May 31, 2017

6:35 pm – Putting the Kibosh on Clean Coal R&D

6:35 pm – Putting the Kibosh on Clean Coal R&D 5:00 pm – So Long SMRs

5:00 pm – So Long SMRs

4:45 pm – Cutting (Down) the Forest Service Budget

4:45 pm – Cutting (Down) the Forest Service Budget

May 25, 2017

5:25 pm – Bump Up for BLM Energy

5:25 pm – Bump Up for BLM Energy

3:45 pm – Cyber Spending Figures are a Cloud

3:45 pm – Cyber Spending Figures are a Cloud

12:30 pm – R&D Reboot

12:30 pm – R&D Reboot

9:20 am – Ephemeral Cuts to the Corps of Engineers

9:20 am – Ephemeral Cuts to the Corps of Engineers

May 24, 2017

2:10 pm – Why a Shipbuilding Request in the Shipbuilding Portion of the Budget – Yes, Really – is a Good Thing

2:10 pm – Why a Shipbuilding Request in the Shipbuilding Portion of the Budget – Yes, Really – is a Good Thing

1:35 pm – GOMESA or Go Home

1:35 pm – GOMESA or Go Home

10:30 am – A Reduced Role in Federal Emergency Response

10:30 am – A Reduced Role in Federal Emergency Response

9:20 am – Billions More for Border Boondoggle

9:20 am – Billions More for Border Boondoggle

9:10 am – Title 17 Eliminated

9:10 am – Title 17 Eliminated

May 23, 2017

4:26 pm – Welcome Cuts to Bioenergy Programs

4:26 pm – Welcome Cuts to Bioenergy Programs

4:25 pm – Coast Guard Unscathed

4:25 pm – Coast Guard Unscathed

2:50 pm – Power Marketers on the Market?

2:50 pm – Power Marketers on the Market?

2:15 pm – Department of Energy Gets a Trim

2:15 pm – Department of Energy Gets a Trim

1:25 pm – Interested in Interest

1:25 pm – Interested in Interest

1:20 pm – Commodity Programs Avoid the Knife

1:20 pm – Commodity Programs Avoid the Knife

12:25 pm – Hey, the Tax Man

12:25 pm – Hey, the Tax Man

11:40 am – TCS Statement from Ryan Alexander, President

11:40 am – TCS Statement from Ryan Alexander, President

11:30 am – The President's FY2018 Budget is out!

11:30 am – The President's FY2018 Budget is out!

May 31st 5:00pm

Putting the Kibosh on Clean Coal

Among other research and development spending targeted for cuts in the FY18 budget, the request takes aim at the Department of Energy's Carbon Capture and Storage (CCS) program. In doing so, the proposed budget represents a welcome divergence from the high levels of funding CCS Research, Development and Demonstration (RD&D) has enjoyed for years.

The President's FY18 budget request calls for an almost 75 percent cut to the 'CCS and Power Systems' line item, allocating a total of $144.8 million dollars to the program, a $309 million decrease from the FY17 Omnibus funding level of $423.8 million. And that's not accounting for the extra $50 million Congress heaped onto the omnibus for two CCS pilot projects. After 20 years of funding CCS RD&D, the program has neither borne fruit nor lived up to its claims of cleaning up coal – the cut is long overdue.

May 31st 5:00pm

So Long SMRs

Among the many cuts it makes to the the Department of Energy's (DOE's) Nuclear Energy program (see below), the FY18 budget eliminates the Small Modular Reactor (SMR) Licensing Technical Support program, and taxpayers won't be sad to see it go.

After receiving initial funding for the program from Congress in FY12, the DOE slated it to end after FY17. Zeroing out the program's budget for FY18 may therefore seem like a simple matter of course. But TCS has known since its founding that Washington is the place where bad ideas never seem to die.

If Congress reviews the program's track record, it should have no reason to keep the initiative afloat. Of the $452 million allocated to the program, more than $100 million was wasted on the program's first award recipient, mPower. Babcock & Wilcox, mPower's parent company, decided to cut funding for the project just a year after securing $150 million from the DOE because it couldn't find other investors willing to bet on the SMR venture.

Then, instead of saving what remained of the mPower award, the Licensing Technical Support program simply funneled more to other recipients than originally intended. Lucky them, poor taxpayers.

There are a host of reasons why the SMR program should've never gotten off the ground, a number of reasons it should've been terminated once it did, and absolutely no reason Congress should keep it around now.

May 31st 4:45pm

Cutting (Down) the Forest Service Budget

In the President's FY18 budget request, the agency responsible for managing the country's national forests—and the cutting of timber in those forests—was itself subject to some budget cuts. Overall, proposed U.S. Forest Service (USFS) spending was cut by roughly 10 percent to a level of $4.73 billion. The reduction was distributed relatively evenly across the USFS sub-accounts, with a few exceptions.

Like enacted spending levels for the USFS in both FY16 and FY17, around half of the FY18 budget request is devoted to wildfire management accounts. At $2.85 billion,[1] the proposed FY18 level is actually $15 million more than the FY17 level—one of only two accounts to see an increase. The other proposed increase is for the "Law Enforcement Operations" line item, which at $129 million is slightly more than the FY17 enacted level of $127 million, but for comparison, is slightly less than the previous administration's FY17 request.

The largest cuts were reserved for the Forest Service's "Capital Improvement and Maintenance" budget. At just under $100 million, the FY18 requested amount is 73 percent less than the FY17 enacted amount of $364 million.

The budget, meanwhile, mostly spares the "Forest Products" account that directly funds the preparation and administration of timber sales. The requested $359 million for FY18 is 2.4 percent less than FY17, but in line with historical spending levels for the program—see below. As we've noted in past years, to the extent that the USFS continues to use this account to fund below-cost timber sales, taxpayers will continue to lose in FY18.

Interior and Environment Appropriations for FY2016

| Budget Line | FY 2012 Enacted |

FY 2013¹ Actual |

FY 2014 Enacted | FY2015 Enacted | FY2016 Enacted | FY2017 Enacted | FY2018 President Request |

| Forest Products | 336.049 | 318.280 | 339.130 | 339.130 | 359.805 | 367.805 | 359.121 |

[1] This total includes the $354 million requested for the Hazardous Fuels program, which the administration proposed moving under the National Forest System budget, but which has previously been a sub-account of the Wildland Fire Management budget. Additionally, the FY17 number to which this total was compared does not include the $342 in emergency appropriations provided in the FY17 Omnibus.

May 25th 5:25pm

Bump Up for BLM Energy

Today, the Department of the Interior (DOI) published the budget justification for the Bureau of Land Management (BLM), one of its sub-agencies, shedding some light on the new administration's approach to land management issues.

Like the DOI budget in general, the President's FY18 request calls for making significant cuts to the BLM: at $1.09 billion the proposed FY18 BLM budget is $165 million, or 13 percent less than the FY17 enacted level. The cuts are spread across all of the BLM's program areas, with only one exception. For the BLM's "Energy and Minerals Management" work, the budget requests an increase of $4.5 million.

The BLM administers more than 700 million acres of sub-surface mineral estate, the energy resources contained therein are significant, and the agency bears responsibility for ensuring taxpayers get a fair return for these federal assets. Whether the prioritization of BLM's energy management work is justified, however, depends on where the administration wants to devote the additional funds.

Examining the plus-up for BLM's oversight of energy development, it becomes clear that the funding increase is not divvied out equally among the program's sub-functions:

| Funding Item ($, thousands) |

FY17 Omnibus | FY18 Request | Compared to Omnibus |

|---|---|---|---|

|

Energy and Minerals Management:

|

172,846

|

177,399

|

+ 4,553

|

|

Oil and gas

|

121,939

|

130,049

|

+ 8,110

|

|

Coal management

|

10,868

|

19,015

|

+ 8,147

|

|

Other mineral resources

|

10,978

|

12,043

|

+ 1,065

|

|

Renewable energy

|

29,061

|

16,292

|

– 12,769

|

According to the budget justification, the extra $8 million over last year for oil and gas management ($15 million more than in FY16) will be devoted to accelerating the processing of drilling permits and rights-of-way requests for pipeline infrastructure. TCS is concerned that the acceleration of drilling activities without addressing much needed reforms at the BLM will hurt taxpayers.

Coal management also received an increase of $8 million and may have the taxpayer interest in mind. The budget request acknowledges recent efforts to improve the deeply-flawed federal coal program, and devotes the new funds to that end. In 2016, the agency began preparing a comprehensive review of the program, and the scoping report released after one year of work highlighted a number of issues preventing the BLM from getting fair market value for federal coal. In a March 29 Secretarial Order, Secretary Zinke ended the Programmatic Review.

May 25th 3:45pm

Cyber Spending Figures are a Cloud

In the recent past, when the President's Budget Request was presented to the Congress, the publicly available budget documents stated topline figures for cyber spending. For instance, here's a portion of our analysis of cyber spending in President Obama's last budget request, for FY17:

- "Across the federal government, the President's budget request seeks to invest $19 billion on cybersecurity programs, an increase of about 35% from the fiscal year 2016 totals. According to the Budget Overview produced by the Office of Management and Budget, this $19 billion is, "to support a broad based cybersecurity strategy for securing the Government, enhancing the security of critical infrastructure and important technologies, investing in next generation tools and workforce, and empowering Americans. In particular, this funding will support the Cybersecurity National Action Plan, which takes near term actions and puts in place a long term strategy to enhance cybersecurity awareness and protections, protect privacy, maintain public safety as well as economic and national security, and empower Americans to take better control of their digital security."

We went on to list the publicly available details about cyber in various federal departments. By contrast, here is the wording from OMB in the Trump administration.

"Investing in Cybersecurity. The Budget supports the President's focus on cybersecurity to ensure strong programs and technology to defend the Federal networks we operate on behalf of the American people."

No dollar figures at all in the OMB documents that relate to cyber issues. We had to drill down to the Department of Homeland Security's budget documents to find this small amount of detail.

"DHS: Safeguards cyberspace with $1.5 billion for DHS activities that protect Federal networks and critical infrastructure from an attack. Through a suite of advanced cyber security tools and more assertive defense of Government networks, DHS would share more cybersecurity incident information with other Federal agencies and the private sector, leading to faster responses to cybersecurity attacks directed at Federal networks and critical infrastructure."

Surely we figured the Pentagon, with its penchant for numbers and charts, would have some details on cyber spending for us on the first day of the budget rollout. And, within the Pentagon, the agency that usually offers up the most detail is the United States Air Force. But not this year. Here is an excerpt from the Air Force budget documents.

Cyberspace Superiority

Cyberspace Superiority is the degree of dominance in cyberspace that permits the secure, reliable conduct of operations and its related air, land, maritime, and space forces without prohibitive interference by an adversary. The Air Force categorizes the Department of Defense Information Network (DODIN) Operations, Defensive Cyberspace Operations, and Offensive Cyberspace Operations as various components of cyberspace operations.

"The FY 2018 budget request continues the focus on the development of Cyber Mission Forces with support for defensive and offensive cyberspace operations capabilities. The unique attributes of cyberspace operations require trained and ready cyberspace forces to detect, deter, and, if directed, respond to threats in cyberspace. Securing and defending cyberspace requires close collaboration among federal, state, and local governments; private sector, and allied partners.

"The FY 2018 budget also supports defensive cyberspace operations that provide information assurance and cyber security to the Department's networks at all levels and continues to augment personnel within the combatant commands to support the integration and coordination of cyberspace operations."

We've been in this game long enough that we know as we drill down into the budget justification documents we'll find some numbers. But the first budget from the Trump administration certainly isn't making it easy.

Looks like our ten year retrospective on unclassified cyber spending is coming at just the right time.

At TCS we are in the final stages of producing a database of all unclassified federal cyber spending. This was a lengthy and complicated process involving a team of people who swarmed the federal budget documents and reviewed thousands of pages and programs for the past ten years to find the lines that openly include cyber spending. Of course, there is a whole different set of cyber spending that is classified and, therefore, not in the database we'll be rolling out in the next few weeks.

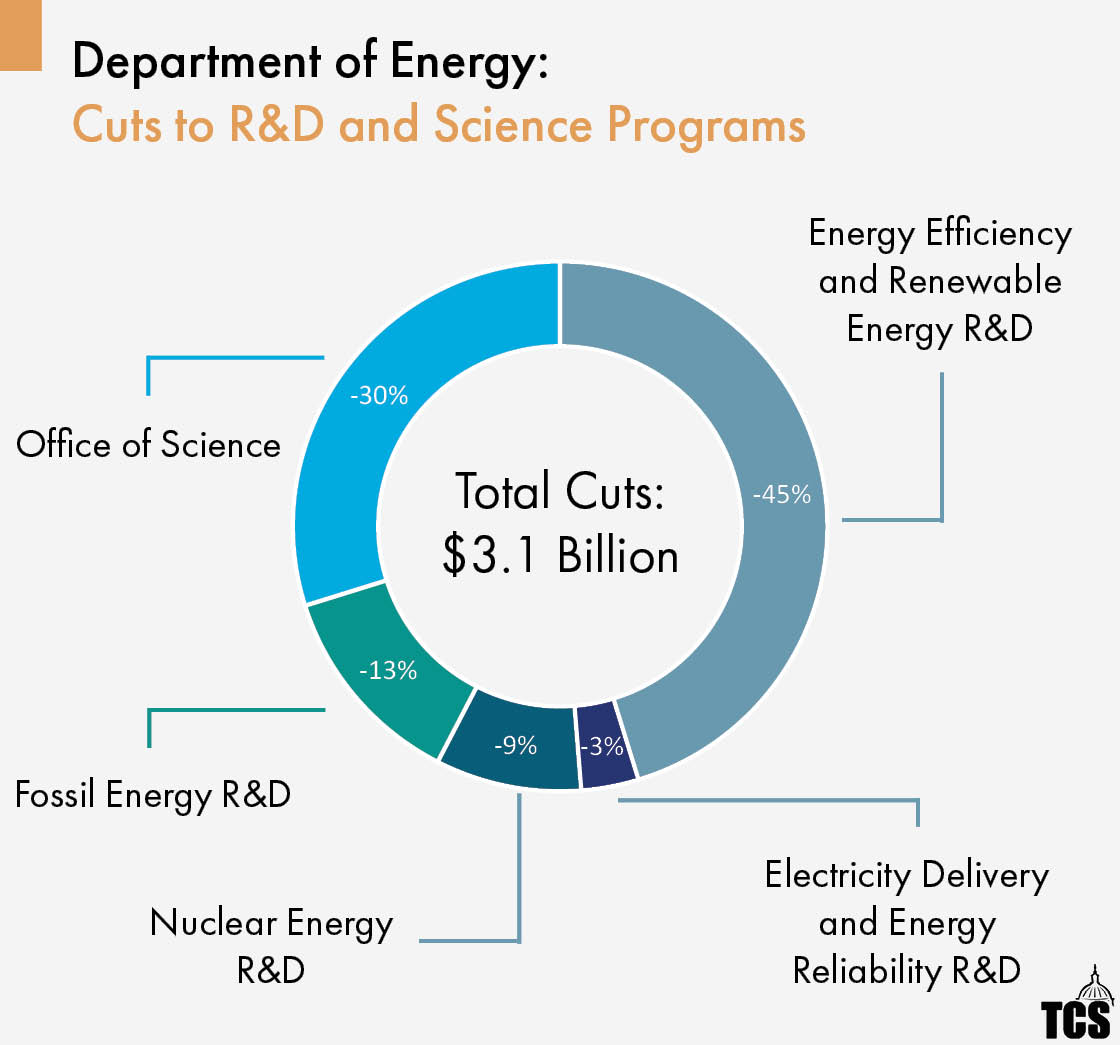

May 25th 12:30pm

R&D Reboot

As we noted earlier, the FY18 budget request for the Department of Energy (DOE) represents both a general cut and a shift of resources away from energy programs and toward the National Nuclear Security Administration (NNSA).

Specifically, $3.7 billion is cut from the DOE's non-NNSA activities, which include the energy power sectors. As a result, the clearest way of identifying the administration's priorities this year is to see which items got cut the least, as opposed to which got increases, as in past years.

With proposed funding at roughly $2.2 billion less than last year, the majority of the cuts are shouldered by the DOE's research and development (R&D) programs. On both a gross and percentage basis, the Energy Efficiency and Renewable Energy (EERE) budget is reduced the most with a proposed $1.4 billion, or 67 percent drop from last year's level. Cuts to the R&D components of the Electricity Delivery and Energy Reliability, Nuclear Energy, and Fossil Energy programs collectively come to around $770 million.

After the R&D budgets, the next biggest cut comes from the DOE's Office of Science, whose proposed FY18 budget is $920 million, or 17 percent less than the FY17 enacted level. Of note, while almost every program area in Science loses significant funding, the FY18 request proposes adding $75 million over the last year to advanced scientific computing research.

TCS has raised concerns with many of the DOE R&D programs, and over the years has supported some cuts to all of these programs, specifically those that go beyond basic research to support mature, well-established energy industries like the fossil fuel or wind industry.

May 25th 9:20am

Ephemeral Cuts to the Corps of Engineers

The budget request for the Army Corps of Engineers-Civil Works division continues a well-worn pattern. Like years past the president's budget requests significantly less money this year than what Congress actually appropriated last year.

| Request | Appropriation | Congress's Increase Beyond Request | % Increase | |

|---|---|---|---|---|

| Fiscal Year 2014 | $4,826,000,000 | $5,467,499,000 | $641,499,000 | 13.30% |

| Fiscal Year 2015 | $4,533,000,000 | $5,454,500,000 | $921,500,000 | 20.30% |

| Fiscal Year 2016 | $4,732,000,000 | $5,989,000,000 | $1,257,000,000 | 26.60% |

| Fiscal Year 2017 | $4,620,000,000 | $6,037,764,000 | $1,417,764,000 | 30.70% |

| Fiscal Year 2018 | $5,002,000,000 | ?? | ?? | ?? |

See when it comes to funding projects under the Corps' purview, Congress just can't enough. The Corps is in charge of constructing projects promoting commercial navigation, flood control and storm damage reduction, as well as environmental restoration on most of our nation's major, and not-so-major, waterways. Congress is loath to impose any sort of prioritization system when doling out funds. And with a $50 billion or so backlog of projects authorized but not yet funded, members of Congress have lots of opportunities to funnel cash back to their districts. So Congress routinely ignores the budget requests and pumps up the Corps budget. To the tune of a billion a year.

| FY15 | FY16 | FY17 | FY18 | |

|---|---|---|---|---|

| Presidential Budget Request Compared to Previous Year's Appropriation | -$934.5 billion | -722.5 billion | -$1.369 billion | -$1.036 billion |

| 17.1% decrease | 13.25% decrease | 22.86% decrease | 17.15% decrease |

Even with a new administration the Executive branch takes advantage of the Congressional fetish for water projects by low-balling the Corps of Engineers budget, thus enabling the administration to budget that cash for other priorities, all the while knowing Congress will ultimately make up the difference.

This song and dance is getting old. Congress and the administration need to be honest about the spending they expect on our nation's water resources.

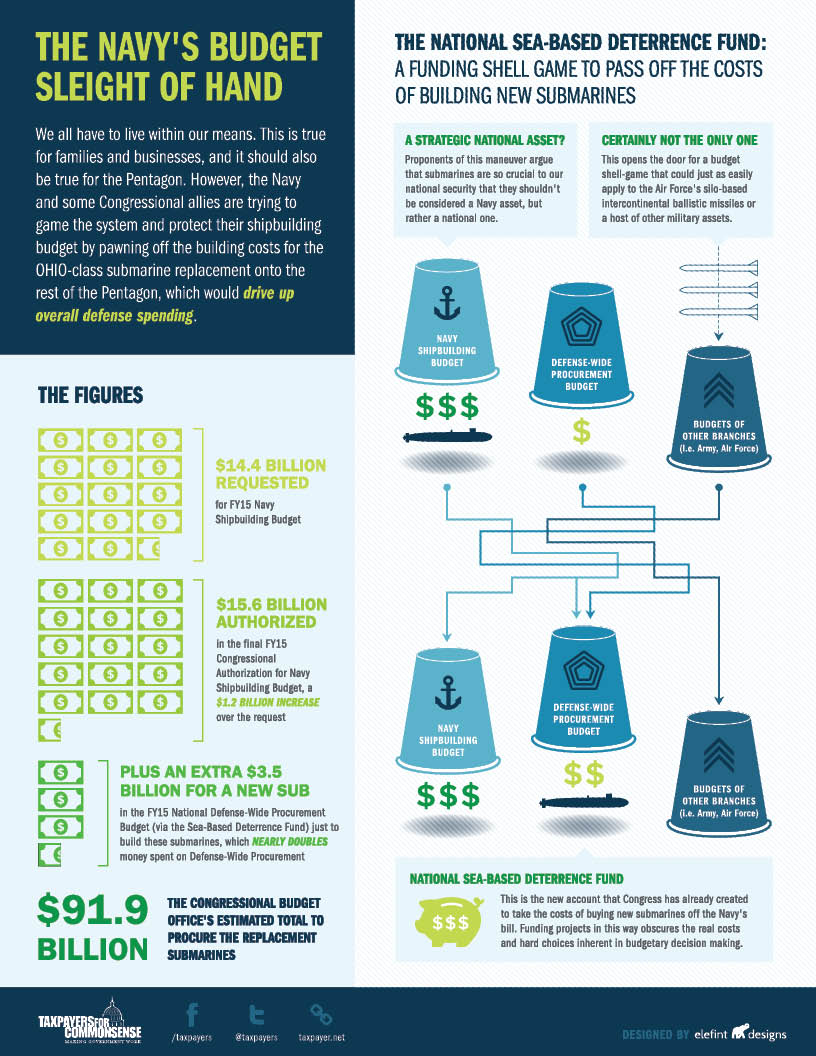

May 24th 2:10pm

Why a Shipbuilding Request in the Shipbuilding Portion of the Budget – Yes, Really – is a Good Thing

Even though we take every opportunity to point out the immense size and relative lack of scrutiny of the Navy's shipbuilding budget (see our post "Sittin' on the Dock of the Bay" from yesterday) we do applaud the Navy's shipbuilding request in one respect.

The budget documents released yesterday indicate the Navy is requesting all FY18 money for the Columbia class ballistic missile submarine in the shipbuilding budget lines. This year's tranche for the next generation submarine is a whopping $842 million for Advance Procurement, but the Navy managed to squeeze it into the approximately $20 billion shipbuilding account.

The serious budgeteers among our readers may wonder why we're congratulating the Navy for putting a shipbuilding request in the shipbuilding portion of the budget. Excellent question from you careful readers! In fact, the U.S. House of Representatives has been on a mission the last couple of years to take the funding for the next generation ballistic missile submarine out of the Navy's budget and put it in a newly-minted line in the budget of the Office of the Secretary of Defense, the National Sea-Based Deterrence Fund. The reason? Because submarines are "national assets."

We've written a lot about this ridiculous idea so let's sum up the TCS argument against it: all weapon systems are national assets. It wasn't the Army and the Marine Corps waging war in Afghanistan; it was the United States. Each military service should be responsible, within its own budget, for purchasing the weapon systems they operate. Period.

So far the last Congressional bulwark against this terrible idea has been the Senate's Committee on Appropriations. They have refused to appropriate funds in the deterrence fund line and continued to put Columbia class submarine money in the Navy's budget lines. We're pleased to see the Navy is taking a hint and maintaining a teensy bit of budget discipline in its massive $20 billion shipbuilding request.

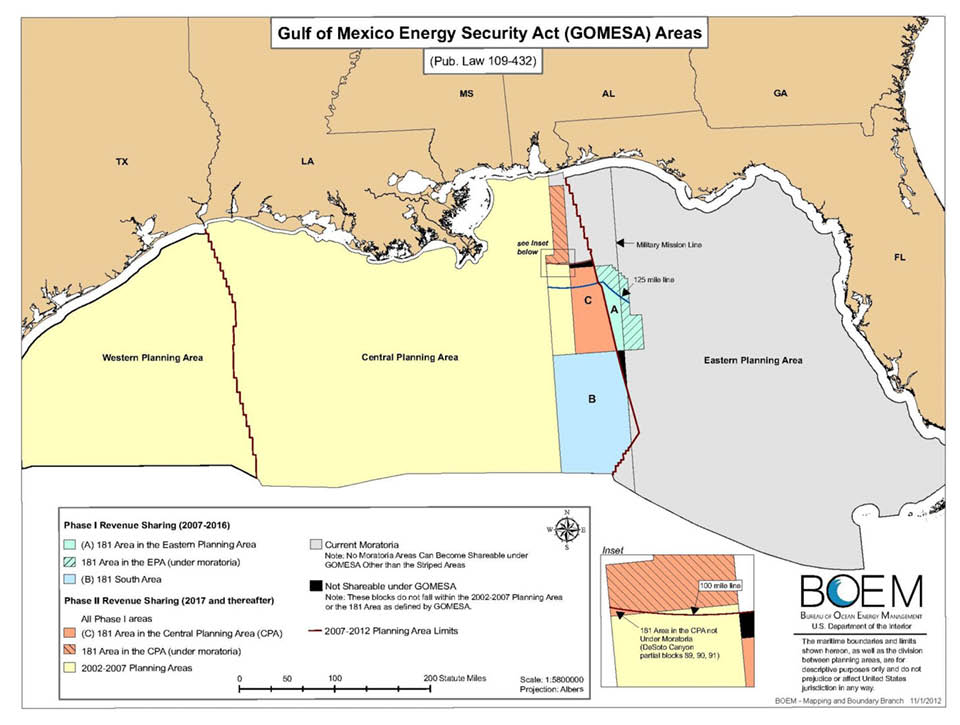

May 24th 1:35pm

GOMESA or Go Home

On the revenue side of the ledger, the FY18 budget proposal gets it right by calling to gut the Gulf of Mexico Energy Security Act, or GOMESA. In 2006, Congress enacted GOMESA, dramatically altering the offshore revenue sharing provisions for oil and gas drilling in federal waters between Alabama, Louisiana, Mississippi, and Texas, and the federal government. That is, it allowed these states to claim a piece of the pie of all revenue – bonus bids, rental fees, and production royalties – generated from certain oil and gas leases on the Outer Continental Shelf, i.e. in federal waters.

In 2018, the revenue sharing provisions balloon and federal taxpayers stand to lose billions more under the legislation. The percentage of revenue directed to the states remains the same at 37.5 percent, but the number of leases that qualify for GOMESA revenue sharing increases dramatically. The exact amount of revenue that will be redirected to these states depends on the amount of production and the market price for oil and gas. Nevertheless, federal taxpayers stand to lose about $940 million over the next three years, $375 million per year after that for nearly 40 years, and more thereafter. Because of this impact on the federal Treasury, both the previous administration and now the Trump administration have targeted this legislation and its harmful revenue sharing policies. TCS opposes all revenue sharing with the states from any oil and gas operations in federal waters.

May 24th 10:30am

A Reduced Role in Federal Emergency Response

Despite a nearly seven percent increase in total Department of Homeland Security funding, not all DHS departments/programs escaped the budget ax. For example, the request cuts $539.9 million in Federal Emergency Management Agency (FEMA) funding for grants that are distributed by the agency because the program lacks congressional authorization (but Congress still appropriates the funds). These programs include FEMA's Pre-Disaster Mitigation Grant Program and others which must "provide more measurable results," such as the Homeland Security Grant Program.

And to "ensure the Federal Government is not supplanting other stakeholders' responsibilities," i.e., not paying someone else's bills, the budget also calls for a new 25 percent non-Federal funding match for FEMA preparedness grants. The proposal also cuts funding for the flood mapping operations of FEMA.

May 24th 9:20am

Billions More for Border Boondoggle

The DHS request focuses a lot of attention on border security and reducing illegal immigration. It contains $2.6 billion for new border security infrastructure and technology, including $1.6 billion for the President's proposed wall along the U.S. southern border – a wall that the he has consistently stated will be paid for by the Government of Mexico, and which has not yet been approved by Congress.

But this is just the tip of the wall's funding "iceberg," which Mr. Trump puts at $8 billion. Other estimates are considerably higher – investment industry analysts have placed the wall's total cost at between $15 and $25 billion, while a Massachusetts Institute for Technology study estimated the cost at around $40 billion.

The budget also includes more than $300 million to recruit, hire, and train 500 new Border Patrol agents at the agency for Customs and Border Protection and 1,000 new Immigration and Customs Enforcement (ICE) law enforcement personnel in 2018, along with support staff.

The Trump administration also requested $975.8 million for high-priority infrastructure and border security technology improvements, and $272.8 million for the Federal Law Enforcement Training Center which trains federal law enforcement personnel from more than 95 agencies. Details are thin on the ground on precisely what technologies this money will buy. We'll keep searching and bring you the details as they are made available.

May 24th 9:10am

Title 17 Eliminated

As indicated in Trump's budget preview released earlier this year, the DOE Title 17 Loan Guarantee Program is targeted for elimination in the administration's FY18 budget request. This is welcome news for TCS. We have criticized major structural flaws in the program that create excessive risk for taxpayers, and bias large-scale capital intensive projects, since its creation 12 years ago.

Originally authorized in the Energy Policy Act of 2005 and expanded in the 2009 Stimulus, the program has issued billions of dollars in loan guarantees, the most infamous of which may be to solar developer, Solyndra. But that's not the biggest. By far the largest guarantee was awarded in 2010 to Plant Vogtle in eastern Georgia for two nuclear reactors, totaling more than $8 billion. The Vogtle project has been on thin ice since day one, but the latest news regarding the bankruptcy of the project's lead developer, Westinghouse Electric Co., could be the straw that breaks the camel's back. And if that happens, taxpayers will lose big.

May 23rd 4:50pm

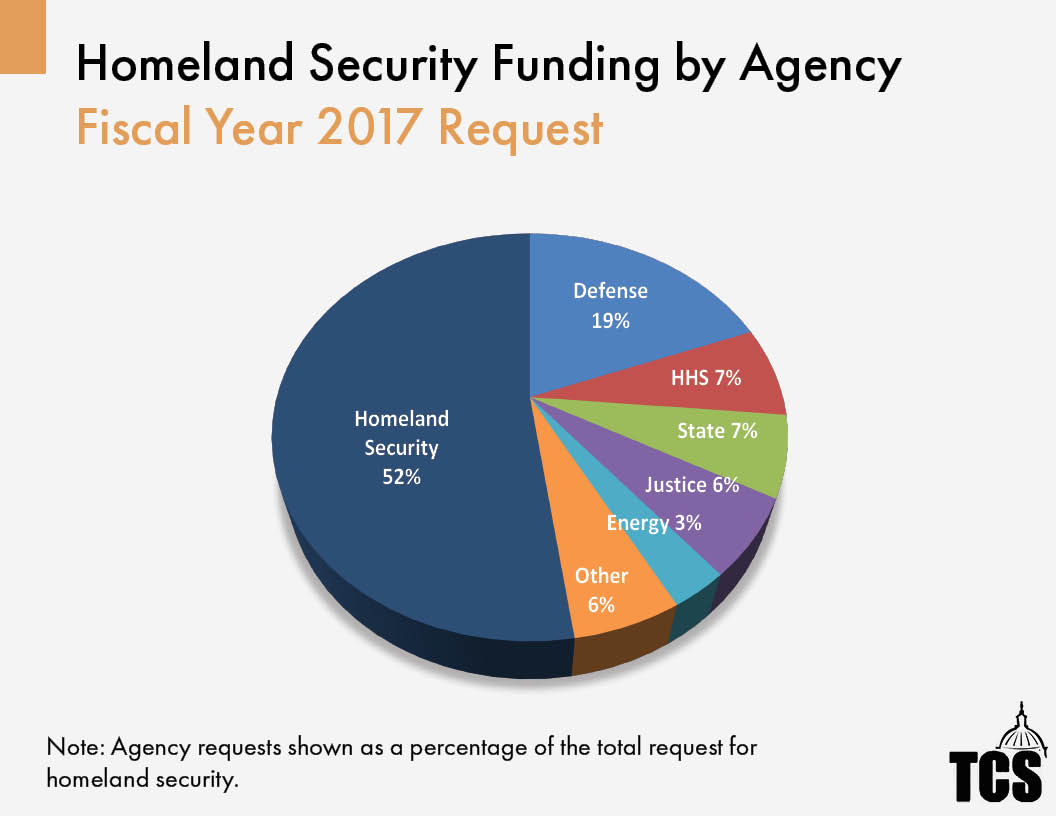

No Easy Way to Track Homeland Security Spending across Federal Agencies

Unlike most other types of government spending, funding for homeland security isn't easily tracked or fully documented. (The same is true for cybersecurity spending, something we'll be writing a lot more about in the near future.)

Because homeland security funding flows through literally dozens of federal agencies and not just through DHS, we have to don our green eyeshades, pull out our magnifying glasses and really search.

This as always been a time consuming task but the Trump administration has just made it infinitely more difficult. Unfortunately, the Office of Management and Budget (OMB) opted not to provide agency-level funding requests for homeland security as has been done in the past. We include this Fiscal Year 2017 chart as an illustrative example of the relative contributions to homeland security funding made by the various other agencies. It shows total federal funding for homeland security by agency as a percentage of the total.

For example, of the $70.5 billion budgeted for "homeland security" last year, only $36.8 billion was requested through DHS. A substantial part was requested through the Department of Defense – $13.5 billion in FY2017 – and others, including Health and Human Services ($5.1 billion) and the Department of Justice ($4.3 billion).

The "Other" category represents 23 departments and agencies, with a total homeland security funding request of roughly $4 billion.

But we can't tell you what happened in the FY18 budget request because the administration won't let us.

May 23rd 4:25pm

Department of Homeland Security: One of Just Three Agencies Receiving an Increase

In the Fiscal Year 2018 budget, the administration request includes $44.1 billion for the Department of Homeland Security (DHS), a $2.8 billion or 6.8 percent increase from the current estimated 2017 level. An additional $7.4 billion for the Disaster Relief Fund (DRF) is requested separately. DHS is one of only three federal agencies whose funding is increased in the President's new proposal (the others are the Pentagon and the Department of Veterans Affairs).

The newest of the federal departments, established in 2002, DHS combines 22 different federal departments and agencies into a single, integrated agency. In addition to preventing terrorism and enhancing our national security, DHS provides border and port security, administers immigration laws, provides disaster response, and coordinates federal cybersecurity initiatives.

May 23rd 4:25pm

Welcome Cuts to Bioenergy Programs

Today's FY18 budget would thankfully eliminate several wasteful biofuels and biomass programs that TCS has opposed for years. These cuts would be a step in the right direction toward toward eliminating programs that work at cross purposes with one another and cause long-term taxpayer liabilities. President Trump's budget proposal also does not appear to include special interest carve-outs for the corn ethanol industry (such as subsidies for ethanol blender pumps) that were found in budgets proposed by President Obama.

However, to ensure taxpayer dollars are not wasted on corporate welfare subsidies, other programs such as the U.S. Department of Agriculture's (USDA) Bioenergy Program for Advanced Biofuels should also be on the chopping block. Otherwise, taxpayer dollars will continue to flow to mature industries such as those for corn ethanol and soy biodiesel. Biofuels subsidies and the federal Renewable Fuel Standard (RFS) were intended to spur the next generation of bioenergy produced from non-food sources while increasing energy independence, but instead have proven to be a massive taxpayer subsidy that is bad for consumers, retailers, taxpayers, and the environment.

– Farm Bill Energy Title programs: FY18 budget would eliminate two programs – the USDA's Biomass Crop Assistance Program (BCAP) and the Rural Energy for America Program – that have propped up unsustainable forms of biomass (through BCAP), in addition to throwing subsidies at wasteful projects and normal costs of doing business in agriculture. For instance, even though REAP was intended to support rural solar and wind systems, it has also wasted taxpayer dollars on ethanol blender pumps (from 2011-2014), farmers' irrigation equipment, tobacco production equipment, grain dryers, and construction of confined poultry feeding operations.

– Perennial Tax Extenders: The proposed budget would not extend the biodiesel, cellulosic biofuel, or alternative fuel refueling property (used for ethanol and other fuels) tax credits.

– Biomass Tax Credit: The proposed budget would also not extend the biomass production tax credit, which has subsidized biomass electricity production in the past.

May 23rd 3:50pm

Coast Guard Unscathed

Reporting leading up to the skinny budget release indicated that the Coast Guard was facing a cut as large as $1.3 billion.

Digging into the Coast Guard's budget proposal, one would conclude that the agency was up for a $440 million whack. But one would be wrong. That's because the Trump administration is using the FY17 Continuing Resolution level of funding as its baseline.

In other words, FY16 funding levels extended. But in reality, Congress cut the Coast Guard's budget in the FY17 appropriations, "a decrease of $467.3 million below the fiscal year 2016 enacted level" according to a House Appropriations Committee press release. So instead of falling from $11.1 billion to $10.66 billion in FY18 request, the Coast Guard got a $160 million bump over the $10.5 billion they got in the Omnibus. Not a big boost, but certainly not a big cut.

May 23rd 3:50pm

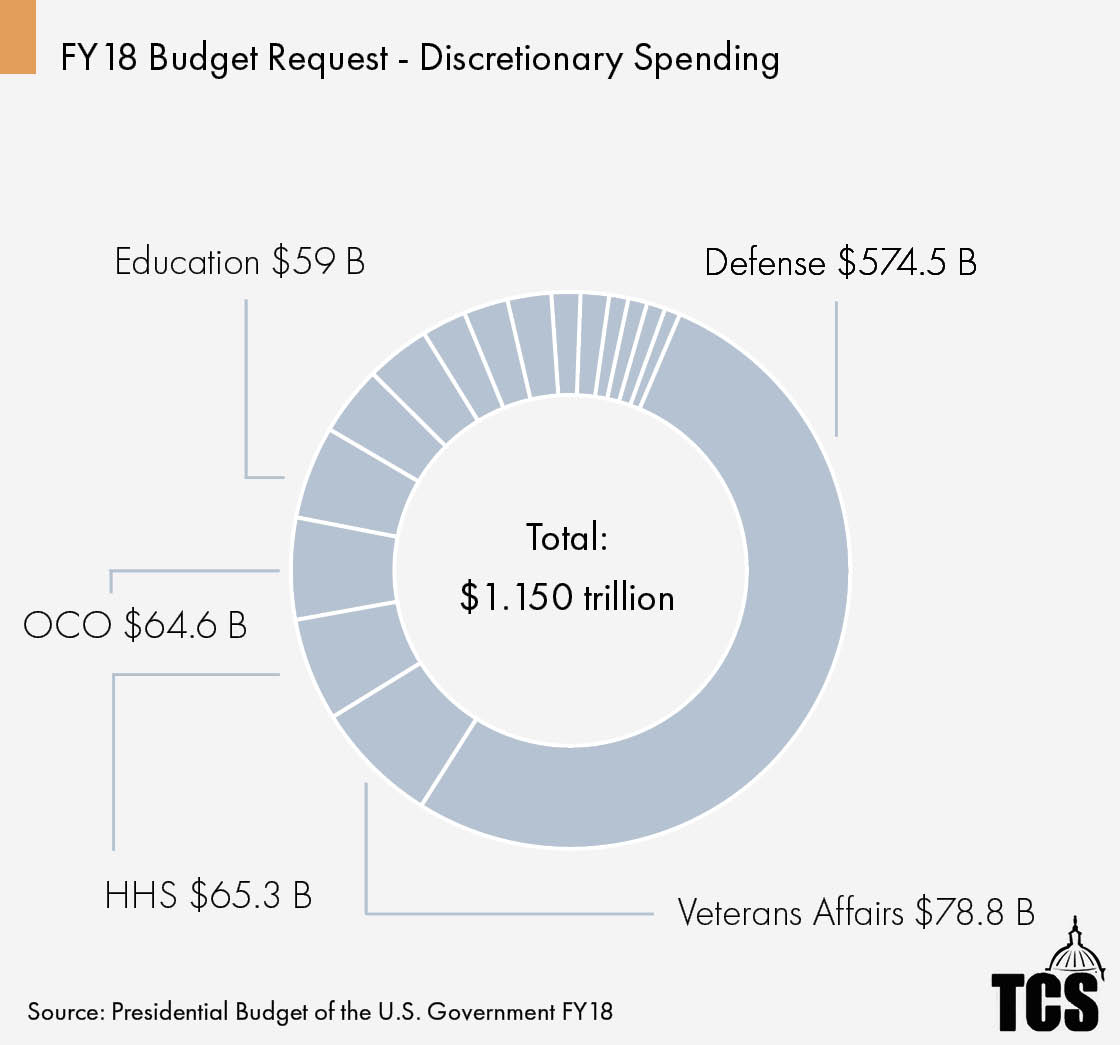

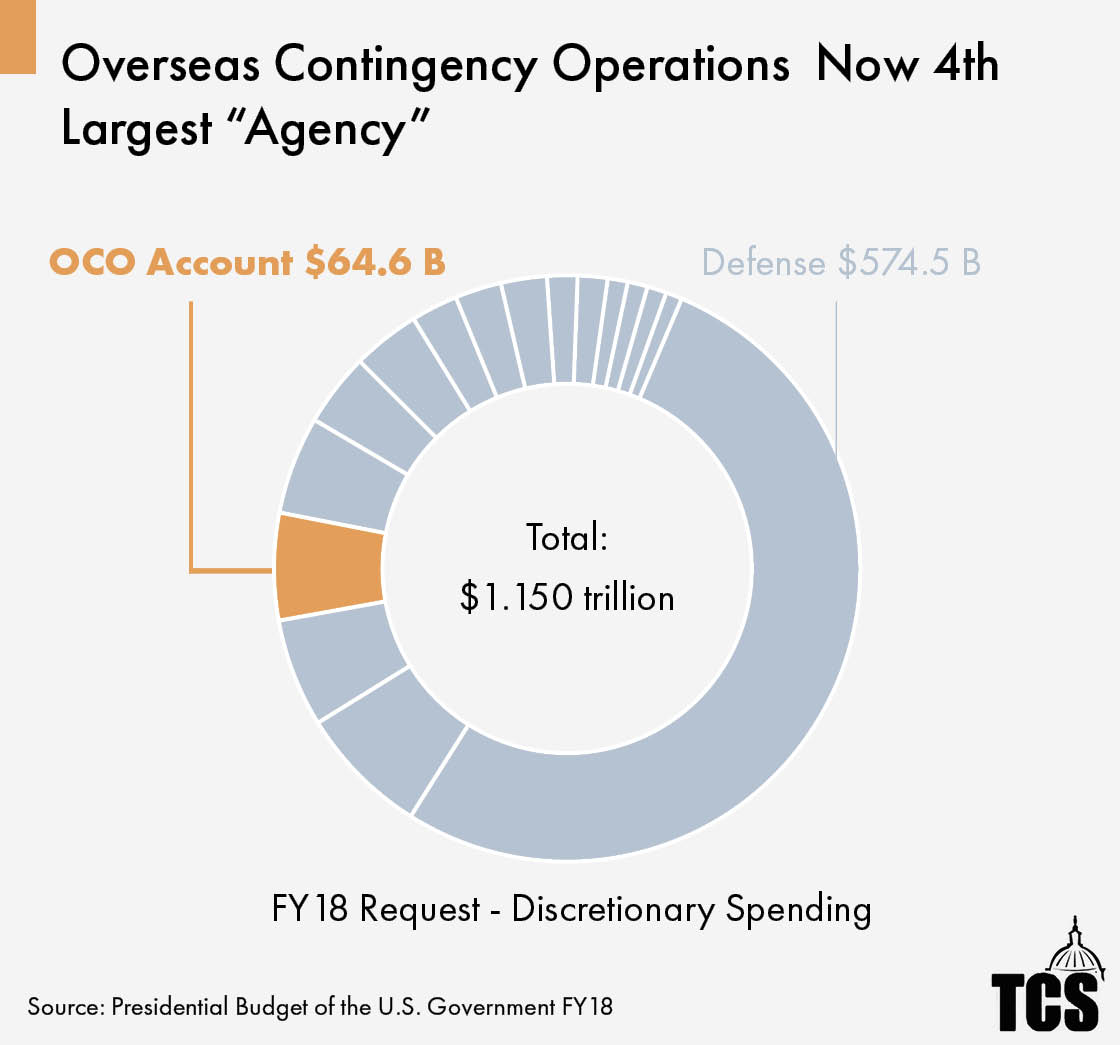

The Tippy Top of the Federal Spending Pyramid – In Numbers

As long as we're pointing out that Pentagon Overseas Contingency Operations (OCO) spending, if it were a separate agency, would be the 4th largest in terms of discretionary spending, let's take a look at what else happened at the top end of the federal spending pyramid.

Pentagon spending is the pointy end of the spear, as they say, and you can buy a lot of spears for $574.5 billion. This, of course, makes the Pentagon the lead spender of discretionary dollars. Nobody else even comes close.

Surprisingly, in second place comes the Department of Veterans Affairs with $78.8 billion. As we noted earlier in the day, VA has nudged aside the Department of Health and Human Services which fell to third place in terms of discretionary spending at $65.3 billion.

In fourth place is Pentagon OCO spending at $64.6 billion.

In fifth place is the Department of Education with $59 billion.

The next closest department is Department of Homeland Security at $44.1 billion. The dollars diminish rapidly after that. It all adds up to a whopping $1.1 trillion in discretionary spending in the President's FY18 request.

Those are your tax dollars. We urge you to keep coming back to this page to look at what we're finding as we scour the budget documents.

May 23rd 3:00pm

Power Marketers on the Market?

Today's budget includes the selloff of the federally owned power marketing administrations—Bonneville Power Administration, Southeastern Power Administration, Southwestern Power Administration, and the Western Area Power Administration.

The PMAs were created at the turn of the 20th century to help provide electricity to rural parts of the country.

The proposal to eliminate the PMAs harkens back to the FY87 budget where President Reagan proposed selling the federal power marketers. PMAs enjoy subsidized federal financing and other taxpayer-backed benefits, while providing subsidized electricity for only certain parts of the country. For taxpayers, it's about making sure that if the PMAs are sold off we get fair value from a truly competitive auction. And that will be no easy task.

May 23rd 2:50pm

Sittin' on the Dock of the Bay, Watchin' the $ Roll in…

With apologies to the Otis Redding classic, it continues to be a good time to be in the business of building ships. Who doesn't love a massive Navy ship, after all? Certainly the defense hawks love them. Ships are the most obvious power projection asset the United States can deploy around the world. When an aircraft carrier comes into port, everybody knows about it.

But shipbuilding, more than any other portion of the Pentagon budget, marries up conservative and liberal politicians who all want to vote for the next round of ships. Why is that? Well, shipbuilding is a heavy industrial and heavily unionized business. And the U.S. Navy buys ships built in America by unionized workers. This means that Democrats in Congress, who might not immediately jump on the bandwagon of higher Pentagon spending, largely support shipbuilding. It's one of the last bastions of heavy industrial work that won't be going overseas anytime soon.

So we don't think there will be much pushback in Congress to the President's request for just a hair under $20 billion in the shipbuilding accounts, in fact there may be a push for more. Major programs within that account include:

– $842 million for Advance Procurement for the new Columbia class ballistic missile submarine

– $1.8 billion down payment on the next Ford class aircraft carrier that is currently estimated to cost $10.6 billion

– $3.3 billion down payment on 2 Virginia class submarines that are currently estimated to cost $5.5 billion

– $1.9 billion in Advance Procurement for those 2 Virginia class subs

– $3.5 billion for 2 Arleigh Burke class destroyers

– $539 million for a Fleet Oiler

Alert readers, and we're sure you're all still alert as you wade through all these numbers, will note this all adds up to less than $12 billion. For brevity's sake, we cut out all the smaller shipbuilding expenditures that bring the total up to a whopping $19.9 billion. But you can check out all the details here.

Meanwhile, we'll keep digging. And we'll keep writing about how few Members of Congress, even those who rail against the staggeringly high Pentagon budget request, actually vote to curtail the shipbuilding program.

May 23rd 2:30pm

Having Your Death/Estate Tax Repeal Cake And Eating It Too

One of the "details" of the brief discussion of tax reform in the budget is to: "Abolish the death tax, which penalizes farmers and small business owners who want to pass their family enterprises on to their children."

The death tax is also known as the estate tax, and according to the budget tables provided "estate and gift taxes" would be anticipated to generate $328 billion in revenue between 2018 and 2027 under current law (baseline). Under the proposed budget—which calls for abolishing the death/estate tax—"Estate and gift taxes" would generate… $328 billion in revenue between 2018 and 2027. That's right the same revenue with and without the tax.

That makes no sense.

May 23rd 2:30pm

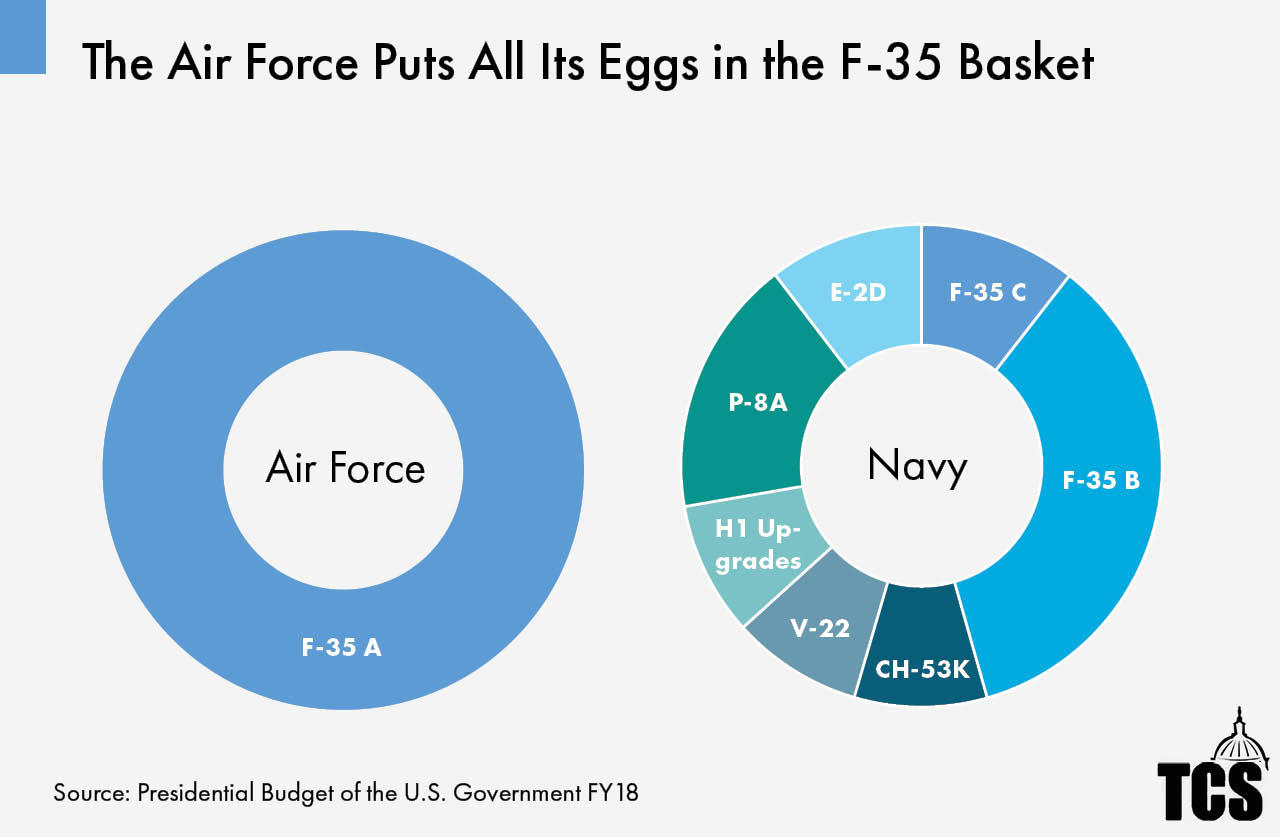

The F-35, Eating The Air Force Budget Alive

For the last few years we've been pointing out how the Air Force is putting all of its Combat Aircraft procurement eggs (errrrr…dollars!) in a single basket. The F-35 is the aircraft eating the Air Force budget alive. And this year is just more (a lot more) of the same.

The FY18 President's budget request asks for 46 of the Air Force variant of the F-35. When you add up the procurement costs for those aircraft, and another 3/4s of a billion dollars in "Advance Procurement," a whopping $5.3 billion is devoted to the F-35 by the Air Force. And, once again, that represents 100 percent of the Air Force request for combat aircraft.

Contrast this approach with the one taken by the Navy. First of all, the Department of the Navy includes two military services (Navy and Marine Corps) that will both fly F-35s. The Navy will fly the carrier variant, the F-35C and the Marines will fly the short takeoff variant, the F-35B. The Navy, in contrast to the Air Force is splitting up its Combat Aircraft budget request across nine different aircraft.

Every single dollar of combat aircraft procurement money for the Air Force is devoted to its version of the F-35. That's what we call putting all your eggs in one enormously expensive basket.

May 23rd 2:30pm

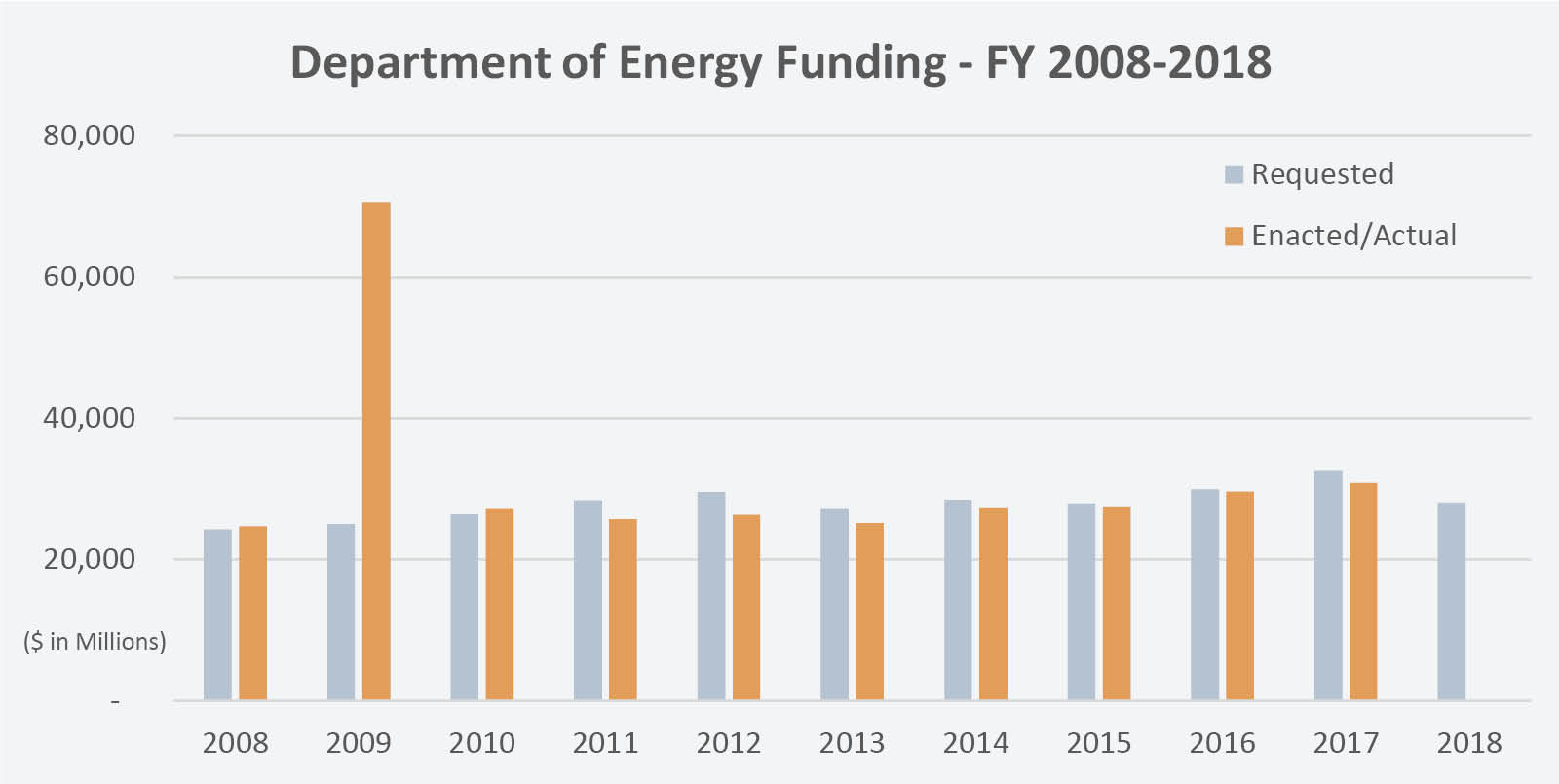

Department of Energy Gets a Trim

The FY2018 Department of Energy (DOE) Budget request totals $28 billion, down from the Obama Administration's FY2017 request of $32.5 billion and the recently enacted FY17 Omnibus Appropriations Bill which provided nearly $31 billion for the DOE.

Of the requested $28 billion, $13.9 billion is slated for the National Nuclear Security Administration – an increase of $1 billion over last year – and $14.1 billion for other program areas, a $3.7 billion decrease. We'll have more posts detailing the proposed cuts, many of which targeted science, research and development in renewables, fossil fuels, and nuclear power energy sectors. Other notable cuts to ARPA-E and the Title 17 loan guarantee program are included in the budget, though those don't reflect significant short-term cost savings.

May 23rd 1:20pm

Highway Trust Fund (HTF) and Undefined Infrastructure Investment

The budget calls for an end to transfers from the General Fund to cover shortfalls in the HTF starting in 2021 when the current authorization expires. HTF gas tax revenues have been supplemented by $140 billion in General Fund transfers since 2008. This is because cars have better gas mileage coupled with increased construction costs, while the federal gas tax has not changed since 1993, at 18.4 cents per gallon for gasoline and 24.4 cents for diesel. Without supplemental funds, the budget estimates HTF outlays would be reduced by $95 billion from 2021-2027. Any surface transportation costs not covered by the HTF during this period would largely shift to states and localities. According to the budget: "While Congress and past Administrations have been unable to find a long-term funding solution to the HTF, many States and localities have raised new revenue sources to finance transportation expenditures. The Administration believes that the Federal government should incentivize more States and localities to finance their own transportation needs, as they are best equipped to know the right level and mix of infrastructure investments."

While the budget does not propose an increase in the gas tax, it does include $200 billion in new mandatory outlays to incentivize state, local, and private investments. The budget references a future infrastructure proposal from the administration that "will include a combination of policy, regulatory, and legislative proposals, ranging from changes to existing programs, to the creation of new programs and initiatives to reshape how the Federal government invests, permits, and collaborates on infrastructure." In other words, stay tuned.

May 23rd 1:20pm

Interested in Interest

Even with magic GDP growth (or perhaps because of it), increased revenue, and a small surplus ($16 billion) by 2027 – the interest the U.S. Treasury pays on our country's accumulated debt will be $639 billion in 2022.

To put that into perspective, the budget estimates defense spending at $722 billion, and non-defense discretionary spending at $429 billion that year. It is only $100 billion less than what was expected under existing baseline.

May 23rd 1:20pm

Commodity Programs Avoid the Knife

While the president's budget includes a number of needed reforms to crop insurance and other Farm Bill corporate welfare programs, major reforms regarding vastly over budget "commodities" programs are noticeably absent. Created as part of the $1 Trillion 2014 Farm Bill, the so-called shallow loss programs (Agriculture Risk Coverage–ARC and Price Loss Coverage–PLC) are bigly over budget. Originally projected to cost $27.2 billion over the ten-year scoring window of the 2014 Farm Bill, after just two years of payments they've cost $13.2 billion and are projected to cost an additional $52 billion over the next ten.

The budget does propose cutting millionaire families out of the commodities programs by limiting commodities payments to agricultural producers with an adjusted gross income (AGI) of less than $500,000. Under current law an "actively engaged" agricultural producer can receive up to $125,000 every year in commodity program payments if he or she has a three-year average AGI of less than $900,000; and their payment is doubled if they have a spouse. Tightening the AGI means-test would only net $653 million of savings over 10 years. That's because it will impact very few businesses. Even in 2013, the most profitable year for agriculture since 1973, only 2.1 percent of all agricultural businesses made more than $500,000 in AGI.

A series of hearings held by the Agriculture Committees make it clear that lawmakers who see themselves as representatives for agricultural businesses are looking to add to the costs of the farm bill commodities programs. They've proposed to wedge cotton producers into the programs, at an estimated price tag of $1 billion annually, want to change payment formulas to increase the size of checks, and are even discussing increasing the government guaranteed minimum prices that trigger payments.

Tightening AGI limits for participation in farm bill commodities programs, and applying these same limits to federally subsidized crop insurance, are welcome reforms. But much more will need to be done to keep "shallow loss" agricultural income subsidy programs from digging deeper into taxpayers' wallets.

May 23rd 12:50pm

MOX, Out

The Trump administration FY18 Budget Request echoes the Obama administration's and calls for the termination of the Mixed Oxide (MOX) Fuel Fabrication Facility.

The Obama administration also called for the project's termination in its FY17 budget request. Don't be confused by the $270 million for MOX under the DOE's Nonproliferation Construction Account, which would presumably fund shutdown activities, the budget states that the DOE will pursue the "dilute and dispose" alternative to the project, as it had under the Obama administration. To that end, the more detailed DOE budget earmarks an additional $9 million for phase one design of the dilute-and-dispose alternative.

For years, TCS has raised red flags about the sky-rocketing costs and technological challenges of the MOX facility, which planned to convert plutonium into fuel for use in commercial reactors. Now let's see if Congress can come to its senses.

MOX by the numbers 2014-2018

($, in millions)

| Fiscal Year | 2014 | 2015 | 2016 | 2017 | 2018 |

| President's Requested | 320 | 196 | 345 | 270 | 270 |

| Enacted | 344 | 345 | 340 | 335* |

*Final number in final enacted FY17 Omnibus

May 23rd 12:40pm

New Administration Continues Call for Base Closure

Hidden in the depths of the thousands of pages of budget materials released today is the blandly named "Major Savings and Reforms." Not surprisingly, in an administration putting its first emphasis on national security, the entire Department of Defense has only one program slated as a major saving or reform. Under "reductions" we find, "Base Realignment and Closure."

This puts the Trump administration in line with the Obama administration in continuing a call for some Congressional sanity on the issue of base closure. As the justification states, "DOD estimates that it has approximately 20 percent excess capacity spread across the Military Departments and projects it could save $2 billion or more annually by 2027."

But these savings and efficiencies cannot be realized unless Congress gets out of the way of what now two administrations, one Democratic and one Republican, have requested.

As the justification goes on to say, "DOD has not conducted a BRAC round since 2005, but has sought BRAC authority and been denied by the Congress each year since 2013."

It's past time for another BRAC round. With their emphasis on Pentagon spending, the administration needs to put their shoulder to the wheel and get this cost saving measure through.

May 23rd 12:25pm

Hey, the Tax Man

"The Budget assumes deficit neutral tax reform, which the Administration will work closely with the Congress to enact." Poof. That was easy.

Actually, the budget does have nine bullets (six individual, three corporate) in their proposal. All but one of which – "Eliminate most special interest tax breaks to make the tax code more equitable, more efficient, and to help pay for lower business tax rates" – is a revenue loser. Yet, the budget projects increased revenues from both individual and corporate income taxes. How do you get that?

The budget packs in magic growth beans that jack up Gross Domestic Product growth to three percent a year by 2020 and year to year real growth 0.7 percent (1.6 to 2.3 percent) between 2016 and 2017.

May 23rd 12:10pm

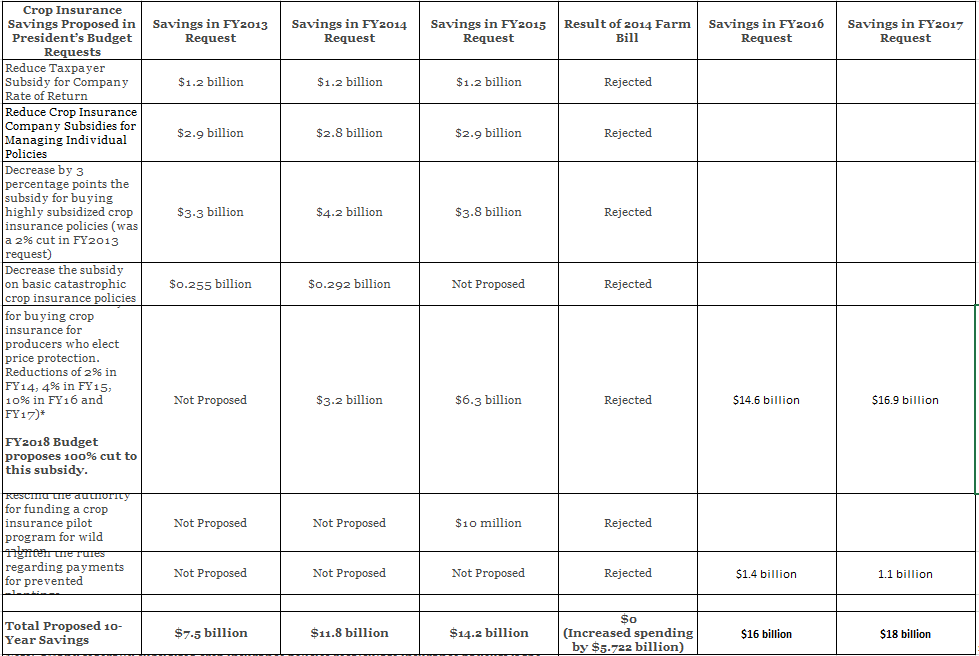

Harvesting Savings from Crop Insurance Reforms

The President's budget request proposes common sense changes to right-size the taxpayer subsidized safety net for agricultural businesses. Specifically the budget looks to rein in spending on federally subsidized crop insurance. Projected to cost nearly $8 billion annually, but spiking to as much as $14 billion in 2012, federally subsidized crop insurance is consistently the most expensive federal entitlement available for agricultural businesses. It's also the only federal income subsidy program with no payment limits or means-testing.

President Trump's budget proposes $28.5 billion worth of crop insurance savings. The budget implements both a cap on the amount of subsidy an individual business can receive ($40,000) and limits subsidies to businesses with less than $500,000 in adjusted gross income (income after costs of seeds, machinery, labor, etc. are deducted). Importantly, the budget would also eliminate subsidies for the Harvest Price Option (HPO) which is a feature that automatically adjusts income guarantees higher if prices at harvest increase above what was expected at planting. Businesses that like this option could still get it, they would just have to purchase it with their own money.

| Crop Insurance Savings Proposed in President's Budget Requests | Savings in FY2018 Request |

| Limit crop insurance premium subsidy to $40,000 | $16.2 billion |

| Limit Crop Insurance eligibility to $500,000 AGI | $0.420 billion |

| Eliminate Harvest Price Option for Crop Insurance | $11.9 billion |

| Total Proposed 10-Year Savings | $28.56 billion |

This budget proposal is notable because it goes much further than recent proposals. President Obama included a number of crop insurance reform proposals in his latter budgets. None of these reforms, however, would have made crop insurance into what it needs to be—a cost-effective, transparent safety net that protects agribusiness from unexpected and unmanageable risks.

Implementing these crop insurance reforms is a necessary step to developing a safety net taxpayers can afford. There are also bipartisan reform proposals already introduced in the House and Senate that include these reforms. Most notably they are a part of H.R. 2332 Assisting Family Farmers through Insurance Reform Measures Act (AFFIRM) sponsored by Reps. Ron Kind (D-WI) and Sensenbrenner (R-WI), and its companion S. 1025 sponsored by Sens. Flake (R-AZ) and Shaheen (D-NH).

May 23rd 11:45am

Overseas Contingency Operations Now 4th Largest "Agency"

As the Department of Defense's Overseas Contingency Operations (OCO) account has become part of the fabric of Pentagon spending we've been tracking the size of that piece of the spending pie.

In recent years we've noted that OCO, if it was an actual federal department, would be the 5th largest agency in terms of federal discretionary spending. Well, move over Department of Education, OCO has moved up to the position of 4th largest agency. In fact, if you combined all OCO spending (State and Defense Departments) the total of $76.6 would be the 3rd largest agency in terms of discretionary spending, edging aside the Department Health and Human Services.

Also of interest, the Department of Veteran's Affairs has moved up to being the second largest federal agency, supplanting the Department of Health and Human Services. This puts programs involving current and former military service members as #1 and #2 federal agencies in terms of dollars spent.

May 23rd 11:40am

TCS Statement from Ryan Alexander, President

"At long last President Trump's budget request is here. Being a reality check on the budget is what we do at TCS, and here is what we see:

We're all for efforts to rein in the budget deficit, but we're also all for reality and math. We appreciate the ambition of this document, but the growth assumptions are wishful thinking.

The priorities— the increases to defense spending, the wall, deep cuts to social programs in the guise of increasing flexibility—are not a surprise. But where is the strategy? Where are the details of how programs are going to be funded, to say nothing of congressional support—without which none of this approaches concrete reality? Also, these same growth projections are what the administration was counting on to pay for tax reform, but they're not accounted for in here as such. Finally, there's the small matter of revenue – the budget projects an increase in both individual and corporate tax revenues over Congressional Budget Office projections, all while assuming deficit neutral tax reform. Cue a thousand opeds quoting economists on "magic math."

So where does that leave us? Congress will likely look at this budget as an interesting thought exercise rather than a guidance document. But our fiscal problems are real and serious. It's time to make some hard choices if we are to move forward and towards a healthier budget.

At TCS we do believe that if it doesn't work, don't fund it. But performance should be measured by how well programs work at achieving their goals, not how much we spend on them. The government—that your taxpayer dollars fund—should work and deliver on its promises. And when necessary, we should pay for it. If Congress disagrees then by all means, hold the oversight hearings and modify programs to demonstrate they are achieving goals.

TCS champions and fights for smart budget cuts. We hope the administration does too.

I invite you to join our rolling blog and live analysis of President Trump's first full budget request through the day on our website."

– Ryan Alexander, President

May 23rd 11:30am

The President's FY2018 Budget is out!

Below are the documents that comprise the President's Fiscal Year (FY) 2018 Budget. Supplemental materials and other information are located on the White House's Office of Management and Budget website.

– Budget of the U.S. Government FY2018