The House and Senate Agriculture Committees recently invited numerous farm commodity group representatives to Washington, DC, to testify about 2023 farm bill priorities. One common theme across peanut, wheat, and other farm lobby group’s testimony has been a push for more taxpayer subsidies, this time increased government-set price guarantees in the Price Loss Coverage (PLC) program.

Government-enforced minimum prices have been around for decades in one form or another. Whether called reference prices, target prices, counter-cyclical payments, or PLC, they’re essentially a way that taxpayer subsidies go out the door when the price of wheat, soybeans, corn, rice, and peanuts falls below a minimum price floor set by Congress. These subsidies are thus categorized as market-distorting by the World Trade Organization (WTO). Subsidies flow to the largest and wealthiest agricultural producers and landowners since they are tied to historical crop plantings.

When you combine PLC with the array of duplicative subsidies available to certain crop producers (we’re not talking about fruit or vegetable production), farmers such as Scott Kinkaid in Nebraska oppose unnecessary farm subsidies such as PLC since they end up increasing land prices and limiting opportunities for young, small, beginning, and diversified farmers. Don’t take our word for it. Here’s Scott Kinkaid and his son Skyles discussing farm subsidies’ negative impact on rural communities, beginning farmers, and the land in our Budget Watchdog, All Federal podcast: https://www.taxpayer.net/agriculture/budget-watchdog-all-federal-ep-38-farm-bill-field-trip/.

The farm lobby is crying wolf, saying input prices have risen so high that the federal government should increase price guarantees for certain commodity crops as a result. Yes, prices for inputs like fertilizer and fuel have increased. However, they’re ignoring the other side of the balance sheet – income. The U.S. Department of Agriculture (USDA) reports that crop receipts have outpaced expenses in recent years, meaning farmers are making money. In fact, 2022 net farm income was expected to reach a 50-year high – despite high input costs.

| Crop Income Outpacing Increases in Input Costs (USDA-ERS) | |||

| 2021 | 2022 | Increase | |

| Value of crop production | $241.1 billion | $269.2 billion | $28.1 billion |

| Manufactured inputs | $67.7 billion | $94.0 billion | $26.3 billion |

| = Crop receipts > input costs | |||

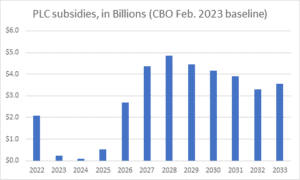

Without any increases in government-set reference prices (being proposed by the farm lobby), the Congressional Budget Office (CBO) already expects PLC to cost taxpayers more than $4 billion annually, beginning in 2027. While PLC costs have been lower in recent years due to farmers receiving higher prices from the market, costs are expected to balloon as crop prices return to historical averages. This is not a reason for expanded government intervention into the marketplace, but rather a great time to scale subsidies back. Why? Not only are PLC subsidies duplicative (with highly subsidized crop insurance, just to name one program covering any potential losses), but eliminating market-distorting subsidies will enable producers to innovate, and utilize successful, unsubsidized risk management options. Moreover, producers finding success in the market do not “need” government support, so eliminating wasteful subsidies will save taxpayer dollars.

For these and other reasons, TCS joined other organizations this week calling on Congress to reject calls to increase wasteful subsidies in the next farm bill. Instead, lawmakers should enact a farm safety net that is focused on true need, fiscally responsible, and fosters resilience, instead of dependence on subsidies. A few simple ways to achieve these goals include reining in subsidies to millionaires, non-farmers, and city dwellers. These types of common sense reforms have been championed by a bipartisan set of lawmakers in the past in addition to both Republican and Democratic Administrations in past President’s budget requests. Independent analysts ranging from CBO to the Government Accountability Office (GAO) have chimed in as well, identifying tens of billions of dollars in taxpayer savings ($49 billion over the next ten years, to be exact) if programs like PLC and ARC were eliminated.

Congress should take note instead of continuing to cater to special interests – to the detriment of beginning farmers, taxpayers, rural communities, and our land.