Taxpayers for Common Sense staff will be combing through the President's budget over the next several hours and days and bringing to light various issues hiding behind the numbers. We'll also post budget documents here as they become available so WATCH THIS SPACE for live updates.

Links into Our Live Stream Analysis:

March 10, 2014

3:00pm: Mature Corn Ethanol Industry Receives New Special Interest Carve-out

The President’s FY15 budget proposes up to $200 million in new tax credits for the “construction of infrastructure that contributes to networks of refueling stations that serve alternative fuels,” or in other words, more subsidies for corn ethanol blender pumps and other alternative fuel infrastructure projects. The corn ethanol industry has already received more than 30 years of taxpayer subsidies, including a nearly identical federal tax credit entitled the “Alternative Fuel Vehicle Refueling Property Credit” for E85 (85 percent ethanol) blender pumps, which expired last year but has been historically renewed in “tax extenders” packages. Instead of creating new special interest carve-outs, it’s time subsidies for this mature industry were ended once and for all. (The President proposes a total of $2.5 billion in new spending on advanced energy manufacturing projects, of which up to $200 million would be dedicated to alternative fueling infrastructure projects).

March 6, 2014

4:00pm: Updated Spending Totals on the F-35

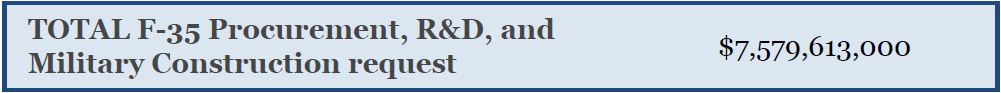

As promised, we keep looking for F-35 spending in the budget request. We can now increase that running total by another $109,184,000 to include the military construction projects that are specifically identified as related to the F-35 program. You can see the details in the chart below.

FY15 Military construction requests in support of F-35 operations

So far we have updated our running total for F-35 spending in the budget request below:

We’ll keep digging. You can keep checking our blog for updates.

Wednesday, March 5, 2014

5:45pm: DOE Budget Briefing

Following the release of the President’s FY2015 Budget, the Department of Energy (DOE) held briefings on the proposed spending for each of its sub-departments on Tuesday, including the Offices of Nuclear Energy, Fossil Energy, Science, and Loan Program. While some questions remain, the briefings did shed some light on the normally opaque budget process.

One noteworthy discussion at the budget briefing addressed the DOE’s decision to put funding for the Mixed Oxide Fuel Fabrication Facility in “cold standby mode.” Secretary Ernest Moniz explained that the “considerable cost increase of the MOX project” prompted the department to re-evaluate the project’s budget. The announcement came as welcome news for taxpayers. For years, TCS has been calling for the project’s termination.

It was also interesting to hear the department voice “very, very strong optimism for the future role of SMRs” in U.S. energy production. That outlook on prospects for Small Modular Reactors (SMRs) stands in sharp contrast to recent news from the nuclear industry that it’s looking to reduce spending on the untested, unlicensed technology due to its poor economics. Even Babcock & Wilcox, one of the two companies that DOE is giving $226 million for SMR technical support, has recently claimed it is looking for ways to get out of the SMR business. Unfortunately, DOE has put its money where its mouth is and requested roughly $97 million for SMRs in this year’s budget, despite the recent red flags.

Learn more about DOE’s budget, visit: bioenergy, Clean Coal, SMRs, MOX, and the Loan Guarantee Program.

5:20pm: To Infinity and Beyond!

The FY15 budget gives NASA $17.5 billion, about $150 million less than what the agency received in the FY14 Omnibus. It also removes the requirement that nearly $2 billion be spent on the Space Launch System. The Mississippi delegation ensured money hundreds of millions of dollars were preserved to continue developing a rocket engine test system at the Stennis Space Center (in – you guessed it – Mississippi). Problem is, the system was designed for the Constellation project, which was scrapped in 2010.

The budget also includes funding to support NASA working with commercial space enterprises to transport astronauts to the International Space Station (which is extended until 2024 by the way). This is a better way to go in the near term. The budget also includes funds to continue development Orion Multi-Purpose Crew Vehicle, which while not envisioned to go “to infinity and beyond,” (sorry Buzz Lightyear) is supposed to go beyond the Moon. It remains to be seen if this will be just the latest Mars project to be scrapped by a future President (like President George H.W. Bush’s plan or President George W. Bush’s).

4:00pm: Naval Reactors: 1, Nuclear Nonproliferation: 0

For those keeping score, the National Nuclear Security Administration (NNSA) budget for fiscal year 2015 shows how much the Administration really cares about nuclear nonproliferation. We went to the briefings offered by the Department of Energy on their budget request where, unfortunately, precious little information was made available.

One thing really stands out, though. Overall, the NNSA budget request this year is a 4% increase over last year. When you look a little deeper you see that not all parts of the budget received an increase. The “Naval Reactors” line, where the propulsion systems of U.S. Navy nuclear powered surface ships and submarines are built (among other things), you see they received almost 26% more money than last year.

In fact, every other major budget activity in NNSA received some kind of increase: Weapons Activities? That was increased almost 7%. Salaries and Expenses? That line got 4% more than last year.

But then there is the Defense Nuclear Nonproliferation Program Office. First, let’s remind ourselves of their mission: “One of the gravest threats the United States and the international community face is the possibility that terrorists or rogue nations will acquire nuclear weapons or other weapons of mass destruction (WMD). NNSA, through its Office of Defense Nuclear Nonproliferation, works closely with a wide range of international partners, key U.S. federal agencies, the U.S. national laboratories, and the private sector to detect, secure, and dispose of dangerous nuclear and radiological material, and related WMD technology and expertise.”

Unfortunately, this mission was the only one within the NNSA to have a budget request lower than last year’s level of funding – in fact they were reduced by more than 20%.

If the possibility of terrorists acquiring nuclear weapons is one of the “gravest threats” we face, and we think it is, why did the office set up to deal with just that threat take a 20% cut in funding?

12:00pm: Let The Good Times Roll for Lockheed Martin and the F-35

The FY15 budget was released on Fat Tuesday and, as we’ve noted for other portions of the Pentagon budget, the Mardi Gras attitude of letting the good times roll continues for Lockheed Martin and the F-35 program.

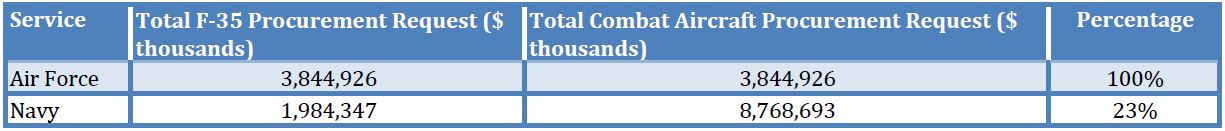

At Taxpayers for Common Sense we’ve previously said the F-35 program threatens to swallow the entire budget for combat aircraft at the Pentagon. The chart below shows what we’ve been talking about. Nearly $7.5 billion is in the budget request for just this single aircraft program. The first chart shows the Procurement and Research & Development budget lines that are readily identifiable as money for the F-35 program. Remember that Marine Corps planes are actually funded by the Department of the Navy budget.

This next chart shows the portion of each service’s combat aircraft procurement budget being eaten by the F-35 in both dollars and as a percentage of the whole:

The Air Force, unbelievably, is putting all of their eggs in this one basket. Well, to keep with the Mardi Gras theme here, let’s just say they’re betting all their beads on the F-35. The Navy is being smarter about things and is also purchasing other types of combat aircraft, including the F/A-18. We think the Air Force is just trying to make it impossible for Congress to truncate or end the program for the bad deal that it is. “You can’t kill the F-35; it’s all we have!” We hope the Congress won’t be taken in by this argument.

These charts reflect only those budget lines that are readily identifiable as related to the F-35 in the base budget. We’ll keep digging to find items that are less easy to identify and also to see if the so-called “Opportunity, Growth, and Security Initiative” includes even more money for this budget-swallowing program. Watch this space for updates.

11:30am: Crop Insurance Savings Die on the Vine

As we reported below, the President’s FY15 budget proposes to cut federal crop insurance subsidies by $14 billion over the next ten years, as compared to $12 billion last year. If he would have followed our lead the President could have found nearly $50 billion in savings by proposing more substantive cuts while still retaining a generous safety net for agricultural producers.

Federally subsidized crop insurance has ballooned becoming the most expensive taxpayer support for agriculture. On average, taxpayers subsidize 62 cents for every dollar of insurance coverage that agricultural producers enroll in, in addition to subsidizing the administrative and operating costs for private insurance companies (totaling more than $1.3 billion annually) and acting as the financial backstop in years with large crop or revenue losses. The administration does still have an opportunity to find savings in the crop insurance program, see here for more details, especially as the agreement between crop insurance companies and the federal government, known as the Standard Reinsurance Agreement, is up for renewal. The government saved more than $6 billion the last time this was renegotiated.

However, given that the President just recently signed a nearly $1 trillion farm bill, H.R. 2642, that actually increases the cost of the federally subsidized crop insurance program through dozens of special interest carve-outs and creating new “shallow loss income entitlement programs,” the President’s potential savings will likely not be harvested.

Below is a table listing the President’s proposed reforms over the past three budgets. As you can see, his reforms have been recycled from years past except for a new idea to rescind a wild salmon crop insurance subsidy pilot program:

|

Crop Insurance Savings Proposed in President’s Budget Requests |

Savings in FY2013 Request |

Savings in FY2014 Request |

Savings in FY2015 Request |

|---|---|---|---|

|

Reduce Taxpayer Subsidy for Company Rate of Return |

$1.2 billion |

$1.2 billion |

$1.2 billion |

|

Reduce Crop Insurance Company Subsidies for Managing Individual Policies |

$2.9 billion |

$2.8 billion |

$2.9 billion |

|

Decrease by 3 percentage points the subsidy for buying highly subsidized crop insurance policies (was a 2% cut in FY2013 request) |

$3.3 billion |

$4.2 billion |

$3.8 billion |

|

Decrease the subsidy on basic catastrophic crop insurance policies |

$0.255 billion |

$0.292 billion |

Not Proposed |

|

Decrease by 4 percentage points the subsidy for buying crop insurance for producers who elect price protection (was 2% in FY14)* |

Not Proposed |

$3.2 billion |

$6.3 billion |

|

Rescind the authority for funding a crop insurance pilot program for wild salmon |

Not Proposed |

Not Proposed |

$10 million |

|

Total Proposed 10-Year Savings |

$7.5 billion |

$11.8 billion |

$14.2 billion |

|

Note: *Many federally subsidized crop insurance policies recalculate insurance payouts if the price of the crop at harvest is higher than what the policy was based on when it was bought at planting. This means producers, even those with a bountiful harvest, could receive a payout because prices are higher than they anticipated at planting. Policies with price protection are more expensive than other crop insurance policies, resulting in higher subsidies, and are more likely to result in claims, leading to increased costs for taxpayers. |

|||

10:45am: Spending Carve-outs for Biofuels and Biomass in Energy

The President’s budget proposes several spending carve-outs for biofuels and biomass sources in both the agriculture and energy budgets (see separate post here for agriculture budget carve-outs). The budget primarily focuses on taxpayer funding for advanced biofuels, which include the production of ethanol from sugarcane, biodiesel from vegetable oils and other feedstocks, and cellulosic biofuels derived from perennial grasses, algae, or wood or agricultural residues; recently, corn biobutanol, another form of corn-based biofuels aside from corn ethanol, has also qualified as an advanced biofuels in the federal Renewable Fuel Standard (RFS). Without additional subsidies or research programs, the RFS already requires 21 billion gallons of advanced biofuels to be produced by 2022, but the industry has been slow to get off its feet since it faces numerous economic and technological challenges. Hence, a 2011 National Academy of Sciences study found that advanced biofuels production was unlikely to meet its government mandates or reduce greenhouse gas emissions, as required by law.

The budget also proposes funding for programs supporting the biomass industry which utilizes feedstocks such as wood or crops for heat, power, and other energy sources. TCS has historically targeted biomass programs for budget cuts since they spur numerous unintended consequences and fail to achieve their stated goals.

TCS has identified the following proposed spending on biofuels/biomass programs so far, but updates will be added when additional information becomes available.

Biofuels/Biomass Spending in Energy Budget

- $359 million in discretionary funding for Department of Energy (DOE) vehicle technology activities, including the Clean Cities Program which promotes adoption of alternative fuel vehicles such as flex-fuel vehicles operating on high blends of corn ethanol fuel.

- $253 million to “develop and demonstrate conversion technologies to produce advanced biofuels, such as “drop-in” replacements for gasoline, diesel, and jet fuel” although several farm bill energy title programs already attempt to accomplish this goal. This appears to be a decrease from $282 million in last year’s budget.

- $2 billion over the next ten years in a “new Energy Security Trust that would provide a reliable stream of mandatory funding for R&D on cost-effective transportation alternatives utilizing cleaner fuels such as electricity, homegrown biofuels, renewable hydrogen and domestically produced natural gas.” This Trust is recycled from last year’s budget request.

- $628 million for Biological and Environmental Research, including funding for biofuels research and relevant scientific facilities, among other technologies.

- $253 million for Bioenergy Technologies which funds R&D projects for biofuels and biomass conversion technologies, including spending on three DOE Bioenergy Research Centers.

10:30am: Spending Carve-outs for Biofuels and Biomass in Agriculture

The President’s FY15 budget proposes several spending carve-outs for biofuels and biomass sources in both the agriculture and energy budgets (see above for energy budget carve-outs and general background on biomass/biofuels).

TCS has identified the following proposed spending on biofuels/biomass programs so far, but updates will be added when additional information becomes available. TCS has specifically called for the end to the programs listed below aside from the newly proposed bio-manufacturing and bioproducts institute.

Biofuels/Biomass Spending in Agriculture Budget

- $25 million for a new institute to “build a National Network for Manufacturing Innovation focused on bio-manufacturing and bioproducts development, using regional hubs to move relevant bio-energy and bio-based research to development, deployment, and commercialization.” Several federal programs already aim to achieve these goals, some of which are listed below.

- $52 million for the Rural Energy for America Program (REAP), which provides taxpayer dollars for projects ranging from biomass/bioenergy utilization to oxygen monitoring systems for catfish farms and updates to farmers’ grain bin dryers and irrigation equipment. As a comparison, the recently-enacted 2014 farm bill provided $50 million in FY15 in mandatory funding, with availability of additional optional funding via annual appropriations bills. The 2014 farm bill also prohibited future taxpayer spending on ethanol blender pumps within this program, a reform that TCS has advocated for since 2011 when the U.S. Department of Agriculture allowed the mature corn ethanol industry to receive additional taxpayer subsidies without Congressional approval.

- $3 million for the Biomass Research and Development Initiative which provides grants to companies, universities, and government research centers to research and develop (R&D) and demonstrate new ways to refine various types of feedstocks and crops into biofuels or biobased chemical and products (same level in 2014 farm bill).

- $50 million for the Biorefinery Assistance Program which was intended to provide grants and loan guarantees to producers of advanced biofuels or heat and power from various bioenergy crops and feedstocks (same level in 2014 farm bill).

- $25 million for the Biomass Crop Assistance Program (BCAP) which was intended to spur development of advanced biofuels and bioenergy derived from non-food and feed crops (same level in 2014 farm bill).

- $15 million for the Bioenergy Program for Advanced Biofuels which was intended to spur development of advanced biofuels derived from non-food crops but instead supports mature biofuels industries such as corn ethanol and soy biodiesel (no request for additional discretionary funding).

- $12 million in FY14, to remain available until expended, for the Repowering Assistance Program which reimburses biorefineries for using biomass sources like wood chips and perennial grasses as a heat and power source instead of fossil fuels (no request for additional discretionary funding).

Tuesday, March 4, 2014

4:00pm: Shipbuilders Still Floating on Federal Funds

At last week’s advance budget briefing, Secretary Hagel announced his decision to truncate the operationally-inefficient Littoral Combat Ship or LCS. “I am concerned that the Navy is relying too heavily on the LCS to achieve its long-term goals for ship numbers. Therefore, no new contract negotiations beyond 32 ships will go forward.” This represents a cut of 20 ships from the most recent projected inventory of 52 LCS. At TCS we call for ending the program altogether, which would save a little more than $18 billion over the next decade. Now that the budget documents are out, we see the Navy plans to buy three more LCS at a cost of a little less than $1.5 billion. We still think the program should just be cancelled.

Any excitement we might have felt about cuts to the LCS budget were dashed with Secretary Hagel’s next statement, “Additionally, at my direction, the Navy will submit alternative proposals to procure a capable and lethal small surface combatant, generally consistent with the capabilities of a frigate. I've directed the Navy to consider a completely new design, existing ship designs, and a modified LCS. These proposals are due to me later this year in time to inform next year's budget submission.” So, although shipbuilding accounts may be taking a bit of a “haircut” this year, look for all kinds of ideas for a “lethal frigate” coming from industry to “inform” next year’s budget. We’ll be watching.

Last year, shipbuilding was funded at $15.2 billion: an increase of $1.1 billion over what the Pentagon was asking to spend. This year’s request shipbuilding request is $14.4 billion.

Biggest programs:

- VIRGINIA class submarines, two of them for roughly $5.8 billion. More than 1/3 of the Navy’s budget for ships will be “sunk” into one program.

- ARLEIGH BURKE class destroyers, two for a total of $2.8 billion.

And according to the Secretary’s briefing in late February, the budget request also includes a plan to “lay up” half of the Navy’s cruiser fleet. Under this plan, which has made Congress highly suspicious in the past, eleven cruisers would be modernized and placed in reduced operating status and “eventually” returned to the fleet. Watch for Congress to try to pin down exactly what “eventually” means.

So those are the “highlights” of the Navy’s shipbuilding plan before Congress starts amending it. We’ll have our periscope up, watching to see how much Congress adds to help out the shipbuilding industry.

3:30pm: Title 17 Loan Guarantee Program Funding Remains Flat

This year’s budget request continues the Administration’s commitment to handout an existing $34 billion in loan guarantee authority for the Dept. of Energy Loan Guarantee Program, providing no loan volume increases for the program for a second year. Created in 2005, the DOE program first received loan guarantee authority in 2007 and shortly thereafter, increased and divided it into pots for various technologies including nuclear reactors, uranium enrichment, fossil fuel facilities, as well as efficiency and renewable energy projects.

The DOE Program first became famous with the default of Solyndra, a solar panel manufacturer costing taxpayers more than $500 million. The most recent deal, a $6 billion agreement with Southern Company and partners was finalized in mid-February for a pair of nuclear reactors.

While loan guarantees dispersed through the DOE program appear to have a low budget score, they saddle taxpayers with up to 80% of a project's cost, if the project defaults. So far taxpayers have seen losses in the hundreds of millions, but with the $6 billion nuclear deal and other risky reactors and fossil fuel facilities in the pipeline, including a near $3 billion proposal for a liquid coal facility, the taxpayer toll could quickly sky-rocket.

2:30pm: DHS Border Security Spending

The Department of Homeland Security (DHS) budget request is a little less than $61 billion for fiscal year 2015. Of that request the largest portion, $12.7 billion, is devoted to Customs and Border Protection (CBP). And within that two thirds of the money goes to salaries and expenses of CBP employees. But tucked into the budget documents is a broad reference to $362 million for “effective surveillance technology” on the border. Details aren’t available in the budget documents released so far, but at Taxpayers for Common Sense we hope that old DHS wish list isn’t being resurrected in these times of budget austerity.

2:00pm: “Mi.gif” Nukes Get Budgetary Boost

The President’s FY15 budget doubles down on investments for small modular reactors (SMRs). The Department of Energy’s Small Modular Reactor Licensing and Technical Support Program is allotted $97 million, up $27 million from last year’s request. SMRs will likely receive a hefty line-item in Reactor Concepts Research, Development, and Demonstration (RD&D) as well around $20 million, bringing the total requested for SMRs in this year's budget to $117 million. That's a 30 percent increase.

With more than $300 million in appropriations since FY’11, it’s time for the subsidies for this untested and unlicensed technology to stop. In fact, industry is starting to pull away from SMRs. Last month, Westinghouse Electric Company announced that it plans to reduce its investment in SMRs. The company’s CEO specifically noted that the economics of SMRs are just too difficult to justify.

Under its Licensing and Technical Support Program, DOE is helping fund the development of two SMR designs: Babcock and Wilcox’s mPower and NuScale’s Power Module. In total, those agreements will cost taxpayers $452 million.

TCS gave the SMR program our Golden Fleece award in February 2013 for handing out hundreds of millions to the profitable nuclear industry.

Here’s a chart of recent requests and appropriations for SMRs (in $millions) :

|

Sub-Program: |

FY2011 (ACTUAL) |

FY2012 (ACTUAL) |

FY2013 (ENACTED) |

FY2014 (REQUESTED) |

FY2014 (ENACTED) |

FY2015 (REQUESTED) |

|

Licensing Support |

– |

67 |

67.41 |

70 |

110 |

97 |

|

Advanced R&D |

3.105 |

24.529 |

~24.529 |

20 |

23 |

~20 |

|

TOTAL SMR Program |

3.11 |

91.53 |

91.94 |

90.00 |

133 |

~117 |

1:45pm: Deficit Duplicity

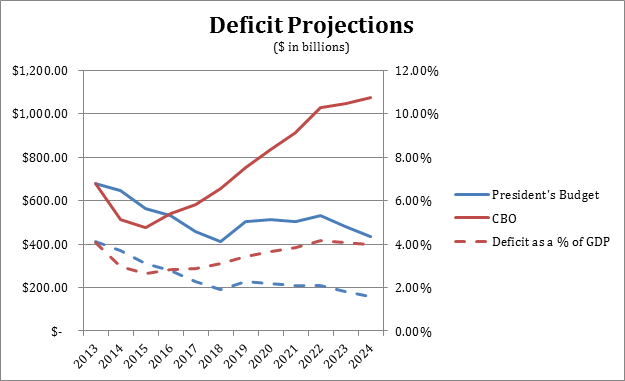

Exactly a month ago, the Congressional Budget Office issue their Budget and Economic Outlook: 2014-2024. CBO noted that the deficit “…is on a path to decline further this year and next year.” They peg the FY14 deficit at $514 billion. Guess the White House doesn’t agree. The FY15 budget released today estimates that the FY14 deficit will be $649 billion. That’s pretty much a head scratcher for us. Fiscal year 2014 spending is already settled, the appropriations bill was passed in January, the fiscal year is nearly half over. Sure there could be additional spending (like $1 billion for Ukraine) and economic assumptions can differ, but this is a $135 billion difference – a more than 25% increase.

The White House $649 billion deficit number for FY14 conveniently makes the $564 billion FY15 President’s budget request deficit look better. If the White House used CBO’s numbers, $514 billion in FY14 and $478 billion in FY15, the President’s budget would be increasing the deficit as opposed to decreasing it. After FY15, the CBO estimates that the deficit keeps going up until it hits $1.074 trillion in 2024. The President’s budget takes a rosier view with deficits generally trending down and ending at $434 billion in 2024.

Now the CBO has to use the laws on the books in their estimates, while the Administration can assume that their every budgetary wish is granted. But that doesn’t explain the big variance between the two in FY14.

1:35pm: Fossil Fuel Tax Breaks on the Chopping Block Again

Like previous budget requests, the President's FY2015 request calls for the repeal of twelve subsidies in the tax code for the fossil fuel industry. The budget proposes the elimination of four coal and eight oil and gas tax preferences totaling approximately $49.1 billion in revenue over the next ten years, according to the budget documents.

| Oil and Gas Company Tax Preferences | 2015–2024 ($m) |

|---|---|

| Repeal Expensing of Intangible Drilling Costs | 14,350 |

| Repeal Domestic Manufacturing Tax Deduction for Oil and Natural Gas Companies | 14,218 |

| Repeal Percentage Depletion for Oil and Natural Gas Wells | 13,030 |

|

IncreaseGeological and Geophysical Amortization Period for Independent Producers to Seven Years |

3,081 |

| Repeal Deduction for Tertiary Injectants | 100 |

|

Repeal Exception to Passive Loss Limitations for Working Interests in Oil and Natural Gas Properties |

59 |

| Repeal Credit for Oil and Gas Produced from Marginal Wells | – |

| Repeal Enhanced Oil Recovery Credit | – |

| Total | 44,838 |

| Coal Tax Preferences | 2015–2024 ($m) |

|---|---|

| Percent Depletion for Hard Mineral Fossil Fuels | 2,052 |

| Domestic Manufacturing Deduction for Hard Mineral Fossil Fuels | 726 |

| Expensing of Exploration and Development Costs | 679 |

| Royalty Taxation | 508 |

| Total | 3,965 |

Here is a brief description of some of the biggest cuts, and why they should be cut. Also worth noting, some of these also appeared in both Rep. Camp’s and Sen. Baucus’ tax reform plans.

Intangible drilling costs (IDC) allows qualified natural resource developers to immediately deduct all of the costs of designing and fabricating drilling platforms and can represent 60 to 80 percent of the costs of drilling a well. The oil industry characterizes the IDC deduction as the equivalent of the “research and experimental” (R&E) cost deduction. In the case of oil and gas wells, the principal uncertainty that exists is only whether oil and gas are present in commercial quantities, not how to construct the oil rig.

Domestic Manufacturing Tax Deduction for Oil and Natural Gas Companies allows oil and gas companies to deduct 6 percent from qualified income. Like other qualifying activities, the nature of oil and gas production is such that the jobs associated with the production of oil and gas from domestic wells cannot be moved abroad in the way that jobs producing consumer goods might.

Special Percentage Depletion Allowance enables producers to claim tax deductions in excess of their investment. While it is nominally designed to allow the oil and gas industry to deduct the cost of purchasing rights to oil and gas resources, the percentage depletion deduction bears no actual relationship to the cost of acquisition. It allows independent producers a flat deduction of a percentage of gross income from each well.

1:30pm: Continued Funding for “Clean” Coal Technology

The budget requests $476 million for the Fossil Energy Research and Development program primarily dedicated to carbon capture and storage (CCS) and advanced power systems. That’s up $46 million from last year’s request for $430 million.

Carbon capture and storage (CCS), also referred to as carbon capture and sequestration, is the process of separating carbon dioxide (CO2) from fossil fuels, pumping it deep inside the earth, and leaving it stored in underground geologic formations such as exhausted oil and gas fields. The technology is predominantly designed to be used with coal, coal-to-liquid, or natural gas plants to decrease their overall carbon emissions.

Despite years of investments, CCS technology is decades away from being commercially viable and taxpayers should not be footing the bill for this costly pursuit. The coal industry has been subsidized for decades and should bear this cost.

1:15pm: Mission (Not) Accomplished on Deficit Reduction

Citing “the deep spending reductions that occurred in 2013, some of which have continued in 2014…” and successful implementation of some of his previous suggestions, the President’s budget includes a vastly slimmed down Cuts, Consolidations, and Savings (CCS) section. This year’s budget identifies 136 programs totaling $17 billion in FY2015, compared to last year’s 215 totaling more than $25 billion in FY2014. If you’re not good at math, that’s 32% less in savings.

This part of the budget, one of our favorites, is typically a laundry list of inefficient or downright wasteful government programs that can be reduced or even eliminated. But, just like last year, this CCS is slim pickings when it comes to details. In the 2013 budget the document was 213 pages long, explaining a bit about each proposed cut and the President’s reasoning for including it. This year we just have eight pages, five of which are lists, with sparse details. A few more details can be found in other materials including the Analytical Perspectives volume…which isn’t out today!

The President should not be pivoting away from reining in our nation’s deficits. While many in Washington are congratulating themselves on the Congressional Budget Office estimate that “only” $514 billion will be added to our nation’s credit card this year, with a projected shortfall of $478 billion in 2015, CBO also projects deficits will begin sharply rising again in 2016. (The President’s budget has dramatically different – higher – deficit numbers, but that’s for another post).

The President should challenge Congress to eliminate inefficient, ineffective, and costly programs that have outlived their usefulness. But to do that he needs to provide taxpayers with more details on a larger number of deficit reduction measures. If he needs somewhere to start, he can always start with the $100 billion we identified in our report Real Savings, Real Deficit Reductions.

1:05pm: President’s Budget Needs Fresh Outlook on Agriculture Saving

The President’s FY15 budget request once again proposes cuts to the federal crop insurance program, among other proposals to reform wildfire suppression funding and spend $75 million on three new institutes dedicated to bio-manufacturing and bioproducts, pollination and pollinator health, and anti-microbial resistance research (antibiotic resistance). His budget request expects to save $14 billion over ten years (slightly more than last year’s $12 billion) by reducing agribusinesses’ crop insurance premium subsidies and reining in lucrative administrative and operating subsidies paid to private crop insurance companies. The President’s budget notes that many of the agriculture reforms he proposed last year – including the elimination of direct payments which are paid regardless of crop prices or farm income – were included in the Agricultural Act of 2014, which he signed into law on Feb. 7. However, instead of proposing additional reforms to inefficient and ineffective programs such as new shallow loss entitlements, bioenergy initiatives that support mature biofuels, market promotion programs, and Soviet-on-the-Potomac government-set price supports, he relies only on modest reforms to the highly subsidized, $9 billion per year crop insurance program.

Last year, the President proposed $38 billion in savings from agriculture programs, nearly three times the level of savings expected in his FY15 budget. Even if expected savings from the recently-enacted 2014 farm bill are included ($16.6 billion over ten years but numerous budget gimmicks were utilized to arrive at even this meager level of savings), his reforms fall short of his own budgets from years past ($38 billion in FY14 and $32 billion in FY13) and Budget Chairman Paul Ryan’s $31 billion in agriculture savings from FY14. The President’s FY15 budget proposes positive and long-overdue reforms to the federal crop insurance program, but overall reforms to agribusiness subsidy programs could go much further to make the farm safety net more cost-effective, accountable, transparent, and responsive to taxpayers. More details will be posted once they become available.

12:45pm MOX Facility Left in the Cold

The President’s FY2015 Budget continues to express significant concerns about the Mixed Oxide (MOX) Fuel Fabrication Facility project in Aiken, South Carolina, placing it on “cold standby” while the Administration explores other options to dispose of weapons-grade plutonium. Last year’s budget included $320 million for the MOX facility.

In the last three years, the Administration’s support for MOX has waned. The Fissile Materials Disposition program, which includes MOX, received $311 million in today’s budget request down from $503 million in FY 2014, which was a 30 percent reduction from FY 2013 for MOX.

The MOX reprocessing facility planned to convert plutonium into fuel for use in commercial nuclear reactors. According to today’s released budget documents, sky-rocketing cost overruns make the project “not viable” within the FY15 budget levels. TCS is opposed to the construction of the MOX facility.

11:45am: No More Special War Funding Account

“…this is the first time in 13 years we will be presenting a budget to the Congress of the United States that's not a war-footing budget.” Those were the words of Secretary of Defense Chuck Hagel on February 24th of this year. And yet the Pentagon budget that was made public today still includes a separate fund for “Overseas Contingency Operations (OCO).” OCO is what the Pentagon calls it when the rest of us call it war funding.

The FY15 budget request, released March 4, 2014 requests an additional $79.4 billion, even as we draw down our forces even further in Afghanistan. For comparison, the FY14 Omnibus included $85.1 billion in OCO funding. Why do we continue to need such high levels of funding, when we plan to reduce to a bare-bones force in Afghanistan? And the six year plan for outyear funding is $29.9 billion every year through fiscal year 2021. So, even though we plan to be out of Afghanistan, the Administration plans on spending close to $30 billion a year for another 6 years, or more than $179 billion between now and calendar year 2022. At Taxpayers for Common Sense, we think this makes no sense at all.

11:35am: By the Numbers

The President released his fiscal year 2015 budget today. It envisions $3.901 trillion in spending, which includes $1.15 trillion for discretionary spending – $136 billion more than was agreed to in December. It also assumes a $564 billion deficit in FY15 and ten year deficit total of $4.93 trillion. The net interest – the amount spent to service the nation’s debt will be $251 billion in FY15, by FY24 that number will balloon to $886 billion.

11:31am: Statement by TCS President Ms. Ryan Alexander

“Any President’s budget is viewed as an entering argument, a wish list, on Capitol Hill. The final product is always different, sometimes significantly so. This year’s budget exercise seems emptier than most because Congress and the President already agreed that $1.014 trillion was the top line discretionary spending number for fiscal year 2015. The $56 billion in additional spending the President is proposing is likely going nowhere. The revenue offsets the administration proposed are perennials that are likely to be rejected, particularly in an election year with tax reform on the horizon. All that said, we will be combing through the budget to see what is buried in there and what direction the President is giving Congress in the base budget priorities. Stay tuned.”

Download White House Budget Documents:

Cuts, Consolidations and Savings (pdf)

Here are some agency briefings providing more detail on certain parts of the budget:

National Nuclear Security Administration Budget Request Briefing for FY2015-2019 (pdf)

Transcript of US Navy Briefing on Budget Request for FY15

Department of Energy Briefing on Budget Request for FY15 Video / Slide Show Presentation

Transcript of US Army Briefing on Budget Request for FY15

Transcript of US Air Force Briefing on Budget Request for FY15

Transcript of DOD Officials Briefing on Budget Request for FY15

Transcript of Missle Defense Agency Briefing for FY15