Turmoil in Congress has thrown everything up in the air. The House left early for its 4th of July recess, and the Senate will soon be gone. And speaking of up in the air, when lawmakers return there will be only 10 calendar days left before the July 15 expiration of the Federal Aviation Administration (FAA) authorization. That’s the bill that authorizes ticket taxes, airport construction spending, and  other FAA operations. And to put their backs up to the wall further, that’s also the last day before Congress recesses to accommodate the party presidential conventions.

other FAA operations. And to put their backs up to the wall further, that’s also the last day before Congress recesses to accommodate the party presidential conventions.

That means the country is looking at an extension of the legislation. If this sounds familiar, that’s because it is. The current authorization is a three-and-a-half-month extension that was preceded by a six-month extension of the “FAA Reauthorization and Reform Act of 2012.” At this late hour, the fight will be over how long and how clean the extension is.

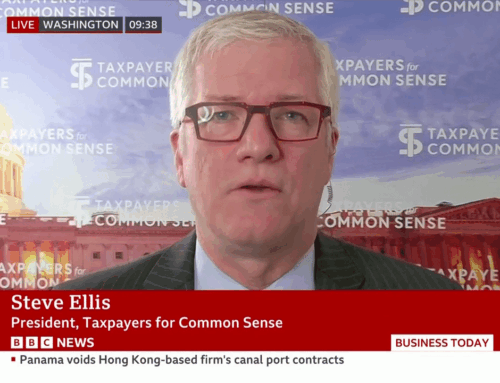

The House and the Senate have passed reauthorization bills, but there are some significant differences. The biggest: House Transportation and Infrastructure Chairman Bill Shuster (R-PA) wants to shift air traffic control operations to a non-governmental organization, something that Taxpayers for Common Sense has supported and Canada did two decades ago with many other countries following suit. The Senate, most notably the Commerce, Science and Transportation Committee’s ranking Democrat, Sen. Bill Nelson (D-FL) doesn’t support this shift.

So, despite each chamber having passed reauthorization legislation months ago, an extension is needed. The question is: Should you have the lame duck Congress have a say in December or do you kick the can down the road into next year and a new Congress? Taking action sooner than later might appeal to Commerce, Science and Transportation Committee Chairman John Thune (R-SD). While most analysts think the Senate will remain in Republican hands after the November election, it has a greater chance of flipping to Democratic control than the House. But an extension into the New Year also introduces a new President and administration to the equation.

In addition to how long there is the question of how clean? Senator Thune has indicated he wants to add some permanent FAA-related policy provisions to the extension. But as soon as you open something like this up it starts to attract flies. Back in the spring when the Senate was considering a long-term FAA extension, there were efforts to add extraneous provisions dealing with residential water conservation, benefits for retired mine workers, and even a “Carbon Capture Improvement Act” (bad idea). Oh, and there was a passel of energy-related tax provisions that got left on the cutting room floor at the end of last year. If this sounds familiar, it’s because we told you about it at the time. We didn’t like it then and we don’t like it now.

The end of year tax extenders package was bad policy then and doing more of it would be bad policy now. As we wrote in April, “First off, we are opposed to Congress playing favorites in the tax code and, particularly in the energy arena, there is a crazy quilt of tax expenditures that favor every type of energy source going. They should all be eliminated.” There you go. The package at the end of the year wasn’t offset, making the deficit hole even wider.

Congress didn’t get its job done on the FAA extension. Fine. Do an extension. And then get to work figuring out the best policies for the agency. We’d like to see air traffic control reform, a rollback of the wasteful so-called Essential Air Service, and changes in airport funding. But whether it’s now, in December or next year, taxpayers can’t afford to have the reauthorization hijacked by a bunch of extraneous provisions.