If It Doesn’t Work, Don’t Fund It

Long before it became national news, TCS exposed the $231 million “bridge to nowhere” in Alaska as a textbook earmark. The project would have served an island of just 50 residents at extraordinary taxpayer expense. Highlighting it helped spark a national debate on wasteful spending.

The F-35 program is projected to cost more than $2 trillion over its lifetime, making it the most expensive weapons system in history. Despite this massive price tag, it can perform all its missions only about 30 percent of the time. We’ve long pressed for cuts and greater accountability.

For more than 20 years, the RFS has failed to deliver advanced biofuels while raising food, feed, and fuel prices. Instead of supporting innovation, it locked in subsidies for corn ethanol and soy biodiesel. Taxpayers bear the costs while consumers see higher prices.

CCS has received decades of taxpayer subsidies but still has not proven itself cost-effective. Projects routinely fall short of performance targets or collapse altogether. Taxpayers shouldn’t bankroll another round of failure.

Congress has spent billions on walls and surveillance systems along the southern border. Evidence shows these projects do little to improve security while causing property damage and environmental harm. Too often they are abandoned, leaving taxpayers footing the bill.

Cut Unnecessary Subsidies and Corporate Welfare

TCS helped end the Volumetric Ethanol Excise Tax Credit (VEETC), once the largest subsidy for corn ethanol. The credit wasted billions on a product already mandated in fuel. Ending it showed that entrenched subsidies can be dismantled.

Defense contractors bill taxpayers for workforce costs that most industries cover themselves. They then use profits for stock buybacks and lavish executive pay. We press Congress to end these handouts and demand accountability.

The federal tax code doles out billions each year in energy subsidies. Many of these provisions duplicate other incentives, distort markets, or worsen pollution. Cutting them would save money and improve energy policy.

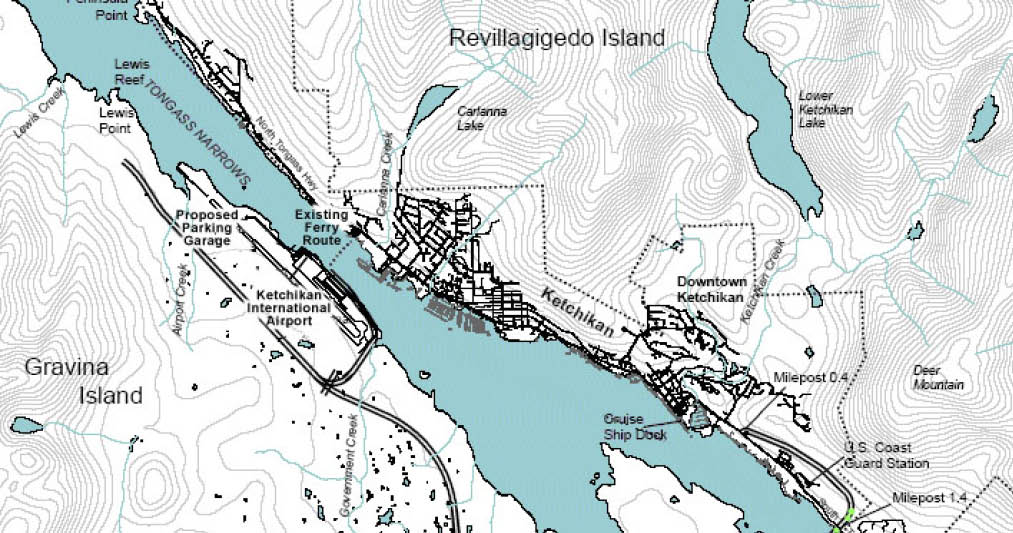

The Forest Service’s Tongass timber program has lost about $1.7 billion since 1980. Most of the losses come from expensive road construction that far outweighs revenue. Reform would stop waste, promote viable logging, and protect taxpayers.

The current farm safety net shifts risk and cost onto taxpayers. It rewards large agribusinesses with subsidies and guarantees while sidelining accountability. A reformed system would cap payments, cut carve-outs, and tie aid to public benefits.

Avoid Unnecessary Long-Term Liabilities for Taxpayers

The National Flood Insurance Program shifts the risk of catastrophic flooding onto taxpayers. By encouraging building in high-risk areas, it locks communities into costly rebuilding cycles. Reform is needed to promote resilience and fairness.

Congress mandated oil and gas leasing in ANWR with promises of big federal revenues. TCS warned that the revenues would fall far short. Instead, taxpayers could be left with ecological damage and financial losses.

Climate change and unchecked development in fire-prone areas are driving up wildfire costs. Federal spending often pours into recovery rather than prevention. Smarter investments in mitigation would save lives, property, and taxpayer dollars.

Oil and gas companies too often abandon old wells without cleanup. Taxpayers then shoulder billions in remediation costs. Stronger bonding requirements would ensure industry pays its fair share.

Today’s farm safety net shifts excessive risk to taxpayers. It lacks payment caps, transparency, and conservation requirements. Reform would make it fairer, more targeted, and more accountable.

Expose and Stop Corruption

Each year, Congress adds tens of billions to the Pentagon budget outside the normal process. These “program increases” often reward districts and donors rather than meet defense needs. We expose the costs, spotlight conflicts of interest, and fight for transparency.

Corruption scandals waste taxpayer dollars and erode public trust in government. Stronger ethics rules and enforcement are essential to prevent abuse. TCS presses for greater transparency so the public knows who benefits from federal spending.

050324-N-8148A-029

Rep. Randy “Duke” Cunningham took more than $2 million in bribes from defense contractors. In return, he steered at least $160 million in federal contracts their way. This case showed how unchecked power turns taxpayer dollars into currency for corruption.

Rep. John Murtha used decades atop the House Defense Appropriations Subcommittee to funnel projects and reward allies. His close ties to lobbyists and earmark recipients triggered repeated ethics inquiries. His career illustrates why appropriators need strict limits and accountability.

Lawmakers and their families often trade stocks in companies overseen by their committees. Even when legal, it creates a perception of insider advantage that undermines trust. Banning individual stock trading would restore integrity and fairness.

Ensure Fair Market Value for Taxpayer Assets

Federal coal leases often sell below fair market value due to weak appraisals and single-bid sales. These practices have cost taxpayers billions over time. Stronger valuation rules and competitive bidding would ensure a fair return.

In 2022, Congress raised royalties, minimum bids, and bonding for onshore oil and gas leases. These changes are projected to earn taxpayers billions more over the coming decades. It marked a long-overdue step toward fair returns.

Federal law requires land sales and exchanges to achieve fair market value, but agency appraisals are often flawed. Undervaluation robs taxpayers of real money and future revenue. Better appraisals and strict equalization would protect the public’s interest.

Many Tongass timber sales cost more to prepare and subsidize than they return in revenue. Road construction and administration often outstrip receipts. Taxpayers should not be underwriting below-cost sales.

The 1872 Mining Law still allows companies to mine gold, copper, and other hardrock minerals from public lands without paying royalties. Weak bonding rules also leave taxpayers exposed to costly abandoned mine cleanups. Updating the law with royalties and stronger safeguards would secure a fair return.