Web of Special Interests Influencing New Taxpayer-Subsidized Crop Insurance Policies

The highly subsidized federal crop insurance program has quickly become the largest subsidy for agribusinesses. It is a shining example of a federal program filled with costly inefficiencies that detract from the program’s goals and produce unintended consequences. The program, which shifts costs of doing business from agribusinesses onto taxpayers, cost the government more than $14 billion in Fiscal Year 2012, and is expected to cost $9 billion annually throughout the next decade. Not only has crop insurance’s cost quadrupled and the number of crops covered more than doubled over the past ten years, but its footprint and potential for future taxpayer liabilities have grown as well. Much of this expansion has been influenced by a complicated web of outside special interests proposing new policy ideas, expansion of current policies to new areas, additional crops or new biotech technologies to be subsidized, among others. The 2014 farm bill continues this trend with special interests ramping up lobbying to secure new costly policies covering everything from catfish and cotton to peanuts and food poisonings.

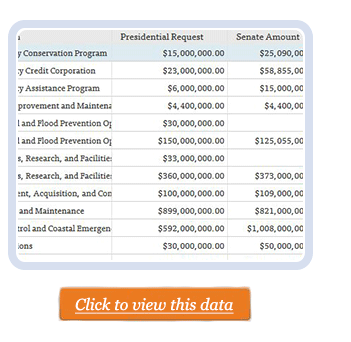

This data set (available by clicking below) tracks new crop insurance policy proposals submitted to the Federal Crop Insurance Corporation from 2001 to November 2013. The data tracks submittals from conception through approval, or denial, and uncovers proposal drafters where possible. TCS analysis of this data can be found in the fact sheet “Web of Special Interests Influencing New Taxpayer-Subsidized Crop Insurance Policies” (March 2014).

Profile of the Taxpayer Subsidized Crop Insurance Industry

Founded on major subsidies to producers and insurance providers, federally subsidized crop insurance is quickly becoming too expensive and unwieldy. Taxpayers not only subsidize crop insurance premiums for agricultural producers (on average, 62 cents out of every $1 of insurance coverage), but also provide $1.3 billion of administrative and operating (A&O) subsidies and, in most years, additional profits called underwriting gains to the 19 crop insurance companies selling the subsidized policies. Many of these companies lobby Congress to secure new and expanded subsidies to enhance their bottom lines.

This data set (available by clicking below) contains crop insurance industry political donations made prior to 2012 farm bill expiration (2008-2012). TCS analysis of this data can be found in the fact sheet “Profile of the Taxpayer Subsidized Crop Insurance Industry” (April 2014)

Selected Farm Bill Energy Title Programs

The so-called “farm bill” is a wide ranging piece of legislation that funds everything from nutrition assistance programs and broadband internet to agricultural subsidies for the production of crops such as corn and soybeans. The energy title of the farm bill, first introduced in 2002, provides grants, loans, and other subsidies to energy efficiency, biofuels, and bioenergy (heat and power) projects. In total, the 2008 farm bill contained 13 major programs under the energy title with a total projected cost of $1.1 billion over five years (FY08-12). This dataset includes available data on recipients of two major energy title programs, including the Rural Energy for America Program (REAP) and the Bioenergy Program for Advanced Biofuels (BPAB). These two programs alone have paid out more than $330 million in federal subsidies (since 2009 for BPAB and since Nov. 2010 for REAP).

While intended to support the next generation of biofuels derived from non-food sources and other renewable forms of energy such as wind and solar, these two farm bill energy title programs have disproportionately benefited mature industries such as soy biodiesel and corn ethanol. In fact, 60 percent of taxpayer dollars were directed to the biodiesel and corn ethanol industries, which have already benefited from tens of billions in federal subsidies over the past 30 years. Among the beneficiaries are large, profitable agribusinesses including Archer Daniels Midland, Renewable Energy Group, Louis Dreyfus, Ag Processing, MN Soybean Processors, and Cargill Inc. Taxpayer subsidies have also been spent on questionable expenditures such as updates to grain bin dryers, irrigation systems, oxygen monitoring systems for catfish farms, ethanol blender pumps, installation of tobacco curing controls, and several types of biomass energy which result in unintended consequences and long-term taxpayer liabilities. Like most subsidies in the farm bill, the majority of REAP and BPAB payments flow to just 11 states: Kansas, Iowa, Pennsylvania, Texas, Missouri, Minnesota, Illinois, North Carolina, Nebraska, Indiana, and Oklahoma.

REAP was created in the 2008 farm bill to provide federal grants and loans to renewable energy projects. While designed to primarily promote rural solar, wind, hydropower, geothermal, and similar projects, the program also provides taxpayer subsidies to the mature corn ethanol industry. While taxpayers should be concerned with all farm bill programs that provide energy subsidies, corn ethanol giveaways are particularly egregious because of the billions of dollars in subsidies the industry received over the last 30 years. Corn ethanol also often has its hand in programs not originally intended for it. When Congress authorized REAP and other farm bill energy title programs, corn ethanol was prohibited from receiving taxpayer funding since lawmakers intended to promote the development of next generation (advanced) biofuels and energy sources from non-food sources. However, the agribusiness industry successfully convinced the U.S. Department of Agriculture (USDA) to recently alter program regulations to allow corn ethanol interests to apply for blender pump funding.

BPAB was intended to pay advanced biofuels producers to expand their annual production levels. Other than corn starch ethanol, nearly every other type of biofuel is eligible for the program, including ethanol, biogas, butanol, or biodiesel derived from cellulose (like perennial grasses or agricultural residues), sugar or starches, waste materials, sugarcane, or woody biomass. But instead of assisting rural residents or small businesses obtain financing to help second-generation biofuels derived from non-food feedstocks get off the ground, the program is instead funneling taxpayer dollars to large, profitable, and well-known agribusinesses. Corn ethanol companies are also receiving subsidies despite the fact that they are not even eligible for funding through this program or defined as an advanced biofuel in any current federal legislation. The 2008 farm bill energy title provided $300 million in mandatory program funding for the BPAB from FY09-12, with opportunity for additional funding through annual appropriations bills. BPAB is administered by USDA’s Rural Development office.

Terms of Use

Because all of the data we offer is public information, we ask that all users agree to these basic terms of use, that:

- information provided by TCS in whatever form is meant for research, educational, or journalistic purposes only;

- TCS Data shall not be used for commercial purposes, to solicit contributions, or sold to third-parties;

- and that appropriate credit will be given to TCS for all reports, articles, mashups, or other use of our data, including a link back to our website for all items published on the web.