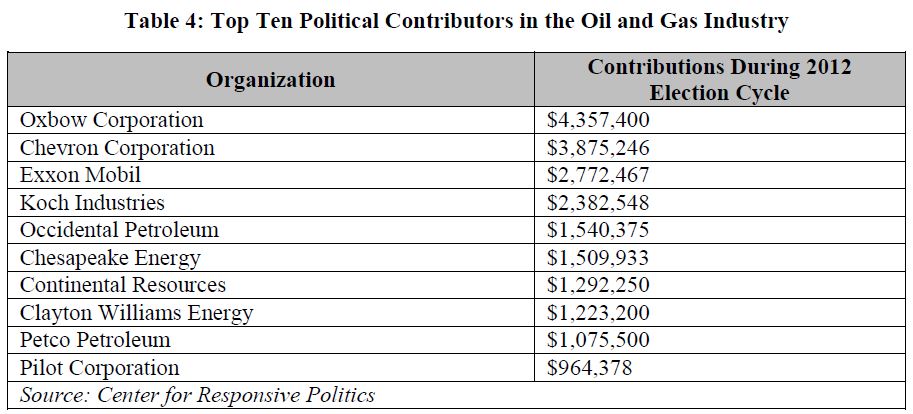

The oil and gas industry spent $141 million lobbying in 2012. So far in 2013, the industry has spent $105.2 million according to the Center for Responsive Politics on lobbying, equal to more than $300,000 per day (See Table 2). Of the 728 lobbyists working for the oil industry, 445 (61 percent) of them are so-called revolving door lobbyists, that is, individuals who have formerly worked in Congress, for the federal government, the White House, or even served as former Members of the U.S. House of Representatives or U.S Senate (See Table 3). During the 2012 election cycle, the oil and gas industry also spent $72.9 million on political contributions, and it has spent $9.9 million in campaign contributions so far this year (See Table 4).

Endless Giveaways to Profitably Companies Must Stop

For nearly a century, the oil and gas industry has enjoyed billion in taxpayer subsidies, while its profits and influence on Congress have soared. The endless cycle of profits, lobbying, and costly taxpayer subsidies must stop. With a near $17 trillion national debt and substantial budget deficits, taxpayers cannot afford to be handing out wasteful and market-distorting subsidies. Congress should act to hold the mature and profitable oil and gas industry accountable for paying its fair share and end these needless giveaways.

For more information, contact Autumn Hanna at (202) 546-8500 x112 or autumn@taxpayer.net.