Since its creation in 1975, the Earned Income Tax Credit (EITC) has quietly become one of the federal government’s most effective anti-poverty programs. Designed as a tax credit for low- and moderate-income workers, particularly those with children, it delivers financial support through the tax code rather than a direct government check. The idea—bipartisan from the start—was to reward work, reduce poverty, and help families get ahead without bloating bureaucracy.

Unlike many tax provisions, the EITC doesn’t just reduce the amount of taxes owed—it can result in a refund even if no income tax is due. This can encourage work, even at very low income levels. The amount of the credit depends on income, marital status, and number of qualifying children, phasing in as earnings rise, plateauing at a maximum benefit, then phasing out as income grows beyond eligibility thresholds. For families with children, it can amount to several thousand dollars per year. For workers without children, the benefit is far smaller but still provides a modest boost to take-home pay.

That structure has made the EITC both popular and effective—but also vulnerable to error. As eligibility hinges on specific income thresholds and nuanced definitions of family relationships, even small mistakes can lead to incorrect payments. And over time, those mistakes have added up. For decades, the program has faced persistent trouble with improper payments—essentially, errors in who gets the credit and how much they receive. According to the Congressional Research Service, the error rate hasn’t dipped below 23.4% since 2003. In FY2022, the IRS estimated that about 32.7% of EITC payments were incorrect, amounting to nearly $18 billion.

These aren’t usually cases of fraud. Most errors come from honest confusion over eligibility rules—particularly who counts as a “qualifying child.” Relationship status, residency, and income limits are easy to get wrong on a filing, and many tax filers don’t have professional help. But even with good intentions, that kind of error rate is unsustainable—for taxpayers footing the bill and for a system that depends on public trust.

In the latest House-passed reconciliation bill, lawmakers propose several administrative changes to the EITC to address these longstanding issues. The headline provision is a new pre-certification process: starting in 2028, families would need to verify a child’s eligibility for the credit before filing their taxes. That means providing documentation up front to confirm a child’s relationship, age, and residency.

The bill would also expand the IRS’s authority to more easily reject duplicate or obviously flawed claims during the processing stage. And it creates a Treasury Department task force focused on improving data collection and reducing improper payments. Notably, these are administrative changes—there’s no reduction in the value of the credit itself.

Some critics see a different picture, warning that the added paperwork will make it even harder for working families to access the credit. They argue that one in five eligible workers already miss out on the EITC because of complexity and cost—and that layering on more red tape could turn a solvable problem into a structural barrier.

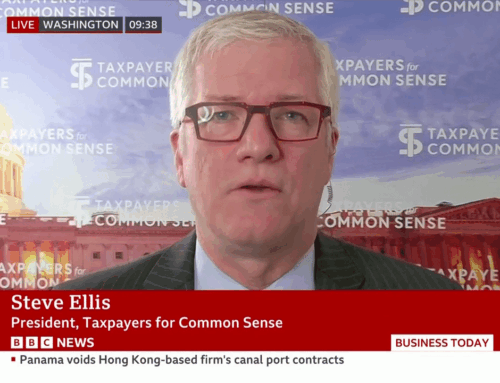

They’re not wrong about the challenge. But that doesn’t mean the status quo is defensible. A 30% error rate is a flashing red light. If any other federal program—defense contracts, crop subsidies, or highway funds—routinely sent nearly one in three dollars to the wrong place, there’d be bipartisan outrage.

We see the proposed reforms as an attempt to strike a balance. Fixing the EITC’s error problem doesn’t require gutting the program, just making it work better. Pre-certification may sound heavy-handed, but it appears to be an effort to move verification to the front end of the process rather than relying on costly audits after the fact. Done right, it could reduce improper payments and help more families claim the credit they’re actually owed.

But enforcement alone isn’t enough. Outreach and assistance are just as critical to helping eligible families navigate the system and get the benefits they’ve earned. That’s hard to do when Congress is simultaneously slashing IRS funding. The agency can’t be expected to run a more robust and accurate program with one hand tied behind its back. If lawmakers are serious about reducing improper payments and helping working families, they need to fund the infrastructure that makes it possible.

This isn’t a call to scale back the EITC. It’s a call to make it smarter. The credit should remain a cornerstone of pro-work, anti-poverty policy. But it must also be accountable—to recipients, to administrators, and to the taxpayers who fund it.