On June 16, the Senate Finance Committee released the tax portion of the FY2025 budget reconciliation bill, known as the One Big Beautiful Bill Act. The Joint Committee on Taxation released their score on the costs of these tax provisions under ‘current policy’ scoring—they estimated that the tax provisions would only cost $441 billion based on the assumption that expiring TCJA provisions would be extended. In reality, the Senate Finance Committee proposal would cost well over $4 trillion over the next decade.

Similar to the House-passed bill, the majority of the bill’s cost comes from the extension of tax credits included in the Tax Cuts and Jobs Act of 2017. That price tag comes with a stark trade-off. The Finance draft preserves the priciest pieces of the 2017 tax law, sweetens biofuel (45Z) and carbon-capture (45Q) breaks, and lets oil-and-gas producers deduct drilling costs under the new minimum tax. To offset even a fraction of the cost, it would slash or kill nearly every Inflation Reduction Act credit—electric-vehicle, hydrogen, wind, solar, and manufacturing incentives—while layering on intricate foreign-entity rules that risk slowing investment more than stopping unwanted foreign influence. The net result is trillions in new debt, a thinner toolkit for cutting emissions, and a tax code tilting back toward legacy fuels.

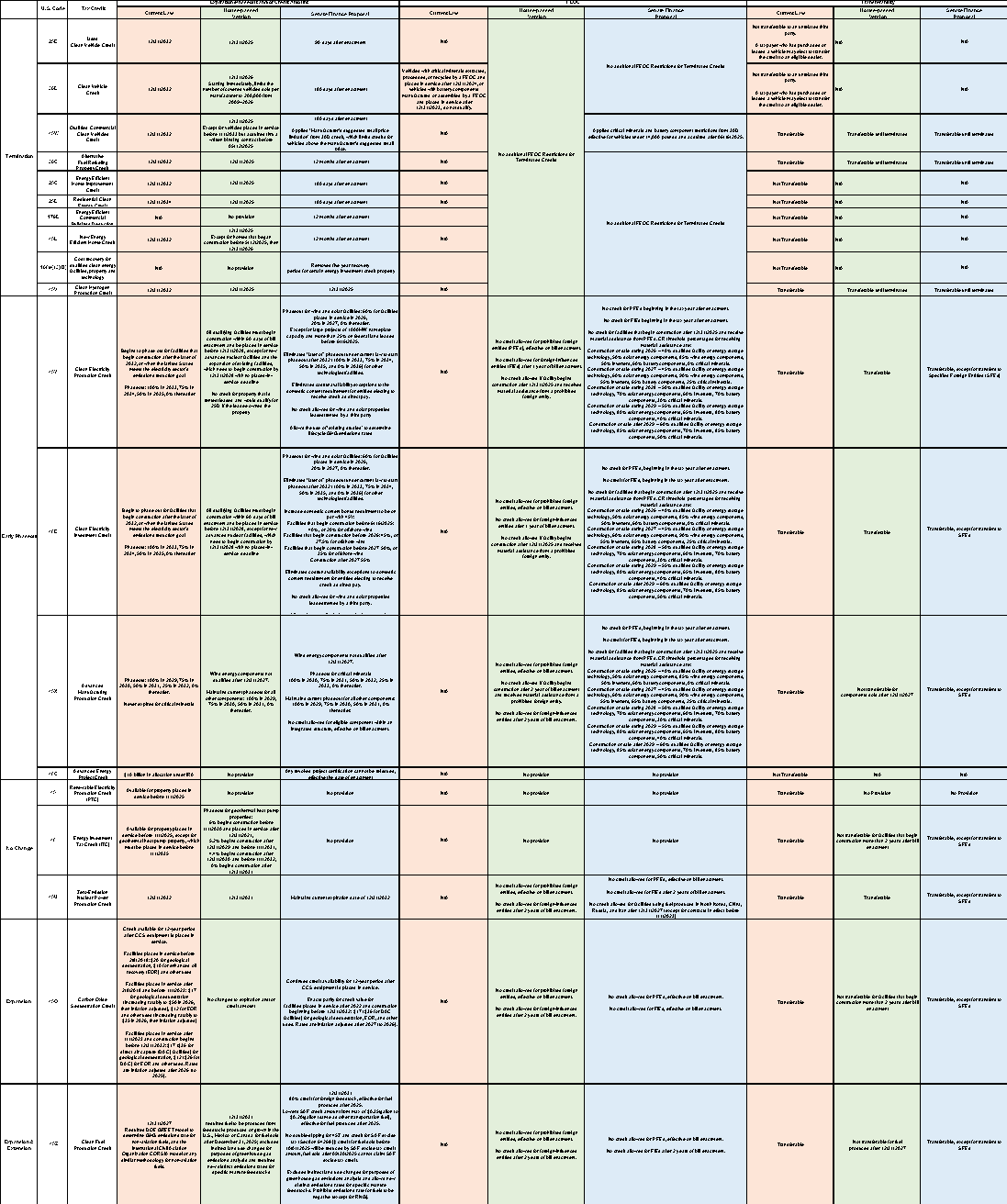

Summary of Energy Tax Provisions in the Senate Finance Proposal

Expansion and Extension of the 45Z Clean Fuel Production Credit

The Section 45Z Clean Fuel Production Credit is a per-gallon biofuel tax credit designed to subsidize production of transportation fuels with low or no greenhouse gas (GHG) emissions. This credit came into effect at the beginning of 2025 and is intended to replace a suite of recently expired biofuel tax credits (Section 40, 40A, 40B, 6426, and 6427). The Senate Finance proposal would extend the expiration date of Section 45Z from the end of 2027 to the end of 2031, as well as lessen lifecycle GHG assessment standards. The latter change would significantly broaden eligibility for the credit and effectively allow first-generation, food-based biofuels like corn ethanol and biodiesel to qualify. The draft text would allow the use of distinct emissions rates for each feedstock and specifically prohibits negative emission rates, except for renewable natural gas.

The Senate proposal would also reduce the credit by 20% for fuels produced using foreign feedstock after 2025. It would end the double-dipping of 45Z and the Sustainable Aviation Fuel (SAF) excise tax credit under Section 6426(k) and established parity between and other transportation fuel under 45Z (SAF is currently eligible for a maximum credit of $0.35 per gallon, whereas other fuels are only eligible for a maximum credit of $0.20 per gallon).

According to the Joint Committee on Taxation (JCT) score of the Senate Finance proposal, the extension and expansion of 45Z would cost taxpayers $57 billion from FY2025 to FY2034.

Expansion of the 45Q Carbon Oxide Sequestration Tax Credit

Structured like a carbon production tax credit, Section 45Q provides a credit for every ton of carbon dioxide (CO₂) captured from power plants or other industrial sources and permanently stored underground in geological formations. The IRA expanded and extended the credit by lowering the minimum capture threshold, increasing the credit amount, and extending eligibility to facilities that begin construction before the end of 2032. The Treasury Department estimates that 45Q will cost taxpayers $36.2 billion over FY2024-FY2033.

Under current law, facilities that are placed in service after 2022 can claim $17 ($36 in the case of a direct air capture, or DAC, facility) for every ton of carbon captured and then stored in geological sequestration, and $12/ton (or $26/ton in the case of a DAC facility) if carbon is used for enhanced oil recovery (EOR) or other uses. EOR is a technique that boosts production by injecting carbon into depleted wells to eke out more oil and gas. The credit amount is inflation-adjusted and can be multiplied by 5 if certain prevailing wage and apprenticeship requirements are met. The Senate proposal would increase the credit amount for EOR and other uses to $17/ton ($36/ton in the case of a DAC facility) for facilities placed in service after 2022.

JCT estimates that this expansion of 45Q (combined with the effect of the foreign entity of concern restrictions) would cost taxpayers an additional $14.2 billion over the next decade.

No Changes to Section 45U Zero-Emission Nuclear Power Production Credit

The Section 45U Zero-Emission Nuclear Power Production Credit provides up to $15 per megawatt-hour (MWh) of electricity produced and sold by qualifying nuclear power facilities, with the credit reduced for plants that earn more income from electricity sales. The credit applies to electricity produced after calendar year 2023 and is currently set to expire at the end of 2032. The Joint Committee on Taxation (JCT) estimated it would cost taxpayers $30 billion from FY2022 to FY2031.

The Senate proposal does not include any changes to the Section 45U credit amount or expiration date, but does impose some foreign entity of concern (FEOC) restrictions that also applies to another credit (see FEOC explanation below). It would also disallow credits for facilities using fuel produced in North Korea, China, Russia, and Iran after 2027 (except for contracts in effect before 2023).

No Changes to Section 45 and Section 48 Renewable Energy Production and Investment Tax Credits

The Senate proposal does not include any provisions related to the Section 45 and Section 48 Renewable Energy Production and Investment Tax Credits, which generally expired at the end of 2024 (except for geothermal heat pumps for the purpose of Section 48, which have a placed-in-service deadline of 1/1/2035). The credits have been largely replaced by the technology-neutral clean electricity production and investment tax credits—Section 45Y and Section 48E. (see changed to 45Y and 48E below)

Special Tax Treatment of Carbon Capture, Hydrogen Storage, Advanced Nuclear, Hydropower, and Geothermal Energy-Related Income

Under current law, Publicly Traded Partnerships (PTPs) whose interests are traded on public exchanges are generally taxed as corporations. However, if at least 90 percent of a PTP’s gross income comes from qualifying sources—such as rents, gains from the sale of real properties, or income from the exploration, production, processing, refining, transportation, or marketing of minerals or natural resources (including industrial source CO₂ and biofuels)—it can be treated as a partnership instead. This allows the entity to avoid corporate-level taxation by passing through its income to partners.

The Senate proposal includes a provision that would allow income to be considered “qualifying income” for PTPs:

- transportation and storage of hydrogen;

- generation of electricity or capture of carbon dioxide at certain carbon capture and storage (CCS) facilities;

- generation of electricity from hydropower, advanced nuclear, and geothermal energy;

- operation of property to produce, distribute or use energy produced from geothermal deposits.

For CCS facilities that meet the minimum capture threshold under Section 45Q, income from electricity generation (for power plants), electricity storage, or carbon capture itself would qualify for the credit as long as the facility captures at least 50 percent of its carbon output.

This expansion of PTP qualifying income would cost taxpayers over $3.2 billion from FY2025 to FY2034.

Allowing Intangible Drilling and Development Costs Deductions for the Purpose of Computing Corporate Alternative Minimum Tax

Under current law, the corporate alternative minimum tax (CAMT) imposes a 15% minimum tax on the adjusted financial statement income (AFSI) of large corporations with an average annual financial statement income exceeding $1 billion, effective in 2023. Corporations pay the larger of the minimum tax or the regular corporate tax, which is set at 21% and includes any additional tax from the base erosion and anti-abuse tax (BEAT). The AFSI allows for tax depreciation, net of operating losses, and other adjustments that reduce the base of the CAMT.

The Senate Finance proposal would allow operators of oil and gas and geothermal wells to deduct intangible drilling costs (IDCs) from AFSI when calculating CAMT, without any regard for depletion expenses that are taken into account in the financial statement with respect to IDC. Expensing of IDCs is a long-standing oil and gas subsidy established in 1913 that allows all of the non-salvageable costs for drilling an oil or gas well (e.g. wages, fuel, and drilling sit preparation) to be deducted the year these costs are incurred, while other industries must expense costs slowly over the life of an asset.

This provision would effectively allow oil and gas drillers to avoid the CAMT altogether. Although the JCT estimates that this provision would cost $427 million over the next decade, a prior JCT analysis of the H.R. 662 Promoting Domestic Energy Production Act, a bill that includes the same provision, found that allowing IDC to be deducted for purpose of determining CAMT would cost taxpayers $1.1 billion over a decade.

Dyed Fuel Excise Tax Refund

The Senate Proposal would allow refunds of federal fuel excise taxes on indelibly dyed fuel, starting 180 days after the date of bill enactment. Currently there’s no mechanism to refund the excise tax for fuel that went to non-taxable purposes—dyed fuel only sold for use in off-road vehicles and for agricultural purposes.

Termination of Certain Energy Tax Credits

The following tax credits would be terminated:

- Section 30D Clean Vehicle Credit

- This credit would expire for vehicles purchased more than 180 days after bill enactment. The credit is currently set to expire at the end of 2032.

- Section 25E Used Clean Vehicle Credit

- This credit would expire for vehicles purchased more than 90 days after bill enactment. The credit is currently set to expire at the end of 2032.

- Section 45W Qualified Commercial Clean Vehicles Credit

- This credit would expire for vehicles purchased more than 180 days after bill enactment. The credit is currently set to expire at the end of 2032.

- The draft would eliminate the credit for vehicles sold above the manufacturer’s suggested retail price. This “manufacturer’s suggested retail price limitation” is currently in place for the 30D credit for personal vehicles.

- For vehicles under 14,000lbs and acquired after June 16, 2025, the draft would impose critical mineral and battery component restrictions. These restrictions are currently in place for the 30D credit.

- Section 30C Alternative Fuel Refueling Property Credit

- The credit would expire for property placed in service 12 months after bill enactment. The credit is currently set to expire at the end of 2032.

- Section 25C Energy Efficient Home Improvement Credit

- The credit would expire for property placed in service 180 days after bill enactment. The credit is currently set to expire at the end of 2032.

- Section 25D Residential Clean Energy Credit

- The credit would expire for expenditures made 180 days after bill enactment. The credit is currently set to expire at the end of 2034.

- Section 179D Energy Efficient Commercial Buildings Deduction

- The deduction would expire for property that begins construction 12 months after bill enactment. The credit is currently permanent and not set to expire.

- Section 45L New Energy Efficient Home Credit

- The credit would expire for homes acquired 12 months after bill enactment. The credit is currently set to expire at the end of 2032.

- Section 168(e)(3)(B) Cost recovery for qualified clean energy facilities, property and technology

- The special 5-year cost recovery for 45Y- and 48E-eligible energy property is repealed if property is placed in service after bill enactment.

- Section 45V Clean Hydrogen Production Credit

- The credit would expire for facilities constructed after 2025. The credit is currently set to expire at the end of 2032.

Early Sunset/Accelerated Phaseout of Existing Credits

- Section 45Y Clean Electricity Production Credit

- Early phaseout for wind and solar facilities: 60% for facilities that begin construction in 2026, 20% in 2027, 0% thereafter, except for large projects of 1,000MW nameplate capacity and more than 25% on federal land leased before 6/16/2025.

- The tax credit is currently set to begin phasing out (100%, then 75%, then 50%) for all facilities either after 2032 or the year after U.S. annual GHG emissions from electricity production are equal of less than 25% of 2022 emissions. The Senate draft would eliminate the “later of” phaseout under current law to start phaseout after 2032 (100% in 2033, 75% in 2034, 50% in 2035, and 0% in 2036) for other technologies/facilities.

- Eliminate cost/unavailability exceptions to the domestic content requirement for entities electing to receive credit as direct pay for facilities constructed after 2025.

- No credit allowed for wind and solar properties leased/rented by a third party

- Allows the use of “existing studies” to determine lifecycle GHG emissions rates

- Section 48E Clean Electricity Investment Credit

- Early phaseout for wind and solar facilities: 60% for facilities placed in service in 2026, 20% in 2027, 0% thereafter.

- Eliminates “later of” phaseout under current law to start phaseout after 2032 (100% in 2033, 75% in 2034, 50% in 2035, and 0% in 2036) for other technologies/facilities.

- Increases domestic content bonus requirement to be on par with 45Y:

- Facilities that begin construction before 6/16/2025: 40%, or 20% for offshore wind

- Facilities that begin construction before 2026: 45%, or 27.5% for offshore wind

- Facilities that begin construction before 2027 50%, or 35% for offshore wind

- Facilities that begin construction after 2027: 55%

- No credit allowed for wind and solar properties leased/rented by a third party

- Allows the use of “existing studies” to determine lifecycle GHG emissions rates

- Section 45X Advanced Manufacturing Production Credit

- Terminates the credit for wind components produced and sold after 2027. The credit is currently set to expire for wind components sold after 2032.

- Delayed phaseout for critical minerals by one year: 100% in 2030, 75% in 2031, 50% in 2032, 25% in 2033, 0% thereafter.

- Keeps the same phaseout for all other components: 100% in 2029, 75% in 2030, 50% in 2031, 25% in 2032, 0% thereafter.

- Section 48C Advanced Energy Project Credit

- The 48C credit is capped at a total of $10 billion in allocation under the Inflation Reduction Act. The Senate draft would disallow the reissuing of funds for any revoked project certification, effective on bill enactment.

Foreign Entity of Concern Restrictions

Under current law, foreign entity of concern (FEOC) restrictions apply only to the Section 30D Clean Vehicle Credit and the Section 48D Advanced Manufacturing Investment Credit. The Senate proposal would apply complex FEOC restrictions to the credits that aren’t immediately terminated, with extensive rules for the 45Y, 48E, and 45X credits.

The Senate proposal denies credits to entities that are deemed to be “specified foreign entities” or “foreign-influenced entities”, and it would also deny credits if facilities (for 45Y/48E) or components (for 45X) include “material assistance” from prohibited foreign entities, which is determined by calculated material assistance cost ratios.

Here’re some key definitions related to FEOC:

- Prohibited foreign entities (PFEs) (including specified foreign entities and foreign-influenced entities)

- Specified Foreign Entity (SFE)

- Similar to the definitions set forth in the House-passed bill, an SFE is generally a foreign entity related to or controlled by adversary nations.

- Foreign Influenced Entity (FIE)

- an entity whose covered officers can be appointed by SFEs

- more than 25% owned by SFEs

- more than 40% of its debt owned or held by SFEs

- for 45Y, 48E, and 45X, an entity that makes a payment to an SFE under an agreement that gives the SFE “effective control” over either a qualified facility/energy storage technology or critical mineral processing/eligible component production

- agreements do not include “bona fide” sales of intellectual property

- Material assistance from PFEs

- Credits are disallowed if an increasing “material assistance cost ratio (CR)” of content unrelated to PFEs is not met

- For qualified facilities, CR = cost of non-PFE manufactured products incorporated into the facility/total cost of manufactured products incorporated into the facility

- For eligible components, CR = cost of non-PFE direct material costs/total direct material costs

- Credits are disallowed if an increasing “material assistance cost ratio (CR)” of content unrelated to PFEs is not met

- Specified Foreign Entity (SFE)

FEOC restrictions generally apply to 45Y, 48E, 45X, 45Q, 45U, and 45Z beginning in the taxable year after the date of bill enactment. Additionally, FEOC restrictions apply to credit transferability as well. The IRA authorized “transferability” for various energy tax credits, which allows entities to transfer all or a portion of an eligible credit to an unrelated taxpayer. The Senate proposal disallows transfers of credit to SFEs.

- Section 45Y Clean Electricity Production Credit

- No credit for SFEs, beginning in the tax year after enactment.

- No credit for FIEs, beginning in the tax year after enactment.

- No credit for facilities that begin construction after 12/31/2025 and receive material assistance from PFEs. CR threshold percentages for receiving material assistance are:

- Construction or sale during 2026 – 40% qualified facility or energy storage technology, 50% solar energy components, 85% wind energy components, 50% inverters, 60% battery components, 0% critical minerals.

- Construction or sale during 2027 – 45% qualified facility or energy storage technology, 60% solar energy components, 90% wind energy components, 55% inverters, 65% battery components, 25% critical minerals.

- Construction or sale during 2028 – 50% qualified facility or energy storage technology, 70% solar energy components, 60% inverters, 70% battery components, 30% critical minerals.

- Construction or sale during 2029 – 55% qualified facility or energy storage technology, 80% solar energy components, 65% inverters, 80% battery components, 40% critical minerals.

- Construction or sale after 2029 – 60% qualified facility or energy storage technology, 85% solar energy components, 70% inverters, 85% battery components, 50% critical minerals.

- No transfers of credit to SFEs

- Section 48E Clean Electricity Investment Credit

- No credit for SFEs, beginning in the tax year after enactment.

- No credit for FIEs, beginning in the tax year after enactment.

- No credit for facilities that begin construction after 12/31/2025 and receive material assistance from PFEs. The same increasing CR threshold percentages for receiving material assistance apply.

- Special 10-year recapture rule if the claimant makes a payment that is deemed to confer effective control under FIE definitions

- No transfers of credit to SFEs

- Section 45X Advanced Manufacturing Production Credit

- No credit for SFEs, beginning in the tax year after enactment.

- No credit for FIEs, beginning in the tax year after enactment.

- No credit for facilities that receive material assistance from PFEs, beginning in the tax year after enactment. The same increasing CR threshold percentages for receiving material assistance apply.

- No transfers of credit to SFEs

- Section 45U Zero-Emission Nuclear Power Production Credit

- No credit for SFEs, beginning in the tax year after enactment.

- No credit for FIEs, beginning in the tax year 2 years after enactment.

- No credit allowed for facilities using fuel produced in North Korea, China, Russia, and Iran after 12/31/2027 (except for contracts in effect before 1/1/2023).

- No transfers of credit to SFEs

- Section 45Q Carbon Oxide Sequestration Credit

- No credit for SFEs, beginning in the tax year after enactment.

- No credit for FIEs, beginning in the tax year after enactment.

- No transfers of credit to SFEs

- Section 45Z Clean Fuel Production Credit

- No credit for SFEs, beginning in the tax year after enactment.

- No credit for FIEs, beginning in the tax year 2 years after enactment.

- No transfers of credit to SFEs

The chart below details changes to IRA energy tax credits that the Senate Finance proposal would make: