Budget Watchdog AF takes a field trip to the corn and soybean fields of northeastern Nebraska in search of common sense on the Farm Bill. Taxpayers for Common Sense Senior Policy Analysts Sheila Korth and Josh Sewell introduce us to the current generations of the Kinkaid family farming this land since the 1940s. Hit play and hear what these farmers think about farm subsidies. It will suprise you.

Episode 38: Transcript

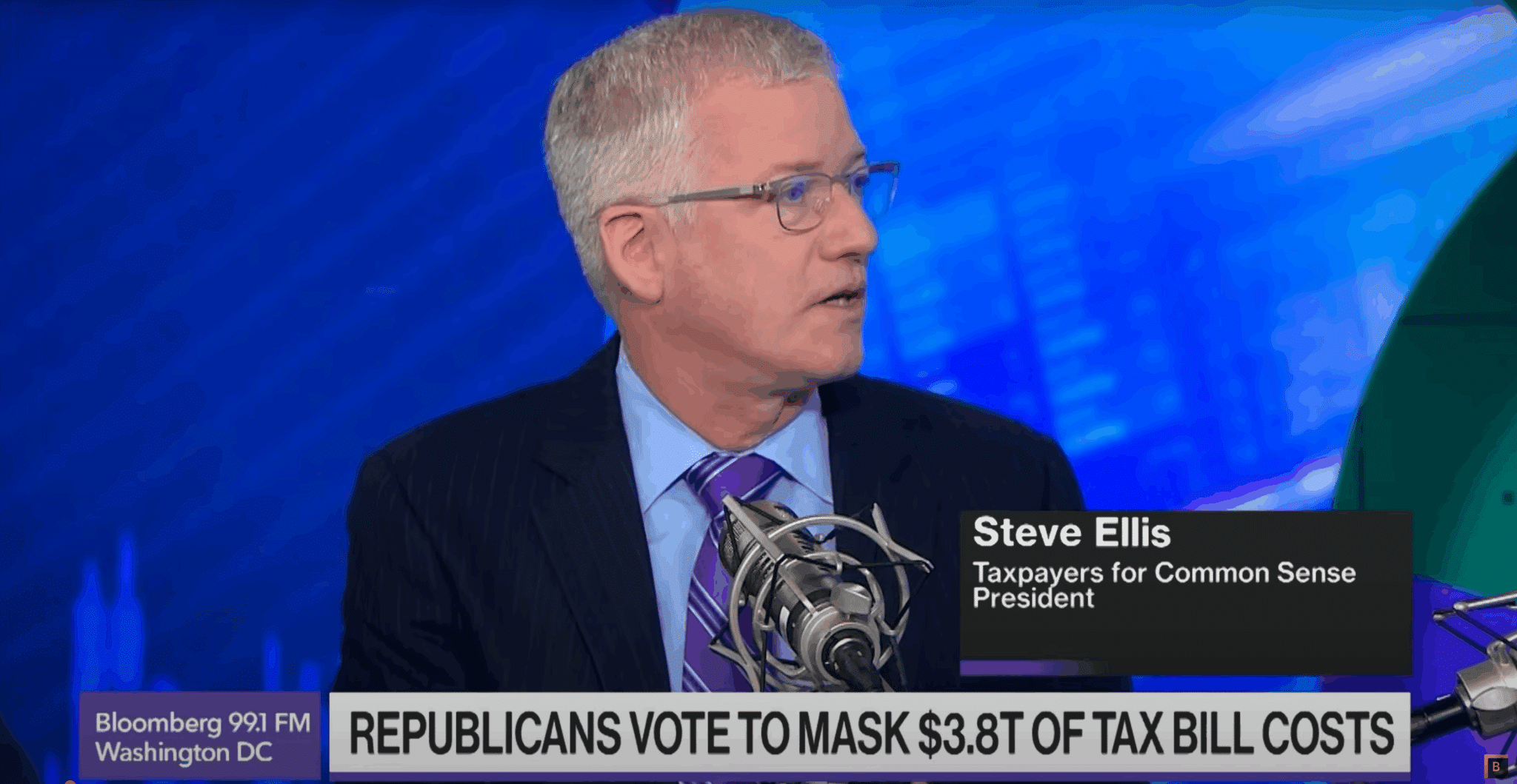

Announcer:

Welcome to Budget Watchdog All Federal, the podcast dedicated to making sense of the budget, spending, and tax issues facing the nation. Cut through the partisan rhetoric and talking points for the facts about what’s being talked about, bandied about, and pushed to Washington, brought to you by Taxpayers for Common Sense. And now the host of Budget Watchdog AF, TCS President Steve Ellis.

Steve Ellis:

Welcome to All American Taxpayers Seeking Common Sense. You’ve made it to the right place, for over 25 years, TCS, that’s Taxpayers for Common Sense has served as an independent, nonpartisan budget watchdog group based in Washington DC. We believe in fiscal policy for America that is based on facts. We believe in transparency and accountability because no matter where you are on the political spectrum, no one wants to see their tax dollars wasted. Today dear podcast listeners, Budget Watchdog AF is taking a field trip away from Capitol Hill outside the beltway and in search of common sense on one of the most important pieces of legislation that will come out of the 118th Congress, the Farm Bill. Joining us on this podcast field trip to the corn and soybean farms of Northeastern Nebraska are Taxpayers for Common Sense Senior Policy Analyst Sheila Korth and Mr. Agriculture himself, Josh Sewell. I hope you both are wearing appropriate footwear and ate a good breakfast.

Josh Sewell:

I had my glass of ethanol this morning.

Sheila Korth:

I’m well fed too, well fed with corn, Steve, thanks.

Steve Ellis:

Well that was John McCain’s plea when he was running for president the second time around. He said that he drank a glass of ethanol with his breakfast every morning to try to appeal to the Iowa farmers. So anyway, let’s get back to the program. Sheila, loyal listeners of this show know that TCS has worked on farm bills for a long time and actually I’ve worked on farm bills since 2002 and Josh, TCS has had success in the agriculture arena, like eliminating wasteful $5 billion a year direct payments. But another part of our work on these issues allows us to connect personally with beneficiaries of the Farm Safety Net everyone here on the Capitol is working on. Sheila, tell us about the father and son farmers, Scott and Skyles Kinkaid.

Sheila Korth:

Well, Steve, they’re the current generations of the Kinkaid family to farm their land in northeast Nebraska. Not far from where I grew up in Randolph, Nebraska. Scott is 63 years old and Skyles is 20. Skyles’s great-grandparents bought their current farm in the 1940s and they farm a total of about 1,800 acres, 1,200 of that is for Scott and 600 for Skyles. Both Scott and Skyles were there together in their original farmhouse when I met with them yesterday.

Scott Kinkaid:

My grandparents owned this farm since ’42, and then my dad bought it from him, and then eventually I bought it from him. So we have corn and soybeans, about 50/50 ratio. We just swap back and forth each year. When I was a kid, we grew mostly corn, and oats, and a few soybeans and eventually the oats kind of went away and soybeans kind of took it over because it’s a good rotation, there’s a lot of good things about oats, but it just wasn’t profitable and soybeans kind of took that over. There is some alfalfa around, some pasture ground, but for the most part, corn and soybeans is what you see when you drive down the road for mile after mile.

Skyles Kinkaid:

I must have been a sophomore in high school when I got into it. I think actually dad had been renting a quarter, it was sharecrop ran for quite a while and essentially gave that up to let me do it. So it was a good opportunity to get started farming. Sharecrop is simple because you don’t have to come up with a bunch of cash at the beginning of the year for cash rent. They essentially pay for I think 40% of the inputs and then they get 40% of the profit. So I don’t have to come up with a ton of cash so it’s a good way to get started. And then I think my junior year of high school we kind of needed a new sprayer and dad convinced me to buy one. It was another way for me to make money. I kind of thought I could turn around and do some custom spraying on the side and that’s kind of evolved a little bit. I’ve upgraded sprayers now and I spray about 10,000 acres south of here about an hour.

I’ve been able to pick up some more ground to rent. So my second year of farming, I picked up another quarter, it’s a few miles down the road, which is a sharecrop as well, and then just last year I was able to get another.

Steve Ellis:

I feel like we are all right there with you in Nebraska for this conversation with Scott and Skyles. Josh, we’re going to hear what these farmers actually think about farm subsidies in just a minute, but back in DC they are a bit of a nightmare for taxpayers, right? Get us all back up to speed here.

Josh Sewell:

Yeah. Steve, you’re right. The current state of farm subsidies is absolutely a fiscal nightmare. So farm programs are costing us as much as ever, even while net farm income nationwide is at its highest level in 50 years. So currently now you have subsidies tied to when crop prices drop, for when there are shallow dips from recent levels of revenue, when profit margin guarantees, and there’s a whole web of revenue insurance products for things like corn, soybeans, cotton, you name it. Plus it’s important to know right now that we’re not just talking about farm bill programs. There’s also these emergency disaster programs that are coming out every year. And so you add it all up and I think in 2020 we had a record $46 billion in direct government subsidies to agricultural businesses and in the last two years it’s only dipped a little from that $46 billion. So here at TCS we think that’s just too much money going out the door.

And we believe that farm subsidies should be what I call the three Fs of farm policy, focused, fiscally responsible, and foster resilience instead of dependence on Uncle Sam. We should note that Scott actually joined us on a crop insurance webinar that the National Sustainable Agricultural Coalition held last July and had a lot to say on this.

Sheila Korth:

As Scott said at the time, he agreed with you on a lot of those Fs. We could insert another one if needed, but I’m not allowed to do that apparently today and that’s not really changed. So let’s hear what Scott and Skyles said yesterday about farm payments and federal crop insurance subsidies.

Scott Kinkaid:

To really understand we need to go back in history and I think it actually started back in the 30s or something, but like most government programs, they never do go away, they just keep growing and growing. And so I guess in the last few years they subsidized crop insurance premium significantly. I want to say it’s like 60% of the premium is subsidized and so we buy crop insurance, which is a good thing to be able to do. I’ve always argued that I don’t know why the government needs to be subsidizing the premium. It sounded like a good deal to begin with, but essentially that subsidy just ends up in a price of cash rent or the land. So I guess to me there’s not really… Why can’t crop insurance just be a private enterprise that’s not subsidized? Yeah, the premium is going to be more, but in the end, I don’t know that I’m really worse off.

Steve Ellis:

I think that’s an interesting viewpoint on the federal government’s involvement in the insurance market. We have federal flood insurance backed by the government too, but to have a farmer say he thinks that he’d be okay without taxpayers subsidizing his crop insurance, that’s something congress should take note of.

Josh Sewell:

Yeah, we talk all the time about finding ways that farmers can use private risk management options instead of relying so heavily on federally subsidized insurance as well as this unpredictable, unbudgeted so-called emergency ad hoc disaster payments.

Steve Ellis:

Yeah, I mean at TCS we work across the spectrum on disaster issues ranging from the impacts of hurricanes, or from drought, wildfire, and working with FEMA on how to better prepare for disasters and save taxpayers money. One of the things that we’ve pushed for years has been this idea of pre-sponding using disaster dollars to prevent future disasters and basically making people less vulnerable or in this case, crops less vulnerable in the future. Speaking of crops, I mean you all have been impacted by a drought in Nebraska I hear, right Sheila?

Sheila Korth:

That’s right, Steve. We have been heavily impacted by an ongoing drought here in Nebraska. There’s been severe drought in some places that impacted last year’s crop and looks like we’re going to have near record crop insurance indemnities, again which are paid for partially by taxpayers, for last year’s drought impacts. We had the 2012 drought, which really impacted farmers here as well. And so Scott and Skyles talked about that yesterday, how they’re impacted by drought conditions.

Scott Kinkaid:

In 2012 as well and last year both were quite dry. 2012 was I think maybe hotter, but at least having the insurance, it does take away a lot of stress of worrying about it. I think back from my grandparents farm, there was no crop insurance, there was no farm program, they just had to make it work. A couple years ago we had a hail storm, it missed us for the most part. We got hail on one farm, pretty well wiped out the soybeans on that farm. And that’s where my grandparents had lived and I thought back when they lived there and they got a hailstorm, that was their whole farm. But to me, it was one farm of a few. I had some other farms a few miles away that were unfazed, so it wasn’t as big a deal to me in that way. That would’ve been everything. They would’ve had livestock that they would’ve had to feed and what are you are you going to feed them? It’s all been hailed off. Alfalfa would grow back in the pasture eventually, but they got to deal with that.

Now we’ve got all kinds of things that it does take away the stress. Crop insurance is good to have, have available, but I don’t know why the government has to be involved because in this case, like I say, what they subsidize just winds up in a pocket of the landowner eventually, either through cash rent or when they sell it. And I always think if I can afford to own a farm, do I really need money from the government? And so if I farmed 20,000 acres and he farmed 1,000 acres, I’m getting help on 20,000 acres and he’s only getting help on 1,000 acres. I don’t have anything against somebody who want to farm 20,000 acres, that’s quite a challenge. And if they can do it more power to them, that’s the American way. But why does the government have to be involved in helping them do that when it’s taking away opportunities from people like Skyles? So to me that’s rather frustrating.

Skyles Kinkaid:

Last year was obviously dry, so I benefited from crop insurance only slightly. The price went up so much that I didn’t come out as short as I guess I would’ve had the price stayed where it was like all year. Same in 2012, the price went up, didn’t harvest a lot, but the price went up so much that you look around and a few years ago everyone’s tractor, and combine, and head, and pickup was a 2013 because everyone got a whole ton of money from insurance that year it allowed you to buy something because the price went up so much.

Josh Sewell:

Yeah, it’s an important point. Just considering yield losses for ag in years of disasters is looking at one side of the equation. There’s also the fact that crop prices actually rise in years when there’s widespread drought. I mean that’s how it always has worked at least so far. And it’s important to know that it’s extremely rare for a complete wipe out in a crop, certainly as a sector, but even for an individual farmer, it is extremely rare that they lose all of their crop. So simple economics says that when supply goes down, prices go up. Scott and Skyles, they make great points about still being able to make money as a farmer with the yield they do have even during years of drought.

And Scott not seeing the need for ad hoc disaster payments, you’re preaching to the choir. They already have subsidized crop insurance. That is the safety net. There is not a need most of the time for the payments on top of what’s already there. But as we’ve said on this podcast and other places, that hasn’t stopped Congress from appropriating another $20 billion total since 2017 and they just threw another $3.7 billion on the omnibus back in December.

Steve Ellis:

Yeah, I’ve heard folks say that it’s not a safety net, it’s a hammock or even a trampoline, so got it. You’re listening to Budget Watchdog All Federal, the podcast dedicated to making sense of the budget, spending, and tax issues facing the nation. I’m your host TCS President Steve Ellis, and we continue now with our farm field trip already in progress. A quick note here to the podcast faithful, resources on this topic, ag disaster aid and other materials on federal spending, everything from the omnibus back in December to staying up to date on the debt ceiling can be found on our website taxpayer.net. Josh, where do things stand at the moment on the farm Bill? The current bill expires at the end of September this year, correct?

Josh Sewell:

Yes. Many of the programs in the bill do expire at the end of this fiscal year. But I got to say, we’ll see how fast these committees move on a Farm Bill reauthorization. There ain’t a lot of stuff moving very fast in this Congress and the Farm Bill is one of those. So to be fair, on the House side, Chairman Thompson, he held one field hearing in Pennsylvania and is promising more. And the Senate, we just got word that they’re holding their first hearing here in DC on February 1st. But it’s going to be tough. I mean we have a divided Congress and partisanship, as anyone who’s been watching knows, is already at a heightened pitch. And so what I would expect is there could easily be an extension of current law that would extend most of the programs for one year buying Congress time into 2024 to just have more time to do these bills.

It’s important to note though that crop insurance is permanently authorized, so Congress could never pass another Farm Bill and the crop insurance program would just keep turning along. It’s the other parts in it that are technically expiring. So the big part, the nutrition programs, supplemental nutrition assistance used to be known as food stamps, commodity programs, those shallow loss programs we’ve talked about, the livestock disaster, those things which make up the most of the spending of the $1.3 trillion bill, those things do technically expire. And so if you want to have them, if they don’t get something done by the end of the fiscal year, they’re going to have to do one year extension. Now, I do want to be a little more specific about why most people that I talked to in Washington are expecting it’s going to be harder to pass a bill because the House has promised, this is ironic, to be more open with debate and amendments.

Nothing scares an aggie more than an open amendment process on the Farm Bill, and that’s because of the past and reality, not conjecture, but the fact that in years past, we and the people we work with have been successful at getting bipartisan Farm Bill amendments that reign in subsidies to farmers, cut off millionaires from programs, and place more meaningful common sense limits on who can actually get farm subsidies. And members like Senator Grassley from Iowa and representative Earl Blumenauer from Oregon who led these past efforts, they’re still here and they’re ready to do this again. They want to have this debate. And the way Congress has jammed through the last two Farm Bills, especially the 2018 one, was by limiting debate and limiting the time and input that members of Congress and Senators could have. In fact, in the Senate we got zero good amendments. There were only, I believe, five total amendments to the bill.

This is after 2014 when we had 71 or 73 votes on amendments on the floor. And this is the Senate where they do everything by UC. They had 73 votes. And this last time they had less than 10, they had five I think it was. And they were frankly garbage, most of them. And so this idea that you’re going to have a more open amendment process and more open debate, let all the members have input, that scares the ag committees because there’s such a diverse set of interests and a desire to have a good bill, whether it’s nutrition title, commodity title, crop insurance, all the crops that don’t get subsidies, there’s such a desire for change that an open amendment process is most likely going to make the Farm Bill better and thus the committee doesn’t want that bill on the floor.

Sheila Korth:

Right, Josh. And one major point about that is the amendments that we’ve seen that have tried to reign in those subsidies. So that’s something that we hear out in Nebraska too. And here’s what Scott had to say about the loopholes that he sees in farm subsidy programs and the impact that that’s having on rural communities.

Scott Kinkaid:

I kind of go back to when we had just making payments from the government and they had payment limitations. They called them payment limitations, but there was hardly any limitation to it. And we argued against that, I and some friends of mine, we were part of the Corn Growers Organization at the time and I always felt like that Corn Growers Organization didn’t want to fight for payment limitations very bad. And we tried to argue for them and they would look at us like they thought we were wanting to live back in the 1950s, but that wasn’t the case. We were just looking at the fact that people are expanding their operations significantly at the expense of rural communities. Obviously it doesn’t take as many people to farm an acre as it used to. I farm several more acres than my grandparents did. That’s just technology and progress and there’s nothing wrong with that.

But when you have farmers who are working the system to get thousands of dollars from the government that they can use to expand their operation, and then you’re displacing people who could have been farming that now they can’t afford to because these big farmers are driving up the price of rent. So they push them off the farm. Well, what happens to the rural communities? The hardware store, lumberyard, and the schools, and makes it harder, you don’t have as many fire departments, and on down a line. And like I said, part of that is just technology, but a lot of it in this case was not technology, it was government, more or less picking and choosing the winners and losers. And that to me was what I felt was wrong. And that’s what I think about my grandparents.

They didn’t bid up the price of land because they couldn’t afford to lose that, so it didn’t happen. Now you got the government guaranteeing that you’re not going to go broke. So yeah, let’s go buy more and pay more. And to me, that doesn’t seem really good for rural America because it’s killing towns and communities.

Steve Ellis:

There can be a limited role for the federal government to step in and help people in times of need, but Scott is saying farm subsidies can do more harm than good. Instead of creating unintended consequences, government programs need to be targeted and achieve public goods in a way that spends tax dollars wisely. Back to Josh’s three Fs. So to that end, the Inflation Reduction Act enacted last year contained additional spending for agriculture conservation. Sheila, what’s going to be the impact of this spending?

Sheila Korth:

Well, Steve, we’ve talked about this spending before. There’s approximately 20 billion more dollars that were enacted in the Inflation Reduction Act from last year that will go to ag conservation programs. These are programs that are already in the Farm Bill. They’re already programs that farmers are familiar with and sign up for. And they fund conservation practices like less tillage of crop land, which can reduce soil erosion, and also reducing the use of expensive fertilizers, which can improve water quality. No-till practices are already required in northeast Nebraska where Scott and Skyle’s farm, which come in exchange for farm subsidies because the hills where they farm are deemed highly erodible land. Here’s what Scott had to say about his support for no-till farming.

Scott Kinkaid:

Well, I think another thing is no-till to me makes a lot of sense. You conserve moisture and the soil. And think back when I was a kid, that was your only option, you had to plow and disc things. You had to bury the residue because the planter couldn’t go through the residue and put the seed in the soil. So this was really your only choice for the most part at the time. But every summer we’d go and cultivate after we plowed and disked, and planted and hose, and cultivated a couple times and never would fail. You’d get a thunderstorm and the water would run right down those where you just cultivated, you’d make a groove right in the dirt, every 36 inches was another groove to guide the water to the bottom of the hill. Well, then you’d have a flat spot there with mud about six inches deep and that all came right off the hillside.

So I got away from tillage about as soon as I could. I still see a lot of tillage going on and I really don’t know why. I don’t know what they’re accomplishing with it. I see a great big four-wheel drive tractor pulling a huge disc when somebody’s got 20,000, 30,000 acres they got to get planted and they got a limited time. Sometimes when you’re no-tilling, you’ve got to wait just a little bit longer. It’s just too wet. You need it to dry a little bit more. Well, that tillage will help dry it out and then get out there and get it planted. So again, with crop insurance and all these programs, we’ve had rules that you couldn’t bury all that residue. You had to leave so much on the ground or you don’t fit into the rules. You’re not eligible for any subsidies. Then yet, I see black dirt all around me every year. I don’t quite understand how that’s working, but I see it constantly.

Josh Sewell:

So USD’s Office of Inspector General has found that the conservation accountability standards that Scott refers to have been inconsistently enforced across the US. In fact, in some places they’re not enforced at all. And so that means in reality that taxpayer dollars are in fact subsidizing soil erosion and degraded water quality in certain places. And I just think having federal programs with virtually no strings attached is not a recipe for success. It’s also not a recipe we see anywhere else in the budget. So instead, ag policies need to be reformed to incentivize farmers to diversify their crops, lower their risk of crop loss, adopt practices like cover crops, these things that help build soil health. And frankly, the beauty is that these conservation accountability standards, which are common sense, is when you make these changes, farmers can build both their physical and their economic resilience over time, meaning less dependence on Uncle Sam for bailouts when disasters strike. And Scott and Skyles, they’ve done just that by planting cover crops and diversifying their operations, even planting ingredients for one of agriculture’s most important products, American craft beers.

Scott Kinkaid:

I have tried some cover crops in the past. In fact, when we were growing the hops, the guy that we were selling the hops to he had a small micro brewery and he was going to start a malting facility and needed barley. So maybe here’s a chance to grow some barley and spread out my time of harvesting a little bit and plant some cover crops. So in this case, oh here, I can plant this barley and harvest it in July, plant a cover crop and kind of looked into how all that was going to work. And so we did that and we planted a cover crop and it grew great. We had great success with that, had that raised off during the winter. And the cover crop that we used, I think there were 10 different species in there, but they were all annual crops, so they didn’t carry over to the next year so we didn’t have to go and spray them.

But anyway, we had good growth on there. And the next year, then I did that on 80 acres. So we grew the corn and we took some soil samples and looked at the number of microorganisms. They have a test for that. You look at how much CO2 is being given off and some things like that. And it was like off the charts almost. Where we had the soybeans, it was way at the low end on microorganisms that we had. I was kind of disappointed in how low that was, but where we had a cover crop, it was almost off the chart the other way. Wow, this is great. I’m really going to learn a lot here and we’re going to have some potential to move on. But when we harvested it, I was disappointed to find that it all yielded pretty much the same and I’ve really never fully understood that, but that was my experience with cover crop.

Steve Ellis:

Great work here, Sheila. I hope all of our podcast listeners appreciate the wisdom our farmers are trying to share with everybody right now.

Sheila Korth:

Thanks Steve, and thanks so much to Scott and Skyles for sharing their expertise and their insight with us. So on that note, here’s what Scott wants lawmakers to understand this year as they get to work on that Farm Bill.

Scott Kinkaid:

When it comes to farm programs, whether it’s crop insurance or just payments of any kind, and I’ve always kind of argued against them if you’re trying to help everybody, you’re not helping anybody and that’s inequitable. But I run into people who just look at me and kind of shake their head and one of them, at least one of them, made a comment, “Well, but in agriculture we got to deal with the weather.” And I thought, well, so what? I mean, I know that, and my grandparents knew that, they had to deal with the weather. So his argument that we got to deal with the weather to me didn’t hold much water as far as I was concerned. Yeah, it’s a risk, but that’s part of business, deal with it. You don’t run to the government for every little thing.

Steve Ellis:

Well, there you have it podcast listeners, straight from the farmer’s mouth. This is the frequency. Mark it on your dial, subscribe and share and know this Taxpayers for Common Sense has your back America. We read the bills, monitor the earmarks, and highlight those wasteful programs that poorly spend our money and shift long-term risk to taxpayers. We’ll be back with a new episode soon, and I hope you’ll meet us right here to learn more.